"The airline has not disclosed its financial results for the period ending 31st December 2020" - FLP

Fiji Labour Party: Whither Fiji Airways?

It is time Economy Minister Sayed-Khaiyum gave us an update on our national airline Fiji Airways.

The airline has not disclosed its financial results for the period ending 31st December 2020.

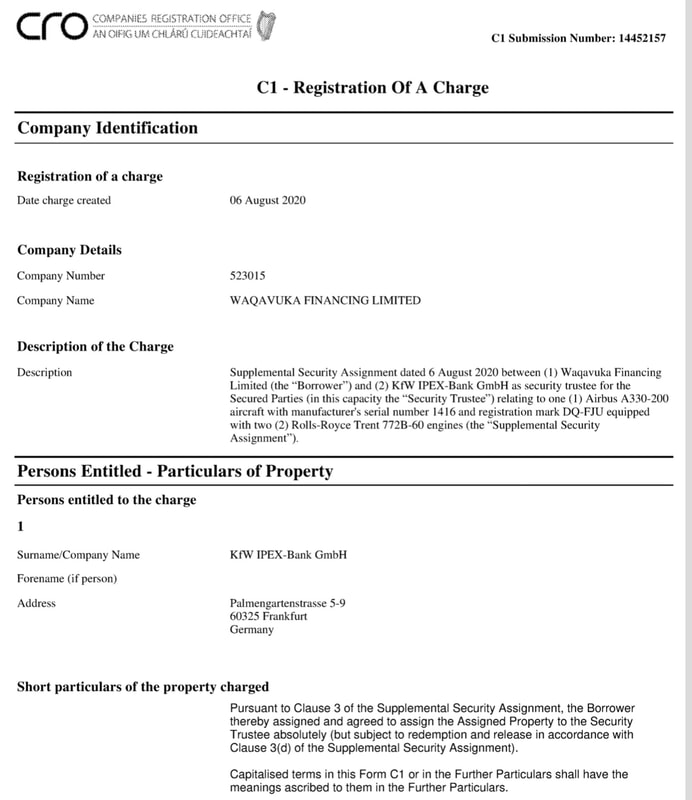

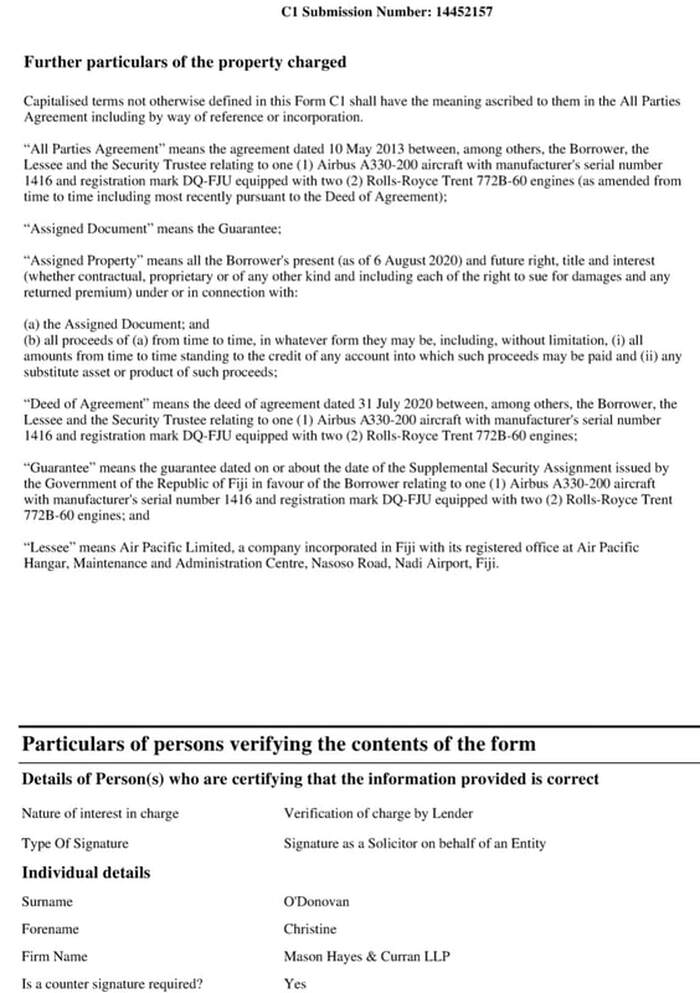

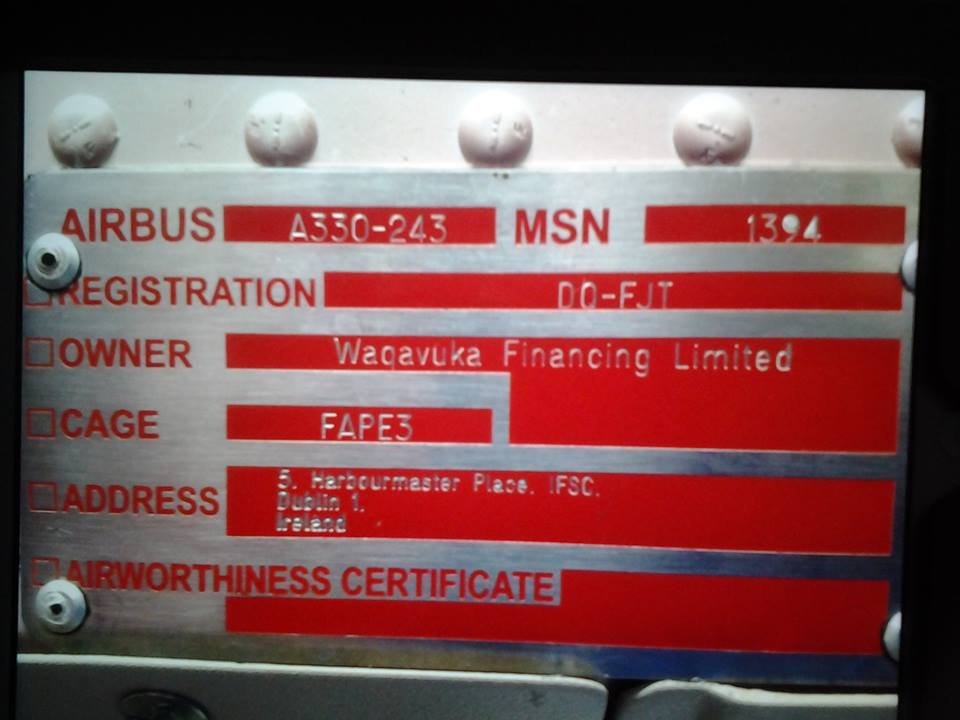

It borrowed $455m in May last year to keep its planes on the ground since the onset of Covid-19 virtually closed its operations in March last year. Ostensibly, Fiji Airways did not have much in the way of cash reserves of its own and had to rely on borrowed money to keep afloat. The airline said it could not return leased aircraft even though it was unable to operate them because of closed borders.

It was initially thought that international borders would open within 6-9 months from March 2020 and the airline would be able to resume operations. But this has not happened and is not likely to happen for some time yet.

Consequently, the airline was forced to borrow a further $132m ($US65m) from the Asian Development Bank by way of a liquidity facilitation loan in March this year. And now, a 2nd wave of the infection here of the Covid-Indian variant B.1.617, has set us further back from entering the Pacific bubble, dashing our hopes of resuming two-way travel between Fiji, Australia and New Zealand.

It looks like we are in it for a long haul. This means the airline will have to borrow more to survive. Not surprisingly, the most recent Moody’s Ratings which gave Fiji a B1 negative outlook, described the government loan guarantee for $455m last year to Fiji Airways as “ the most significant risk for the Fijian government”. This echoes FLP’s warning at the time that “Fiji Airways will be a millstone around our necks”.

Fiji Airways must disclose its financial results for 2020 and then it must tell the Fiji taxpayer what rescue plan it has to save the airline. It must not be permitted to borrow endlessly without a credible rescue plan. “Fiji Airways is unlikely to survive without a comprehensive review and restructuring of its operations – finances, workforce, fleet size, flight schedules and destinations,” says Labour Leader Mahendra Chaudhry. “The people are entitled to know how it proposes to restructure itself to meet the demands of a changed market without becoming an enormous liability on the taxpayer,” he said.

