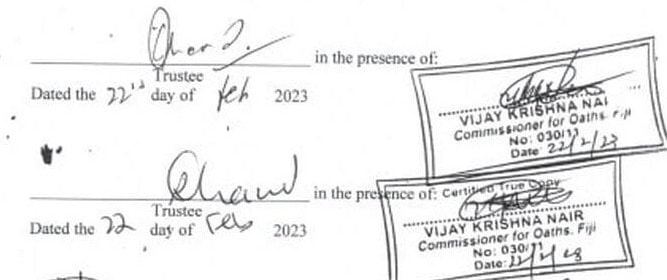

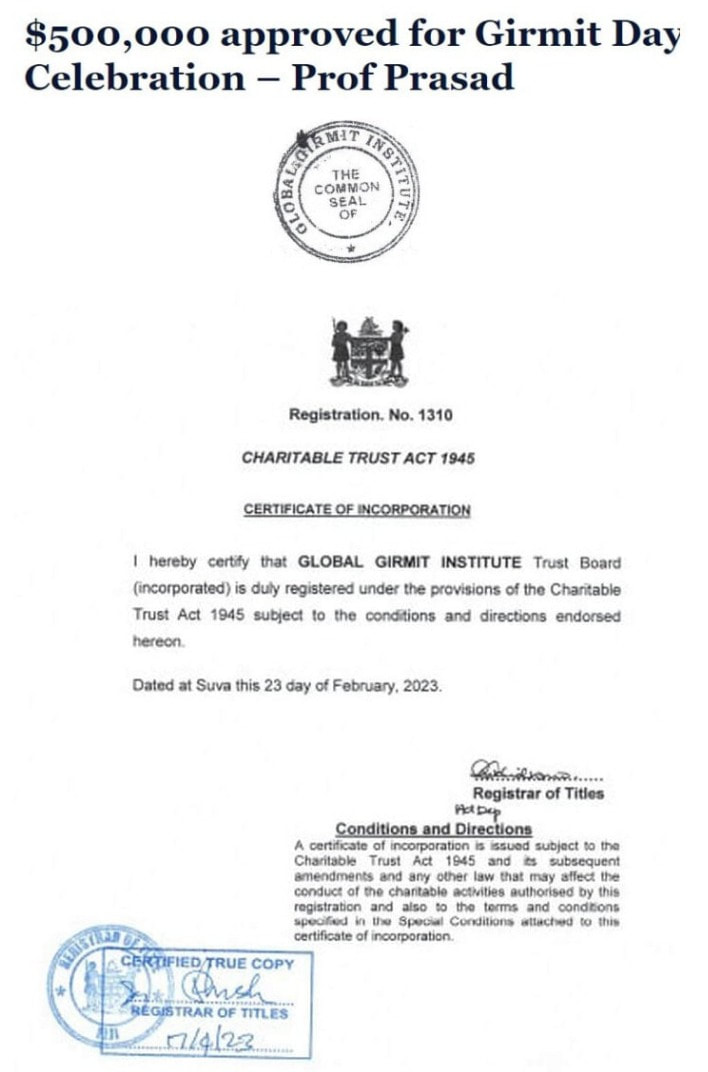

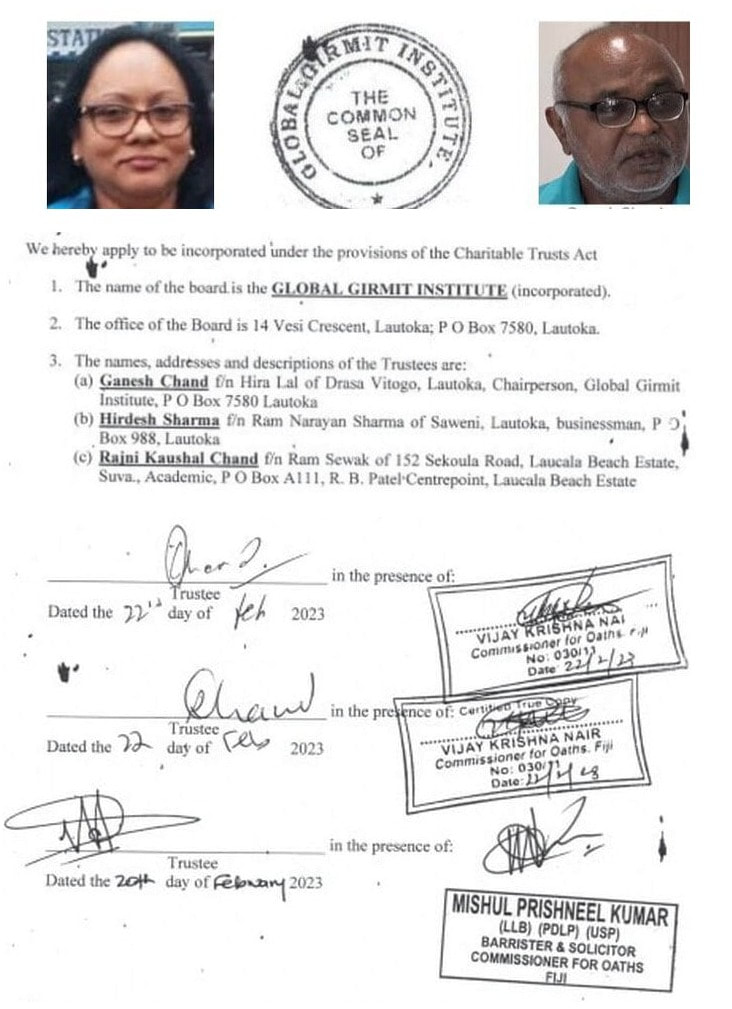

How did the Global Girmit Institute break Guinness World Record to file application on 22 February 2023 and get re-registered the next day, on 23 February? It was one week after Prasad announced that $500,000 was up for grabs.

Fijileaks: We don't speak on behalf of FLP leader Mahendra Chaudhry or Opposition leader Inia Seruiratu (whom we have condemned in the past and will continue to hold to account) although it is patently clear that they raised the scandal after we leaked the Global Girmit Institute File

CRIMINAL INVESTIGATION: We repeat that Biman Prasad must step down from Coalition government, his wife must step aside from USP, so FICAC and Police can