"6. We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

7: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent which dealt with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Study Group letter dated 12 October 2004.

8: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account." Victor Lal and Russell Hunter's 60 page legal submission to DPP's Office, 12 September 2012

THE MODI MANIA: As some Indo-Fijians forget that Narendra Modi is no Prodigal Son of a Girmitiya returning to Fiji (but an Indian Prime Minister), we remind them that it was his previous BJP government which secretly funneled $2million into Chaudhry's bank account via Indian Consulate in Sydney after the Speight coup

THIS MAN, Vijay Jolly, the convenor, OFBJP (Overseas Friends of BJP), the overseas wing of the present ruling Bhartiya Janta Party, seen below with Mahendra Chaudhry, and recently with Khaiyum, is the principal suspect linked to Chaudhry's 'Haryana millions'; he falsely wrote up a letter under the banner of 'Delhi Study Group' for Chaudhry to present to the Fiji High Court, instead of the original 'Harbhajan Lal Letter' which was the key piece of document that had alerted FIRCA to

Mahendra Chaudhry's millions in Australia

Jolly and Mahend in Delhi, 2004

Jolly and Mahend in Delhi, 2004 Perjury probe request in Mahendra Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court and call for other criminal investigations arising out of Mr Chaudhry’s income tax file

By VICTOR LAL and RUSSELL HUNTER, 4 September 2012

After Justice Goundar’s recent judgment Victor Lal wrote to Mr Jolly (28 August and 1 September respectively) and copied it to other Delhi Study Group office bearers, demanding answers from the Group:

Dear Vijay Jolly

Recently the Fiji Hgh Court gave a judgment in the case of Mahendra Chaudhry and the $2million he had kept in his Australian bank account without informing the Inland Revenue Department here in Fjii

In his ruling, Justice Goundar observed the following:

The applicant (Mahendra Chaudhry) has annexed to his affidavit a reference dated 12 October 2004 from an institution called Delhi Study Group, which gives some insight of the original source of the funds the applicant received. The reference reads:

“This is to confirm that funds were collected in New Delhi and other parts of India, including NRI's (Non-Resident Indians) to assist Hon'ble Mahendra Pal Chaudhry, Former Prime Minister of Fiji in 2000-2002.

The funds were intended to solely assist Hon'ble Chaudhry and his family members to establish residence in another country following the political upheaval in Fiji in May 2000, in which his life and those of his family members were threatened by terrorist elements in Fiji.

Hon Chaudhry is very popular and is held in high regard by the people of India. It was the wish to the people of India to provide Hon'ble Chaudhry financial and physical security at a time when he was bravely defending the democratic and human rights of his people. The funds collect were sent to Hon'ble Chaudhry through assistance provided by the government of India between 2000 and 2002.”

(1) I would be very grateful if you could kindly let me know when the letter was actually written and who signed the above letter on behalf of DSG?

(2) I know that Mahend was in New Delhi in October 2004 and was seen at a press conference organized by the Delhi Study Group, and you were also present that day

(3) When did Mahend ask for the above letter?

(4) Did he tell the DSG what was the purpose of the letter?

(5) How was the funds transmitted into his Australian bank account?

(6) And what amount was put into his bank account in Australia?

In October 2004 he had provided a very similar letter to Fiji’s tax authorities by someone called Harbhajan Lal from Haryana – see a copy of the letter dated 9 September 2004 (provided by his delegated accountant Nalin Patel)? It’s an English translation from the original which was written in Hindi.

(1) Do you know who is Harbhajan Lal of Haryana?

(2) I wonder if DSG and Harbhajan Lal are talking about the same amounts – nearly $2million?

(3) Was Harbhajan Lal also part of the DSC?

(4) Was the DSG letter in English or Hindi?

