Fijileaks Editor: SPOT THE DIFFERENCE - In 2007/2008 Fiji Sun was in forefront of exposing Chaudhry's secret millions, now Fiji Sun is State's propaganda organ, with MIDA ensuring investigative journalism remains DEAD in Fiji; in 2007 the same FICAC deputy Langman had denied receiving SUN's investigation findings, sent by registered post to him:

Blind to Chaudhry's file in 2007/2008

Blind to Chaudhry's file in 2007/2008 Langman and Bainimarama

"We (Lal and Hunter) had, before the publication of the first story on 15 August 2007, already mapped out our publication strategy, as an e-mail dated 10 August 2007 from Mr Hunter to Victor Lal reveals:

“Here is what I think. We publish, pointing out that these files were received before the coup. We don't name the daaku - at least not yet. We hand over copies of the documents to FICAC - and say so - and also to the RBF intelligence unit but don't say so.

We challenge FICAC to launch an inquiry naming the person being investigated - as it has done in the past. It won't do it, of course. But we can keep on badgering them about it. When the boot boys come down here demanding all our information we can put our hands on our hearts and say FICAC already has it.

At least someone is acting in the public interest here.”

Victor Lal agreed to the strategy, commenting: “Ok. The end game is to name him and I am sure we will get there.”

FICAC and Interim Prime Minister Bainimarama get tax documents

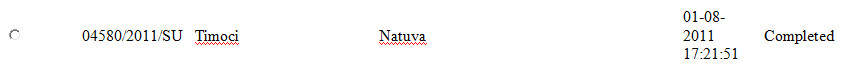

On 13 August 2007 Victor Lal sent all the tax documents in his possession to FICAC’s deputy head Lt Col George Langman and also copied them to the then Interim Prime Minister Commodore Bainimarama.

While Commodore Bainimarama did not reply, Lt Col Langman, on the other hand, claimed that he did not receive the documents, which was sent by registered post to him, and addressed to FICAC headquarters in Suva. He further claimed that they did not have the expertise to investigate tax evasion charges by the “Minister” and had referred it to FIRCA to deal with. At no point in time did Lt Colonel Langman ask Victor Lal to re-submit copies of the tax documents.

Under the heading “Re: Mr Mahendra Chaudhry and FIRCA Tax Documents”, Victor Lal wrote to Lt Colonel Langman:

1: In 2005, I anonymously received a brown envelope purportedly containing the tax records (1994-2004) of Mr Mahendra Chaudhry, currently the Minister of Finance in Prime Minister Commodore Frank Bainimarama’s Interim Government. I looked through it and put it on the shelves. When the coup took place (which I supported in my Fiji Sun columns on the grounds of Doctrine of Necessity) and the list of the Cabinet ministers was announced, I could not resist reaching for that mysterious brown envelope that had been gathering dust on my shelve.

2: In January I began examining the documents on proving certain conclusions. I collaborated with overseas publications, which submitted the documents to forensic accountants who offered the view that while this kind of behaviour was entirely typical of attempted tax evasion they did not by themselves prove tax evasion. More investigation was needed on that front.

3. What is relevant, however, is what the documents reveal, and the conclusion and speculation that is derived from them, and particularly how Mr Chaudhry appears to have accumulated such a vast fortune, in such a short space of time. We also found that Mr Chaudhry did not submit returns for three years (2000, 2001, 2002) was proved. What else?

4: The income tax records purportedly relating to him reveal late payments, penalties, and negotiations to bring down payments, and huge lump sum payments and negotiated settlements over the 10-year period...

13: These are, according to experienced English tax assessors, very large payments by someone who is a mere politician. These are negotiated settlements for undeclared incomes, which the Cabinet minister could not argue his way out with the Fiji taxman. The large number of assessments and charges imposed also shows FIRCA “discovering” undeclared income. These two payments, at a top tax rate of 32% in Fiji, represent undeclared income of around $300,000.

14: As I have already noted, most of the figures purportedly belonging to Mr Chaudhry cannot be accurate to the dollar unless the actual taxation and interest formula are known. But on the assumptions made the figures are fairly close, and raise the question of the sources of the additional incomes.

