Fijileaks Editor: In 2010, VICTOR LAL wrote a series of articles on the Penina-Tappoocity deal in the pro-democracy website Coupfourpointfive, based on the secret Ernst and Young Report of 2007 titled "FNFP Special Investigation - Internal Report". To date, Aiyaz Khaiyum has not made the Report public. We are of the opinion that the contents of this Report should be re-produced for our readers and for all those interested in the Tappoocity deal between FNFP and the Tappoos!

The FNFP Board had on 18 October 2004 approved the pursuit of the FNPF/Tappoo Investment through FNPF Investment Board (FIL). Minutes of an FIL meeting held on 16 December 2004 indicate the design of the Project was flagged at this meeting. It was proposed that the Project would compose an 8storey building with retail space (three floors), a cinema, food court (one floor), offices (two floors) and a car park (two floors).

It was estimated according to the Board Minutes that the Project would cost a total of $23-$25 million. This was a change to the original project as described in the MOU, which described only six or seven story complex. Pursuant to the Joint Venture arrangement, land which was owned by Tappoos, located adjacent to the FNPF site, would be simultaneously redeveloped, with the aim of utilising the whole block for development.

On 9 March 2005, a Joint Venture Agreement was signed by FIL and Tappoos. Penina Ltd was incorporated on 2 May 2005. The issue capital of Penina Ltd included 30,000 shares of $1 each, of which 6,500,000 were paid up upon the incorporation of the Company.

Each shareholder contributed their respective land lots as consideration for equity in Penina Ltd, with the land valued at $6,500,000 for the purpose of this equity issue. The following individuals were members of the Board of Penina: Olota Rokovunisei and Neal Wright, representing FNPF and Kanti Tappoo and Vinod Tapoo, of Tappoos Ltd.

FNPF land was valued at $3,315,000 and Tappoos land was valued at $3,185,000 for the purpose of the equity issue, which resulted in 51% of the shares being allocated to FIL and 49% to Tappoos. Further equity comprising 4 million redeemable preference shares in Penina had been issued to the shareholders on a 51% and 49% basis in consideration of cash totalling $4million.

On 10 May 2005 Penina Ltd ratified the Joint Venture Agreement (JVA). Rokovunisei, Wright and the Tappoos were appointed as directors of the Company, and David Hanfakaga was appointed Company Secretary.

Project Cost Estimates

FNPF Board Paper No 1707 dated 23 July 2003 estimated that the Construction cost of the development would be $14 million, with a total development cost of $20 million. It is not known upon what information or assumption that estimate was based, as pointed out by Ernst & Young auditors.

By December 2004 the total project cost range was estimated at $20-25million. The JVA, signed in March 2005, noted that the total project building cost, including consultants, was estimated at $30 million. When the land cost was included the total project was set by the Board of Penina at a board meeting held on 10 May 2005.

A document titled “Board Paper No (no number) Penina-Tappoo City project – Request for Approval of revised Construction Budget from $25m to $38.6m”. In October 2005, FIL estimated the total cost of the project at $42,500,000, which included the estimated construction and contractor cost of $36m (including interest capitalization of $2million) and the land cost of $6,500,000. In mid-2006, after the construction contract had been awarded, the Project cost estimate was revised upwards, to approximately $44 million.

Financing the Project

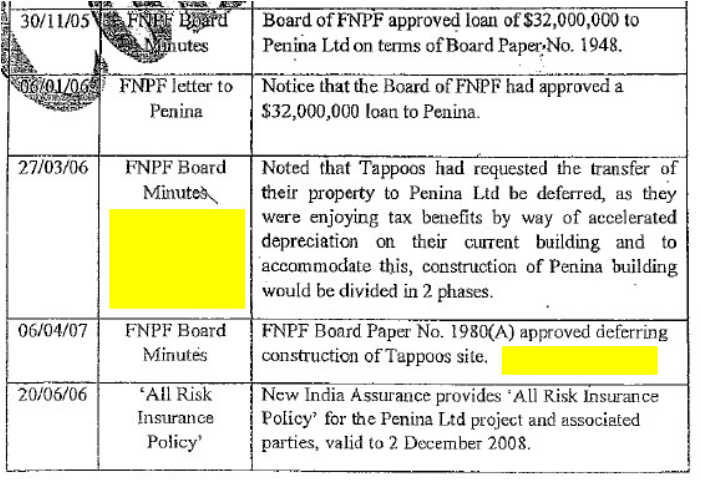

On 26 September 2005, Pradeep Patel of Deloitte (now charged with reviewing the FNPF’s controversial Natadola Project) provided advice to Penina Ltd regarding the financing of the Project in a document titled “Financial Projections”, in which he proposed that Penina issue equity totalling $10,5000,000 and obtain a term loan of $31,300,000 from FNPF.

