BLACK DAY required a complete Blackout. Aiyaz Khaiyum, Minister for Finance and Minister for 'Many Other Things', wanted all MPs phones switched off. He wanted all live camera and internet feeds switched off. He wanted Parliament to be cleared of all and sundry except staff from the Ministry of Finance and Reserve Bank of Fiji. He ordered Parliamentarians not to leave Parliament. His request was granted by the Speaker. For WHAT? Fiji under his economic dictatorship is in deep financial MESS. Fiji is on the cusp of DEFAULTING on the US$250million (F$500m) in global bond. Khaiyum is holding frantic talks with the LENDERS. In order to avoid Fiji sliding into economic chaos he wanted Parliament (especially from the Opposition benches whom he held, and still holds, in contempt) to join forces and convince the mostly Asian lenders that Fiji will be in a position to refinance the bond. Fiji has a five year sovereign bond maturing requiring repayment of US$250million - Five Hundred Million Fijian Dollars.

Typically, instead of discussing this in the Business House session in the morning to get approval, he locked parliamentarians in under one of his many Constitutional clauses and got a

COLLECTIVE APPROVAL to take to the LENDERS.

But will the LENDERS still take FIJI to the LAUNDRY?

MPs not allowed to discuss the refinancing for a week till deals are financed. Diplomats alarmed at Government's tactics

WELCOME TO KHAIYUM'S FIJIFIRST PARTY GOVERNMENT!

The government has, today, priced a record-breaking US$250 million (F$500 million) 5 year at 9.00% international bond transaction via sole lead-manager and bookrunner, ANZ.

This is the second global bond issuance by the Fijian government. The first international bond was raised in September 2006 with a sum of US$150 million (F$300 million), which will mature in September this year.

Fiji's international investor profile was significantly broadened following a week long international roadshow across Hong Kong, Singapore and London in February that brought government officials in front of over 85 international fixed income investors via 1-on-1 meetings, group luncheons and an on-line investor presentation.

The road show presentation was led by the Attorney General, together with the Permanent Secretary for Finance, the Acting Governor Reserve Bank, and three senior officials from the Ministry of Finance and Reserve Bank.

The transaction was launched in Asia yesterday morning (Tuesday 08/03/2011), and was fully subscribed by midday with the orderbook closing almost 3 times oversubscribed within 12 hours of launch.

The final order book was substantially oversubscribed with over F$1.4 billion bids received (US$683 million) and compromised of 43 investors from 6 countries. “This is a clear indication of the level of confidence that investors in the international market have in Fiji’s economic development and progress, on-going reforms and future prospects”, said the Prime Minister and Minister of Finance.

Asian investors bought 36% of the transaction with Europe and Offshore-US accounts contributing the remaining 64%.

A very high quality order book comprised of 69% asset managers, 24% hedge funds, 5% private banks and 2% bank portfolios.

The transaction was successfully executed in the face of challenging international market conditions in the wake of the European sovereign crisis as well as the recent unrest across the Middle East.

The Prime Minister added that the successful execution of this global bond reaffirms government’s commitment towards financing priority capital investments that are earmarked in the 2011 Budget to generate economic activity, macroeconomic stability and a prudent fiscal position in the medium term.

It also demonstrates Government’s willingness to enhance growth through partnership with the private sector in the domestic as well as international market.

The government wishes to acknowledge the support and contribution of the rating agencies, the ANZ Fiji office, state owned enterprises and Government Ministries that submitted information which formed the Fijian story that was marketed during the roadshow.

The overwhelming response is due to the teamwork demonstrated by all parties, who share in this historic achievement.

-End-

From Road Show Presentation to Global Investors to

Digging Out of the Black Hole by Begging Parliamentarians:

Narsey

Narsey The bond issue: when failure is called success, while they dig our hole deeper (2011)

By Professor Wadan Narsey

The Military Government has announced with great fanfare that their “roadshow” in Hong Kong, Singapore and London, had successfully raised F$500 millions in foreign bonds to pay off $300 millions on a foreign bond raised in 2006, with the remaining F$200 millions allegedly being set aside for capital projects (The Fiji Times, 10 March 2011).

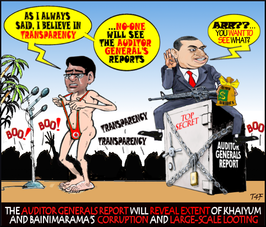

Khaiyum claimed with joy “This is a clear indication of the level of confidence that investors in the international market have in Fiji’s economic development and progress, ongoing reforms and future prospects”. What rubbish!

The Permanent Secretary Finance (Waqabaca) said the Government was happy to “showcase” the ANZ bank internationally (really?) for supporting Government in difficult times (but what did ANZ put in, and what will ANZ get?). Waqabaca, also made many euphoric and supporting statements for the bond conversion (with dubious economic logic).

