Fijileaks to Khaiyum: Face Up and Answer Questions! The Registrar of Companies kept telling us that Midlife Investments Ltd was not in their system; if so, why, and it is still NOT in the system?

Hiding something, you CON MERCHANT?

You were quick to send your goons to the ROC and have come back now to tell the public of Fiji about Mick Beddoes: "He has declared that he has shares in Power Savers. For Power Savers it says holder/ recipient Millis M Beddoes Director/ Shareholder valued declared $8000. Now, he has shown in the last company return that was filed on 31st December 2012. He shows that he has shares of $3,500 presumably another $3,500 was transferred to him again to $7000 at one dollar each. So he is giving $8000 perhaps its $7000 here but he has valued the company or the shares at $7000."

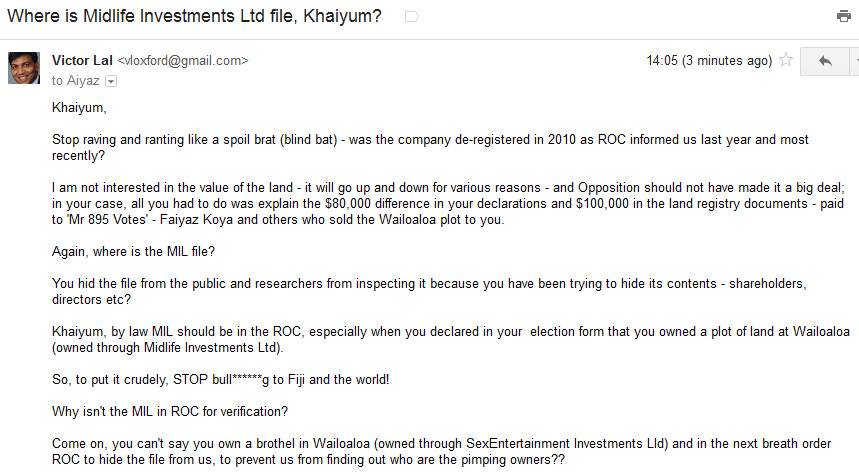

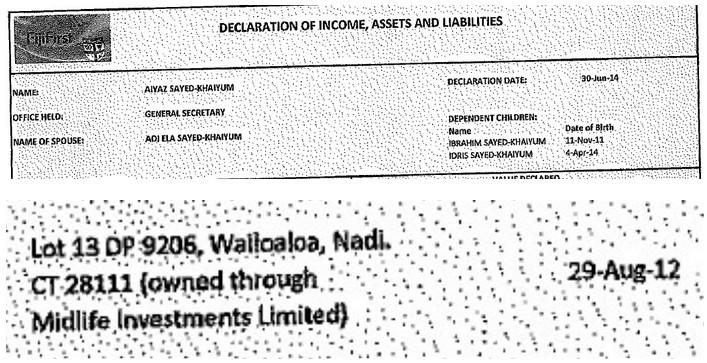

Fijileaks to Khaiyum: Who are Directors/Shareholders of Midlife Investments Ltd? "For Power Savers it says holder/ recipient Millis M Beddoes Director/ Shareholder"; its two years and ROC keeps telling us that they don't have your MIL in their system - tell us,

WHERE IS THE MIL FILE?

"Fiji One news tonight AG Khayium finally breaks his silence concerning the allegations against him by the Leader of the Opposition for false declarations. Khayium says the land in question is owned by Mid Life Investments, a company in which he has shares. Yes we know Aiyaz that Midlife Investments is owned by you and your mother. The question is Mid Life Investments was deregistered in 2010 after which you signed off on a gazette notice whereby deregistered companies could not be searched. Now how do you declare shares in a company in 2014 & 2015 when the company was deregistered in 2010? You are drowning in your own bullshit again Aiyaz!" -

Ben Padarath, on Rajendra Chaudhry's Facebook

Fiji media did not publish nor air Opposition's claims, but now running away with FICAC's finding through the mouth of Aiyaz Sayed Khaiyum

Read below:

The PPRD is very clear from section 24(5) of the PPRD, which reads:

Applicants, office holders of political parties and independent candidates to Parliament to declare assets and liabilities

24.--

(5) Any person who fails to comply with the requirements of subsections (1) or (2), or provides any information that is false, commits an offence and shall be liable upon conviction to a fine not exceeding $50,000 or to a term of imprisonment not exceeding 10 years or to both.

More important is section 27(1), which reads:

PART 4—GENERAL PROVISIONS

Offences

27.—(1) A person who--

(a) fails to furnish particulars or information required to be furnished by a political party or by him or her under this Decree;

(b) makes a statement which he or she knows to be false or which he or she has no reason to believe to be true; or

(c) recklessly makes a false statement under this Decree, commits an offence and shall be liable upon conviction to a fine not exceeding $10,000 or to imprisonment for a term not exceeding 5 years or to both.

