UPDATE:

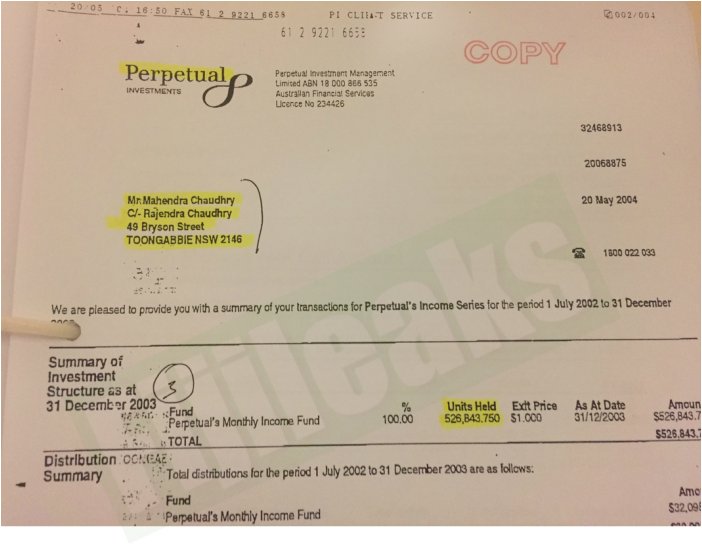

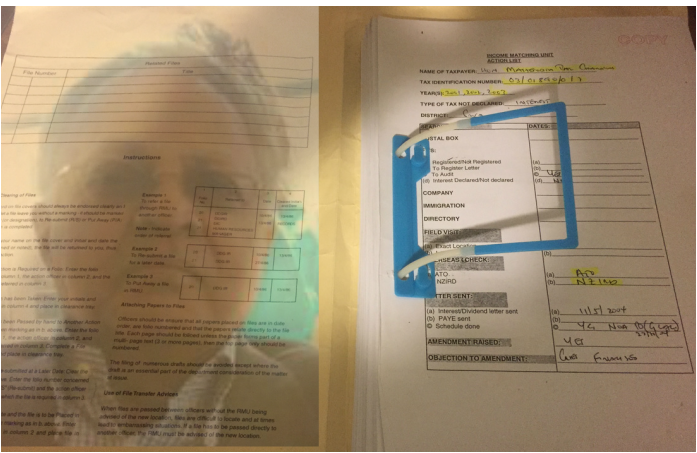

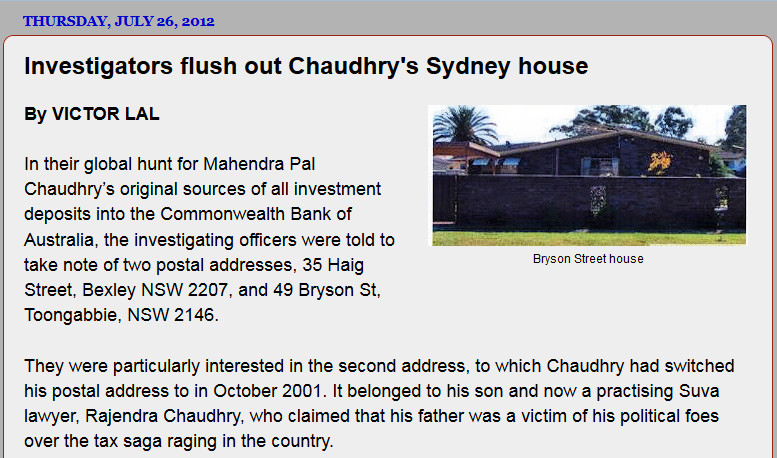

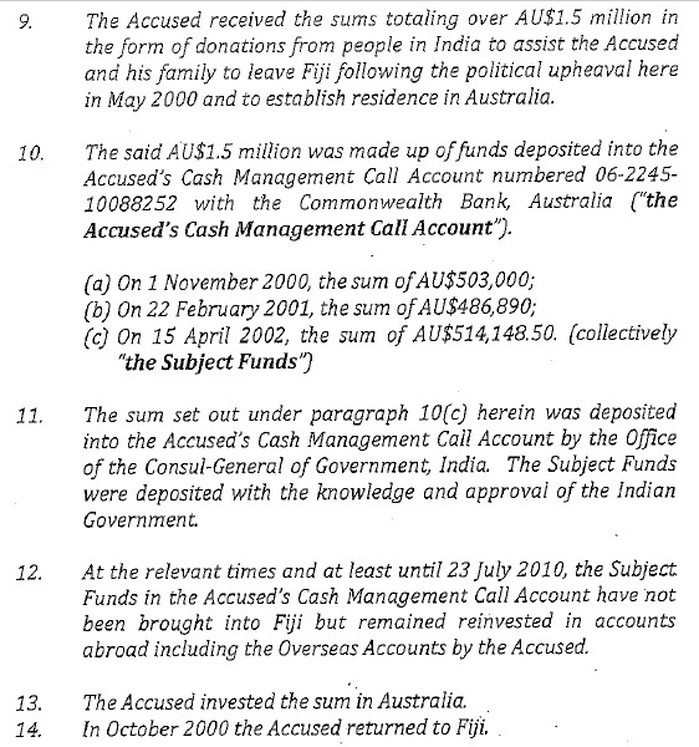

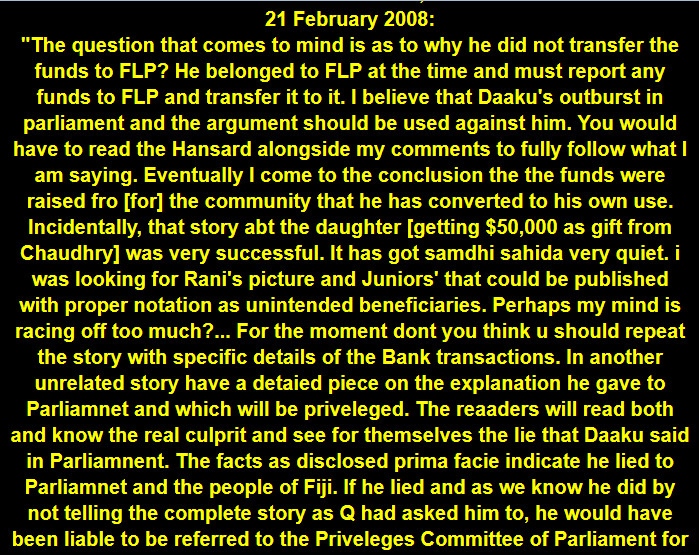

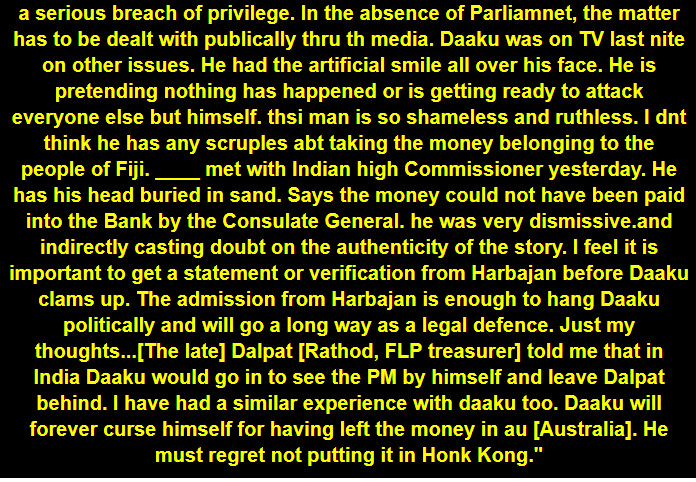

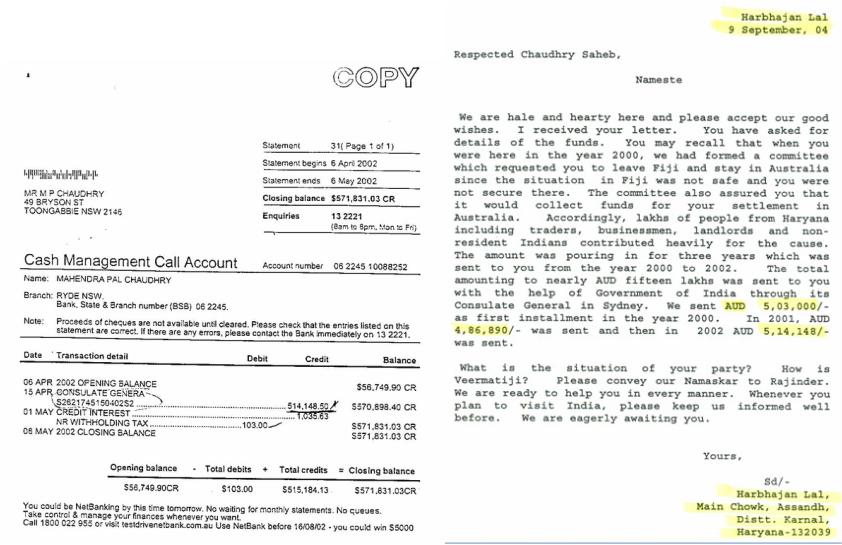

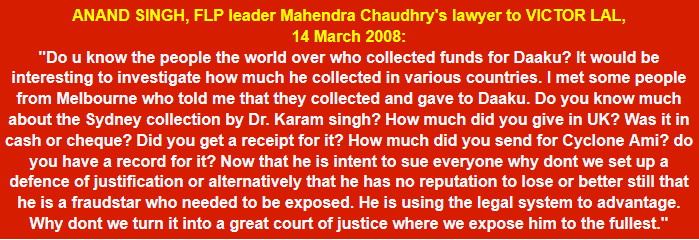

Fijileaks: Yes, keep on riding the thieving horse on your convicted father's back and enjoy the $2million he was hiding in the Australian bank account and investing it from your former home address at 47 Bryson St, Sydney! The first payment of $503,000 was deposited into your father's account on 1 November 2000. We do not know the sender from his Tax File; on 22 February 2001, again sender not specified, deposited $486,000 and on 15 April 2002 he received $514,148.50. This was sent via Indian Consulate in Sydney, Australia. So, tell us who sent the first two instalments? It was not the Government