Letter to Bainimarama to halt the sale:

1] Proposed Changes in Legislation: The EGM papers state that the PNG Govt will introduce a Media Ownership Decree (similar to that we have in Fiji) where only locals can own shares in a media company.

In fact: This has not been implemented. The PNG Government recently issued long term TV broadcast licenses to both Digicel TV and Click TV (owned by Fijian Richard Broadbridge)– both foreign owned. Both foreign companies operate a Pay TV station on a terrestrial platform and they have made huge capital investment based on this long term license.

Sir, please refer to Item 6 of the Management], it encapsulates this point. This paper was prepared by the former Head of SKY, Nitesh Lal and endorsed by the Fiji TV Executive team.

Sir, the key person that would fully understand the potential impact of the sale of MNL is Mr Isoa Kaloumaira, the former FHL/Fiji TV Chairperson & current iTaukei Trust Fund CEO –. He served the longest on both boards and he oversaw the entire acquisition, transition and growth of Fiji TV & MNL from its early years.

Sir, we implore you to seek his wise counsel, as he can tell you the truth of the potential impact on Fiji TV if MNL is sold.

PNG is a great nation build and supported by majority owned foreign companies. A lot of companies in Fiji are investing in PNG and yet Fiji TV is selling its shares and pulling out from PNG.

2] Investment in Digitization: The EGM papers say that it will be costly for MNL to invest in digital upgrade.

In fact: MNL uses 38 terrestrial towers to deliver its terrestrial signal across the entire PNG nation. MNL owns 4 and pays a total rental fee for the 34 remaining towers (all owned and built by the Provinces).

MNL will only be required to upgrade 4 of its towers at an estimated cost of $200k/tower upgrade. An assessment on the remaining 34 tower upgrade may also be considered with the provinces, but very costly option.

Aside from this, MNL has a viable commercial option to push MNL’s signal throughout the entire country via SKY Pacific’s digital platform (in accordance with Fiji TV’s former Board & Management team’s strategic direction). This option is now being implemented – the SKY team has been in PNG since mid 2014. SKY Pacific can be seen via a digital signal throughout the entire PNG territory with a simple dish & a decoder. NONE of the competing Pay TV Operators in PNG have this competitive advantage over SKY, they deliver their digital signal on a terrestrial platform.

3) Aggressive Competition: The EGM papers say that MNL cannot compete in PNG due to new competitors.

In fact: Aggressive competition is part and partial of any business competing in the global community. In MNL’s case, it is the only commercial free to air TV station in PNG. There is no other competitor in this market apart from KUNDU 2 – public service broadcaster. All the new entrants are Pay TV ‘Terrestrial’ Operators. The cost for digital upgrade for any public broadcaster is costly for any Government, Fiji TV took the strategic approach and invested in digital TV (Sky Pacific) 10 years ago.

Not only does MNL have a competitive advantage over its competitors in terms of broadcast coverage via the SKY Pacific platform (as explained above) but it also has a competitive advantage over its competitors in terms of exclusive rights to compelling content. Fiji TV has secured exclusive free to air & Pay TV NRL rights for Fiji, PNG and the Pacific Islands till 2017. The presence of NRL on SKY Pacific will enable all Papuans (including those in remote areas to watch) and will strengthen the expansion of SKY. If MNL is sold, NRL (free to air only) for the PNG territory will be sold with the business. This will make it even more difficult to market SKY to local Papuans.

FHL has made investments in RB Patel in Fiji where there is a competitive market and yet, FHL is not selling it off. MNL is the only free to air commercial TV station in PNG and yet FHL is looking at selling it off.

Summary of key impacts on Fiji TV & FHL Shareholders if MNL is sold

1] No future dividends for Class B Shareholders

MNL was purchased for FJD$2.76m in Dec, 06. Dividend & Management fee from 2005 – 2014 is FJD$21.7m, more than 650% on our Return of Investment (ROI) from MNL. Upon receipt of these monies, dividends are paid out and for obvious reasons, FHL, receive the dividends and pays out to FHL Class A & Class B shareholders. The dividends that Class B receives are invested back into the 14 iTaukei provinces to develop roads, hospitals, education, water & sanitation, etc.

