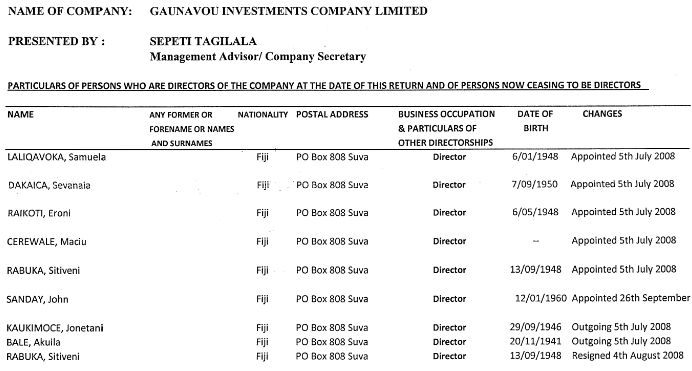

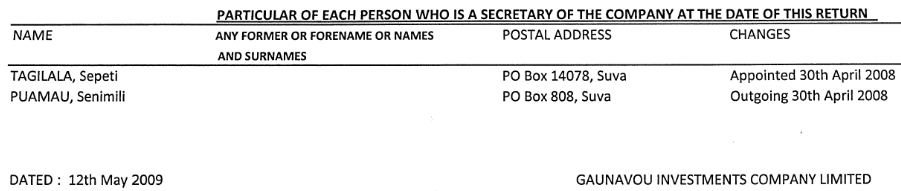

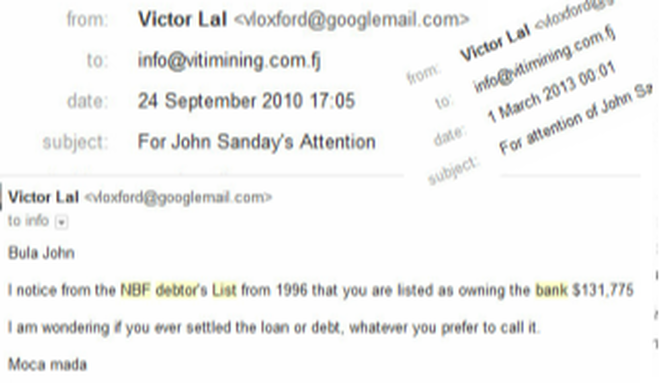

The Gaunavou Investments Company Ltd, incorporated as a public company, was set up on 13 January 1993 by the Suva City Fijian Urban Constituency branch of the ruling SVT 'with the positive intention to start and promote indigenous Fijian enterprise and business activities'. Amongst the shareholders were Sitiveni Rabuka, John Sanday and the late SVT and SDL Minister Jonetani Kaukimoce. In the 2008 Report filed with the Registrar of Companies accountant Sepeti Tagilala was listed as company secretary. Last week he was one of the panelists who interviewed Rabuka, Gavoka and others for position of SODELPA leader