of India? Lest you forget the over Half a Million Dollars he was hiding in an New Zealand bank account! Tell us, who is Harbhajan Lal, and where can we FIND HIM? As your father's lawyer Anand Singh had asked Lal in 2008: "I feel it is important to get a statement or verification before Daaku clams up. The admission from Harbhajan is enough to hang Daaku politically... this man [Daaku] is so shameless and ruthless. I don't think he has any scruples about taking the money belonging to the people of Fiji..." Again, if the money was for the Chaudhry clan to relocate to Australia, what were you, your father, your mother, your sister, all doing in Fiji; you only left for Australia after running foul with the authorities? And they are still living in FIJI!

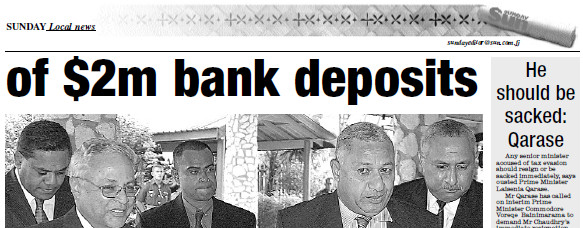

Why didn't he ask INDIA to stop the poor from donating when he had not relocated to Australia? The first payment of $503,000 was deposited into his account on 1 November 2000. We do not know the sender from his Tax File; on 22 February 2001, again sender not specified, deposited $486,000 and on 15 April 2002 he received $514,148.50. This was sent via Indian Consulate in Sydney. Chaudhry never relocated to Australia but in September 2001, the FLP led by him, narrowly lost the election to SDL's Laisenia Qarase. What did he do with the money? He INVESTED it! When FRCA cornered him in 2004 he offered a letter from one Harbhajan Lal to explain the source of the $2million but when he was charged, he and his lawyer Anand Singh presented a letter from Delhi Support Group; the infamous "Harbhajan Lal Letter' was never tendered to court to support his claim. Was Harbhajan Lal letter FAKE to hoodwink FRCA? Victor Lal disclosed the $2million (as Fiji Sun headline read) based on the Harbhajan Lal letter that is in Chaudhry's tax file. There is no Delhi Support Group letter!