The former Fijian Holdings & Yasana Holdings Ltd board members (some were former board members of Fiji TV) had made submissions to your office some years back advising against the sale of YHL shares to FHL. One of the key reasons – Fiji Government was receiving 3 forms of dividend income through their investment in Fiji TV: i) dividend from YHL ii) dividend Government of Fiji (sold its shares to Hari Punja & Sons) & iii) dividend from FHL. The sale of YHL & Govt of Fiji shares reduced its revenue stream from 3 down to 1. Once Fiji TV is sold/closed – FHL will not receive any dividends from FTV and this will result in dividends reduction to the Class B shareholders as well.

2] Hindrance of SKY Pacific growth in PNG

SKY Pacific expansion into PNG without MNL support will be difficult. EMTV is the free to air TV channel & moves are already underway by the current MNL Executive to remove EMTV News from SKY Pacific (Pacific Channel). The absence of a local EMTV News does not make it viable to market SKY in PNG. Fiji One, Super Channel and Pacific Channel are popular channels with PNG Sky customers. This will also affect Fiji TV’s expansion plans to Solomon Islands & Samoa – legal groundwork already done. In TV business, local viewers watch a TV stations programs if there is a strong & compelling local and key international content. Fiji TV produces more local programs than any of its competitors, even against MNL.

3] Inability to acquire International Sports Content/Programs

To sustain the payment of International programs, satellite costs, etc, our ROI from MNL enables Fiji TV to meet its international program & satellite payments, etc. If we sell MNL, we cease watching key sports content in our nation. Even FBC/Mai TV will not be able to afford the costs. This is one of Fiji V’s competitive advantage, is affordability to outbid other Pacific broadcast bidders because of its synergies with MNL.

4] Decline of Fiji TV Share Price

The sale of MNL will continue to further decline Fiji TV’s share price.

5] Underselling MNL

Deloittes had valued MNL in September, 2013 at PGK60 – PGK80m. Another valuation was done late last year and it drastically dropped overnight to around PGK25 – PGK37m due to the financial forecast provided by the MNL Management themselves to the 3 independent companies. One of the reasons given by the MNL Management was that advertisers were spending less, quite astounding given that MNL is the only free to air commercial TV station in PNG.

6] Fiji TV Year end 2013/14 results

MNL’s dividend income was FJD$6m and an additional $600k in Management Fees payable to Fiji TV. MNL achieved a NPAT FJD$3.2m vs Fiji TV NPAT FJD$1.3m. MNL is the cash cow.

7] Understanding our Pacific Friends & Families

The closure of Fiji TV will have an impact on all our Pacific friends. We understand the Pacific way & the challenges that we all face against the global community. The Pacific broadcasters/partners throughout the region can attest to the assistance that Fiji TV gives to their stations. In a collective bid with our Pacific friends (Fiji TV cushions the impact) for key sports international content, we assist each in driving the bid down. The bid is open to all broadcasters in each country, Fiji TV has built up years of strategic alliances and goodwill with all its Pacific TV broadcasting partners.

Deterioration of Good Governance, Transparency & Accountability

Given that FHL is the largest shareholder, they really do not need anyone’s approval. As a public listed company, the rules of good governance require that all shareholders be fully informed of major or substantial changes incurring within Fiji TV.

There has been a deterioration of Good Governance, Accountability and Transparency at the Fiji TV board level since FHL took over in mid-2013.

The former Executives (including the recent resignation of Head of SKY and Hari Punja & Sons board members) have brought this issue up numerous times to the current CEO FHL (Nouzab Fareed) but it seems to fall on deaf ears.

The former Executives of Fiji TV had been pushing to present to the FHL board the consequence of the sale of MNL [Annexure “GW 2” - Management Report dated 17th November, 2014]. The push for the sale of MNL has come from FHL board members themselves, and they have no understanding on the financial impact that it will have on Fiji TV. MNL rakes in the most money for Fiji TV – why then do they want to sell?

