Fijileaks to FICAC: When will Chand be charged with further offences?

THE GHOST OF HARYANAGATE

RECALL BAINIMARMA ACTING LIKE A BARKING 'GUARD DOG' OF MAHENDRA CHAUDHRY IN 2008; NOW HE IS ACCUSING THE SAMOAN PM OF ACTING LIKE A 'LAPDOG' FOR AUSSIES AND KIWIS

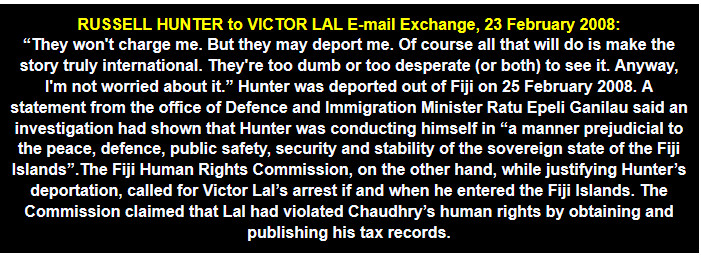

“We also have the recent case of an opinion columnist in the Fiji Sun masquerading as a regular correspondent...writing front page stories. So blatant has been the Fiji Sun’s disregard for ethics that these lead stories have explicit opinions contained within the article. These little tricks are getting out of hand and that is the reason why we have called everyone here to explain to you in detail once and for all the truth that continues to be misconstrued and disregarded by most sections of the media.” Bainimarama attacking Victor Lal at a hastily convened press conference while defending his then Finance Minister Chaudhry over the tax story, 24 February 2008

“Further to my previous communication in which I insisted that an analysis of the tax records of Mr Mahendra Chaudhry clearly establishes tax evasion, I want to re-iterate that I have no political agenda against anyone, as FIRCA continues to assert, regarding my stories in the Fiji SUN of tax evaders, and whom FIRCA is protecting.

Mahendra Chaudhry: As I stated previously, I still stand by my claims, and I have obtained further details from the Australian authorities that he has monies in Australian banks and had failed to declare the interests he received there to FIRCA. He is yet to account for the thousands of dollars he collected worldwide for the Cyclone Ami funds. I wrote to him in 2006, asking him to open up the books in relation to the funds held in the Bank of Baroda - to date he has not responded.

Fiji Water: Regarding Fiji Water, those involved in the case include the former director of Fiji Water, Mr Kubs, Mr Lyne (who was Mr Kub's expert witness in the case that Mr Kubs lost and FIRCA lawyer Michael Scott (who had given advice to Mr Kubs).

Now, FIRCA is threatening to take legal action against me. Well, I look forward to the opportunity, for perhaps what they are trying to prevent me from exposing, I will be able to expose in a court of law. On law, FIRCA’s own legal consultant, who is most likely to frame charges against me, has been found to have failed to declare $630,000 in consulting fees from FIRCA and RBF over the period June 2004 and October 2007.

According to FIRCA sources, who are disgusted with the double standard, corruption, and nepotism in their organisation claim that Mr Scott’s assessed bill still stood, with additional penalties for late payments now totalling $154,000.

The Debt Collection Department is too frightened to approach him. While admitting tax liability to the Governor of the Reserve Bank of Fiji, Mr Scott instead launched a vicious attack on the officer who audited him during the recent audit of FIRCA staff, calling him, according to evidence I have on me, incompetent, ignorant and someone who was full of malice against Mr Scott.

Many FIRCA officers are horrified because according to them this was the very officer who was tasked by their CEO Mr Jitoko Tikolevu and Mr Aiyaz Sayed Khaiyum to investigate Chief Justice Daniel Fatiaki’s tax records and had concluded that he (Justice Fatiaki) evaded taxes, and should therefore be charged with 26 counts of tax evasion - the matter is now a subject of a public enquiry.

Chief Justice Daniel Fatiaki and Income Tax Act: Well, if Mr Tikolevu, Mr Filipe Bole previously, and now Mr Chaudhry claim that a taxpayer’s records are private and cannot be obtained without the permission of the taxpayer, then why Mr Fatiaki's tax records, to the minute details, was released by Mr Khaiyum for public consumption?

