"That Lynda Diseru Tabuya did not declare the income of her spouse one Robert Peter Semaan- therefore it constitutes a clear breach under section 24 (1a) (b) whereby the spouse’s income must be declared. I argue that Rob Peter Semaan is the Director of Pacific Building Solutions and earns an income which has not been declared. (This can be verified by pursuing through the said person’s declaration)."

19th March 2024

Dear Ms Mataiciwa, Re: Lynda Diseru Tabuya- Peoples Alliance Party- Minister of Women and Poverty Allievation- Complaint for False and Non Declaration (1st Janaury to 31 December 2023)

*I am writing this letter to lodge a complaint against one Lynda Diseru Tabuya for false and non-declaration under the Political Parties Act 2014. I note that Ms abuya is a member of the Peoples Alliance Party which forms part of the Coalition Government. In expressing my constitutional rights to formally submit a complaint I state the following below:-

1. That under section 24 (1 (a) (b) (ii) Lynda Diseru Tabuya declared her income of $11,818.33 as the Minister for Women and Poverty Alleviation. This can be verified by pursuing through the said person’s declaration.

2. That under section 24 (1 (a) (b) (ii) Lynda Diseru Tabuya did not declare total source of income which is from the Travel Allowance she received - This can be verified by pursuing through the said person’s declaration and the (Attached as exhibit 1- Parliamentary Remuneration Act 2014).

3. That under section 24 (1 (a) (b) (ii) Lynda Diseru Tabuya did not declare her travel allowances she received when she undertook overseas travel in the course of her employment between the period of the 1st of January to the 31st of December 2023 and is an additional benefit paid and seen as income.

4. That should Lynda Diseru Tabuya claim she did not receive the income from the Travel Allowance, and that she paid her own travel expenses whilst overseas for work related purposes- she did not declare the liability/expenditure required under section 24 (1) (a) (b) (viii).

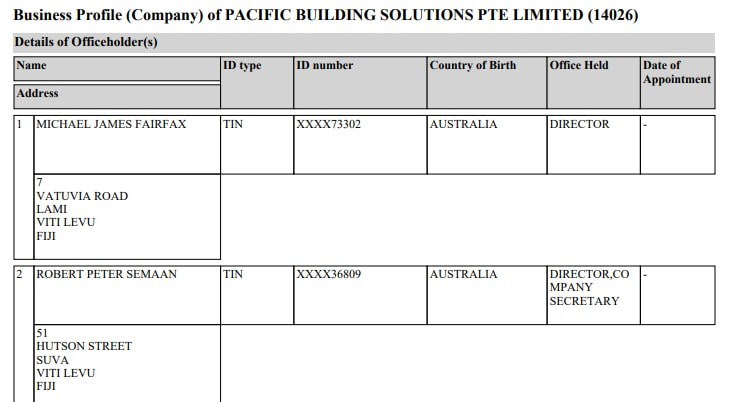

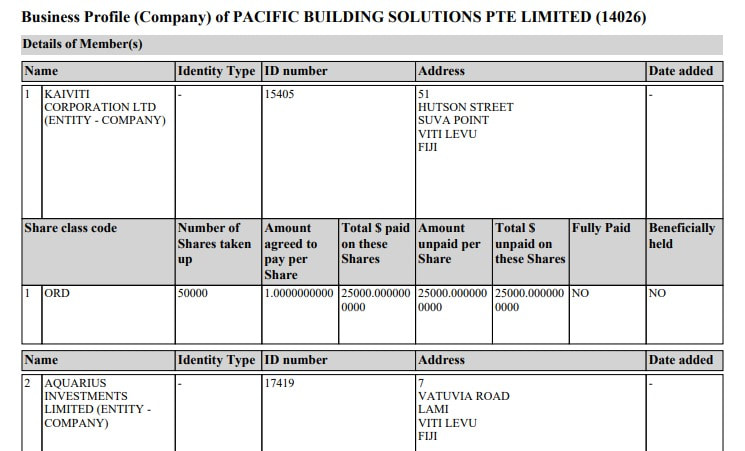

5. That Lynda Diseru Tabuya did not declare the income of her spouse one Robert Peter Semaan- therefore it constitutes a clear breach under section 24 (1a) (b) whereby the spouse’s income must be declared. I argue that Rob Peter Semaan is the Director of Pacific Building Solutions and earns an income which has not been declared. (This can be verified by pursuing through the said person’s declaration).

