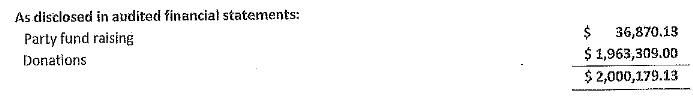

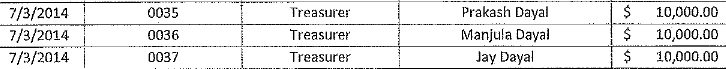

In 2014, the FijiFIRST Party received over $2million in donation, mostly from BIG Company directors, their wives, sons, daughters, and even staff

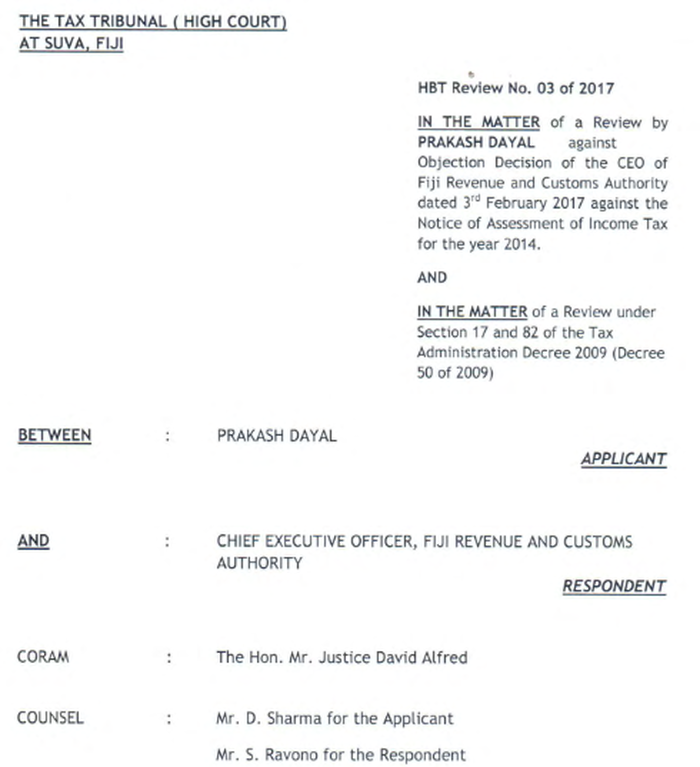

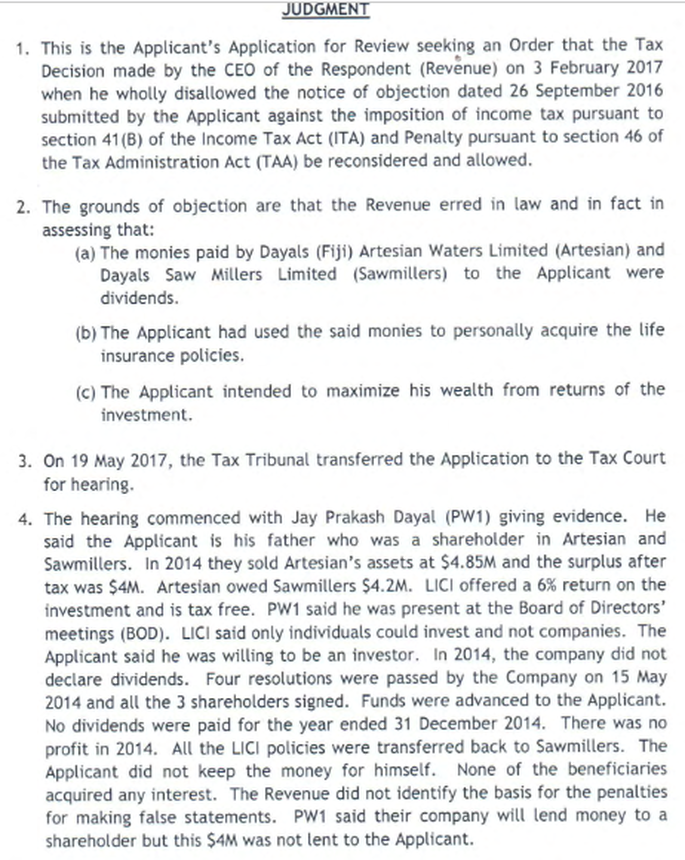

After a three-day hearing in October 2018, Fiji High Court Tax Tribunal had ruled that PRAKASH DAYAL pay FRCA $2,252,234.68 in requisite