Like the mysterious Harbhajan Lal in 2008, Mr Jolly (nor the other DSG’s office bearers) have replied to Victor Lal; an Indo-Fijian acquaintance of Mr Jolly even called him at his Delhi home on our behalf but we were informed that Mr Jolly is no longer answering his home or mobile phones regarding the Delhi Study Group letter; (P.S. Jolly later told one of our contacts, after Victor Lal had threatened to report him to India's Criminal Bureau of Investigation in New Delhi, that just to keep Chaudhry from badgering him for a letter, he had written the 'Delhi Study Group' letter. This letter is not in Chaudhry's 340 page tax file in Victor Lal's possession.

The Unauthenticated Harbhajan Lal letter – Unanswered Questions!

What about the “Harbhajan Lal Letter” dated 9 September 2004, that Mr Chaudhry submitted through his tax agent, G. Lal & Co to FIRCA? Victor Lal has never accepted the Harbhajan Lal letter as conclusive proof that the $2million from India was for Mr Chaudhry’s resettlement in Australia but at the time of his investigation he had given Mr Chaudhry benefit of the doubt that the author of the letter was, indeed, one Harbhajan Lal of Haryana.

To date, we are yet to locate the mysterious Harbhajan Lal and Mr Chaudhry has not provided any further information on the author of the letter to FIRCA. He had instead paid the outstanding tax to prevent any further investigation into the “Harbhajan Lal letter.

There is clear evidence, however, that Mr Chaudhry (and Nalin Patel) presented to FIRCA the letter from someone calling himself Harbhajan Lal, the contents of which were false in part, most glaringly the opening paragraph of the letter which did not correspond with the bank statements from Australia that Mr Chaudhry (and his accountant Nalin Patel) offered to FIRCA.

Victor Lal had pointed out the discrepancy in 2008, which we repeat for your consideration:

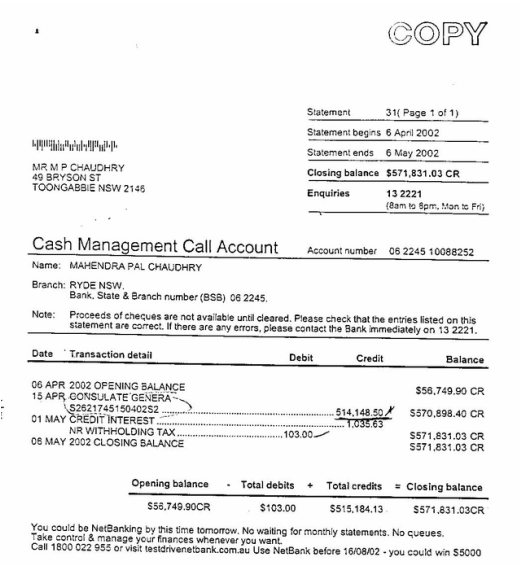

“It is strange that FIRCA did not question Mr Chaudhry as to why he was inquiring from Harbhajan Lal about the details of the funds in 2004. We do not have on us the contents of the letter that Mr Chaudhry wrote to Harbhajan Lal but it does not take a feverish mind to point out that when Harbhajan Lal wrote that letter in September 2004, Mr Chaudhry had already received the three separate instalments of money from Haryana in 2000 ($503,000), 2001($486,890) and 2002 ($514,148.50).

The deposit of $486,890 on February 22, 2001 had swelled Mr Chaudhry’s bank account to over a million dollars. There is also evidence that the next day, on 23 February, Mr Chaudhry or someone with power of attorney on his behalf had made two withdrawals of $400,000 etc on the same day.”

2004: The questionable Harbhajan Lal letter to FIRCA – Forgery or Falsification of Facts?