Did FIRCA or the A-G or Michael Scott seek Justice Fatiaki’s permission before making it public? The truth is that there is a general apprehension that I am inching closer to the big sharks in FIRCA, including Mr Chaudhry, so the best defence is to attack the messenger, discredit me by accusing me of having a political agenda, and then to hide behind the cloth of legalism.

Tax Scam inside FIRCA: The FIRCA Board member is none other than Mr Chaudhry’s relative and appointee Mr Arvind Datt who was the subject of my front page story in the Sunday SUN. I had nothing to do with the FIRCA tender story - for that is not my area of investigation. Mr Datt has been threatening staff, I am told, and only got caught for falsely claiming rental loss on his property because he was harrying the staff to speed up his returns. I have incontrovertible evidence to support my claims that he evaded tax but was caught out.

I am told that there never was any investigation into Chaudhry’s tax matter and that Mr Bole, as chairman of FIRCA, blatantly lied to you that Mr Chaudhry was in the clear. I call upon you to ask Mr Chaudhry, Mr Datt, Mr Scott and Mr Tikolevu to step down so that a thorough investigation by an independent investigator of our choice can look into their tax records.

I still do not understand what is it that is making you so protective of Mr Chaudhry, who is simply abusing his position, and so are his supporters inside FIRCA, while identifying and pursuing his political opponents, according to those inside FIRCA.

The scale of the scandal and tax fraud committed by FIRCA top brass in fact calls for a Commission of Inquiry, which could even bring down your government if I decide to go public on the Doctrine of Public Interest like you invoked the Doctrine of Necessity to execute your December 5 2006 coup.

Let me put it the other way. It took your illegal coup to finally catch the highest judicial officer in the land, Justice Fatiaki, who now admits to irregularities in his tax returns. A report into his tax files concluded that he could be charged with criminal tax offence because “The offence was wilful as Mr Fatiaki prepared his own tax returns and was not misled into the omission by a tax agent or other person. Mr Fatiaki signed the tax returns personally including the declaration that the returns were “true and complete”. The declaration will be tendered as evidence before the court by the very FIRCA officer, who also audited Mr Scott and Datt and found that they had not honestly declared their tax returns.

So the nation is entitled to ask you why should Mr Fatiaki be hauled before a public inquiry and those around Mr Chaudhry inside FIRCA, the likes of Mr Datt and Mr Scott should be untouchables, including Mr Chaudhry.

Independent Commission of Inquiry: I am sorry to have been too long but the gravity of the scandal inside FIRCA is so deep that it needs to be highlighted. It’s time you acted against these people, and it is in their own interests to clear their names, for evidence on me, in the form of their tax files, tell a very different story.

We cannot invoke Section 4 of the Tax Act and allow them to hide, for do you really believe that they will grant me permission to analyse their tax records, if it was so, Justice Fatiaki would have been caught out long ago.

I am willing to fully co-operate with any independent investigator provided all those mentioned are suspended from their positions, including Mr Chaudhry, and failing to do so I relish meeting FIRCA in a court of law where I will be able to produce irrefutable evidence of, what appears from their tax files, systematic tax evasion by these individuals!”

Yours sincerely

Victor Lal

4 February 2008

Fijileaks: Number One Online Destination for What Is Really Happening Inside Fiji

Founding Editor-in-Chief: VICTOR LAL. E-mail: [email protected]

Wednesday, 22/04/2015

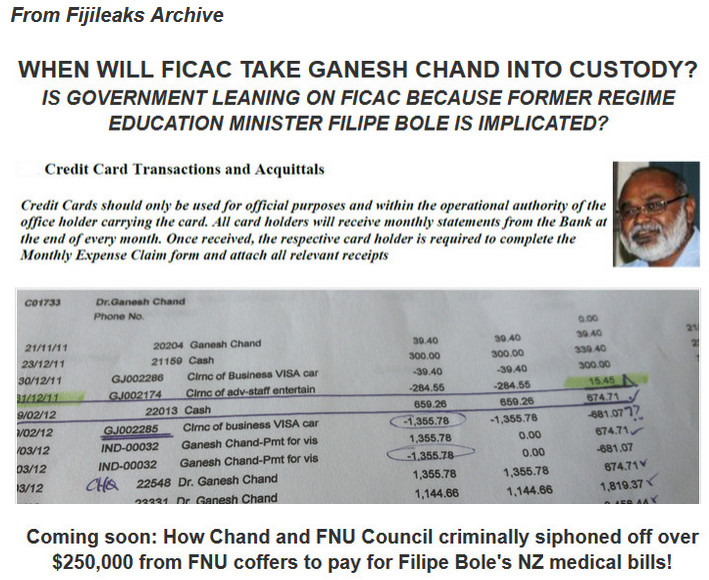

Former Vice Chancellor of the Fiji National University Doctor Ganesh Chand who has been charged with one count of abuse of office by the Fiji Independent Commission Against Corruption reappeared in the Suva Magistrates Court this morning.