6. That under section 24 (1a) (d) which stipulates that any directorship or other office in a corporation must be declared- as such Lynda Diseru Tabuya did not declare that her spouse is the Director of Pacific Building Solutions (Attached as exhibit 2 – Business Registration of Pacific Building Solutions for verfication).

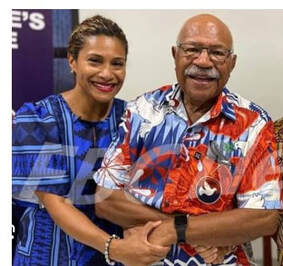

7. That under section 24 (1) (a) (b) (iv) which stipulates that members must declare any directorship(s), or other office in a corporation or other organisation whether in Fiji or Abroad –I therefore argue as Lynda Diseru Tabuya is the president of the Kadavu Rugby Club a post she had since 14th of December 2023, which she did not declare within the statement period (Attached as exhibit 2- FBC News Article of Lynda Tabuya’s post)

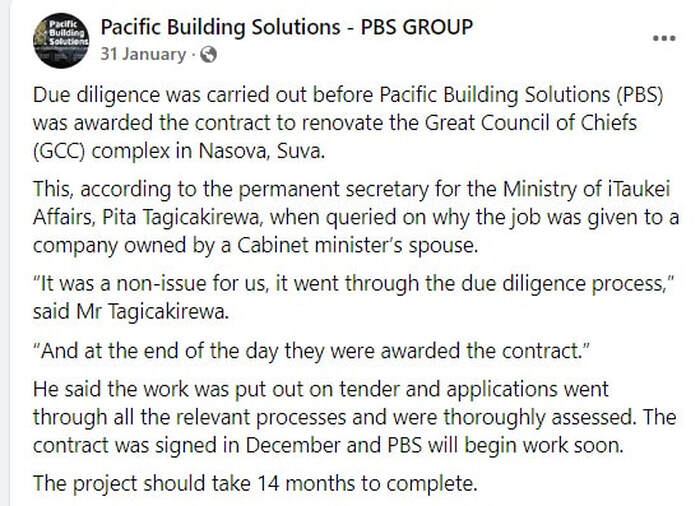

8. That under section 24 (1) (a) (b) (iii) one must declare any business connection in Fiji or Abroad, hence I argue that Lynda Diseru Tabuya failed to declare that her spouse one Rob Peter Semaan is the Director of Pacific Building Solutions who obtained a $6 million contract to build the Great Council of Chiefs Building which was awarded in 2023 and may not have gone to Tender under the Procurement Regulations 2010 given that the value is over $50,000.

9. That under section 24 (1a) ( e) which states one must declare any business transaction entered by them within the statement period being the 1st of January 2023 to the 31st of December 2023. I argue that Lynda Diseru Tabuya failed to declare that her spouse one Rob Semaan entered into a Business Transaction with the Itaukei Lands Ministry for the Great Council Chiefs Contract.

10. That under section 24 (1a) (e) which states one must declare any business transaction entered by them within the statement period being the 1st of January to the 31st December of any given year. I state Lynda Diseru Tabuya may/may not [in] previous years declared that her spouse entered into a business transaction in obtaining the School Recovery Project awarded by the Ministry of Education and the value of that transaction. The awarding of the contract to Pacific Building Solutions may not have followed the Procurement Regulation 2010.

11. That under section 24 (1a) ( e) which states one must declare any business transaction entered by them within the statement period being the 1st of January to the 31st December of the year. I state Lynda Diseru Tabuya did not declare that her spouse Rob Semaan entered into a business transaction under the Coalition Government pertaining to School Recovery Project awarded by the Minister of Education (This can be verified by pursuing through the said person’s declaration).

12. That under section 24 (1a) (a) which stipulates that total assets must be declared (including money and other property under each of them). I therefore, argue that Lynda Diseru Tabuya did not declare the properties her spouse owns under Pacific Building Solutions which are Uduya Point Apartments which is rented out on AirBnB- the income from that rental is not declared.

13. That under section 24 (1a) (a) which stipulates that total assets must be declared (including money and other property under each of them. I therefore argue that Lynda Diseru Tabuya did not declare vehicle held under Pacific Building Solutions which are Chey Captiva Reg No IH221, Land Rover Reg No HJ314, Nissan Navara Reg No MB442 and Isuzu Truck MJ352 (which may now have been sold), nonetheless it should have been declared as an asset.