Further, under the Fiji TV Articles of Association, the minimum number of directors on the board is 7. This is the minimum legal requirement for the number of directors on the board of Fiji TV at any time. Fiji TV has been operating with only 6 board members since the 9th of December 2014. This means that all proxies received, decisions, transactions and deals made by the Fiji TV board from 9th December, 2014 to date (and continuing until such date as there is a 7th board member appointed) are unauthorized, illegal, null and void and the directors may be subjected to criminal and civil legal proceedings from the shareholders of Fiji TV.

Need to change current Class B board members of FHL

Sir, under the Fijian Holdings Limited (‘FHL’) Memorandum and Articles of Association, you have the powers to appoint 6 members to the FHL Board to represent iTaukei Affairs Board and iTaukei Trust Fund as the majority shareholders of FHL. Only 3 members currently represent Class B shareholders at FHL, and the remaining 3 represent Class A shareholders, We recommend that a further 3 Class B board members be appointed to the FHL board to protect the Class B Shareholdes investment.

In our humble opinion, there needs to be a change of the current Class B board members that sit on the FHL board.

The decision vests with you through the iTaukei Affairs Board and iTaukei Trust Fund in consultation with the 14 iTaukei Provinces on the best team that will serve on the FHL board for the interests of all the 14 iTaukei provinces.

Sir, you have the ability through the iTaukei Affairs Board and iTaukei Trust Fund as shareholders of FHL to save Fiji TV, its people and the shareholders

Conclusion

Sir, our concerns are based on:

1] The impact of the sale on Fiji TV and FHL (as its shareholder)

2] The lack of transparency on the part of the board of FTV in its failure to provide full and key information needed for the shareholders to make a clear commercial decision

3] The deterioration of good governance, transparency and accountability at Fiji TV board level.

In terms of its impact, the sale of MNL will be the quick demise/closure of Fiji TV.

The demise/closure of Fiji TV is more than just the shareholders interest, Fiji TV (Fiji One/Sky Pacific) is one of nation’s key product that is known throughout the Pacific.

Fiji TV aired the first Rugby World Cup 1991, started the first TV station (Fiji One), brought entertainment and infotainment of News, Current Affairs, Sports and local programs PLUS all the 24 SKY Pacific channels to Fiji and all the other 14 Pacific Island countries that it beams its channels into(via Sky Pacific). Fiji TV has brought the world to the Pacific (via Sky Pacific’s 24 channels) and it has taken our nation to the Pacific through our local programs on Fiji One and Pacific Channel.

Fiji TV has become a national icon of Fiji and a source of patriotic pride at its many and varied achievements.

The demise of Fiji TV will be sad for everyone, not only for the shareholders. It is a Pacific name icon and one of the best brand Ambassador for our nation throughout the Pacific.

We have left Fiji TV but we still care for the people, an excellent team of multi-racial, talented and hard working. They have invested their lives and talent for Fiji TV. They have mortgages, children and personal commitments and we know that the sale of MNL will mean job losses and eventual closure of Fiji TV.

Sir, please stop the sale of MNL and save Fiji TV, its people and the Fiji TV/FHL shareholders. Fiji TV is a great investment for our 14 iTaukei Provinces.

GW 1 - Management Report dated 17th November, 2014.

GW 2 - Fiji TV Extraordinary Meeting Papers

MONTH : November 2014

SUBJECT : SALE OF MEDIA NIUGINI LIMITED (MNL)

TYPE : For Discussion & Decision

FROM : Fiji TV Management (CEO, HOD’s, and Managers)

DATE : 17 November 2014

____________________________________________________________

1. PURPOSE

1.1 The purpose of this paper is to advise Fiji TV Board of the business implication and possible consequences on Fiji TV if the decision is made to sell 100% of MNL shares that Fiji TV currently owns

1.2 Fiji TV management recommendations to Fiji TV Board with outlined strategies for future of MNL.

2. BACKGROUND

2.1 With the vision “To be The communication business for Pacific communities”, Fiji TV bought MNL for FJD $2.76m in December 2004. According to the recently valuation (July 2013) conducted by Deloitte PNG, MNL’s value is anywhere between PGK 72k to PGK 102k.