16 June

FIRCA writes to Mr Chaudhry granting him extension till 15 August 2004 to provide information in relation to investments held overseas

14 August

Nalin Patel of G. Lal & Co writes on behalf of Mr Chaudhry to FIRCA asking for an extension till 15 September. Informs FIRCA that Mr Chaudhry has appointed him as his tax agent and confirms that the information was being completed

18 August

FIRCA grants extension

6 September

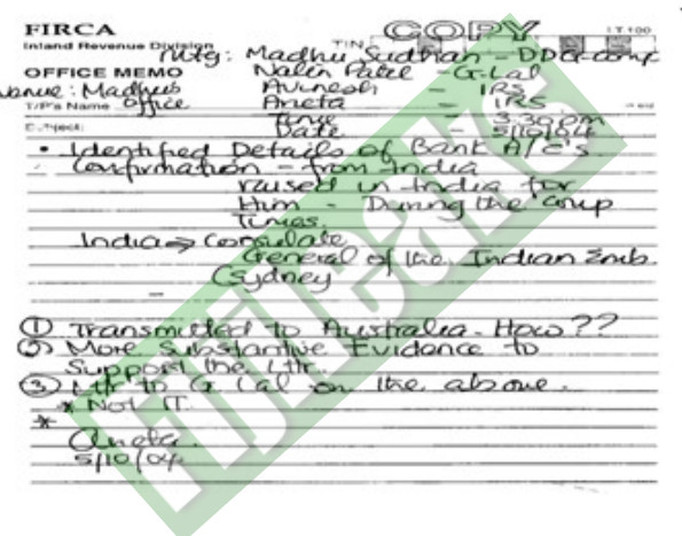

Nalin and Pardeep Patel of G. Lal & Co meet FIRCA’s Madhu Sudhan (now working with G.Lal & Co) and state that information would be submitted by 15 September 2004

9 September

Harbhajan Lal of Haryana or someone purporting to be him writes his letter to Mr Chaudhry regarding the funds collected in India

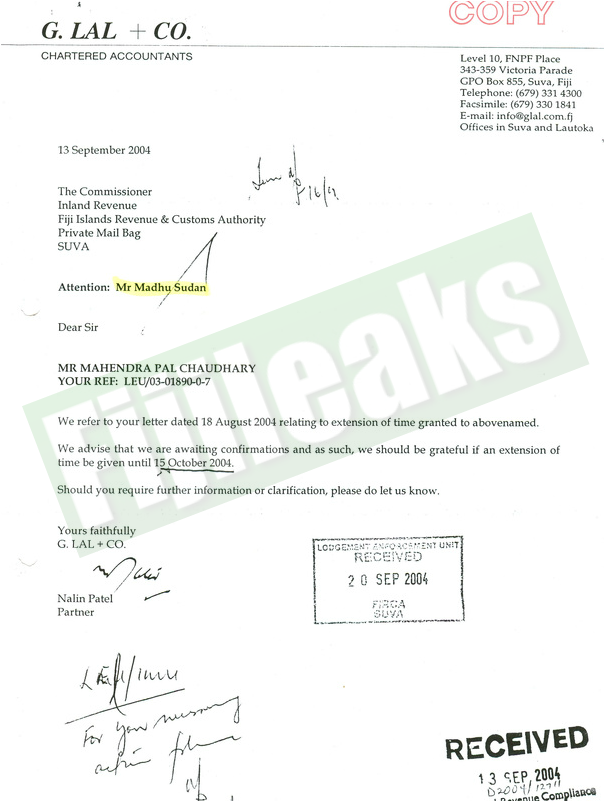

13 September

Nalin Patel writes to FIRCA asking for further extension of time until 15 October 2004

21 September

FIRCA writes to inform no further extension will be granted after 15 October

5 October

FIRCA officials meet with Nalin Patel in Madhu Sudhan’s office to discuss Harbhajan Lal’s letter; seek more substantive evidence to support the letter (see 5 October “Note” for full details)

22 October

FIRCA writes to Nalin Patel regarding the evidence he had on hand at the 5 October meeting

Agree to amend the income tax returns

Refuse to allow tax credits due to lack of documentary evidence

FIRCA still to pursue the source of funds

Document (Harbhajan Lal letter) explaining source of funds insufficient for FIRCA purposes

10 November

Mr Chaudhry pays $86,069.62.