His lawyer Devinesh Sharma told the court that he will have discussions with FICAC in relation to jurisdiction matters.

The case has been transferred to the High Court where Sharma can make his submission.

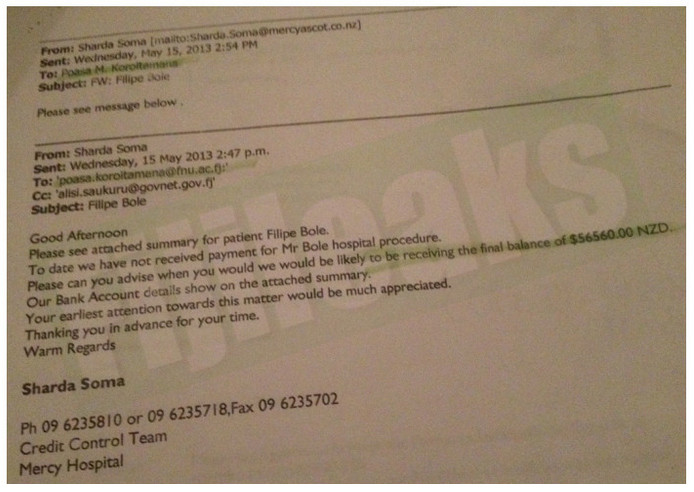

Doctor Chand while being employed in the Public Service as the Vice Chancellor of FNU, allegedly abused his authority by approving the payments for overseas medical treatment for the then Minister of Education and the Chairman of the Fiji National University Council, Filipe Bole without the approval of the FNU Council.

Chand’s bail is extended to the 15th of next month.

Story by Vijay Narayan,Swastika Singh and Tokasa Rainima, Fijivillage News.

THREE YEARS ON: FICAC nor DPP willing to charge another regime lackey Nalin Patel who played key role with Chaudhry in 'Haryanagate'

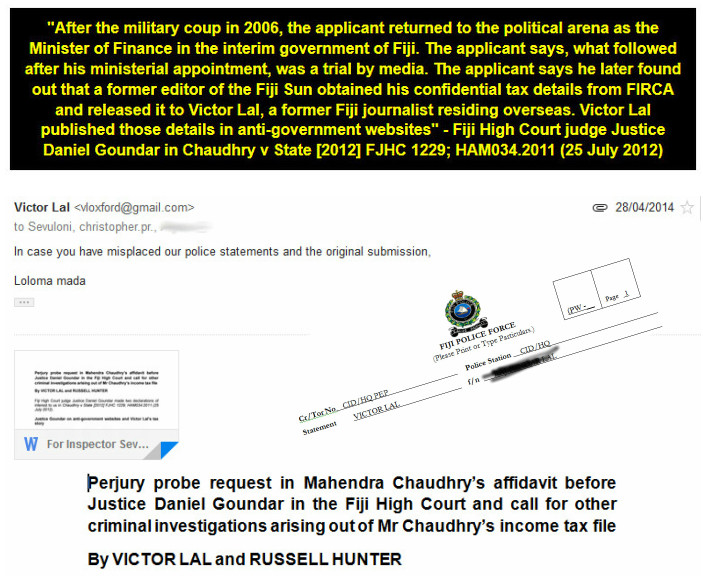

“The applicant says he later found out that a former editor of the Fiji Sun obtained his confidential tax details from FIRCA and released it to Victor Lal, a former Fiji journalist residing overseas. Victor Lal published those details in anti-government websites.”

We have demonstrated that we never published Mr Chaudhry’s tax details in any anti-government websites but in the Sunday Sun dated 24 February 2008, including the first tax story in the Fiji Sun, on 15 August 2007.