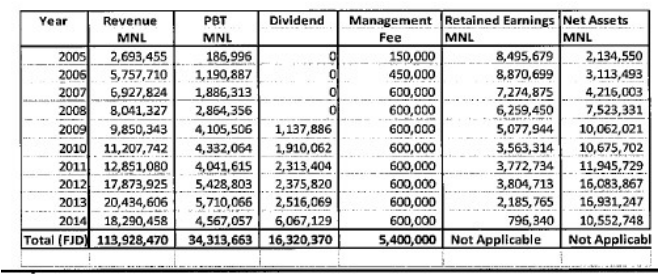

2.2 Fiji TV to-date (from 2005 to 2014) has recouped total of FJD $21.7m from MNL via dividend income and management fees. This is more than 650% on the total initial investment over the period of 10 years.

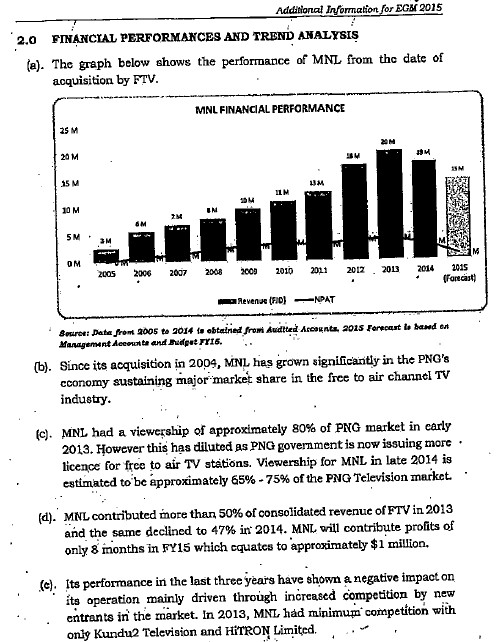

2.3 Total MNL turnover in 2005 was at FJD $2.69m and we grew this to FJD $18.29m by end of 2014 FY. The average profit before tax figure for MNL for last 10 years is at FJD $3.43m.

2.4 Since its operation in 2005 there has been no other investment and capital contribution from Fiji TV to MNL. During the first year, Fiji TV made some contributions, a loan to MNL which now has been repaid.

2.5 Tabulated below for information is summary of MNL’s revenue, PBT, Dividend paid to Fiji TV, retain earnings and net assets for last 10 years:

2.7 Please refer annexure 2 for financial trend analysis for MNL for last 10 years.

3 BUSINESS IMPLICATION & OTHER CONSEQUESNCES OF 100% SALE OF MNL

3.1 Fiji TV losing on its vision “To be The communication business for Pacific communities”, by losing our presence in the Pacific biggest market (7.6m population) if we sell 100% MNL.

3.2 Fiji TV losing out on its competitive advantage by selling MNL and also losing out on our strategic alignment and direction. Where we go from here? Currently we have huge competitive advantage over our competitor by owing 100% of MNL.

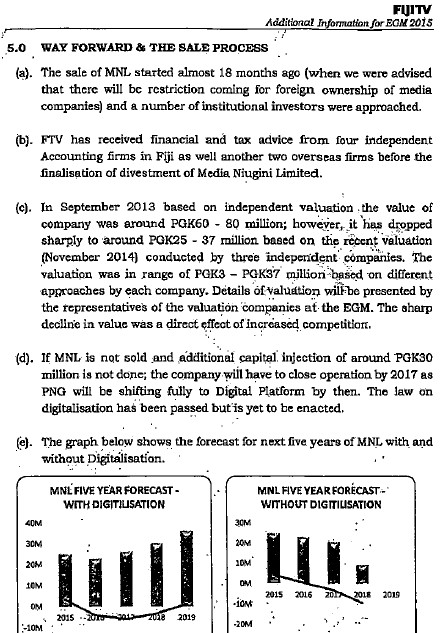

3.3 Ability to earn equivalent or better return than MNL and ability to find investment project and timeliness to do this. By selling MNL, we will not be in a position to find an investment that will give Fiji TV a better rate of return on its investment. Please refer annexure 2 for MNL financial trends.