Various financial projection scenarios were attached to this document, based upon four different proposed funding scenarios. In the FIL Board Paper No 1948 dated 30 November 2005, Penina Ltd’s request for a loan of $32,000,000, which included the estimated cost of building construction, consultant’s fees and capitalised interest during the construction period, was described.

The Board of FNPF approved a loan of $32 million to Penina on a twenty year term, fixed at 6% for the first 12 years with repayments based on a loan authorization over 20 years, after which the remaining balance will be refinanced or rolled over. On 6 January 2006, FNFP wrote to Penina providing notice that the Board of the FNPF had approved the loan for $32million. Note that after the construction contract was awarded the total project had increased and hence a loan extension was sought by Penina Ltd.

Penina Ltd and FNFP Project Revenue

In relation to the expected or projected revenue of Penina in this development, the JVA at section 9.5(c) provided that, “The tenant shall pay to the owner rent in amount of 8% of the Project Cost fixed for a period of 15 years. The Agreement defined Project Cost as the total construction cost of the building including the consultant’s costs and including the cost of the building.”

In Patel of Deloitte’s ‘Financial Projections’ for Penina dated 26 September 2005, he provided Cashflow Forecasts, project Forecasts and Balance Sheet Forecasts for the Project, which incorporated rent payable by Tappoos to FNPF calculated at 8% of the estimated cost of $39,300,000, set for a fixed term of 15 years (increasing to 10% of the estimated construction cost for the balance of the 10 year contract term).

Oh this basis, Pradeep Patel estimated that the rental income to Penina from the Project would be approximately $3,100,000 per annum for the first 15 years after the completion of the Project, with the next profit of approximately $2,900,000 prior to loan repayments to FIL.

In relation to revenue, FIL would generate from the project, a document titled “Return on Investment from TappooCity Project to FIL” dated 16 May 2005 (author unknown) noted that returns to FIL on this Project would include interest at 5.6% from the loan to Penina; receipt of 1% of the profits form the Joint Venture Company and the increased capital appreciation of building.

Penalty Payments

Another short-term potential source of income for FIL from this Project was a penalty of $40,000 per month, which was payable by Tappoos to FNPF upon FNFP’s initial interpretation of the commence of this Project was delayed beyond 2005. The justification for this penalty payment arrangement was that FNFP would be losing rental income from the time that the initial tenants of the site were evicted and construction of the Project commenced until the construction was completed and the new Tenant commenced paying rent. (N.B. Construction commenced in June 2006 and was expected to be completed by December 2008. It was however not known when the previous rental tenants of the FNFP site were evicted, and hence Ernst & Young was unable to calculate the total lost rental to FNPF by entering into the Project).

It appears, according to the Report, that Tappoos disputed the basis of this penalty payment. It was noted in the FIL Board Minutes of 14 June 2005 that this penalty payment was only payable by Tappoos “if there was delay in finalizing the design concept of the building."

There appeared to have been a lack of due diligence on the part of Fiji National Provident Fund prior to its decision to invest in the Project, resulting in the following issues: increased construction cost, increased overall Project cost, design changes to the Project and delays to the Project.

The construction cost estimated had risen from an initial estimate of $14million to approximately $35million. Given this significant variance, and the fact that the proposed design of the structure had not changed significantly, E & Y questioned how this initial construction forecast was produced, and how much due diligence was conducted by FNFP in this regard.

No documentation on files produced to E & Y indicated that any external engineering or other relevant consultant was engaged for the purpose of providing the initial cost of the Project.

The initial construction cost estimate was significantly altered upon receipt of a Report by the Quality Surveyor for the Project in August 2005. It would appear that this Quality Surveyor’s Report should have been commissioned prior to the decision to invest in the Project, which was made in or around late 2003.

