Fijileaks: We will publish a copy of bankruptcy order that was prepared by ANZ and was to be published in Fiji Sun against Aiyaz Sayed Khaiyum

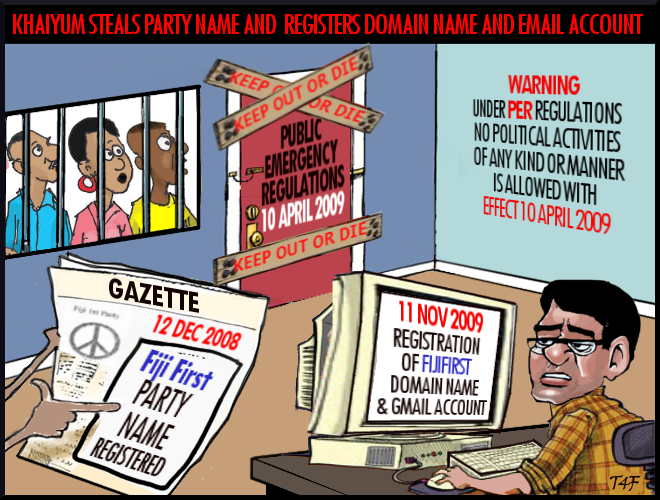

“We have had discussions with the RB [Reserve Bank of Fiji]. In fact we have had discussions with the Governor of the RBF couple of days ago and I think they have liaised with one agency that exists by the name of Data Bureau. So as soon as the Act comes into effect from tomorrow, they will have to hand over all the existing data to RBF which will then quarantine that information...All information about an individual’s credit history [Khaiyum means his and that of Faiyaz Koya] which until today was stored by the Data Bureau must be surrendered to the Reserve Bank tomorrow – never to be used again. Fijians applying for credit or buying on hire purchase won’t have their credit report accessed via Data Bureau anymore.” - Aiyaz Khaiyum on Fair Reporting of Credit Act which comes into effect on 27 May 2016

The Director of Public Prosecutions, Mr Christopher Pryde, has approved charges against a financial institution under the Financial Transactions Reporting Act 2004.

The Australia and New Zealand Banking Group Limited (ANZ) is charged with two counts of failure to verify customer identities contrary to section 4(1) and 39 of the Financial Transactions Reporting Act 2004.

It is alleged that the ANZ failed to verify and properly identify two customers of the bank and established two bank accounts without proper verification of the customer’s identities.

The matter will be called on 7 July 2016 for First Call at the Suva Magistrates’ Court.

Fiji Times

Saturday, July 04, 2015

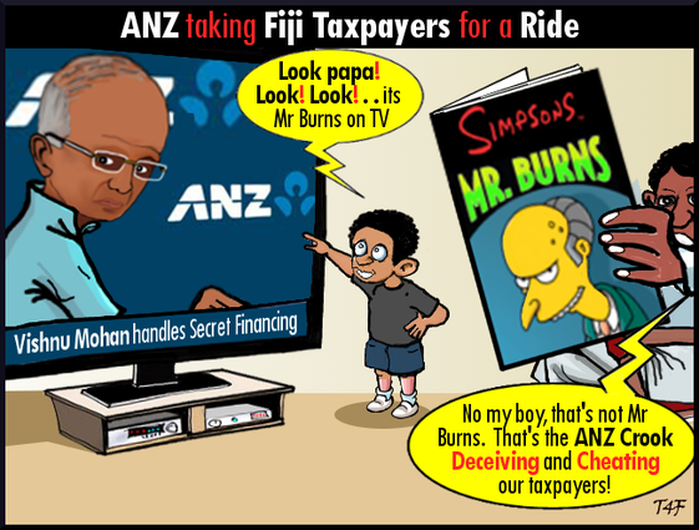

GOVERNMENT has signed an agreement with ANZ Bank Fiji to streamline processes that will make business registration easy. Attorney-General and Minister for Finance Aiyaz Sayed-Khaiyum said this was all part of improving the ease of doing business. The bank forged a relationship with Government in Suva yesterday after its application was approved through a tender process.

"We need to capitalise on the huge amount of interest in Fiji. If we don't capitalise on it now we can actually miss the boat and this is very critical for everyone within the different sectors including banks, employees and employer organisations and so on to take advantage of this opportunity and Government is very keen to do this," Mr Sayed-Khaiyum said at the Grand Pacific Hotel.

He said Government was looking forward to further its relationships with the bank. Government is also perusing through Investment Fiji's application with a view to launching it next week. He said this was a one-window application for foreign investors that will allow for approval by the Companies Office, Reserve Bank of Fiji, Investment Fiji, Immigration and Fiji Revenue and Customs Authority.

"Through that one-window application you will have all those approval in place. You can make your payment online, whichever country you're sitting in," he said. Government is also working on software that will be able to make the Registrar of Titles Office processes come online by the end of the third quarter of this year. ANZ Fiji CEO Vishnu Mohan said the signing would make applications and processes simple.