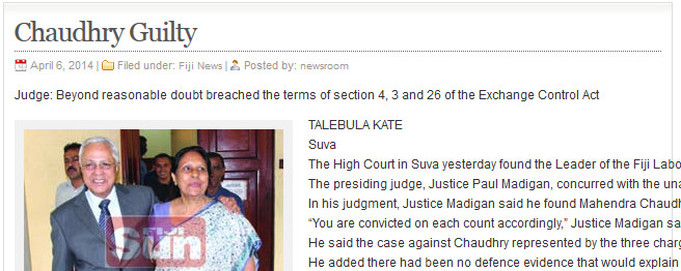

1: We therefore call upon the Director of Public Prosecutions to investigative whether Mr Chaudhry committed the offence of “perjury in a false affidavit”.

2: We call upon the Director of Public Prosecutions to investigate whether Mr Chaudhry’s legal representatives in offering his affidavit to the Fiji High Court are also guilty of aiding and abetting the offence of perjury in a false affidavit, for it is abundantly clear that we did not publish Mr Chaudhry’s tax details in any anti-government websites.

3: We request the Director of Public Prosecutions to establish on what grounds the original letter tendered from one Harbhajan Lal dated 9 September 2004 to FIRCA from Haryana in India was withheld [if it was] and a new letter from Delhi Study Group dated 12 October 2004 substituted in Mr Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court. The “Harbhajan Lal Letter” of 9 September 2004 states the money was collected in Haryana and part of it was transacted through the Indian Consulate in Sydney, Australia. Harbhajan Lal wrote from Haryana:

“Respected Chaudhry Saheb, Nameste. We are hale and hearty here and please accept our good wishes. I received your letter. You have asked for details of the funds. You may recall that when you were here in the year 2000, we had formed a committee, which requested you to leave Fiji and stay in Australia since the situation in Fiji was not safe and you were not secure there. The committee also assured you that it would collect funds for your settlement in Australia. Lakhs of people from Haryana including traders, businessmen, landlords and non-resident Indians contributed heavily for the cause. The amount was pouring in for three years, which was sent to you from the year 2000 to 2002. The total amounting to nearly AUD fifteen laks was sent to you with the help of Government of India through its Consulate General in Sydney. We sent AUD 503,000/- as first instalment in the year 2000. In 2001, AUD $486,890/- was sent and then in 2002 AUD $514, 149/- was sent.”

The “Delhi Study Group Letter” states, “This is to confirm that funds were collected in New Delhi and other parts of India, including NRI's (Non-Resident Indians) to assist Hon'ble Mahendra Pal Chaudhry, Former Prime Minister of Fiji in 2000-2002.”

5: We call upon the Director of Public Prosecutions to ask Mr Chaudhry who transferred the money from India – Delhi Study Group based in New Delhi or Harbahajan Lal in Haryana, India?

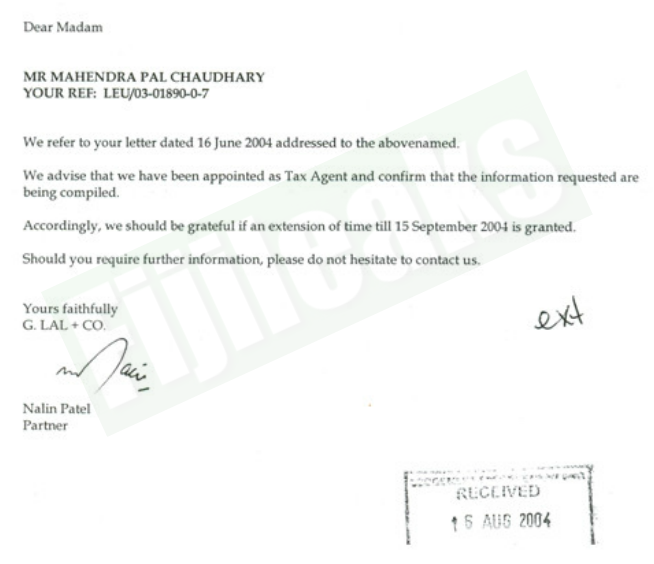

6: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

7: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent to deal with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Support Group letter dated 12 October 2004.

8: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account.