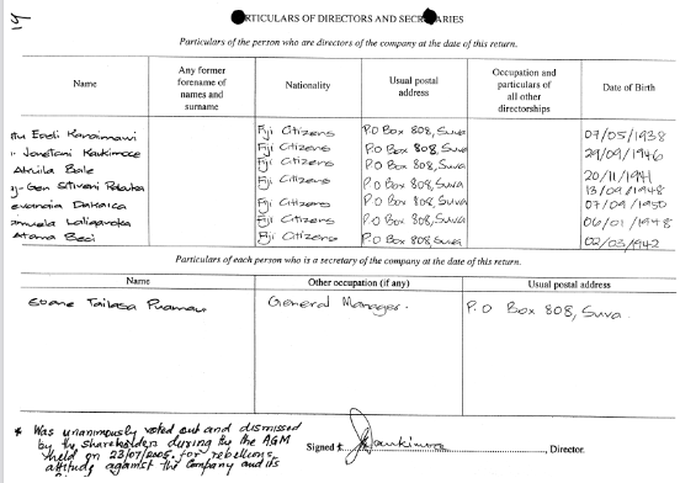

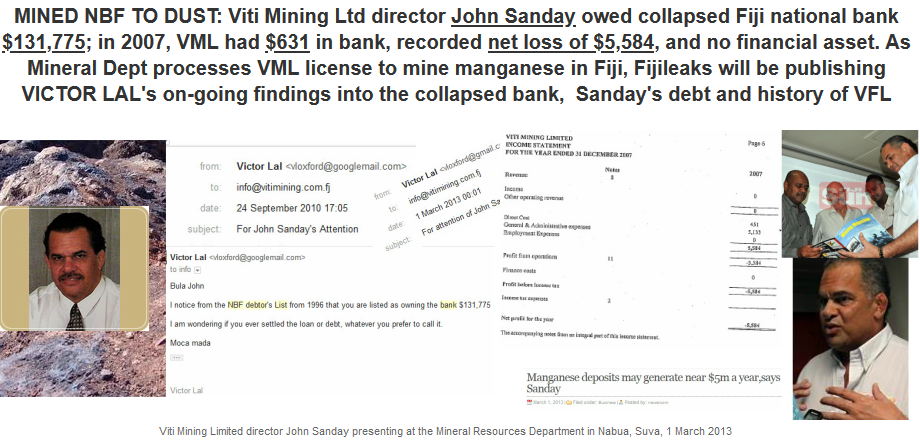

In 2010 and 2013 we asked John Sanday if he cleared his $131,776 he borrowed from the collapsed NFP. No reply.

In the guise of affirmative action for the poor i-taukei, the elite Fijians,

the Rotumans, the Part-Europeans and Indo-Fijians with political connections or capital, saw the NBF as a ‘milking cash machine'.

In 1987 the management of the National Bank of Fiji was abruptly changed. The

Chief Executive was replaced. In 1996, the late Savenaca Siwatibau had noted, 'His position was filled by a person who had run a small branch and did not have the breadth of knowledge, experience and management expertise required to run the whole bank'. That man was the Rotuman VISANTI MAKRAVA. As Rabuka's official biographer John Sharpham noted: "Rabuka had appointed Visanti Makrava in December 1987, at the point of a gun. Makrava entered the NBF headquarters in Suva with a group of soldiers saying he had been appointed by the Brigadier, as Rabuka was then. At the time Makrava was manager of the NBF's Samabula branch where the army did its banking...The other link Rabuka had with the bank was through his friend and former army commander, Paul Manueli, who had become NBF chairman in January 1988. He was to stay in that position until June 1992 when he left to become Rabuka's Minister of Finance...Makrava certainly did Rabuka no favours when he was reported to have said, "If I open my mouth, half the Government goes, including the leader.".

When the NBF collapsed, we found out that the RFMF Officers Mess, that did its banking at the Samabula branch, owed the NBF a staggering $835,307. MAKRAVA himself owed his very NBF: $888,827. In 1999, Rabuka and the NBF debtors disappeared into the sunset. Rabuka went and became chairman of the much venerated GREAT COUNCIL OF CHIEFS - Chief of the Chiefs. Sadly, many high ranking and junior chiefs were on the debtors list, including Ratu Sir Kamisese Mara, T/A Lomaloma Resort, owing $180,784; army commander Brigadier Ratu Epeli Ganilau, $631,594; and Rabuka Government Minister Ratu Inoke Kubuobola, $193,951. Many hardcore i-Taukei Movement leaders, including the Methodist Church, also looted the National Bank of Fiji

CHASING RABUKA'S NBF DEBTORS:

* Thanks to our Founding Editor-in-Chief's blessed photographic memory, now and then we are able to recapture those on the run who had vanished with their NBF debts after coupist Sitiveni Rabuka ran the NBF to the ground. Ten years ago, our Founding Editor-in-Chief revealed, like the present FFP Donors, the

Who Was Who on the NBF's Debtor List. He had on him not only the Debtors List but records of debtor companies, their directors, and shareholders

* Last week, the Fiji Sun relayed the lyrical praise of the [Gaunavou] company by its present Board chairman John Sanday. 'As a public company, this is a matter that comes down to profits and accountability. But given the time, money and effort each of us have put in to the take the company forward and further shareholder interests, it’s only fair that some remuneration be considered. Because of cash constraints, its up to the shareholders to decide whether to remunerate us with cash, or shares in the company.”

* The paper also noted that Gaunavou was formed in 1993. What it omitted to mention was that Sitiveni Rabuka was involved with the company.

A World Bank investigation into the NBF concluded that some people borrowed without the intention to repay their loans.

* Was John Sanday one of them? Its over ten years now, and we are still waiting to hear from John Sanday

Board remuneration topped discussions at Gaunavou Investments annual general meeting in Suva yesterday. It followed the company’s announcement of its second consecutive year of profit, under the new management that was appointed last year.