The Acting Governor of the Reserve Bank (Mr Barry Whiteside) safely noted that foreign reserves will be boosted by the new borrowings, and hopefully suggested that FNPF might even benefit (perhaps, but only for a short while). All in all, if the media are to be believed, the bond conversion appears to be a great successful WIN-WIN venture for the Khaiyum/Bainimarama Government and Fiji, doesn’t it? Yes, it is a success for Bainimarama and Khaiyum- because they have managed to pass the buck to the future generations.

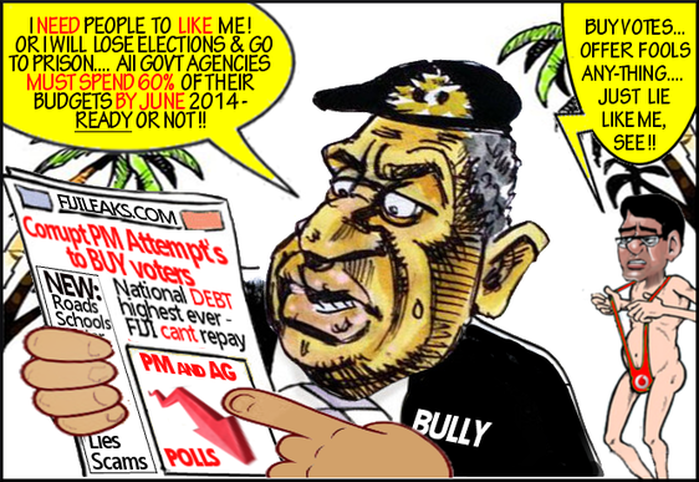

And Bainimarama and Khaiyum are digging Fiji’s future generations deeper into the Public Debt hole, with a higher proportion now denoted in very scarce foreign exchange. While they turned down a less costly but more sensible loan from the International Monetary Fund (IMF).

Failure to pay the US$150 million bond

Why did we borrow this F$500 million in the first place?

Because the Military Government was unable to repay the US$150 million bond undertaken in 2006 (whose local value rose to F$300 million after the 2009 devaluation).

Why cannot they repay?

Because the Bainimarama Government refuses to cut recurrent expenditure (and especially the bloated military budget) in order to achieve the level of fiscal surpluses needed to repay that US$150 million bond. So the magical Bainimarama/Khaiyum solution for the debt you cannot repay: borrow again to repay that $300 millions! AND to make it worse, borrow even more (another US$100 million) so as to pass on an even bigger burden (US$250 million) to the future generations.

But why did this Military Government not borrow the US$150 million (or US$250 million) from IMF at a much lower interest rate? Because the IMF conditionality would also have required them to reduce their recurrent fiscal expenditure to manageable levels, and probably there were other conditions too difficult for this incompetent regime to implement.

Higher interest, higher public debt, now owed in foreign exchange

How can you call successful, the conversion of a bond which was originally costing us 6.875 percent interest, into a bond now costing us a higher 9% interest?

AND to borrow overseas another US$100 million ($F200 million) also to be repaid at a higher 9% in foreign exchange, when its domestic borrowings from FNPF was at a much lower 6% at the margin? The repayments on this F$500 million bond will also have to be in foreign exchange, which the Fiji economy has great difficulty in earning. We may have healthy reserves now, but that is largely a result of the total lack of domestic investment and stagnant domestic incomes and demand. Our export earnings can only rely on tourism, water, gold and fish exports.

The sugar industry’s net foreign exchange earnings are not only lower because of the destroyed industry, but also because FSC itself owes large amounts overseas, which have now also been shouldered by the Fiji taxpayers (courtesy of the Bainimarama Regime).

With the devalued Fiji dollar, the increase in foreign debt will increase the burdens on tax-payers who are already being squeezed by FIRCA struggling to increase revenues in a stagnant economy, while facing higher inflation.

Should we devalue even more in the future (God forbid), the burden on Fiji’s tax-payers of this US$250 million bond, will be even higher.

False capital investment justification

How misleading of Khaiyum to claim that the extra $200 millions borrowed will not be used for recurrent expenditure but for capital investment.

That statement would have been true, had recurrent expenditure been at the appropriate lower level. That statement would have been true, had the Military Government not already wasted hundreds of millions in all its badly managed projects such as at FSC and other contingent liabilities which are going to come home to roost, sooner or later. Make no mistake, the extra $200 million is being borrowed to maintain the bloated Bainimarama Regime’s recurrent budget. That capital expenditure Khaiyum talks about would have been incurred in normal times, any way.

ANZ and international confidence in Fiji?

Contrary to Khaiyum’s claim, the financing of this bond is not an indicator of broad investor confidence in Fiji.