"Dear Uncle. I ran into Rajendra Chaudhry on Marks Street this afternoon. He told me that Russell Hunter will be deported out of Fiji tomorrow morning." Ben Padarath to Victor Lal, 24 February 2008

Hunter

Hunter According to documents in Mahendra Chaudhry's Tax File, only one lot of money - $514,148.50 (15 April 2002) - was transferred via the Indian Consulate in Sydney. Who or which organization had transferred the other two instalments? We should not forget that he was neither in India or Australia but had led Fiji Labour Party into the 2001 general election!

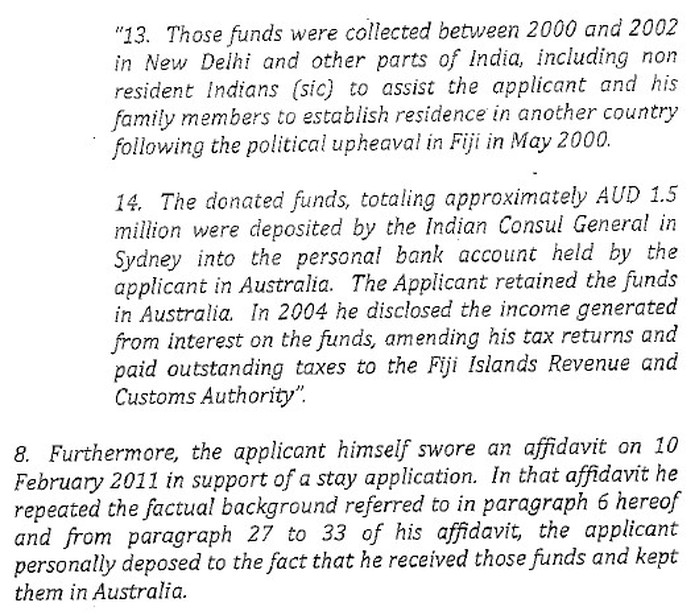

Perjury probe request in Mahendra Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court and call for other criminal investigations arising out of Mr Chaudhry’s income tax file

By VICTOR LAL and RUSSELL HUNTER, September 2012

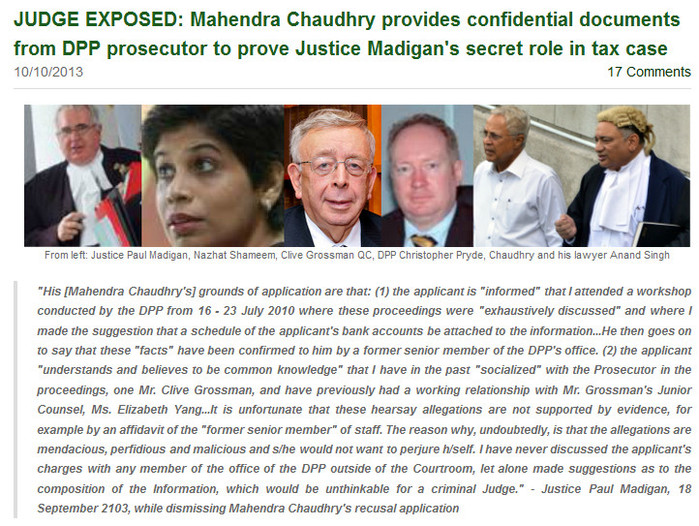

Fiji High Court judge Justice Daniel Goundar made two declarations of interest to us in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012).

Justice Goundar on anti-government websites and Victor Lal’s tax story Let us take Justice Goundar’s second observation first.

After the military coup in 2006, the applicant returned to the political arena as the Minister of Finance in the interim government of Fiji. The applicant says, what followed after his ministerial appointment, was a trial by media. The applicant says he later found out that a former editor of the Fiji Sun obtained his confidential tax details from FIRCA and released it to Victor Lal, a former Fiji journalist residing overseas. Victor Lal published those details in anti-government websites (our emphasis underlined)

Response to Affidavit Content: Manifestly False, re Victor Lal and Russell Hunter

(A): It is manifestly false for Mr Chaudhry to claim in his affidavit (and uncritically repeated by Justice Goundar in his judgment) that Victor Lal had published his (Mr Chaudhry’s) tax details in anti-government websites.