3.4 Sourcing of content, especially sports content will become more expensive for Fiji TV and Sky Pacific without MNL. As stated earlier that we have competitive advantage over our competitor by having MNL. Currently we can afford to get compelling content for Fiji and Pacific Island countries. With the sale of MNL, this will become very difficult and Fiji TV will lose out on key content.

3.5 Fiji TV expansion in other Pacific Island countries (Samoa & Solomon) will be negatively impacted. Also we will lose out on business synergies that we can do with EMTV and Sky Pacific in PNG.

3.6 Possible decline in Fiji TV’s share price as a direct result of MNL sale.

4 BENEFITS OF RETAINING 100% OF MNL

4.1 Competitive advantage and competitive edge for Fiji TV over its competitors in Fiji, PNG and other Pacific Island countries.

4.2 EMTV is very strong brand name to let go. MNL is cash cow and our Gold Mine in PNG.

4.3 Strategically aligned to our Vision and 90% market share advantage in free-to air business in PNG (Pacific’s biggest Nation).

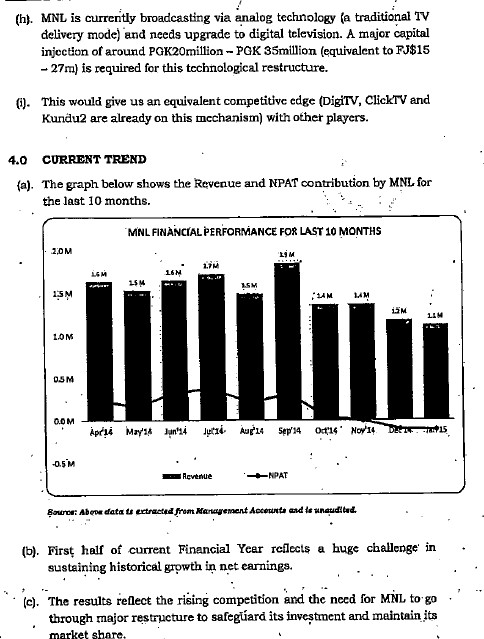

4.4 Positive financial trend even with competition in PNG. Constant return to shareholders (Dividend Payout)

4.5 Proven track record for last 10 years in regards to performance and contribution to Fiji TV group in terms of revenue and profitability.

4.6 Sky Pacific expansion in PNG without EMTV support will be very difficult there for by having MNL, we will have business synergies between the two companies.

5 ISSUES UNDER DISCUSSION

5.1 Media decree similar to Fiji will soon be enacted for PNG

5.2 Stiff competition from Digicel & Click Pacific

5.3 Fiji TV’s Poor financial Performance

6 FIJI TV MANAGEMENT RESPONSE TO THE ABOVE ISSUES

6.1 Just recently government of PNG has issued long term licenses to three companies (Digicel, Click Pacific and Sky Pacific) to commence and operate television/media business in PNG. Both Digicel and Click has made huge capital investment in PNG based on this long term licenses. In no way will government of PNG ask these investors to divest from PNG by intruding media laws. In addition, there is no mention of any such conditions in the licenses that we have been issued. Furthermore, CFL has been in PNG for more than 2 decades and they have huge operations there. According to CFL there is no such media law in PNG and except for Fiji TV, no one else is talking about enactment of any such laws in PNG.

6.2 Competition is part of any business and just because we have competition coming up in PNG doesn’t mean we sell out our strongest performing company. EMTV brand is very strong and we have developed over the year’s very strong viewership for EMTV. We still have competitive advantage through our brand. In addition, Digicel and Click Pacific will be in direct competition with Sky Pacific as they will be delivering Pay TV services to the customers. They will need EMTV platform to grow their Pay TV business and in case of Digicel their telecommunication business.

6.3 Fiji TV’s poor financial performance for one financial year (FY 2014) should not be the reason to sell MNL. We should look at the trend analysis for Fiji TV for last 10 years and make assessment. There is no ‘going concern’ issue for Fiji TV or MNL. FY 2014 was a difficult one and we had to take into account unwanted provisions. The company and the Group have huge potential and we will turn around. Fiji TV will continue to pay expected levels of dividends to its shareholders.

