GOT a 'LEAK' for us? Email us at [email protected]

"The minister [Khaiyum] makes vague allegations about having received "many complaints from members of the community regarding information held by Data Bureau". That is a meaningless statement. He does not say if he has investigated the complaints or even established if those complaints are justified. As of last month Data Bureau held 415,275 consumer files and 91,729 business files. There have been 1,141,109 consumer searches and 26,855 business searches in the past 15 years, and 7870 public notices. Mrs Premila Kumar of the Consumer Council of Fiji said the council received 47 complaints. Only 14 complaints from the Consumer Council have reached Data Bureau in 15 years."

Callaghan

Callaghan By Gary Callaghan

Saturday, May 21, 2016

Fiji Times

LAST week the Minister of Finance, in a letter published in full in the Fiji Sun, replied to the concerns of the Association of Banks of Fiji about the new Fair Reporting of Credit Act.

Like all of his other statements regarding this Act, which has come into force from April 29, the reply is full of incorrect information and irrelevant sidetracking. Spin and diversion is not going to change the facts.

First, the minister accuses ABIF's chairman, Mr McCarthy, of a "conflict of interest". This is because Mr McCarthy is the head of BSP Bank and BSP Bank's associated company, BSP Life, is a shareholder of Data Bureau.

This is just plain silly. Is the minister suggesting that the BSP Bank should not do any business with the tourism industry because BSP Life has shares in a large Denarau hotel?

Is he perhaps suggesting that every Parliamentarian whose relatives had a listing on Data Bureau's files should have declared their interests before voting?

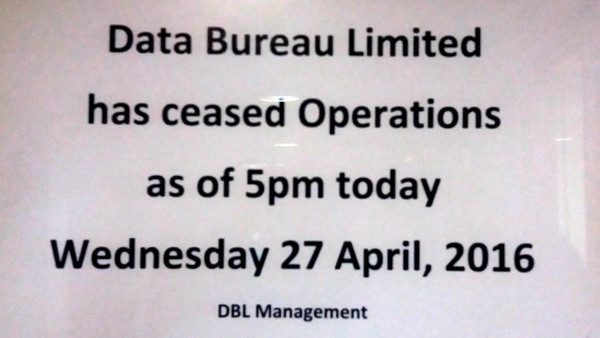

The minister has made a blunder. This Act will do harm to many people in Fiji in a very unfair way. It will effectively close our business. There has been no consultation with our company or the people who use its services.

The minister seems to think it is Data Bureau's fault that there is no regulation of credit reporting in Fiji.

In fact, we have worked with organisations such as the World Bank to develop the best and fairest systems of data collection and recording.

Our rules most certainly protect people's privacy. They also provide for quick and confidential correction of any errors which are made.

The minister makes vague allegations about having received "many complaints from members of the community regarding information held by Data Bureau".

That is a meaningless statement. He does not say if he has investigated the complaints or even established if those complaints are justified.

As of last month Data Bureau held 415,275 consumer files and 91,729 business files. There have been 1,141,109 consumer searches and 26,855 business searches in the past 15 years, and 7870 public notices.

Mrs Premila Kumar of the Consumer Council of Fiji said the council received 47 complaints. Only 14 complaints from the Consumer Council have reached Data Bureau in 15 years.

Data Bureau responded to every single Consumer Council complaint and the council took no further action.

Mrs Kumar has been to our offices. We have explained to her our processes, how we protect people's privacy and how we correct errors. She has never once suggested to us that our systems are wrong or need improving.

The majority of Fijians have no adverse credit history. If a credit provider inquires about a person and is told that a person has no adverse records at Data Bureau, that helps that person to get credit more quickly and at better rates of interest. So the majority of people will lose as a result of this Act.

The minister seems to be under the delusion that, as a result of the new Act, there will be a new credit bureau and it will have perfect information.

The minister does not seem to understand the basics of a credit bureau.

It is about a history of credit information, obtained by consent and shared by the majority of credit providers, who make their own credit decisions.

The key word is "history". Data Bureau had 15 years of history. If there is no history then there cannot be a useful credit bureau. If the minister had engaged in some meaningful consultation he would have understood this.

Lastly, I need to once again correct the minister on several points:

* Data Bureau's information is not flawed, or as he says, "tainted". Just because the minister says he has received "complaints" does not make it so. He has produced no evidence of his so-called "complaints". Just assume (even though it is not true) that the Consumer Council was correct in its 14 complaints about our 415,275 consumer files. Is that a good reason to throw away the other 415,261 files;

* Many government departments and statutory bodies are customers of Data Bureau. They have never complained of "tainted" information;

* Some people seem to think that if they take a long time to pay a debt, but they finally pay it or settle it, that they should not have an adverse record at Data Bureau. Ask anybody in business who has ever spent valuable time chasing bad debtors, or paid legal fees to lawyers or had to discount an invoice to get payment. Why, with a bad credit history, should a person get credit on the same terms as someone who has honestly and diligently paid all his or her bills on time;

* All information contained on our database — other than public information such as court judgments — has been collected with consent. People seeking credit from a credit provider give consent because they know that a Data Bureau search gives confidence to credit providers;

* Sometimes an adverse record appeared and people objected to it. If the record was wrong, it was quickly and confidentially corrected. Data Bureau had a process for this. But how can people object to information which is true, and which they have agreed that Data Bureau may have;

* The minister says that he is "perplexed" about news that interest rates may rise as a result of this Act. He says "a decrease in interest rates was not touted as a reason for the introduction of the Data Bureau." In fact, they were. And the evidence clearly shows that these two benefits have occurred; and

* Of course we cannot show a direct correlation between interest rates and the existence of Data Bureau in the past 15 years. Interest rates are affected by many things. The minister was also once a lawyer for a bank. And therefore he must surely know that when, because of a lack of information, a credit provider's risks of loan default increase, the cost of credit — that is, the interest rate — will also decrease. How else will a credit provider cover its losses?

We will shortly be updating our website to include all statements made by any minister and the Consumer Council regarding this new Act together with our comments and corrections. The public will then be able to judge who is right and who is wrong.

* Gary Callaghan is the chairman of Data Bureau Limited. The views expressed in this article are his own, not the views of The Fiji Times.