The effect of the increased construction cost was that the project was now expected to cost approximately $44million to complete, a significant increase on the initial estimate of $20miilion, and $30million when the decision was made to invest. Generally, in relation to these cost estimate increases, E & Y emphasised that the Project cost estimates had significantly increased the risk and return profile of the Project for FNPF/FIL. E & Y also noted that in 2007 that the expected completion of the project was approximately two and a half years later than initial estimates.

Valuation of the sites

On 31 March 2003 David Ragg of Property Valuation & Consultancy Services provided a market value of $3,250,000 for the FNPF site. An agreement that the market value of the Tappoos site was $3,250,000 was reached by Carl Mar and Kanti Tappoo on 29 July 2003.

A ‘kerbside’ valuation of the site for this amount appeared to have been obtained by Tappoos from Property Valuation & Consultancy Services on a date unknown, and in turn was the price Management recommended FNPF should pay for the site (when that was a component of the development plan).

FIL Board Paper No 1707 dated 19 June 2003 stated that the purchase price paid by FNPF for Tappoos property being CT Number 24623 would be its “current market valuation” of $3,250,000. On 21 July 2003, Rolle Associates provided a document describing a valuation of $3,800,000 for the Tappoo site, comprising a land value of $1,400,000 and buildings value of $2,400,000.

The sites were valued at a combined $6,500,000 for the purpose of the initial equity distribution in Penina Ltd. However, E & Y noted correspondence from Himmat Lodhia, a director of FNPF and president of the Fiji Retailers Association, to Olata Rokovunisei, then general manager of FNPF, dated 6 October 2003, in which Lodhia stated that the valuation of the land to be used for the Tappoocity Project appeared to be “biased”, based upon the fact that the properties of Tappoos and FNPF were attributed as nearly equal in value, however Tappoos' portion of land comprised 27.45% of its aggregate size (762 sq metres compared to FNPF’s 2,014 sq.metres).

On this issue, advice was received from Ragg of Property Valuation & Consultancy Services on 9 March 2003. Ragg concluded that if the equity issue in Penina Ltd was based upon the respective size and value of the land being contributed to the Joint Venture by the Joint Venture Partners, FNPF’s proportionate interest in the Joint Venture should be 65% and Tappoos 35%.

It was noted in this advice that if it was determined that equity in the Joint Venture company should be issued according to the market value of the sites, then a 50/50 equity split would be appropriate.

If this was the case, noting that no documentation had been produced to E & Y which would allow any detailed analysis or comment on the respective properties in terms of size, one issue that arose was that Tappoos received 49% of the equity of Penina Ltd, yet contributed only 27.45 of the land to build Tappoocity in Suva.

In his letter to Rokovunisei dated 6 October 2003, Lodhia had also expressed concern at some of the terms of the Joint Venture Agreement. He stated: “I have listed some of the factors that we should consider for such a project, or else we could end up in serious breach of our guidelines. As stated earlier, this could be a subject of ridicule and incompetency on our behalf as Board Members, in the public eye as well as the parliament.”

The factors listed by Lodhia that contributed to his perception that the contract terms of the Joint Venture may have favoured Tappoos included: the value attributed to the respective properties, rent payable by Tappoos as Tenant should not have been fixed at 8% of total construction cost for 15 years, outgoings should be paid by Tappoos, a proposed loan on terms of 6-8% interest was too low (the loan was in fact advanced at 6%).

Based upon interviews conducted by E & Y, it was considered by FNFP staff in 2007 that the terms of the contract entered into with Tappoos was an area of concern. Principally, a concern was expressed that fixing the rent at 8% for the Tenant for a period of 15 years was less attractive to FNPF than calculating the rent payable by the Tenant according to the current market value of the property at the date of completion.

A file note regarding the Tappoocity Project indicated that general agreement regarding the terms of the agreement was reached on 29 July 2003 between Kanti Tappoo and Mar, including that the value attributed to Tappoos land would be its market value sum of $3,250,000 and the lease term to be 25 + 25 with first rent set at 8& of the Project cost fixed for 15 years (Document: Memorandum titled ‘FNPF/Tappoo Project – General Agreement Reached on Tuesday 29th July 2003 between Kanti Tappoo (Tappoo Group of Cos and Carl Mar (FNPF) undated).

Mar resigned from FNPF on 31 October 2006 to open his own consultancy company. He had been retained by Penina Ltd to act as a client representative and/or project manager and described his position as Client Rep/Project Manager of Penina Ltd (and GPHL).