7 ALTERNATIVE AVILABLE OPTIONS

7.1 Retain 100% of MNL. Do not sell and Fiji TV maintain control of business and operations of MNL.

7.2 Do not sell 100% of MNL. We can consider dilution of 49% shares through POM stock exchange. At share price of PGK 3.00 and dilution of 49% shares, Fiji TV will get approximately PGK 30m. Worse case at minimum share price of PGK 2.5, Fiji TV will receive PGK 25m.

7.3 Dilution of 49% through calling of expression of interest and opening this offer to markets outside PNG. We have not explored this option as there are investors wanting to set their foot in PNG and this will be a great opportunity for them.

8 CONCLUSION & RECOMMENDATIONS

Fiji TV executives, management and key employees strongly recommends to Fiji TV board to retain MNL as wholly owned subsidiary of Fiji TV. We strongly recommend Fiji TV board not to sell 100% of MNL.

Fiji TV Management proposed strategies going forward for MNL will be as follows:

a) Change of Leadership at MNL and Fiji TV to have full control MNL.

Fiji TV to excise the exit clause in the employment contract for CEO MNL. Fiji TV Board is to note and assess his conflict of interest. The CEO of MNL, Mr Bhanu Sud has a three year employment contract with MNL that commenced from 1st August 2014 and 31st July 2017. If the CEO were to resign, the total payout costs as per his employment contract will be KINA 513, 156, FJD equivalent $342,200

Fiji TV has two options for replacement of MNL Leadership:

Option 1

• Fiji TV will use the RB Patel Family model whereby staff will be on 3 months rotation basis given that we also have the subsidiaries of Solomon Islands & Samoa.

• No Change to Management fees paid to Fiji TV. Fiji TV will provide Allowances for staff working in MNL. MNL will pay for accommodation, travel, and all other necessities.

• Fiji TV will ensure that the team chosen will be of a minimum of two people on rotations to a maximum of 4 being deployed to PNG at a time. Fiji TV will also drive the SKY PACIFIC PNG.

• In regards to the marketing strategy, it will be developed in Fiji. We currently have two of our local staff currently working at MNL namely Sheena Hughes and Devika Prasad who is more experienced in the PNG market and also to work closely with the local staff. MNL staff will be required to head NCAS and other support services.

• The Corporate team which consists of Head of Corporate, Manager Finance and the two accountants will be the Finance team that will be deployed on a rotational basis for up to a maximum of 3 months at a time.

Option 2

• Alternative option is to appoint GM MNL reporting to CEO Fiji TV. CEO Fiji TV with Fiji TV executive management team will provide strategic direction and have control on MNL Business from Fiji. However day to day management of MNL operation on ground becomes GM MNL responsibility. This model has worked out very well in the previous years for Fiji TV when Ken Clark was CEO MNL but based in Fiji and we had a GM MNL based in PNG. We produce exceptionally good financial results. Please refer MNL financial trend analysis in annexure 2.

b) Maximise Shareholders return.

i) Fiji TV management to ensure value of MNL grows and we deliver minimum of 7% in revenue growth and 5% in NPAT.

ii) Fiji TV management to ensure adequate returns to shareholder through dividend payouts.

c) Conversion to digital cost?

i. MNL owns 4 towers and pays a tower rental fee for 34 towers. The estimated total cost for 4 towers is at $200,000/tower upgrade. Will work on assessment on the remaining 34 towers. Will also strategically work with SKY pacific services in PNG.

ii. With the transition from analogue to digital in PNG, MNL is required to negotiate the rental boxes to access the digital signal. However, the Digital signal is relevant for main city centres and not viable for the interior. Digital signals will require decoders to access by individual households. Who will pay for it?

iii. Will continue to push for the Sky pacific to deliver the signals to the outskirts of PNG. MNL will only invest in its own 4 towers.

d) Other Measures

i. Reduce costs in Human Resource as all related costs will be paid by Fiji TV

ii. Management fee charge justification (all personal is from FTV on rotation)

iii. Allowance will be paid in Fijian dollars.

iv. Strategic Direction set by FTV to grow Pacific market as a whole.

v. Content cost will be shared cost upon an agreed % on the costs.

vi. Fiji TV will be targeting specific content which will be on exclusive basis.

Respectfully Submitted

Fiji TV Management