In 2008 Victor Lal wrote to Nalin Patel before publishing his findings on 24 February 2008 but Mr Patel never acknowledged or replied to a series of questions sent to him.

On 20 August 2012 Victor Lal wrote to Nalin Patel asking the following questions

Dear Nalin

Bula.

Did You/Pradeep read the contents of Harbhajan Lal's letter dated 9 September 2004, which is in direct contrast to the evidence you were presenting to FIRCA on his [Mr Chaudhry’s] behalf?

When was the first time you came into possession of Harbhajan Lal's letter?

From all the correspondence to FIRCA there are so many inconsistencies - the letter was written on 9 September and you chaps were still asking for extension on the 15 September.

Please note that I am not blaming you for anything but I need to ascertain certain facts

Warm regards

Victor Lal

Three days earlier, on 17 August 2012, Victor Lal had written to Nalin Patel:

Bula Nalin

You may recall I contacted you regarding Mahendra Chaudhry's tax details. You neither acknowledged nor replied to my set of questions that I had sent you in 2008.

To date, I have not been able to locate Harbhajan Lal in Haryana, and now Justice Goundar's judgment quotes a letter from Delhi Study Group, which was never a part of your exchanges, on behalf Mr Chaudhry, with FIRCA in 2004.

I would be very grateful if you could comment on the attachment, especially with the Prime Minister calling upon accountants to take a more active role in the Constitution making in Fiji.

When did you submit that Harbhajan Lal letter dated 9 September 2004 to FIRCA that year?

Did you have a copy of the Delhi Study Group letter dated 12 October 2004 also but chose to submit the Harbhajan Lal one?

Look forward to hearing from you.

Warm regards

Victor Lal

Excerpted from Submission to DPP and CID, 12 September 2012:

We are not able to comment on the letter from the Delhi Study Group because we don’t have a copy of Mr Chaudhry’s affidavit despite requests to the Director of Public Prosecutions Mr Christopher Pryde for a copy.

However, we strongly feel that a further investigation is needed to ascertain the identity of Harbhajan Lal, and when Mr Chaudhry wrote to him, and why it took so long for G. Lal & Co to submit Harbhajan Lal’s letter to FIRCA.

There is also evidence that Mr Chaudhry was in India when the Delhi Study Group allegedly wrote its letter dated 12 October 2004. Why was Nalin Patel, on 13 September 2004, asking for an extension until 15 October when Harbhajan Lal had already written his letter on 9 September 2004?

In 2008 Victor Lal had asked whether Harbhajan Lal’s letter was written to FIRCA after Mr Chaudhry had failed to provide a trust deed to support his initial claim that he was holding the millions in trust for the Indo-Fijian community.

And the same question could be asked in 2012 regarding the letter from Delhi Study Group in India mentioned in Justice Goundar’s judgment.

After Justice Goundar’s recent judgment Victor Lal wrote to Mr Jolly (28 August and 1 September respectively) and copied it to other Delhi Study Group office bearers, demanding answers from the Group (see above to Jolly)

The Supreme Court of Fiji has today dismissed the application for special leave to appeal filed by the Leader of the Fiji Labour Party Mahendra Chaudhry.

Chaudhry was seeking leave to appeal from a judgement dated 14th August 2014 of the Fiji Court of Appeal which affirmed his conviction by the High Court of Suva for the alleged violation of Sections of the Exchange Control Act with a variation of the sentence.

During the judgement, Justice Saleem Marsoof said Chaudhry’s argument that the present convictions do not constitute offences concerned with any currency is both contrived and artificial.

Justice Marsoof further said that he is of the opinion that Chaudhry has failed to demonstrate any excess of jurisdiction which could give rise to any questions of general legal importance or substantial questions of principle affecting the administration of criminal justice or occasion any substantial and grave injustice to justify the grant of special leave to appeal to the Supreme Court.