Section 27(4) is instructive and clearly makes the offence one of strict liability and where the Court must be satisfied that the offence was not committed. It reads:

(4) A person does not commit an offence under subsection (1) or (2) if that person proves to the satisfaction of the court that he or she exercised due diligence to prevent the commission of that act as he or she ought to have exercised, having regard to all the circumstances.

This means that there is no requirement for any explanation to FICAC or DPP. K**** must be charged and must prove his innocence in Court given that the onus is on him (AND NOT FICAC OR DPP) to prove that he exercised due diligence.

So the issue is very clear and that is that Khaiyum:

1. Made a false statement;

2. Made such statement recklessly; and

3. Committed an offence under PPRD.

He must be charged and presented in Court to make his defence (flimsy as it may be) and not on national media. There is no other way. Time to walk the talk.

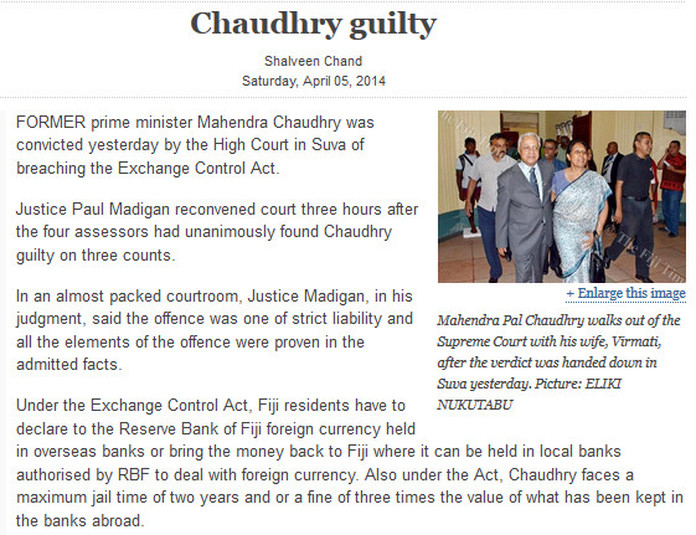

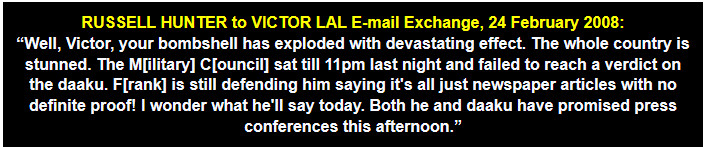

Reserve Bank of Fiji had failed to act upon Victor Lal’s 2007 submission

We have already stated that in an e-mail dated 10 August 2007 Mr Hunter had advised Victor Lal to provide Mr Chaudhry’s tax documents to the RBF Intelligence Unit. Victor Lal duly obliged and submitted his own legal opinion to the RBF that Mr Chaudhry might have breached various provisions of the Exchange Control Act and the Proceeds of Crime Act. Like FICAC, the Prime Minister’s Office, and Mr Chaudhry himself, the RBF neither replied nor acknowledged Victor Lal’s letter or the tax documents.

Victor Lal on Report of the Independent Inquiry into the Taxation Affairs of Mahendra Pal Chaudhry

It is quite clear why Mr Chaudhry declined to accept Option Two – for “His Excellency the President to establish a Commission under the Commission of Inquiry Act ('Inquiry')”.

Responding to the findings of the above Report, the Fiji Sun had editorialized:

“This inquiry did not even touch on the reasons why Mr Chaudhry did not file tax returns for three successive years or why he did not disclose the interest earned on or even the existence of his overseas accounts for the very simple reason that it wasn’t asked to.

It did not examine the extensive dossier sent by Fiji Sun correspondent Victor Lal to the Fiji Independent Commission Against Corruption, the commissioner of police and the prime minister – again, because it was not asked to. This, of course, is no fault of the three tribunal members who merely did what they were employed to do...”

In his own analysis of the Report Victor Lal wrote: “The three-member team enquiry was tasked to see if tax assessments had been raised in accordance with the tax laws. As FIRCA’s duty includes the administration of the tax laws, this was in effect an enquiry into FIRCA not Mr Chaudhry.

He should be stood down and a Commission of Enquiry should be set up, whose terms of reference should read:

“To determine if Mahendra Pal Chaudhry had complied with the tax laws by declaring all his income.”