launch a criminal investigation into how the Global Girmit Institute managed to break Guinness World Record to file application on 22 February 2023 and get re-registered the next day, on 23 February.

*The investigating authorities must also take in the other two trustees, GANESH CHAND and HIRDESH SHARMA for questioning, including the GGI Auditors and the acting Registrar of Titles, Adi Kelera Rokoleba Kididromo who approved the GG1 application.

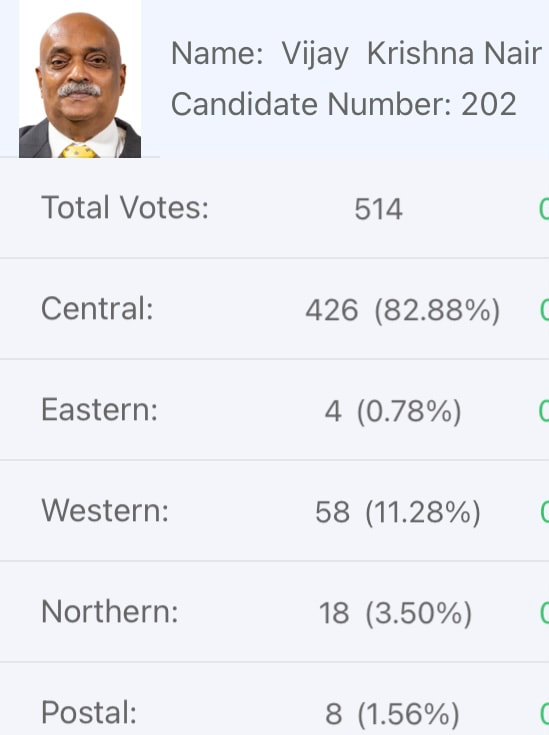

*Another principal suspect who should be questioned is VIJAY KRISHNA NAIR, the failed NFP election candidate and Justice of Peace, who witnessed the the re-registration application

*We know the GGI had failed to submit four years (2018, 2019, 2020, and 2021) financial accounts and was de-registered.