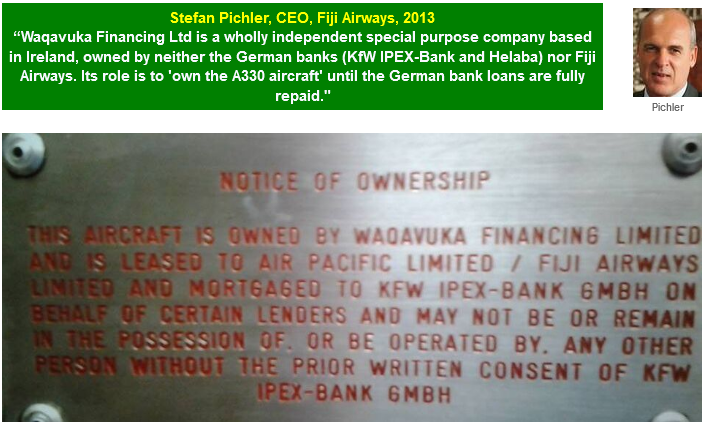

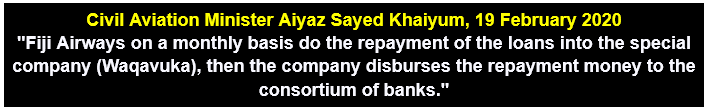

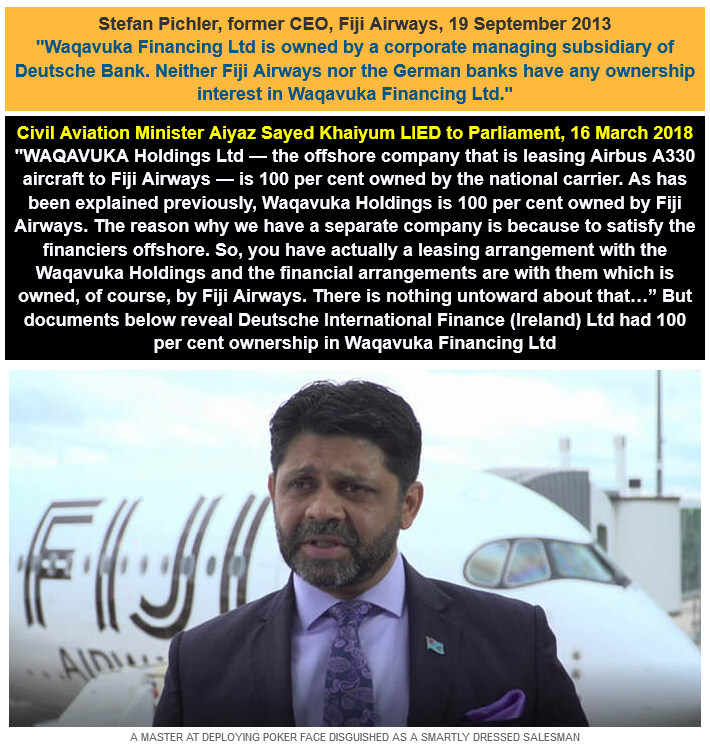

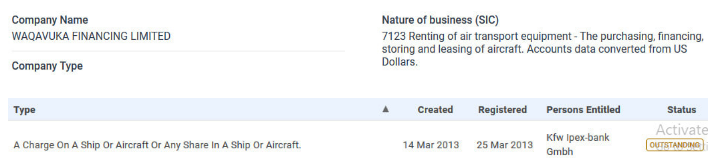

The airline carries a huge debt burden associated with its hasty fleet and route expansion programme. But the true extent of its debts is not known because audited accounts are not published and tabled in Parliament.

It will be a different market once international borders begin to open. It will be a painfully slow process which could take up to three years , even longer, before returning to the 2019 operational levels. The restructuring will require cutting costs across-the-board to match the demands of a changed market. The question is whether Fiji Airways can survive on its own during this transition or will it need to be supported by Qantas, its much bigger and experienced partner airline?