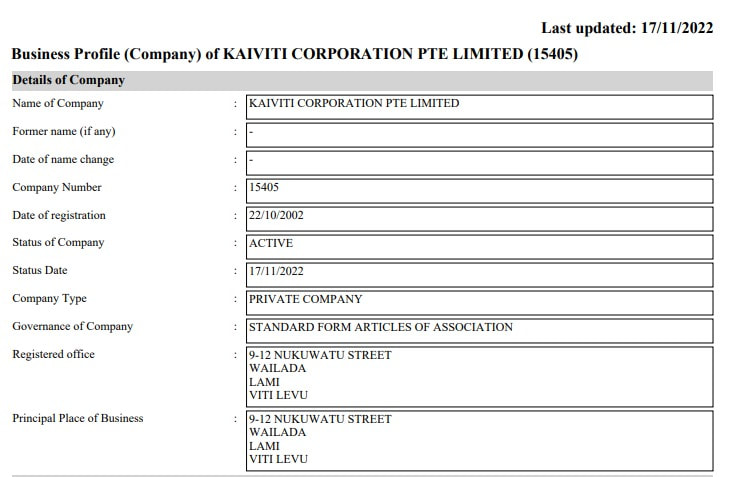

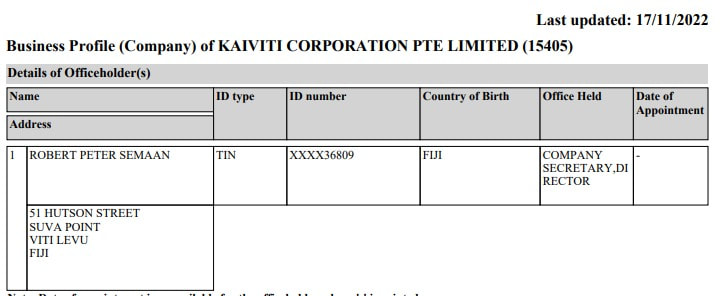

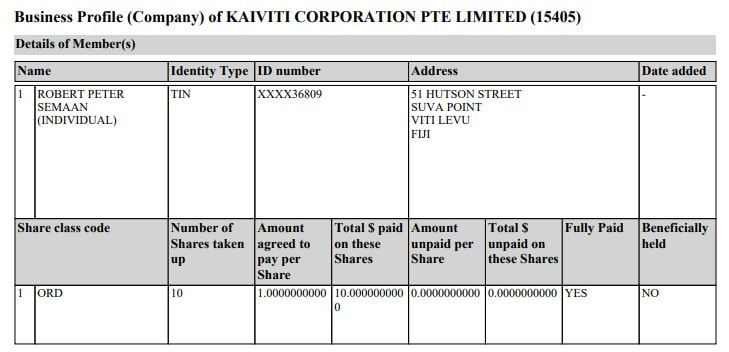

14. That under 24 (1a) (b) Lynda Diseru Tabuya failed to declare that her spouse (Rob Semaan) is the Director of Kaiviti Corporations (Attached as exhibit 4 Kaiviti Corporations Business Registration).

15. That under 24 (1a) (b) which states that the total income and the source of income must be declared. I therefore argue that Lynda Diseru Tabuya failed to declare her spouse Rob Semaan’s income received from Kaiviti Corporations.

16. That Lynda Diseru Tabuya failed to declare the bank accounts of her spouse and the value of the Bank accounts he possesses (This can be verified by pursuing through the said person’s declaration).

17. That under section 24 (1a) (h) which stipulates a political member must declare their spouse’s expenditure and liability including the amount of each liability. I therefore submit that Lynda Diseru Tabuya failed to declare that Rob Semaan paid (liability/expenditure) of $4000 one way airfare for their daughter one Mercedes Tabuya and her spouse Brendon from Israel to Fiji in October 2023 (Attached as exhibit 5 is the receipt obtained pertaining the amount Rob Semaan paid to WABS Trading as Pacific Voyager for the Israeli Charter- currently under investigation at FICAC).

18. That under section 24 (1) (a) (b) (vi) any gift received by each of them whether in Fiji or abroad must be declared. I declare that Lynda Diseru Tabuya failed to declare that she received an all-expenses trip paid for to attend the Fiji Day (October) Celebrations 2023 as a Chief Guest in the United States of America.