15: From a legal perspective, it is worth reminding ourselves that in the past, High Court judges attempted to draw a bright line between tax avoidance, on the one hand, and tax mitigation or tax planning, on the other. One widely used definition is that of Lord Nolan in Willoughby, that tax avoidance is a course of action designed to conflict with or defeat the evident intention of Parliament, even if all legal routes are followed to avoid paying tax. It is curious that Mr Chaudhry as a former Government auditor and Finance Minister in the deposed Bavadra Government has not be[en] able to correctly assess his tax records, and has not been following the rules on submission of his tax returns.”

In November 2007 Victor Lal sent the tax documents once again to Commodore Bainimarama via the Prime Minister’s private secretary Parmesh Chand.

For PM Commodore Bainimarama

FROM: Victor Lal

TO: [email protected]

Thursday, 29 November 2007, 23:43

Dear Parmesh

Bula.

I would be very grateful if you could pass on the following attachments to the PM, although I had sent the originals with supporting documents to him in August. You might want to also inform him that I have other supporting evidence against the Interim Minister regarding my most recent article and the Australian bank accounts etc. I hope you will inform the Prime Minister that he cannot expect us to call upon FIRCA to investigate its own boss until the Interim Minister is stood down from Cabinet. There is no malicious intent on my part, especially when I supported the initial coup under the Doctrine of Necessity, to weed out corruption etc.

Warm regards

Victor Lal

Further excerpt from submission to DPP:

However, before going public, we gave Mr Chaudhry the right to admit or deny that he was the Interim Cabinet Minister in question. On the advice of Mr Hunter, Victor Lal had, on Monday August 6, 2007, sent Mr Chaudhry a list of questions regarding his (Mr Chaudhry’s) tax matters to a private e-mail address. Victor Lal had used the same e-mail address some years previously to communicate with Mr Chaudhry: <[email protected]>. It was a formal e-mail and was sent under the Fiji Media Council’s Code of Ethics. The e-mail read:

“Dear Mr Mahendra Chaudhry,

Further to my earlier questions, I would be extremely grateful if you could indicate whether you are willing to confirm or deny that the interim Cabinet Minister that the Daily Post alluded to is none other than yourself. As I mentioned, I am working on a general tax story and your co-operation as interim Minister of Finance would be greatly appreciated.

You will also agree that although the Income Tax Act requires the FIRCA to maintain secrecy, it does not permit the taxpayer not to be untruthful in reporting his tax details.

Again, I would be extremely grateful if you could explain why you did not submit your tax returns in 2000, 2001, 2002, and 2003, presuming you are the minister in question?

Also, why were you allegedly wrong in calculating your earnings, given that you are a former government auditor, a former finance minister in the ousted Bavadra government, and now the official purse keeper of the nation?”

In the same e-mail Victor Lal raised other matters:

“I would also be grateful if you could answer the questions that I sent you on the Cyclone Ami and the Haryana funds. I hope you fully understand the seriousness of the matter and that your name is now being floating around on the Internet; especially on Why Fiji is Crying website.

It is therefore in your own interest and in the interest of the nation and the interim government to confirm or deny that you are the minister in question, and are willing to give your side of the story… I look forward to hearing from you, preferably by the end of the week, as my deadline for the story is approaching, and as required by the Media Council’s Code of Ethics.

Yours sincerely,

Victor Lal.”

Mr Chaudhry ignored the above questions. As a result, on Wednesday August 15, 2007, the Fiji Sun ran Victor Lal’s version of Mr Chaudhry’s tax affairs, without naming him (Mr Chaudhry) as the Interim Minister: “Taxman and the Minister - Revealed: How FIRCA did not believe him.”