(B): Fragmentary details of Mr Chaudhry’s tax records were first published in the Fiji Sun of 15 August 2007 and full details in the Sunday Sun of 24 February 2008. This led to the deportation of Fiji Sun and Sunday Sun editor in chief and publisher Russell Hunter the next day, 25 February, from Fiji.

We recommend you to obtain copies of the two editions from the Fiji Sun head office in Suva which will support our contention of the falsity in Mr Chaudhry’s affidavit before Justice Goundar in the Fiji High Court in Suva.

To summarize, Justice Goundar observed in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012):

“The applicant says he later found out that a former editor of the Fiji Sun obtained his confidential tax details from FIRCA and released it to Victor Lal, a former Fiji journalist residing overseas. Victor Lal published those details in anti-government websites.” We have demonstrated that we never published Mr Chaudhry’s tax details in any anti-government websites but in the Sunday Sun dated 24 February 2008, including the first tax story in the Fiji Sun, on 15 August 2007.

1: We therefore call upon the Director of Public Prosecutions to investigative whether Mr Chaudhry committed the offence of “perjury in a false affidavit”.

2: We call upon the Director of Public Prosecutions to investigate whether Mr Chaudhry’s legal representatives in offering his affidavit to the Fiji High Court are also guilty of aiding and abetting the offence of perjury in a false affidavit, for it is abundantly clear that we did not publish Mr Chaudhry’s tax details in any anti-government websites.

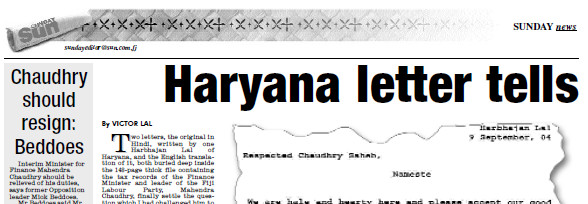

3: We request the Director of Public Prosecutions to establish on what grounds the original letter tendered from one Harbhajan Lal dated 9 September 2004 to FIRCA from Haryana in India was withheld [if it was] and a new letter from Delhi Study Group dated 12 October 2004 substituted in Mr Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court.

The “Harbhajan Lal Letter” of 9 September 2004 states the money was collected in Haryana and part of it was transacted through the Indian Consulate in Sydney, Australia. Harbhajan Lal wrote from Haryana:“Respected Chaudhry Saheb, Nameste. We are hale and hearty here and please accept our good wishes. I received your letter. You have asked for details of the funds. You may recall that when you were here in the year 2000, we had formed a committee, which requested you to leave Fiji and stay in Australia since the situation in Fiji was not safe and you were not secure there. The committee also assured you that it would collect funds for your settlement in Australia.Lakhs of people from Haryana including traders, businessmen, landlords and non-resident Indians contributed heavily for the cause. The amount was pouring in for three years, which was sent to you from the year 2000 to 2002. The total amounting to nearly AUD fifteen laks was sent to you with the help of Government of India through its Consulate General in Sydney. We sent AUD 503,000/- as first instalment in the year 2000. In 2001, AUD $486,890/- was sent and then in 2002 AUD $514, 149/- was sent.”

The “Delhi Study Group Letter” states, “This is to confirm that funds were collected in New Delhi and other parts of India, including NRI's (Non-Resident Indians) to assist Hon'ble Mahendra Pal Chaudhry, Former Prime Minister of Fiji in 2000-2002.”

4: We call upon the Director of Public Prosecutions to ask Mr Chaudhry who transferred the money from India – Delhi Study Group based in New Delhi or Harbahajan Lal in Haryana, India?

5: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

6: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent to deal with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Support Group letter dated 12 October 2004.

7: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account.

