From the archives:

Nikhil Singh of Australia says…

—– Original Message —–

From: Victor Lal

To: Russell Hunter

Sent: Saturday, February 02, 2008 9:10 PM

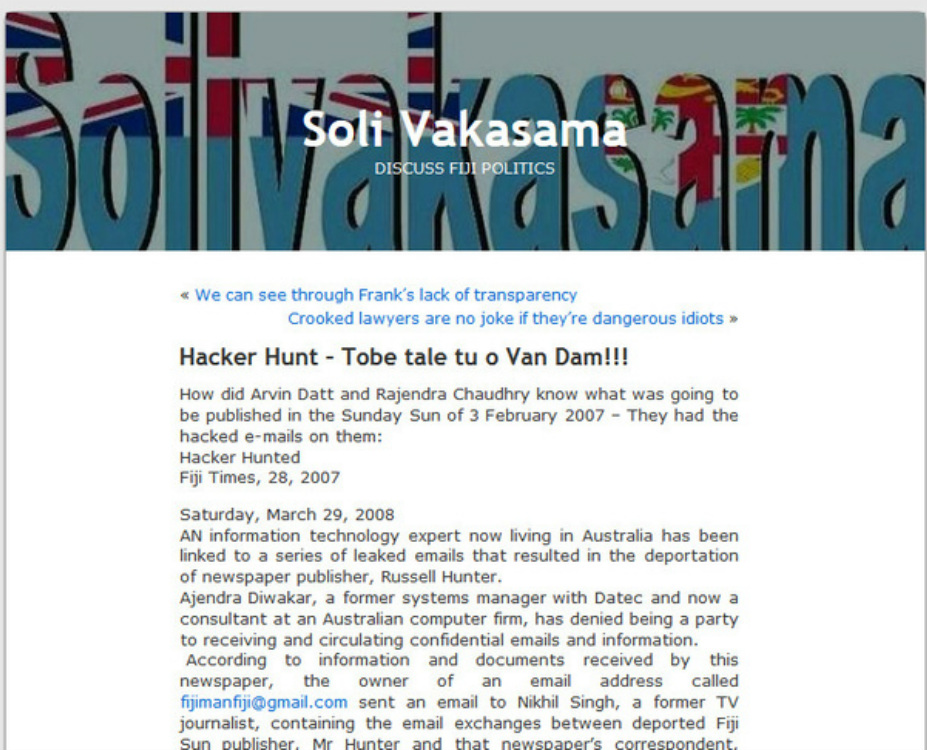

Subject: [Bulk] Re: Datt Piece – Use This One Amazing! It could be a fishing exercise – we had planned the story for Monday – unless Leone said something – maybe not. What blogsite – so they are reading about themselves? There is fear and panic in their camp – who is going to be next? I have looked at some regular sites but couldnt find anything. We must not be deterred from our strategy – I will try and rush through the Coventry piece, maybe for Monday or Tuesday followed by Scott piece. Yes, you can delete the stuff for I have all the copies including hard evidence

Nikhil Singh of Australia says…

[email protected]> wrote:

Sorry too late. When the sevens team bombed out, Sami decided to bring

it forward. It’s page 1 tomorrow.

Here’s something more interesting. AD called me on my mobile about two

hours ago saying daaku junior had seen on a blog that there was a

story about him (AD) in tomorrow’s Sun. I told him there was a story

on FIRCA that did not mention him. Are you aware of any such blog? I

could find nothing.

To be safe I’m going to permanently delete everything on DT etc in

case the boot boys come here in the morning armed with a search

warrant – or worse.

AD is Arvind Datt – FIRCA Board Member

Daaku Junior: Nickname for Rajendra Chaudhry for story purposes:

Victor Lal’s story on Arvind Datt was published in the Sunday Sun on 3 February 2008:

FIRCA Official in Tax Scam

A Fiji Islands Revenue and Customs Authority board member claimed a rental loss in his tax return, whereas the rental property was owned half by himself and half by his wife, it has emerged.

He was able to claim his refund within three days – well below the normal time.

According to a FIRCA source, speaking to me on condition of anonymity, the board member not only abused his position to influence his treatment as a taxpayer but he joined the club of tax avoiders, along with an interim Cabinet minister and another tax expert.

In September 2007, the FIRCA board had directed that all senior FIRCA staff be audited.

Coincidentally, one of the FIRCA departments was already looking at the rental loss claimed by the board member, who according to the FIRCA source, “was jumping up and down for his refund and threatening the staff”.

As a result a senior member was suspended a few months later and then reinstated. An internal memo dated September 27, 2007 and seen by me, regarding the board member and his wife revealed there were two rental properties.

One comprised his residence with a flat at the back, which was rented for $550 a month.

This property was in the board member’s name alone. He bought it for $325,000, of which $90,000 related to land value.

The second property, according to the memo, comprised three flats, all of which were rented at the time, although one was vacant while the board member sought a tenant.

In 2006 he had collected rent totalling $7200. This property was, however, in the name of both the board member and his wife. The net rental income or loss should have been divided between the two of them.

According to the memo, the board member claimed $6,064 in maintenance, and provided receipts. The expenditure was for maintenance and not capital. There was additional capital expenditure of $100,000 for the first property and $35,000 for the second property, for which no expenditure claim was filed. This was later added to the building value for depreciation purposes.The memo advised that depreciation should be allowed at 2.5 per cent of the prime cost (concrete buildings) as follows for the first property: cost of building ($325,000-$90,000) = $235,000 plus improvements $10,000 = $245,000 at 2.5 per cent = $6,125. The cost of flat construction for the second property, $35,000 at 2.5 per cent = $875. The memo recommended the amendment of the assessments of the board member and his wife accordingly, and as soon as possible. A copy of the memo was also sent to FIRCA’s then acting chief executive officer Jitoko Tikolevu.

The board member was also informed of the decision about the depreciation and that since one of the properties was jointly owned, income and expenses “should be allocated 50 per cent to each joint owner”.

On October 23, 2007 in response to his enquiry about the 2006 tax calculation for himself and his wife, FIRCA also provided the board member a detailed breakdown of his request.

Basically, FIRCA split the rental loss 50/50 between the board member and his wife, being the normal practice, which resulted in a lower combined refund for the pair ($8,000 instead of $12,000) because the wife was in a lower tax bracket.

The above case, the FIRCA source claims, clearly demonstrates how the board member had joined the club of tax evaders, only to be caught out after an audit was carried out on his two properties