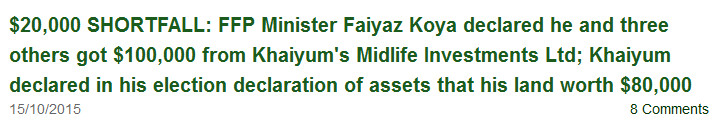

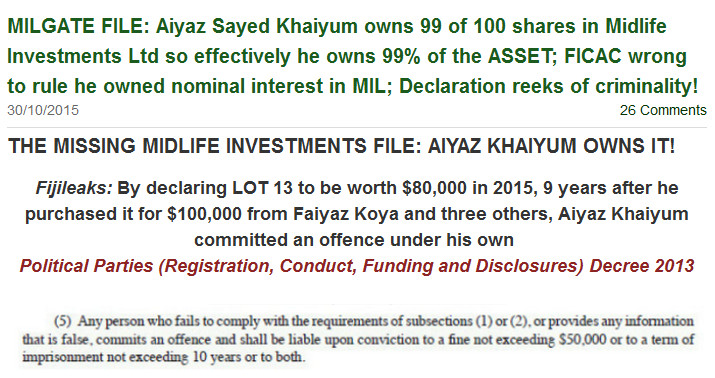

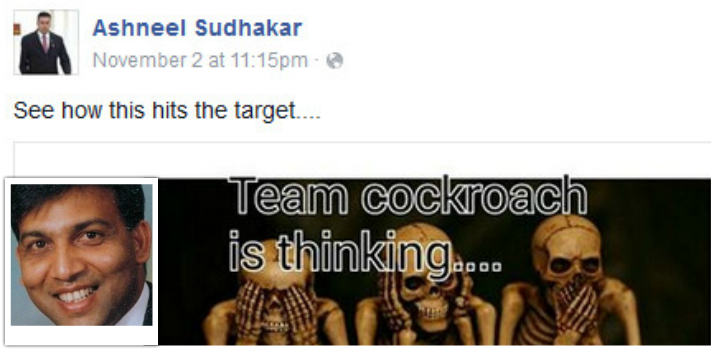

THE 2016 BUDGET IS BUDGET OF DECEPTION AND CONFUSION

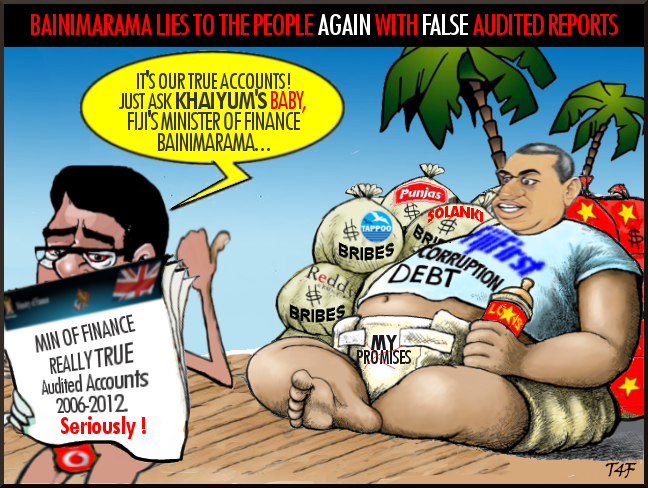

"Madam Speaker, we will not ask anything of Fijian citizens that we do not demand of ourselves. The people who assess, collect and record taxes and duties must be unquestionably honest. We have been dismayed by instances of corruption uncovered recently by FICAC involving payments and favors to FRCA employees... FICAC, the FRCA Board and the Ministry of Finance will be unrelenting in rooting out corruption and in prosecuting to the fullest extent anyone who betrays the people‘s trust. We are asking people to pay their share. They must believe they can trust their government....Freight handlers who give gifts to FRCA employees if they agree to falsify customs documents could very well end up sharing a prison cell with their co-conspirator."