9: We request the Director of Public Prosecutions to investigative whether Mr Chaudhry, in presenting the Tax Amnesty submission to the Cabinet in September 2007 for endorsement, might have abused office as Interim Finance Minister and direct line manager of Fiji Island Revenue and Customs Authority (FIRCA), to benefit himself, and to escape any future criminal prosecutions for submitting late tax returns between 2000 and 2003. We have documentary evidence that in August 2007 Mr Chaudhry still owed FIRCA $57,000 in tax debt, due to be paid on 9 August 2007. His own $57,000 could have fitted into insufficient advance payment or even late payment amnesty.

10. We therefore request the DPP to establish whether Mr Chaudhry had taxes or returns outstanding and paid during the amnesty period he had ordered and hence gained avoidance of penalties, and if so, then a case for Abuse of Office as Finance Minister and line manager of FIRCA could be made against him.

11: We call upon the Director of Public Prosecutions to plead with the Fiji High Court to expunge the patently false claims made against us in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012) – re that we published Mr Chaudhry’s tax details in anti-government websites. In conclusion, we leave you with the words of the great English judge, the late Lord Denning in King v Victor Parsons & Co [1973] 1 WLR 29, 33-34:

“The word 'fraud' here is not used in the common law sense. It is used in the equitable sense to denote conduct by the defendant or his agent such that it would be 'against conscience' for him to avail himself of the lapse of time. The cases show that, if a man knowingly commits a wrong (such as digging underground another man's coal); or a breach of contract (such as putting in bad foundations to a house), in such circumstances that it is unlikely to be found out for many a long day, he cannot rely on the Statute of Limitations as a bar to the claim: see Bulli Coal Mining Co v Osborne [1899] AC 351 and Applegate v Moss [1971] 1 QB 406. In order to show that he 'concealed' the right of action 'by fraud', it is not necessary to show that he took active steps to conceal his wrongdoing or breach of contract. It is sufficient that he knowingly committed it and did not tell the owner anything about it. He did the wrong or committed the breach secretly. By saying nothing he keeps it secret. He conceals the right of action. He conceals it by 'fraud' as those words have been interpreted in the cases. To this word 'knowingly' there must be added recklessly': see Beaman v ARTS Ltd [1949] 1 KB 550, 565-566. Like the man who turns a blind eye. He is aware that what he is doing may well be a wrong, or a breach of contract, but he takes the risk of it being so. He refrains from further inquiry least it should prove to be correct: and says nothing about it. The court will not allow him to get away with conduct of that kind. It may be that he has no dishonest motive: but that does not matter. He has kept the plaintiff out of the knowledge of his right of action: and that is enough: see Kitchen v Royal Air Force Association [1958] 1 WLR 563.”

The limitation statute’s aim is to prevent citizens from being oppressed by stale claims, to protect settled interests from being disturbed, to bring certainty and finality to disputes and so on. These are, as legal commentators have pointed out, laudable aims but they can conflict with the need to do justice in individual cases where an otherwise unmeritorious defendant can play the limitation trump card and escape liability.

We call upon the Director of Public Prosecutions to ask Mr Chaudhry which of the two letters – Harbhajan Lal or Delhi Study Group – is the lie – as they both can’t be genuine. Apart from the false accusations against us in his affidavit, the contents of the Harbhajan Lal letter dated 9 September 2004 does not accord with his bank statements from the Commonwealth Bank of Australia which he offered to FIRCA.

In our humble submission we beg the Director of Prosecutions to call upon the Fiji High Court to waiver the statute of limitation for prima facie there is evidence in the “Harbhajan Lal” letter that Mr Chaudhry obtained a favourable decision from FIRCA (an oversight on the part of FIRCA tax officers) through alleged fraud – the contents of the Harbhajan Lal letter does not square with his Australian bank statements.

Moreover, although we do not have a copy of Mr Chaudhry’s affidavit cited by Justice Goundar (despite requests for one from the Director of the Public Prosecutions) we call upon the Director of Public Prosecutions to examine the contents of both the Harbhajan Lal and the Delhi Support Group letters. If there are glaring disparities in the two letters than Mr Chaudhry must be deprived of the statute of limitation for the “fraud”, if any on his part, would be a continuing “fraud” since 2004 when he first offered Harbhajan Lal’s letter and now the Delhi Study Group letter in 2012 to explain away the $2million is his Australian bank account.

VICTOR LAL and RUSSELL HUNTER, 4 September 2012