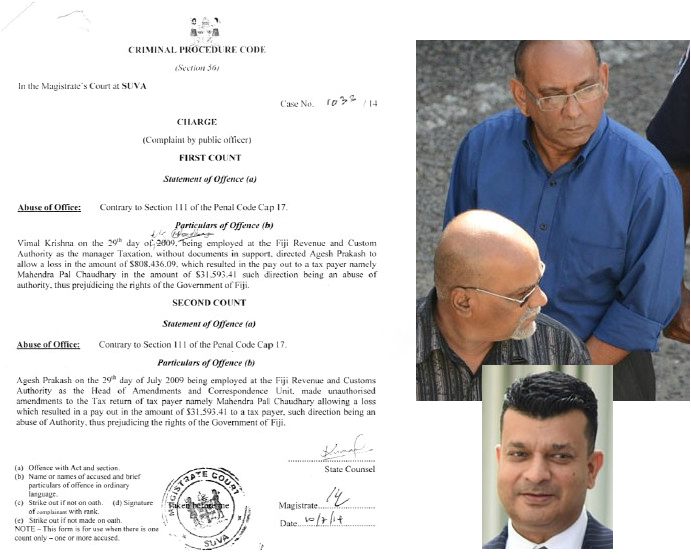

This was after the Office of the DPP had filed a nolle prosequi signed by the DPP, Christopher Pryde when the matter was called in court. It was alleged that former general manager taxation, Vimal Krishna, on July 29, 2009, without documentary support, had directed Agesh Prakash to allow a loss of $808,436.09 which resulted in the payout of $31,593.41 to the former Prime Minister Mahendra Chaudhry.

Prakash, who was head of amendments and correspondence unit, on July 29, 2009, allegedly made unauthorised amendments to the tax return of Mahendra Chaudhry allowing loss which resulted in payout of $31,593.41. Such direction was an alleged abuse of authority thus prejudicing the rights of the Government of Fiji.

The duo’s lawyer Devanesh Sharma had earlier submitted to the ODPProsecution (Office of Director of Public Prosecutions) addressing them on some key elements. Mr Sharma, in his submission, said that it could not be disputed Krishna as general manager taxation had the power delegated to him to amend any tax assessment; that all supporting documents already existed in the tax file of Mahendra Chaudhry; that Krishna properly acted in accordance with FRCA’s Standard Operating Procedure.

Mr Sharma submitted that Krishna as general manager taxation was authorised to deal with high profile taxpayers; that FRCA until now did not challenge the tax assessment amended by Krishna. He also submitted that if FRCA wanted, it had the power to amend any tax assessment at any time but did not do this therefore it meant that the tax assessment amended by Krishna was correct.

Magistrate Shageeth Somaratne dismissed the case setting the two free of the allegations. Source: Fiji Sun

Fijileaks: If Vimal Krishna had the delegation, as part of his authority, why did this case (at taxpayers expense) go to trial in the first place - to have a statutory process clarified, i.e. did he have delegated powers or not. Krishna is working as in-house tax consultant with RPatel Lawyers. He joined the company before the case. Sharma is a partner in RPatel Lawyers.

Meanwhile, how the hell could Mahendra Chaudhry make a loss of $800,000 on overseas investments? To do that Chauhdry would have to have more stashed away than Lal and Hunter discovered - much more. It doesn't seem possible.