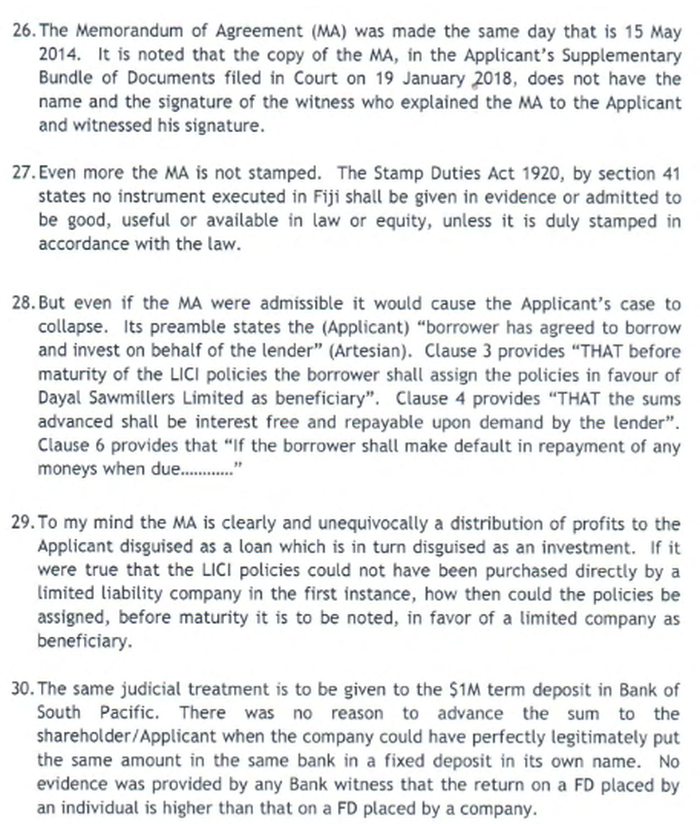

income tax and penalties for the year 2014 plus $1,000 court cost. PRAKASH DAYAL had objected that FRCA had erred in law and in fact in assessing that: (a) The monies paid by Dayals (Fiji) Artesian Waters Limited (Artesian) and Dayals Saw Millers Limited (Sawmillers) to the Applicant (Prakash Dayal) were dividends. (b) The Applicant had used the said monies to personally acquire the life insurance policies. (c) The Applicant intended to maximize his wealth from returns of the investment

"At the end of the day I am satisfied that the whole exercise was to enable the Applicant (Prakash Dayal) to receive the princely sum of $4M without him paying the requisite tax on it...In the result the Application for Review filed on 3 March 2017 is dismissed and I shall make the following orders: (1) The Respondent’s Decision (income tax and penalties) for the sum of $2,252,234.68 for the year 2014 to be paid by the Applicant is affirmed. (2) The Applicant shall pay the Respondent the costs of these proceedings summarily assessed at $1,000" . - Judge David Alfred

Ms Laisa Bainimarama, principal auditor with the objection and review team at FRCA told the Tax Tribunal that its role is to handle objections and review objection applications. The review here was for the end of 2014. She said penalties are imposed specifically on tax shortfalls where there are false or misleading statements. Revenue has the jurisdiction to treat substance over form and to treat something as dividend. This is a concept used in tax jurisdictions. $4M was recorded as an advance and it was invested in an insurance product by the Applicant (Prakash Dayal) and his wife (Manjula Dayal) for the benefit of their children. No additional information was available to make it to be seen as an advance. Other than in financial statements there was no other information about these large amounts.

"It cannot be denied that to describe the payments as loans for investment on the company’s behalf is at variance with the truth. It would be like describing chalk as cheese. The Applicant (Prakash Dayal) advised by accountants, auditors and no doubt tax lawyers knew full well he was receiving moneys from the company which would have been objectively described as dividends. But he chose to assert to the very end that they were not dividends..." |