8: We request the Director of Public Prosecutions to investigative whether Mr Chaudhry, in presenting the Tax Amnesty submission to the Cabinet in September 2007 for endorsement, might have abused office as Interim Finance Minister and direct line manager of Fiji Island Revenue and Customs Authority (FIRCA), to benefit himself, and to escape any future criminal prosecutions for submitting late tax returns between 2000 and 2003.We have documentary evidence that in August 2007 Mr Chaudhry still owed FIRCA $57,000 in tax debt, due to be paid on 9 August 2007. His own $57,000 could have fitted into insufficient advance payment or even late payment amnesty.

9. We therefore request the DPP to establish whether Mr Chaudhry had taxes or returns outstanding and paid during the amnesty period he had ordered and hence gained avoidance of penalties, and if so, then a case for Abuse of Office as Finance Minister and line manager of FIRCA could be made against him.

10: We call upon the Director of Public Prosecutions to plead with the Fiji High Court to expunge the patently false claims made against us in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012) – re that we published Mr Chaudhry’s tax details in anti-government websites.

11. In conclusion, we leave you with the words of the great English judge, the late Lord Denning in King v Victor Parsons & Co [1973] 1 WLR 29, 33-34:

“The word 'fraud' here is not used in the common law sense. It is used in the equitable sense to denote conduct by the defendant or his agent such that it would be 'against conscience' for him to avail himself of the lapse of time. The cases show that, if a man knowingly commits a wrong (such as digging underground another man's coal); or a breach of contract (such as putting in bad foundations to a house), in such circumstances that it is unlikely to be found out for many a long day, he cannot rely on the Statute of Limitations as a bar to the claim: see Bulli Coal Mining Co v Osborne [1899] AC 351 and Applegate v Moss [1971] 1 QB 406. In order to show that he 'concealed' the right of action 'by fraud', it is not necessary to show that he took active steps to conceal his wrongdoing or breach of contract. It is sufficient that he knowingly committed it and did not tell the owner anything about it. He did the wrong or committed the breach secretly. By saying nothing he keeps it secret. He conceals the right of action. He conceals it by 'fraud' as those words have been interpreted in the cases. To this word 'knowingly' there must be added recklessly': see Beaman v ARTS Ltd [1949] 1 KB 550, 565-566. Like the man who turns a blind eye. He is aware that what he is doing may well be a wrong, or a breach of contract, but he takes the risk of it being so. He refrains from further inquiry least it should prove to be correct: and says nothing about it. The court will not allow him to get away with conduct of that kind. It may be that he has no dishonest motive: but that does not matter. He has kept the plaintiff out of the knowledge of his right of action: and that is enough: see Kitchen v Royal Air Force Association [1958] 1 WLR 563.”

The limitation statute’s aim is to prevent citizens from being oppressed by stale claims, to protect settled interests from being disturbed, to bring certainty and finality to disputes and so on. These are, as legal commentators have pointed out, laudable aims but they can conflict with the need to do justice in individual cases where an otherwise unmeritorious defendant can play the limitation trump card and escape liability.

We call upon the Director of Public Prosecutions to ask Mr Chaudhry which of the two letters – Harbhajan Lal or Delhi Study Group – is the lie – as they both can’t be genuine. Apart from the false accusations against us in his affidavit, the contents of the Harbhajan Lal letter dated 9 September 2004 does not accord with his bank statements from the Commonwealth Bank of Australia which he offered to FIRCA.

In our humble submission we beg the Director of Prosecutions to call upon the Fiji High Court to waiver the statute of limitation for prima facie there is evidence in the “Harbhajan Lal” letter that Mr Chaudhry obtained a favourable decision from FIRCA (an oversight on the part of FIRCA tax officers) through alleged fraud – the contents of the Harbhajan Lal letter does not square with his Australian bank statements.

Moreover, although we do not have a copy of Mr Chaudhry’s affidavit cited by Jutsice Goundar (despite requests for one from the Director of the Public Prosecutions) we call upon the Director of Public Prosecutions to examine the contents of both the Harbhajan Lal and the Delhi Support Group letters. If there are glaring disparities in the two letters than Mr Chaudhry must be deprived of the statute of limitation for the “fraud”, if any on his part, would be a continuing “fraud” since 2004 when he first offered Harbhajan Lal’s letter and now the Delhi Study Group letter in 2012 to explain away the $2million is his Australian bank account.

VICTOR LAL and RUSSELL HUNTER, 4 September 2012