In April this year, the Suva High Court convicted Chaudhry and on 2nd May 2014 the Court ordered him to pay a fine of $2 million.

Chaudhry paid the fine however took the matter to the Fiji Court of Appeal where the conviction was affirmed but the sentence was varied.

The Appeals Court was of the view that in all the circumstances of the case, the quantum of the fine imposed by the trial Judge was excessive and it was reduced to $1 million. Source: Fijivillage News

To summarize, Justice Goundar observed in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012):

“The applicant says he later found out that a former editor of the Fiji Sun obtained his confidential tax details from FIRCA and released it to Victor Lal, a former Fiji journalist residing overseas. Victor Lal published those details in anti-government websites.” We have demonstrated that we never published Mr Chaudhry’s tax details in any anti-government websites but in the Sunday Sun dated 24 February 2008, including the first tax story in the Fiji Sun, on 15 August 2007.

1: We therefore call upon the Director of Public Prosecutions to investigative whether Mr Chaudhry committed the offence of “perjury in a false affidavit”.

2: We call upon the Director of Public Prosecutions to investigate whether Mr Chaudhry’s legal representatives in offering his affidavit to the Fiji High Court are also guilty of aiding and abetting the offence of perjury in a false affidavit, for it is abundantly clear that we did not publish Mr Chaudhry’s tax details in any anti-government websites.

3: We request the Director of Public Prosecutions to establish on what grounds the original letter tendered from one Harbhajan Lal dated 9 September 2004 to FIRCA from Haryana in India was withheld [if it was] and a new letter from Delhi Study Group dated 12 October 2004 substituted in Mr Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court. The “Harbhajan Lal Letter” of 9 September 2004 states the money was collected in Haryana and part of it was transacted through the Indian Consulate in Sydney, Australia. Harbhajan Lal wrote from Haryana: “Respected Chaudhry Saheb, Nameste. We are hale and hearty here and please accept our good wishes. I received your letter. You have asked for details of the funds. You may recall that when you were here in the year 2000, we had formed a committee, which requested you to leave Fiji and stay in Australia since the situation in Fiji was not safe and you were not secure there. The committee also assured you that it would collect funds for your settlement in Australia. Lakhs of people from Haryana including traders, businessmen, landlords and non-resident Indians contributed heavily for the cause. The amount was pouring in for three years, which was sent to you from the year 2000 to 2002. The total amounting to nearly AUD fifteen laks was sent to you with the help of Government of India through its Consulate General in Sydney. We sent AUD 503,000/- as first instalment in the year 2000. In 2001, AUD $486,890/- was sent and then in 2002 AUD $514, 149/- was sent.”

The “Delhi Study Group Letter” states, “This is to confirm that funds were collected in New Delhi and other parts of India, including NRI's (Non-Resident Indians) to assist Hon'ble Mahendra Pal Chaudhry, Former Prime Minister of Fiji in 2000-2002.”

4: We call upon the Director of Public Prosecutions to ask Mr Chaudhry who transferred the money from India – Delhi Study Group based in New Delhi or Harbahajan Lal in Haryana, India?

5: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

6: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent to deal with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Support Group letter dated 12 October 2004.

7: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account.

8: We request the Director of Public Prosecutions to investigative whether Mr Chaudhry, in presenting the Tax Amnesty submission to the Cabinet in September 2007 for endorsement, might have abused office as Interim Finance Minister and direct line manager of Fiji Island Revenue and Customs Authority (FIRCA), to benefit himself, and to escape any future criminal prosecutions for submitting late tax returns between 2000 and 2003. We have documentary evidence that in August 2007 Mr Chaudhry still owed FIRCA $57,000 in tax debt, due to be paid on 9 August 2007. His own $57,000 could have fitted into insufficient advance payment or even late payment amnesty.