The negotiation of the terms of Mar’s contract with Penina was delegated to Vinod Tappoo (Document: Penina Ltd Board Minutes dated 20 October 2006). E & Y understood that Mar was paid $10,000 per month for his position. Mar had also allegedly been retained by Tappoos in relation to its Lautoka project with FNPF but E & Y could not confirm it in its Report.

In the circumstances, E & Y concluded that it may have been ill-considered for FNPF to delegate or rely upon Mar to act as Project Manager and negotiate contractual terms for the Tappocity Project with Tappoos. This highlighted the need to have a better spread of commercial skills to be able to consider investment opportunities of this nature.

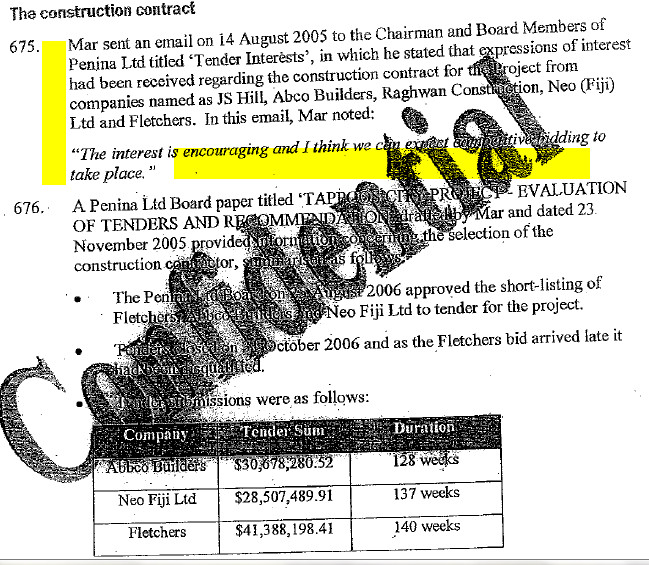

Appointment of Neo Fiji Ltd as construction contractor

It was stated in Clause 9 of the Joint Venture Agreement that Tappoos or a Joint Venture Company shall be eligible to tender for the construction contract of the Project, notwithstanding its role as a Joint Venture partner.

On 20 August 2003, Kanti Tappoo wrote to FNPF outlining why they should be given the construction contract without it going out to tender, which acknowledged was the normal practice by which FNPF awarded contracts for construction work. In November 2003, Tappoos expressed their interest in their subsidiary company Neo Fiji Ltd undertaking the construction of Tappoocity (Document: FNPF/Tappoo Project – Meeting with Tappoo Directors’ dated 29 &30 November 2003).

In early 2005, Neo Fiji Ltd became a fully-owned subsidiary of Tappoos for the purposes of bidding for the construction contract. Neo was awarded the contract on 25 November 2005 and commenced on site in late March 2006.

There was concern in the marketplace about this appointment, given that Neo was a fully-owned subsidiary of Tappoos. Minutes of the FNPF Investment Committee dated 30 November 2005 noted that: “Committee also was informed of the concern by some contractors in the market who regarded the tender process as a mere formality due to Tappoo Holdings association with NeoCorp, who they believe were earmarked for the project before the tender process was called. Management however assured Committee that all processes with regard to the tender were transparent and that NeoCorp was given the tender on the basis that it was the lowest.”

Tappoos resist tender process to build Tappoocity

It appeared to E & Y that any attempt to keep the process transparent and free of bias was met with resistance by Tappoo, based upon an analysis of the email exchange below.

Mar sent an email to Kanti Tappoo and Vinod Tappoo titled “Tappoos City project” on 3 October 2005 in which he noted: “I just wanted to briefly update you on the project and say that the project consultants meetings are progressing very well…The meetings so far have been held in the absence of a Tappoos rep as we want to show transparency during this stage of tendering process.”

On 5 October 2005 Vinod Tappoo replied to Mar’s e-mail in which he stated: “You will appreciate that Tappoos cannot be left out in these crucial decision making process for “transparency reasons” in view of the fact that the real conflict of interest lies not with Tappoos but with FNPF because, as you well know, the rent paid by Tappoos will be based on final total cost of the project. A cost increase, therefore, means increased rental for Tappoos and direct gain to FNPF through the JV. You may want to refer to the minutes of the last Board Meeting. Under these circumstances we trust that you will jointly make all decisions on the clear appreciation of those issues.”

