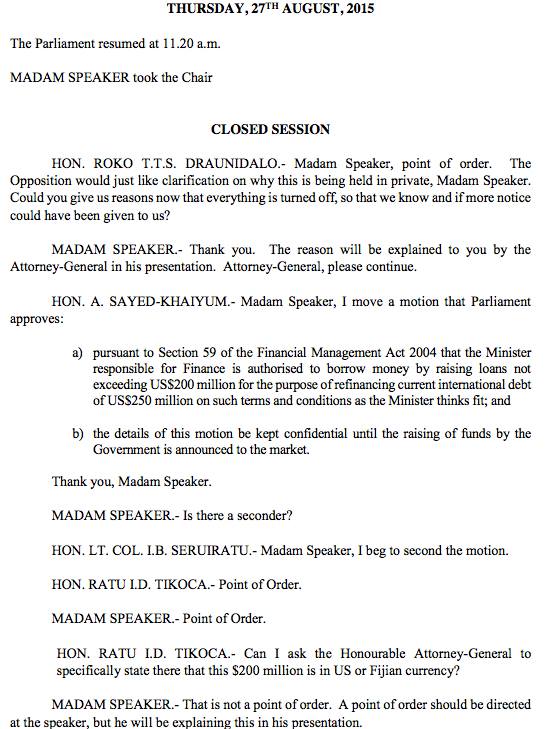

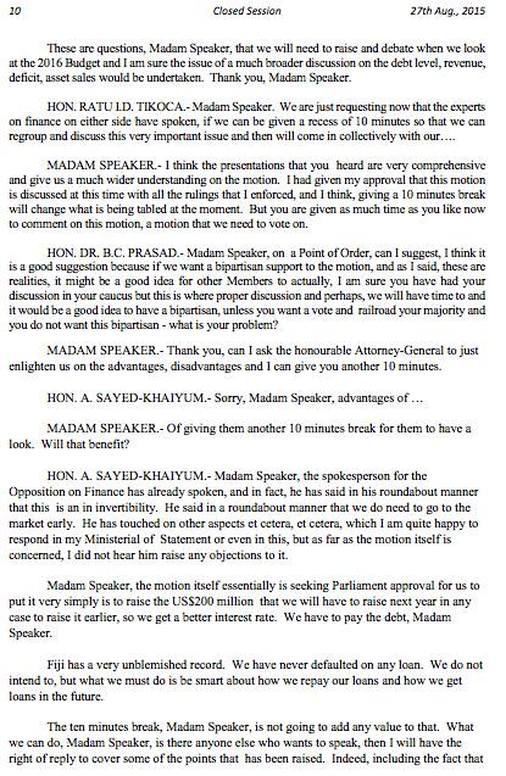

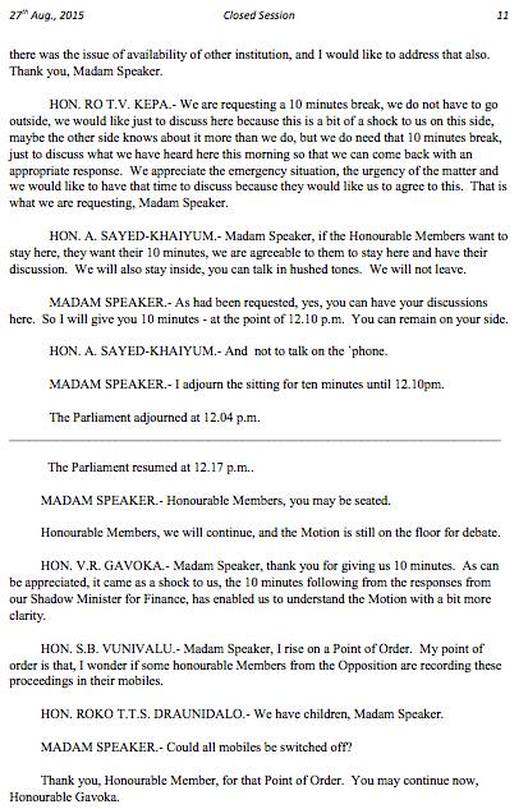

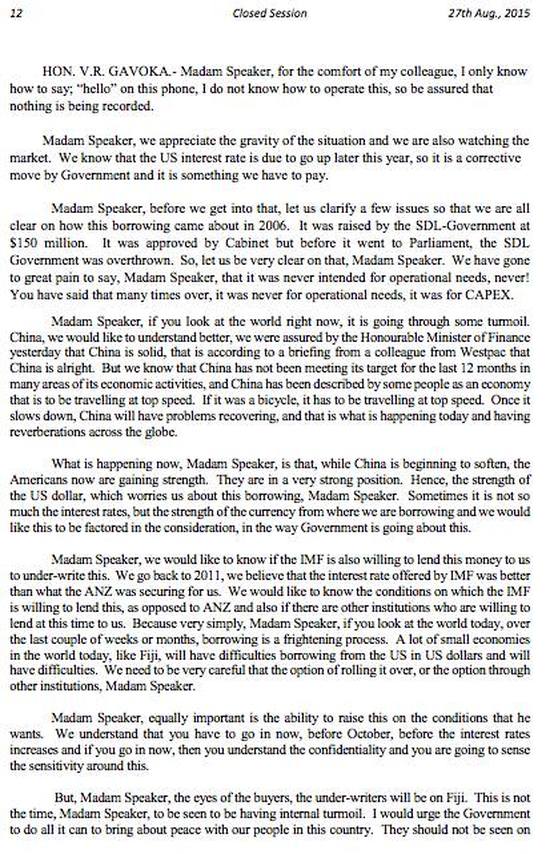

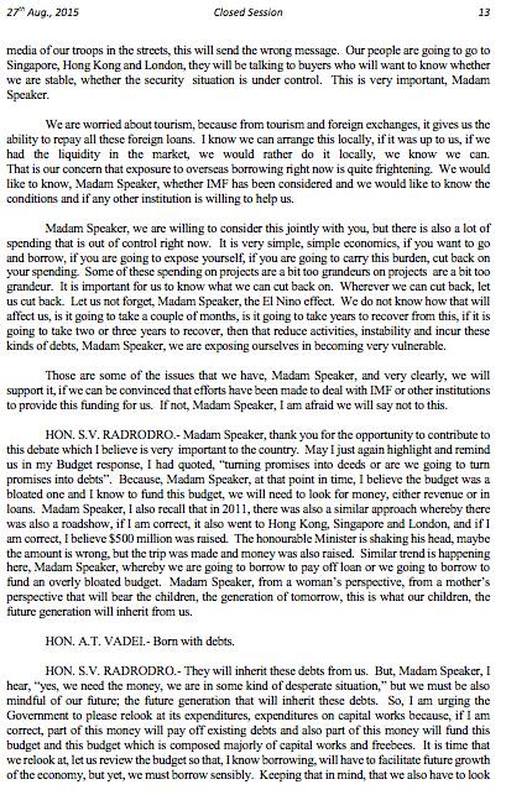

Mr Filimoni Waqabaca, the Permanent Secretary of Finance addresses participants at the discussion. Also in picture are the members of the panel. (Sitting from left - right): Dr Mahendra Reddy from the Fiji National University, Professor Wadan Narsey from the School of Economics at USP, Mr Norman Wilson, the CEO of ANZ and Associate Professor T. K. Jayaraman from the School of Economics at USP.

The School of Economics at The University of the South Pacific organised a panel discussion on “Fiji’s Second International Bond Issue” on 30th March, 2011 at USP’s Marine Studies Lecture Theater in Suva. The discussants were Associate Professor Jayaraman (School of Economics, USP), Mr Filimoni Waqabaca (Permanent Secretary of Finance, Government of Fiji), Dr Mahendra Reddy, Dean (College of Business, Hospitality and Tourism, Fiji National University), Mr Norman Wilson (CEO, ANZ) and Professor Wadan Narsey (School of Economics, USP).

The Panel was chaired by Dr Sunil Kumar, the Acting Head of Economics, who introduced the topic by explaining what the international bond issue implied. He noted that the US$250 million was borrowed by the Government of Fiji at a coupon rate of 9% that would cost the Government roughly $41 million Fijian dollars per year until March 2016. The government will then be required to pay a lump sum equal to the face value of US $250 million.