As the data from the Fiji Bureau of Statistics and RBF clearly show, the Fiji economy has been badly failing the real test of confidence in the economy for the last four years: private sector investment has been less than 7% of GDP and has dropped to around 3% currently, when it should have been around 15% to 20%.

These bond buyers are merely confident that Fiji has enough foreign reserves to repay the interest and principal when it becomes due.

And the bond buyers are confident that this military dictatorship has enough control of the economy to squeeze the tax-payers for the required amounts, or to simply borrow yet again in the future, should they not have the funds.

What about ANZ? Of course ANZ has some excellent investment initiatives in Fiji with have much growth potential, such as its call and data-processing centres.

But, ANZ must have made their cut out of this deal? What percentage of the bonds did ANZ buy?

And if Wilson was so confident in the Bainimarama/Khayum management of the Fiji economy, why didn’t ANZ International lend Fiji the whole US$250 million?

Will ANZ now expect future tax and other benefits from a Military Government which was so grateful to have on its “road-show” a multinational bank whose representative “Wilson was able to give its side of the story” on the Fiji economy, and convince the other bond buyers? What Fiji story did Wilson indeed give?

The Reserve Bank and FNPF

Of course, the Reserve Bank will now have some higher reserves, for a few years, until the debt become due again, when it will all go, and they might need even more.

Of course, FNPF might benefit if it is able to invest some of its funds off-shore. But these funds can be forcibly brought back anytime the Reserve Bank wants.

And any benefits to us FNPF shareholders, will of course, be paid for by all the tax-payers of Fiji (of whom FNPF shareholders are only a part).

The PS euphoria and justification

It is extraordinary that the PS Finance (Waqabaca) is reported to have said that his emotion at the bond sale was “one of elation, we were overjoyed, we were happy with the outcome”.

What? Happy that after the Bainimarama Government failed to repay the old debt, happy that the public debt and burden on tax-payers was being further increased, happy at the significantly higher interest rate we taxpayers will be paying ?

Waqabaca claimed that they borrowed overseas because they wanted to “avoid a crowding out effect whereby Government does not restrict private sector demand for domestic finance”.

But “crowding out” only occurs if the available domestic finance was already being fully used by the private sector, which might indeed be “crowded out” if government barged in offering higher interest rates.

The reality has been that domestic investment demand has been so low for five years that the financing institutions (private banks as well as FNPF, FDB and Home Finance) have been desperate to lend their cash to anyone credit-worthy.

As for not wanting to “increase domestic interest rates”- well, were interest rates to rise, the biggest beneficiary may well have been FNPF, which has for decades been a captive lender to Government at low interest rates (much to the private banks’ relief).

While higher domestic interest rates would provide the appropriate discipline on the uncontrolled borrowings by this reckless Military Government.

Civil Servant Coup Collaborators

If Khaiyum and Bainimarama tried to reduce recurrent government expenditure in order to repay the 2006 bond, they would have faced resistance from the civil service and especially the military officers and rank and file whose support has been bought by grossly inflated salaries, promotions, appointments to higher civil service positions, and other perks.

This damaging bond conversion into a bigger Public Debt allows Bainimarama and Khaiyum to avoid the flak that would come from painful fiscal discipline today, while thoroughly enjoying their party in the meantime.

One can therefore expect the public relations spin from Aiyaz Khaiyum who is on a personal fairy-tale roller coaster ride, playing around with hundreds of millions of dollars of Fiji tax-payers’ funds (not his own or his father’s, as Indians say), trotting around the globe at tax-payers’ expense, feted and supported by sycophant prominent members of the business community, who naturally also get the benefits they want.

But Fiji’s tax-payers should not be receiving an unnecessary PR exercise and faulty economics from civil servants like Waqabaca, who ought to know better.

One of the tragic consequences of the Bainimarama coup has been that inexperienced civil servants without any depth of knowledge or experience, have been rapidly pushed up the ladder into enormously powerful positions, where they are easily misused.

In their gratitude to their Masters for the rapid promotion, so many civil servants (mostly indigenous Fijian), have been prepared to enthusiastically spout all the rhetoric and public relations spin, justifying the decisions and policies of this illegal Military Government- whether it is the Pillars of the Charter, the supposed grand electoral reform, or this foreign bond conversion which is going to be so damaging to the future generations.

Assisted by a censored or pliant media, these civil servants also thereby irresponsibly encourage the public to swallow all the spin- hook, line and sinker, and be totally lulled into a false sense of complacency and well-being.

The Fiji “road-show” indeed, goes on, while our future slowly erodes.

https://narseyonfiji.wordpress.com/2012/03/18/the-bond-issue-when-failure-is-called-success-while-they-dig-our-hole-deeper-2011blogs/