*USP Vice-Chancellor PAL AHLUWALIA must also explain when did he know that USP was to host the two-day conference, when was an invitation sent out to him to be the keynote speaker, and who paid the USP to host the international conference - the total cost?

*The NFP president and Minister responsible for the Police, PIO TIKODUADUA must also explain if any Police check was ordered on the TRUSTEES, for Ganesh Chand's Abuse of Office charge has been permanently stayed until the principal witness testifies against him.

*Naidu warned violators that the process to re-register can be expensive and disruptive. From Global Girmit Institute file, it was PLAIN SAILING for GGI. Hence, a thorough and joint FICAC and Police investigation is the only way to reach the bottom of the GGI case.

As Naidu had warned, ignoring to comply with Charitable Trust, could result in de-registration, meaning 'significant work to restore or re-incorporate organisations that had 'missed the boat'.

The GGI sailed through in a day, breaking Guinness World Record.

"Last year the Registrar “cracked down” on non-compliant trusts, issuing 21-day notices which, in some cases, were ignored, resulting in de-registration. This meant significant work to restore or re-incorporate organisations that had “missed the boat”. This process can be expensive and disruptive and also damage relationships with donors and funders."

Charitable Trusts Act 1945 – Annual Return reminder

Introduction

The Charitable Trusts Act 1945 (Act) requires charitable trusts registered in Fiji to file a return with the Registrar of Titles (Registrar) at least once a year[1].

Requirements

The annual return should contain the following details:

The Registrar has powers to publish any or all information in relation to the non-compliance of the charitable trust (including the names of trustees and board members)[2]. The Registrar can also, after delivering and publishing the relevant notice in the Gazette, cancel the incorporation of trusts that fail to comply with this annual filing requirement[3].

Last year the Registrar “cracked down” on non-compliant trusts, issuing 21-day notices which, in some cases, were ignored, resulting in de-registration. This meant significant work to restore or re-incorporate organisations that had “missed the boat”. This process can be expensive and disruptive and also damage relationships with donors and funders.

What should charitable trusts do?

First – pay attention to the requirement for annual filing and ensure that audited accounts and usual financial governance processes are on track.

Second – if you receive a notice from the Registrar, do not ignore it. Contact the Registry to explain the trust’s situation and ensure that the Registrar is aware of the trust’s intention to comply.

Third – if you anticipate that, for whatever reason, the trust will take longer than usual to make its annual filing, contact the Registrar to explain the situation.

If you have any questions regarding this Alert, please contact either Richard Naidu, Glenis Yee or Karthik Chandra.

[1] s. 29A(1)

[2] s. 29A(3)

[3] s. 29A(2)

Introduction

The Charitable Trusts Act 1945 (Act) requires charitable trusts registered in Fiji to file a return with the Registrar of Titles (Registrar) at least once a year[1].

Requirements

The annual return should contain the following details:

- names and addresses of all trustees

- names and addresses of current board members

- names, addresses and designations of office bearers

- a copy of the trust’s audited annual accounts/financial report.

The Registrar has powers to publish any or all information in relation to the non-compliance of the charitable trust (including the names of trustees and board members)[2]. The Registrar can also, after delivering and publishing the relevant notice in the Gazette, cancel the incorporation of trusts that fail to comply with this annual filing requirement[3].

Last year the Registrar “cracked down” on non-compliant trusts, issuing 21-day notices which, in some cases, were ignored, resulting in de-registration. This meant significant work to restore or re-incorporate organisations that had “missed the boat”. This process can be expensive and disruptive and also damage relationships with donors and funders.

What should charitable trusts do?

First – pay attention to the requirement for annual filing and ensure that audited accounts and usual financial governance processes are on track.

Second – if you receive a notice from the Registrar, do not ignore it. Contact the Registry to explain the trust’s situation and ensure that the Registrar is aware of the trust’s intention to comply.

Third – if you anticipate that, for whatever reason, the trust will take longer than usual to make its annual filing, contact the Registrar to explain the situation.

If you have any questions regarding this Alert, please contact either Richard Naidu, Glenis Yee or Karthik Chandra.

[1] s. 29A(1)

[2] s. 29A(3)

[3] s. 29A(2)