"Banks have already been contacted by borrowers in arrears stating that if there is no Data Bureau, they see no need to pay back their loans." - Kevin McCarthy, Chairman, the Association Of Banks

Khaiyum himself was on the verge of being declared bankrupt by ANZ Bank but he jumped on the coup gravy train to become Interim Attorney-General; Lest we forget, for several months ROC, on his orders, was hiding his Midlife Investment Ltd file from Fijileaks, for he had bought the land through his Latifa Investment Ltd from his now FFP Minister Faiyaz Koya. Sadly, what SODELPA only wants is the re-reinstatement of the GCC, many of whose members had used their chiefly influential positions to borrow thousands of dollars from the NBF until it collapsed from the weight of unpaid debts. Worst, just read the stupid comments of the Consumer Council of Fiji CEO Mrs Premila Kumar : “After years of lobbying, finally consumers have won. It is a joyous moment for consumers to start afresh. This means now they can access loan or buy goods on credit without being subjected to embarrassment and inconvenience.” - The Data Bureau should reveal ALL the names of those on the list, and let the 47 complainers to CCF clear their names, to prove that they had paid off their loans.

IF YOU KNOW SOMEONE OR A COMPANY THAT WAS ON THE DATA BUREAU'S ADVERSE CREDIT LIST CONTACT US:

[email protected]

The Data Bureau's List of Members included the Fiji Muslim League, iTAUKEI AFFAIRS BOARD, iTAUKEI AFFAIRS SCHOLARSHIP UNIT, iTAUKEI LAND TRUST BOARD, etc, etc, etc. See full list in pdf form

CAN MINISTER FAIYAZ KOYA confirm or deny he was on the DB's List?

By Vijay Narayan and Semi Turaga

Fijivillage News

28/04/2016

The Association Of Banks In Fiji has expressed their disappointment in regard to the passage of the Fair Reporting of Credit Act through parliament yesterday afternoon.

Chairman Kevin McCarthy said the act has been passed with zero consultation with any of the stakeholders.

He said this includes the Data Bureau, commercial banks, finance companies, hire purchase and credit providers.

McCarthy said there appears to be no consultation with the proposed regulator, Reserve Bank of Fiji.

He said the inability now to be able to search a person’s credit history will greatly increase the risk levels within the personal lending market.

The Association of Banks said lenders will have little option but to increase interest rates to compensate for the increased risk.

McCarthy said banks have already been contacted by borrowers in arrears stating that if there is no Data Bureau, they see no need to pay back their loans.

He said the banks will have no option but to pursue legal action through to bankruptcy to enforce payment of these loans.

The Association of Banks also said that processing times for loan approvals will now increase as banks ask borrowers to provide evidence of having paid off loans in the past.

McCarthy said loans will be more difficult to obtain and interest rates higher, at this time when those affected by Cyclone Winston may be looking to borrow funds to rebuild.

Meanwhile the Consumer Council of Fiji has termed the passing of the Fair Reporting of Credit Bill as a win for all consumers who had been bullied by the Data Bureau.

CEO Premila Kumar said consumers can now start afresh and access loans or buy goods on credit without being subjected to embarrassment and inconvenience.

She said since 2008 they have received 47 complaints against the Data Bureau and it reflected the invasion of privacy, inaccurate information and even the listing of names for seven long years despite clearing the loan.

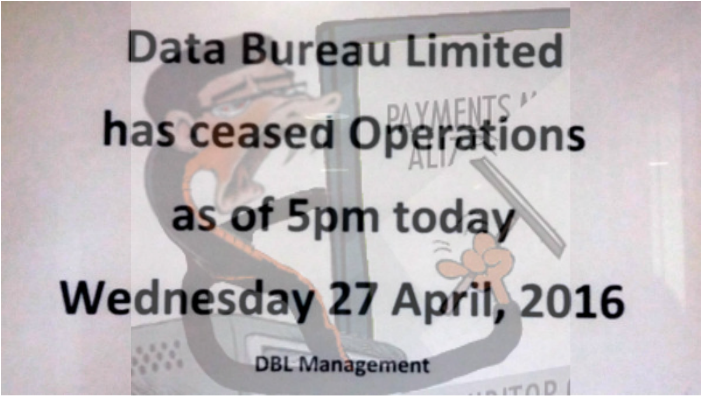

All credit history with the Data Bureau of Fiji will now be erased after the Fair Reporting of Credit Bill was passed by parliament.

The new law requires credit reporting agencies to obtain a license from the Reserve Bank of Fiji.

Credit reporting agencies will also be required to submit to the Reserve Bank an annual compliance report in addition to its audited financial statements.

Data which is currently with the Data Bureau will also need to be verified by the Reserve Bank.

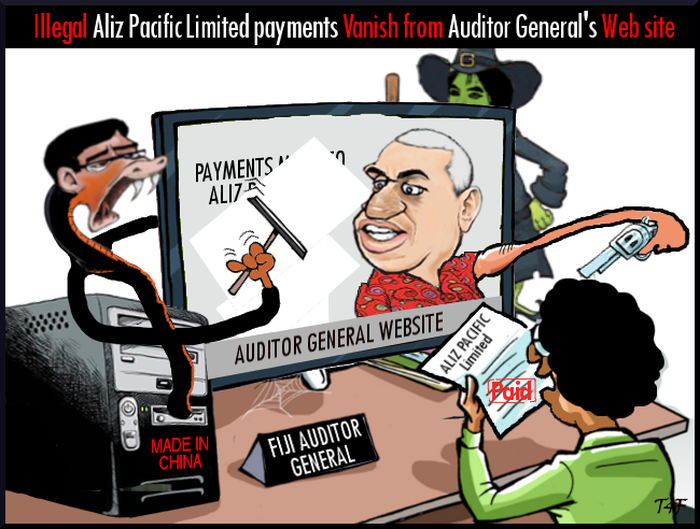

Attorney General Aiyaz Sayed‑Khaiyum said there were a number of complaints about the Data Bureau for a couple of years and now it has been given a lot of significance in the wake of Cyclone Winston.

He said the business of credit reporting was previously carried out in Fiji without any legal framework.