Mar in turn responded by email on 5 October 2005 to Vinod Tappoo, stating: “Totally agree Vinod. It is just the Tender Phase that requires me to police carefully but I truly respect the importance of the bottom line i.e. project cost and this will naturally require Tappoos input.”

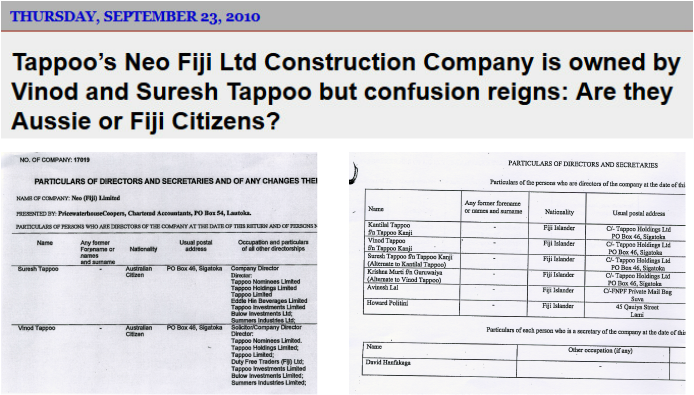

In one of the earlier series, we promised to investigate those behind Neo Fiji Ltd. What began as a routine inspection of company files in the Registrar of Companies has revealed other anomalies - anomalies that are not contained in the confidential Ernst and Young Report of 2007.

Penina Ltd

Particulars of Directors and Secretaries: Kantilal Tapoo f/n Tappoo Kanji, Fiji Islander; Vinod Tappoo f/n Tappoo Kanji, Fiji Islander; Suresh Tappoo f/n Tappoo Kanji (Alternate to Kantilal Tappoo), Fiji Islander; Krishna Murti f/n Guruwaiya (Alternate to Vinod Tappoo); Fiji Islander; Avinesh Lal, Fiji Islander, representing FNFP and Howard Politiini, Fiji Islander, also representing FNPF. The Tappoos and Murti gave their postal address as c/- Tappoo Holdings Ltd, P O Box 46, Sigatoka. The Tappoo business empire was started by Tappoo Kanji in 1941.

Neo Fiji Ltd

On 28 October 2004, the following persons were listed as Directors of Neo Fiji: Suresh Tappoo f/n Tappoo Kanji, Australian Citizen, P. O. Box 1105, Nadi, Businessman; Vinod Tappoo f/n Tappoo Kanji, Australian Citizen, P. O. Box 953, Suva, Businessman; Krishna Murti f/n Gurwaiya, Australian Citizen; Dr Ronald Neo, Singapore Citizen, P. O. Box 953, Businessman; and Karen Neo, Singapore Citizen, P. O. Box 953, Businesswoman. Karen Neo was also listed as Secretary. The Particulars of Directors and Secretary were signed off by Suresh (Lal) Tappoo.

Another Return to the Registrar of Companies (ROC) showed that Ronald and Karen Neo had resigned from the company on 12 August 2005 but Murti had continued as Company Director; he was also listed as Director, Summers Industries Limited, Tappoo Limited, and Tappoo Investments Limited. As noted earlier, in early 2005, Neo Fiji Ltd became a fully-owned subsidiary of Tappoos for the purposes of bidding for the construction contract for Tappoocity. Neo was awarded the contract on 25 November 2005 and commenced on site in late March 2006.

In its Annual Return for 2009 to the ROC, filed on 26 May 2010, Vinod Tappoo is listed as Australian Citizen, P O Box 46, Sigatoka, Solicitor/Corporate Director; Director, Duty Free Traders (Fiji) Ltd; Kia Motors Ltd, Tappoo Nominees Ltd, Tappoo Holdings Ltd, Tappoo Investments Ltd, Tappoo Ltd. Suresh Tappoo is listed as Australian Citizen, P O Box 46, Sigatoka, Corporate Director; Director, Eddie Hin beverages Ltd, Kia Motors Ltd, Tappoo Holdings Ltd, Tappoo Investments Ltd, Tappoo Ltd and Tappoo Nominees Ltd.Krishna Murti is listed as Australian Citizen, P O Box 46, Sigatoka, Company Director; Director, Kia Motors Ltd, Tappoo Investments Ltd and Tappoo Ltd.