9. We therefore request the DPP to establish whether Mr Chaudhry had taxes or returns outstanding and paid during the amnesty period he had ordered and hence gained avoidance of penalties, and if so, then a case for Abuse of Office as Finance Minister and line manager of FIRCA could be made against him.

10: We call upon the Director of Public Prosecutions to plead with the Fiji High Court to expunge the patently false claims made against us in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012) – re that we published Mr Chaudhry’s tax details in anti-government websites. In conclusion, we leave you with the words of the great English judge, the late Lord Denning in King v Victor Parsons & Co [1973] 1 WLR 29, 33-34:

“The word 'fraud' here is not used in the common law sense. It is used in the equitable sense to denote conduct by the defendant or his agent such that it would be 'against conscience' for him to avail himself of the lapse of time. The cases show that, if a man knowingly commits a wrong (such as digging underground another man's coal); or a breach of contract (such as putting in bad foundations to a house), in such circumstances that it is unlikely to be found out for many a long day, he cannot rely on the Statute of Limitations as a bar to the claim: see Bulli Coal Mining Co v Osborne [1899] AC 351 and Applegate v Moss [1971] 1 QB 406. In order to show that he 'concealed' the right of action 'by fraud', it is not necessary to show that he took active steps to conceal his wrongdoing or breach of contract. It is sufficient that he knowingly committed it and did not tell the owner anything about it. He did the wrong or committed the breach secretly. By saying nothing he keeps it secret. He conceals the right of action. He conceals it by 'fraud' as those words have been interpreted in the cases. To this word 'knowingly' there must be added recklessly': see Beaman v ARTS Ltd [1949] 1 KB 550, 565-566. Like the man who turns a blind eye. He is aware that what he is doing may well be a wrong, or a breach of contract, but he takes the risk of it being so. He refrains from further inquiry least it should prove to be correct: and says nothing about it. The court will not allow him to get away with conduct of that kind. It may be that he has no dishonest motive: but that does not matter. He has kept the plaintiff out of the knowledge of his right of action: and that is enough: see Kitchen v Royal Air Force Association [1958] 1 WLR 563.”

The limitation statute’s aim is to prevent citizens from being oppressed by stale claims, to protect settled interests from being disturbed, to bring certainty and finality to disputes and so on. These are, as legal commentators have pointed out, laudable aims but they can conflict with the need to do justice in individual cases where an otherwise unmeritorious defendant can play the limitation trump card and escape liability.

We call upon the Director of Public Prosecutions to ask Mr Chaudhry which of the two letters – Harbhajan Lal or Delhi Study Group – is the lie – as they both can’t be genuine. Apart from the false accusations against us in his affidavit, the contents of the Harbhajan Lal letter dated 9 September 2004 does not accord with his bank statements from the Commonwealth Bank of Australia which he offered to FIRCA.

In our humble submission we beg the Director of Prosecutions to call upon the Fiji High Court to waiver the statute of limitation for prima facie there is evidence in the “Harbhajan Lal” letter that Mr Chaudhry obtained a favourable decision from FIRCA (an oversight on the part of FIRCA tax officers) through alleged fraud – the contents of the Harbhajan Lal letter does not square with his Australian bank statements.

Moreover, although we do not have a copy of Mr Chaudhry’s affidavit cited by Justice Goundar (despite requests for one from the Director of the Public Prosecutions) we call upon the Director of Public Prosecutions to examine the contents of both the Harbhajan Lal and the Delhi Study Group letters. If there are glaring disparities in the two letters than Mr Chaudhry must be deprived of the statute of limitation for the “fraud”, if any on his part, would be a continuing “fraud” since 2004 when he first offered Harbhajan Lal’s letter and now the Delhi Study Group letter in 2012 to explain away the $2million is his Australian bank account.

VICTOR LAL and RUSSELL HUNTER, 4 September 2012