Dr T. K. Jayaraman stated that the advantage of selling the bond was that it would increase the foreign reserves and provide real resources for the government to build the economy which he argued was conditioned on wise policies. He pointed out that part of the new bond would be used to repay the earlier bond of US$150 million, which was issued in 2006. The rest would be added to the government treasury for disbursements. Dr Jayaraman said that the higher interest rate of 9% was not a favorable rate compared to the 7% paid earlier. He noted that there were cheaper loans possible from IMF and ADB, but the Government shied away from the harsh conditions laid down by these institutions to implement reforms such as reduction of public debt, trimming of the civil service and cutting recurring expenditures of the government. Observing that bond is not a magic wand, he said the need for reforms has not vanished. Fiji should now implement the needed reforms on its own accord without any outside goading.

Dr Jayaraman emphasised the importance of evaluating the outcomes of such loans before proceeding with this recent borrowing. He stated further that such borrowings should be avoided in the future and another one should not be issued to pay this one as it was done this time.

Mr Filimone Waqabaca, the Permanent Secretary of Finance, said that various reforms were being undertaken in Fiji including the reduction in the ratio of current expenditure to capital expenditure. He argued that recurrent expenditure had been racing ahead like a Rolls Royce while Government revenues were stagnating. The Fiji Government did not wish to draw down on their current foreign reserves in case they needed urgently for imports. Government also chose to borrow internationally rather than locally, as they did not wish to “crowd out” local private sector borrowings by putting upward pressure on domestic interest rates. An internal borrowing of this magnitude would have hurt everyone in Fiji by raising inflation and reducing investment. He stated that Government did not wish to borrow from the IMF because the conditions of IMF would have raised the interest rate while leading to a tighter fiscal policy which would have harmed the domestic economy. Mr Waqabaca referred to the IMF conditionality as harsh three-day medicine, while the bonds would be more gentle family medicine applied over a longer period.

Dr Mahendra Reddy stated that there was no reason why Fiji should not borrow for development and Fiji’s Debt to GDP ratio was not particularly alarming when compared to international norms. He pointed out that Fiji was unable to borrow at a lower rate internationally because of poor economic performance of the domestic economy. He advised that IMF conditionality had proven to be extremely harmful elsewhere in the world and he drew on several examples.

Mr Norman Wilson (CEO, ANZ) described the process through which the bond was raised and the due diligence followed by them to safeguard Fiji Government’s interests. He noted that ANZ had also made other loans to the Fiji Government.

Professor Wadan Narsey pointed out that the debate was being side-tracked into less important issues such as the cheaper loans available from the IMF (which was true) and whether the bond issue would be used for capital investment (highly debatable). Recent data showed higher government recurrent expenditure towards non-productive sectors like the military. He emphasised that the real issue was that the Fiji Government had been unable to pay the earlier bond, because of its refusal to curb unnecessary recurrent expenditure over the previous five years during which unauthorized military expenditures had escalated. He warned that the taxpayers (and the future generations) who were being asked to shoulder the burden of increased debt, did not know how their funds were being used, as the Fiji Government consistently refused to release any of the Auditor General Reports for the last four years.

The recent reports on the losses of public funds at Natadola and Momi have also not been released, nor the reports on the FNPF. The new bond was not only merely paying back the old bond, but the Fiji Government had borrowed another US$100 million in foreign exchange at the costly rate of 9% when much cheaper funds were available from the IMF and ADB. Professor Narsey pointed out that even ANZ, despite its strong financial base, did not itself want to lend the US$250 million, but went on a road show to attract other lenders, suggesting that they themselves did not have confidence in the Fiji economy. Following the presentations, there was a vigorous session of questions and comments from the floor.

The IMF (PFTAC) representative (Dr Yang) revealed that contrary to the impressions created that evening, the IMF had been willing to make the necessary loans at only 2% interest rate without many conditions except for those that normally apply to such loans. There were also questions raised on the appropriate exchange rate for Fiji as well as the impact of recent price control measures by the Commerce Commission. It was suggested that this mode of government control could further damage the investor confidence in the country.

The Dean of the Faculty of Business and Economics, Professor Biman Chand Prasad closed the session by thanking all the participants, and the large audience which had packed the Marine Studies Lecture Theater to listen to the discussions. He also highlighted that it was important to look at ways to build confidence in the economy. He suggested an immediate start to an inclusive political dialogue that would create the kind of confidence that investors would like to see.

This news item was published on 7 April 2011 by USP Media Team