It should also examine the Haryana letter, Victor Lal argued, in his reply:

“There is evidence in Mr Chaudhry’s tax file that FIRCA refused to accept Mr Harbhajan Lal’s letter, writing to a partner of the Suva accounting firm on October 22, 2004, re “Honourable Mahendra Chaudhry: “I refer to our meeting on the 5 October 2004, and thank you for the submission of information you had “on hand”. We have examined the same and wish to state here that we will be amending the income tax returns for the respective years, however, will not be allowing the tax credits due to lack of Documentary Evidence.”

The tax agent was informed in no uncertain terms that despite amending the returns, FIRCA would still be pursuing the “source of the funds” issue. The submitted document, FIRCA stated, explaining the source of the funds was not sufficient enough for FIRCA’s purposes.

(P. S. We did not re-produce the above “5 October Note” in the 17 February 2008 article – and it remains unpublished to date by us)

In his analysis of the Report, Victor Lal contended as follows in the Fiji Sun:

“He [Mr Chaudhry] never told us that he had made late lodgements of his 2001, 2002, and 2003 tax returns, which was the subject of my first tax story on him in August 2007. Even the inquiry team has now confirmed my earlier assertions that Mr Chaudhry lodged his tax returns for the 2000 and 2001 financial years together on 30 May 2002, which was outside the 31 March due date for the lodgement of those returns. He lodged his returns for the 2002 year on 12 December 2003, which was also outside the time allowed.

Mr Chaudhry did not declare interest on the Australian and New Zealand financial institution accounts in his return lodged with FIRCA in respect of any of the 2000 to 2003 (inclusive) years.

We are yet to hear from Mr Chaudhry why he made late lodgements, and why he did not disclose interest earned on his investments for the years 2001, 2002, and 2003.

It would not be out of context to suggest to Mr Chaudhry that one of the primary reasons was because if he had, then he might have been forced to reveal that he had secretly received three instalments of funds running into thousands of dollars in 2000, 2001, and 2002?”

The Report of the Independent Inquiry into the Taxation Affairs of Mahendra Pal Chaudhry and Justice Goundar in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012) reached the same conclusion as alleged by Victor Lal in his 15 August 2007 story in the Fiji Sun – that Mr Chaudhry had not declared his incomes in the 2001, 2002 and 2003 tax returns to FIRCA.

Mr Chaudhry escapes making false claim in income tax returns on legal technicality – prosecution time barred after 2007

The Fiji High Court deliberated, among other charges, four counts of making a false statement in an Income Tax Return: The four counts were dropped because the three-year time limit for prosecution had expired. After 2007, the offence of making a false tax return under the Income Tax Act was time barred.

It does not mean, however, that Victor Lal’s story was false – the facts in the four counts reinforce his claims that Mr Chaudhry raked in thousands from his investments which he had not declared to FIRCA.

Again, without naming Mr Chaudhry, Victor Lal had disclosed in the Fiji Sun (and not in anti-government blogsites) the incomes that Mr Chaudhry had earned from his investments abroad: “Minister raked in $215,000 from investments.” (see Appendix Six)

Victor Lal had based his story from the file, although the actual document above was never published by us

It is our contention that if FICAC had acted on Victor Lal’s initial complaint in 2007 and had invited him to re-submit copies of Mr Chaudhry’s tax documents maybe the outcome of the judgment on the making false claim charges would have been completely different from the one delivered by Justice Goundar.

The issue of time-barred prosecution would not have arisen, which itself raises another question of import – when and who introduced the statute of limitation in the Income Tax Act in 2007?

In his ruling Justice Goundar noted at [53] that Mr Chaudhry paid his outstanding taxes in 2004. We do not question Justice Goundar’s observation. The records in Mr Chaudhry’s file reveal a receipt (see below) dated 10 November 2004 stating the sum of $86,069.52.

Victor Lal’s contention in his 17 February 2008 story was that the amount was only paid when FIRCA confronted him [Mr Chaudhry] about the undisclosed funds in Australia.

Regarding the payment, Victor Lal wrote: “On November 22, 2004, one of the partners in the accountancy firm replied to the letter, confirming the payment of $86,069.02, noting that, “The tax paid by our client includes 2004 provisional tax amounting to F$34,962”. He also pointed out: “We note that credit for non-resident withholding tax deducted at source amounting to $22,858.03 has not been considered by Inland Revenue.”

We have taken great pains to explain our case to demonstrate that claims by Mr Chaudhry against us in his affidavit are manifestly false. We were awarded the Robert Keith-Reid Award for Outstanding Journalism in recognition of the tax story in the Fiji Sun and not in any anti-government websites. VICTOR LAL and RUSSELL HUNTER, 12 September 2012