We might also recall that in Bright Star Investments Ltd, which bought the illegal A-G Aiyaz Khaiyum’s Berry Road property, Suresh Tappoo gave his nationality in the 2005 BSIL report to the ROC as Australian. And yet, curiously, when they filed the Annual Report for Penina Ltd for 2008 on 21 January 2010, signed off by David Hanfakaga Ltd, Vinod and Suresh Tappoo and Murti have all listed their nationalities as Fiji Islanders.

Are they holding dual citizenships under Khaiyum’s Citizenship of Fiji Decree 2009, which came into force, with fees, in July 2009? The major citizenship policy change introduced by the Citizenship of Fiji Decree 2009 is the policy on dual/multiple citizenship both for registration and naturalization cases. Likewise, a new citizenship application form together with the new citizenship application fees was also being introduced.

The implementation of the citizenship of Fiji Decree No 23 effectively means that former citizens who live abroad and have acquired the citizenship of their adopted countries may regain their Fiji citizenship. This is possible under the meaning of Section 8(6) of the decree. Provided the applicants satisfactorily meet the requirements stipulated under the Section 8 of the citizenship regulations 2009: “Those wishing to be naturalised as a Fiji citizen would need to have been lawfully present in Fiji for a total of five of the 10 years immediately before the application for naturalisation is made as at Section 11 (2) of the Citizenship of Fiji Decree.”

Application by registration by a former citizen under section 8(7) of the Decree costs $3375. This includes, application fee, making oath of affirmation of allegiance, grant of certificate and application for passport. Application for naturalisation under section 11 of the Decree costs $5625. This includes application fee, making oath of affirmation of allegiance, grant of certificate and application for passport. Grant of certificates for bother statuses costs $120 each.

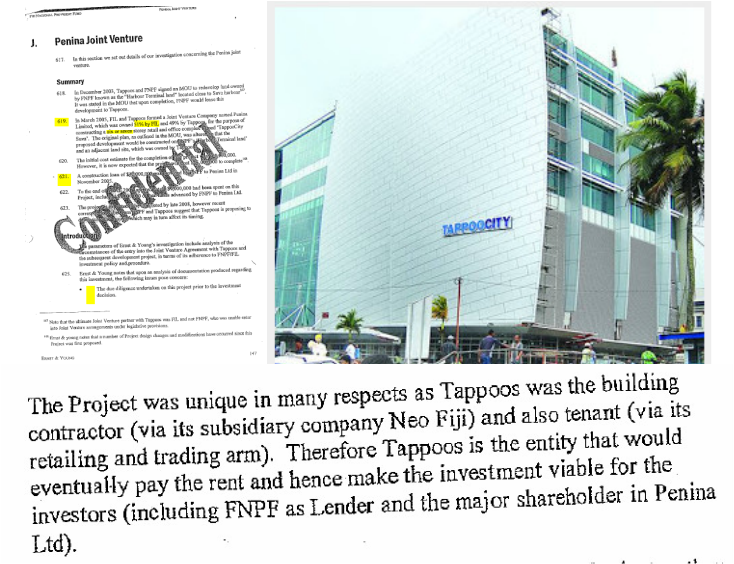

Whether the trio are Fiji or Australian citizens is another question, in Shakespearean language, “To be, or not to be”. In its conclusion, Ernst and Young, even without noticing the anomalies, noted that Neo Fiji Ltd was awarded the construction contract principally because it tendered the lowest price of $28,507,489.91. However, this contract price was subsequently revised within six months to $34,428,995.10. Tappoos was the building contractor of Tappocity (via its subsidiary company Neo Fiji) and also tenant (via its retailing and trading arm), and a shareholder with the FNPF in Penina Ltd.

The confidential E & R Report of 2007 concluded that the independence in the appointment of Neo Fiji Ltd as construction contractor appeared questionable. It was of even greater concern, however, that Neo Fiji Ltd was allowed to retain the contract after subsequently revising its costs estimate some six months after winning the contract.

Neo Fiji, the construction, interior decorating and finishing subsidiary of the Tappoo Group, also completed the construction of the new building for the new Great Council of Chiefs as well as the new FIRCA headquarters buildings in Suva.

Despite ups and downs, with Cyclone Mick, ripping off some roof panels in December 2009, the state of the art shopping complex finally opened to the public in 2010. Speaking to The Fiji Sun on the day TappooCity opened, one of the bosses wept. He was asked how the family did it. They date back a long time and their sweat has achieved. “The founder instilled in us the firm belief that there is no substitute for hard work.”