Board member, Ratu Deve Toganivalu, said the board had taken the company to new heights of positive growth in a short span of time, given the track record of previous administrations. “The debts are all finally cleared,” he said.

“We took on the challenge at no additional expense to the company, at a time when the company had no means of affording our remunretation” Board chairman, John Sanday, said as a public company, the board was entitled to remuneration. “Remuneration wasn’t an issue for us when we took office,” he said. “We were caught up with other things , [sic]hat we oversaw this.

“As a public company, this is a matter that comes down to profits and accountability. “But given the time, money and effort each of us have put in to the take the company forward and further shareholder interests, it’s only fair that some remuneration be considered. “Because of cash constraints, its up to the shareholders to decide whether to remunerate us with cash, or shares in the company.”

The Sanday-led board, which include Rafaele Kasibulu and Ratu Timoci Taniela, took over the reigns in 2018, lifting the company from financial doldrums to a $5 million profit in its first year in office.

Board members have a $150 sitting allowance.

Profits and dividends

The overall profits to date stand at $8.3 million. The company, established as a public entity in 1993, record a profit of $273, 956 in 2019, against $4.2 million in 2018.

The board suggested its shareholders reinvest dividends in the company in the interest of expanding the company’s investments into other sectors. Mr Sanday said close to half the shareholders owned small quantities of shares in the company. Gaunavou Investment has just over 500 shareholders. “If there was a dividend payout, most of them would be getting 60 cents.” The company’s last dividend payout was in 2014, following the sale of Valelevu property.

The board also recommended retaining its $300,000- land investment at Legalega, Nadi, as the market value of the property had increased with the high-end development surrouding the vacant lot. Discussions at the annual general meeting at Rewa Street, Suva, explored the prospects of investting in:

■ the stock market,

■ opening the shareholding policy to include interested parties who were not registered in the Vola ni Kawa Bula, and

■agriculture, by taking advantage of the number of farms that were advertised for sale.

Recommendation

The meeting called for:

■ a remuneration policy,

■ a special general meeting in the coming three months for an update on pivotal development ideas,

■ a strategic development plan,

■ a change to the vision and mission statements of the company as it did not reflect the true intent of the organisation, and the adoption of a dividend policy. About 15 people attended the meeting. Source: Fiji Sun

Board member, Ratu Deve Toganivalu, said the board had taken the company to new heights of positive growth in a short span of time, given the track record of previous administrations. “The debts are all finally cleared,” he said.

“We took on the challenge at no additional expense to the company, at a time when the company had no means of affording our remunretation” Board chairman, John Sanday, said as a public company, the board was entitled to remuneration. “Remuneration wasn’t an issue for us when we took office,” he said. “We were caught up with other things , [sic]hat we oversaw this.

“As a public company, this is a matter that comes down to profits and accountability. “But given the time, money and effort each of us have put in to the take the company forward and further shareholder interests, it’s only fair that some remuneration be considered. “Because of cash constraints, its up to the shareholders to decide whether to remunerate us with cash, or shares in the company.”

The Sanday-led board, which include Rafaele Kasibulu and Ratu Timoci Taniela, took over the reigns in 2018, lifting the company from financial doldrums to a $5 million profit in its first year in office.

Board members have a $150 sitting allowance.

Profits and dividends

The overall profits to date stand at $8.3 million. The company, established as a public entity in 1993, record a profit of $273, 956 in 2019, against $4.2 million in 2018.

The board suggested its shareholders reinvest dividends in the company in the interest of expanding the company’s investments into other sectors. Mr Sanday said close to half the shareholders owned small quantities of shares in the company. Gaunavou Investment has just over 500 shareholders. “If there was a dividend payout, most of them would be getting 60 cents.” The company’s last dividend payout was in 2014, following the sale of Valelevu property.

The board also recommended retaining its $300,000- land investment at Legalega, Nadi, as the market value of the property had increased with the high-end development surrouding the vacant lot. Discussions at the annual general meeting at Rewa Street, Suva, explored the prospects of investting in:

■ the stock market,

■ opening the shareholding policy to include interested parties who were not registered in the Vola ni Kawa Bula, and

■agriculture, by taking advantage of the number of farms that were advertised for sale.

Recommendation

The meeting called for:

■ a remuneration policy,

■ a special general meeting in the coming three months for an update on pivotal development ideas,

■ a strategic development plan,

■ a change to the vision and mission statements of the company as it did not reflect the true intent of the organisation, and the adoption of a dividend policy. About 15 people attended the meeting. Source: Fiji Sun