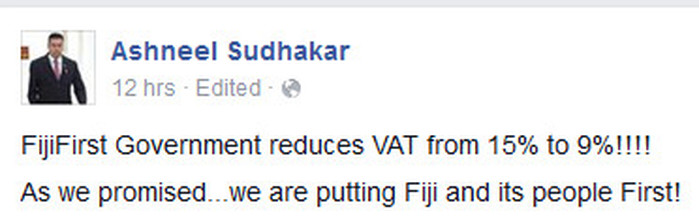

"Madam Speaker, Take for example a family looking to purchase a $20,000 car. That family will now save $1,200 thanks to the lower VAT. This kind of savings can make dreams a reality for many Fijians who will now have greater purchasing power in the marketplace."

"A sum of $15.88 million is provided to fund the operations of the Independent Commissions: the Human Rights and Anti-Discrimination Commission, the Accountability and Transparency Commission, Public Service Commission and the Fiji Independent Commission Against Corruption and Freedom of Information." |

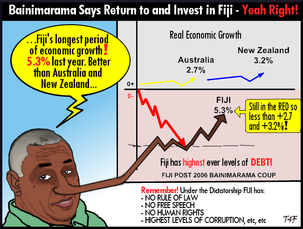

Unprecedented Growth and Economic Performance | They called Fiji‘s growth momentum ― exceptionally strong,‖ and predicted that GDP would grow by 4.3% in 2015 and show continued momentum in 2016." |

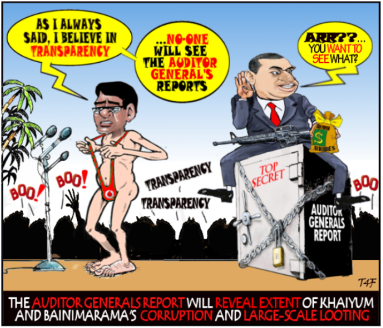

Auditor General |

Women, Children and Poverty Alleviation |

“The imposition of 9% VAT on basic food items will now force 45% of our people who live in or on the verge of poverty to pay more for food and medicine from their meager incomes. It is a highly insensitive move against the poor who spend a large part of their income on putting food on the table for their families.” - FLP

Denouncing the move as insensitive, Labour Leader Mahendra Chaudhry said it is a blow to the poor.

“The imposition of 9% VAT on basic food items will now force 45% of our people who live in or on the verge of poverty to pay more for food and medicine from their meager incomes,” he said.

“It is a highly insensitive move against the poor who spend a large part of their income on putting food on the table for their families.”

“Why was it not possible to reduce VAT without hitting food and medicine?” Mr Chaudhry asked. “After all, it is VAT/GST free in Australia, Canada, New Zealand, United States and the UK. Why can’t it be so in Fiji?”

VAT is a uniform tax paid by all, irrespective of their incomes and penalises the poor. This is why in 1999 the Labour Government removed VAT from basic food items to provide some relief to the poor from the imposition of a 10% VAT by the Rabuka Government.

“People must understand that reconfiguring the tax net is a ploy to rake in more revenue by shifting the burden to other sectors of the economy.

In the instant case, and in the Finance Minister’s own words there will be no loss of revenue, as it will be more than recovered by making basic food items more expensive.

Indeed, he has calculated that he will net more revenue by charging VAT on basic food but needed a ploy to sell it to the people by offering a reduction elsewhere.

The doubling of STT (Service Turnover Tax) from 5% to 10% was, no doubt, conceived as another revenue boosting measure.

A host of other revenue measures – increases in existing rates of fee, charges and levies will all add to business costs which will eventually be passed on to the consumers thus pushing up prices and fuelling inflation.

Here’s how basic food costs will go up:

Item Current price Jan 2016

$ (imposition of 9% VAT)

Flour/sharps 10.45 (10kg) 11.50

Cooking Oil (Soya Bean) 2.40 (750ml) 2.65

Powdered Milk (Rewa) 5.45 (450g) 6.00

Rice (long grain) 12.64 (10kg) 13.90

Tea Leaves 2.02 (200g) 2.22

Baby Milk 8.98 (350g) 9.90