Fijileaks Editor: A year later, on 24 February 2008, Victor Lal revealed Chaudhry's $2million with supporting documents, resulting in the abduction and deportation of Hunter from Fiji. In the course of his three-year investigation Lal finally tracked down Chaudhry's millions to Haryana in India. Victor Lal had written to Hunter on 13 February 2008: “WE HAVE GOT HIM. Thanks - Father Murphy got the files and heaven has finally opened up on the Haryana money - we can even confront him and name him...". The two had kept the investigation completely under wraps from senior Fiji Sun journalists, whom they suspected of being Chaudhry sympathizers on the paper, and Hunter changed the headline at the eleventh hour to avoid any 'leak' of the story before the reading public woke up on 24 February. Hunter was resigned to face the consequences as he informed Lal on 23 February 2008: “They won't charge me. But they may deport me. Of course all that will do is make the story truly international. They're too dumb or too desperate (or both) to see it. Anyway, I'm not worried about it.” Hunter was deported out of Fiji on 25 February 2008.

A PLEA TO JOURNALISM STUDENTS: Fiji Sun will not teach you

The Art of Investigative Journalism and HOLDING POWER TO ACCOUNT, for as you can see from its Coconut Wireless column, they are TOO busy attacking individuals singled out by the Bainimarama/Khaiyum Government to discredit in their paper:

Fijileaks will reveal identity soon

Fijileaks will reveal identity soon The 'Italian Job' from inside Aiyaz Sayed Khaiyum's Attorney-General Cambers:

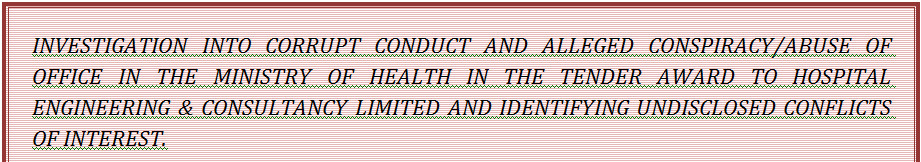

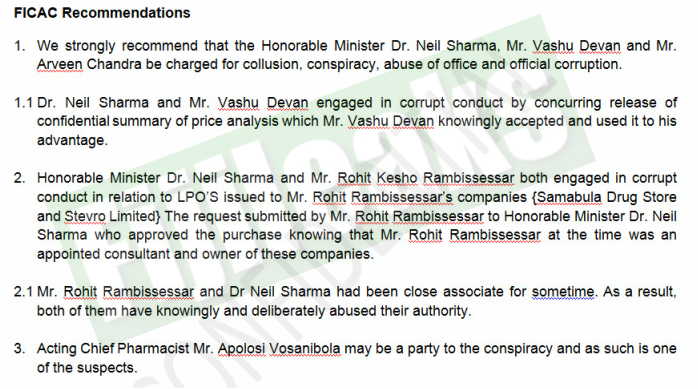

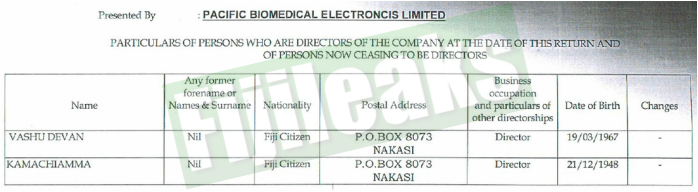

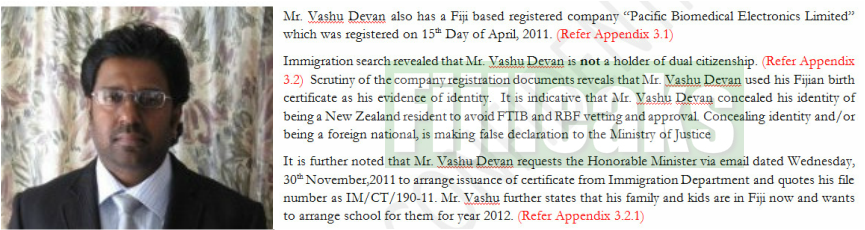

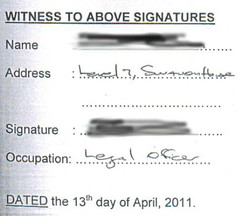

Fijileaks Editor: Coming soon - How one of the lawyer's in Attorney-General's Chambers helped Vashu Devan, one of the key suspects with former Health Minister Neil Sharma, form one of Devan's companies in 2011 in Fiji, and helped him allegedly lie on the registration form to the Registrar of Companies that Devan was a Fiji citizen, when in fact, according to FICAC Report, he was a citizen of New Zealand