“After all, the Fijian government has huge problems of its own and is hardly in a position to go beyond the assistance it has so far provided. But it must ensure that concrete steps are taken to avoid Fiji Airways becoming a millstone around the neck of the taxpayer,” said Mr Chaudhry.

Going forward, will the airline take a critical look at its fleet size and retire aircraft that are uneconomical to run or in excess of requirement? It will be a much smaller market for quite some time when the borders re-open requiring a much reduced fleet size.

Likewise, routes that are not profitable are best axed. Staff costs need to be rationalized by right sizing the workforce and employing expatriates only where locals with requisite qualifications are unavailable. Going forward, its financials should be confined entirely to its own operations and not lumped with those of its associated companies, which distorts its actual trading results.

Once normality returns, Fiji Airways must be encouraged to recapitalise through equity raise – and not expect to survive through borrowing endlessly on government guarantees.

It is time Economy Minister Sayed-Khaiyum gave us an update on our national airline Fiji Airways.

The airline has not disclosed its financial results for the period ending 31st December 2020.

It borrowed $455m in May last year to keep its planes on the ground since the onset of Covid-19 virtually closed its operations in March last year. Ostensibly, Fiji Airways did not have much in the way of cash reserves of its own and had to rely on borrowed money to keep afloat. The airline said it could not return leased aircraft even though it was unable to operate them because of closed borders.

It was initially thought that international borders would open within 6-9 months from March 2020 and the airline would be able to resume operations. But this has not happened and is not likely to happen for some time yet.

Consequently, the airline was forced to borrow a further $132m ($US65m) from the Asian Development Bank by way of a liquidity facilitation loan in March this year. And now, a 2nd wave of the infection here of the Covid-Indian variant B.1.617, has set us further back from entering the Pacific bubble, dashing our hopes of resuming two-way travel between Fiji, Australia and New Zealand.

It looks like we are in it for a long haul. This means the airline will have to borrow more to survive. Not surprisingly, the most recent Moody’s Ratings which gave Fiji a B1 negative outlook, described the government loan guarantee for $455m last year to Fiji Airways as “ the most significant risk for the Fijian government”. This echoes FLP’s warning at the time that “Fiji Airways will be a millstone around our necks”.

Fiji Airways must disclose its financial results for 2020 and then it must tell the Fiji taxpayer what rescue plan it has to save the airline. It must not be permitted to borrow endlessly without a credible rescue plan. “Fiji Airways is unlikely to survive without a comprehensive review and restructuring of its operations – finances, workforce, fleet size, flight schedules and destinations,” says Labour Leader Mahendra Chaudhry. “The people are entitled to know how it proposes to restructure itself to meet the demands of a changed market without becoming an enormous liability on the taxpayer,” he said.

The airline carries a huge debt burden associated with its hasty fleet and route expansion programme. But the true extent of its debts is not known because audited accounts are not published and tabled in Parliament.

It will be a different market once international borders begin to open. It will be a painfully slow process which could take up to three years , even longer, before returning to the 2019 operational levels. The restructuring will require cutting costs across-the-board to match the demands of a changed market. The question is whether Fiji Airways can survive on its own during this transition or will it need to be supported by Qantas, its much bigger and experienced partner airline?

“After all, the Fijian government has huge problems of its own and is hardly in a position to go beyond the assistance it has so far provided. But it must ensure that concrete steps are taken to avoid Fiji Airways becoming a millstone around the neck of the taxpayer,” said Mr Chaudhry.

Going forward, will the airline take a critical look at its fleet size and retire aircraft that are uneconomical to run or in excess of requirement? It will be a much smaller market for quite some time when the borders re-open requiring a much reduced fleet size.

Likewise, routes that are not profitable are best axed. Staff costs need to be rationalized by right sizing the workforce and employing expatriates only where locals with requisite qualifications are unavailable. Going forward, its financials should be confined entirely to its own operations and not lumped with those of its associated companies, which distorts its actual trading results.

Once normality returns, Fiji Airways must be encouraged to recapitalise through equity raise – and not expect to survive through borrowing endlessly on government guarantees.