I subsequently state that should Lynda Tabuya claim she paid for the trip of the Fiji Day Celebration in October 2023- she did not declare the liability in relation to the said claim under section 24 (1) (a) (b) (viii).

I therefore submit this complaint for the breaches under the Political Parties Act 2014 upon which I understand that whilst some elements of this complaint cannot be handled by your office.

You must, therefore, refer the matter to FICAC under section 18 of the Political Parties Act. Should you require any further information please do not hesitate to contact me directly as I am happy to assist in any matter.

Fijileaks: We have withheld the name of the complainant but the Acting Supervisor of Elections has accepted the Letter of Complaint and is acting on it,

Dear Ms Mataiciwa, Re: Lynda Diseru Tabuya- Peoples Alliance Party- Minister of Women and Poverty Allievation- Complaint for False and Non Declaration (1st Janaury to 31 December 2023)

*I am writing this letter to lodge a complaint against one Lynda Diseru Tabuya for false and non-declaration under the Political Parties Act 2014. I note that Ms abuya is a member of the Peoples Alliance Party which forms part of the Coalition Government. In expressing my constitutional rights to formally submit a complaint I state the following below:-

1. That under section 24 (1 (a) (b) (ii) Lynda Diseru Tabuya declared her income of $11,818.33 as the Minister for Women and Poverty Alleviation. This can be verified by pursuing through the said person’s declaration.

2. That under section 24 (1 (a) (b) (ii) Lynda Diseru Tabuya did not declare total source of income which is from the Travel Allowance she received - This can be verified by pursuing through the said person’s declaration and the (Attached as exhibit 1- Parliamentary Remuneration Act 2014).

3. That under section 24 (1 (a) (b) (ii) Lynda Diseru Tabuya did not declare her travel allowances she received when she undertook overseas travel in the course of her employment between the period of the 1st of January to the 31st of December 2023 and is an additional benefit paid and seen as income.

4. That should Lynda Diseru Tabuya claim she did not receive the income from the Travel Allowance, and that she paid her own travel expenses whilst overseas for work related purposes- she did not declare the liability/expenditure required under section 24 (1) (a) (b) (viii).

5. That Lynda Diseru Tabuya did not declare the income of her spouse one Robert Peter Semaan- therefore it constitutes a clear breach under section 24 (1a) (b) whereby the spouse’s income must be declared. I argue that Rob Peter Semaan is the Director of Pacific Building Solutions and earns an income which has not been declared. (This can be verified by pursuing through the said person’s declaration).

6. That under section 24 (1a) (d) which stipulates that any directorship or other office in a corporation must be declared- as such Lynda Diseru Tabuya did not declare that her spouse is the Director of Pacific Building Solutions (Attached as exhibit 2 – Business Registration of Pacific Building Solutions for verfication).

7. That under section 24 (1) (a) (b) (iv) which stipulates that members must declare any directorship(s), or other office in a corporation or other organisation whether in Fiji or Abroad –I therefore argue as Lynda Diseru Tabuya is the president of the Kadavu Rugby Club a post she had since 14th of December 2023, which she did not declare within the statement period (Attached as exhibit 2- FBC News Article of Lynda Tabuya’s post)

8. That under section 24 (1) (a) (b) (iii) one must declare any business connection in Fiji or Abroad, hence I argue that Lynda Diseru Tabuya failed to declare that her spouse one Rob Peter Semaan is the Director of Pacific Building Solutions who obtained a $6 million contract to build the Great Council of Chiefs Building which was awarded in 2023 and may not have gone to Tender under the Procurement Regulations 2010 given that the value is over $50,000.

9. That under section 24 (1a) ( e) which states one must declare any business transaction entered by them within the statement period being the 1st of January 2023 to the 31st of December 2023. I argue that Lynda Diseru Tabuya failed to declare that her spouse one Rob Semaan entered into a Business Transaction with the Itaukei Lands Ministry for the Great Council Chiefs Contract.

10. That under section 24 (1a) (e) which states one must declare any business transaction entered by them within the statement period being the 1st of January to the 31st December of any given year. I state Lynda Diseru Tabuya may/may not [in] previous years declared that her spouse entered into a business transaction in obtaining the School Recovery Project awarded by the Ministry of Education and the value of that transaction. The awarding of the contract to Pacific Building Solutions may not have followed the Procurement Regulation 2010.

11. That under section 24 (1a) ( e) which states one must declare any business transaction entered by them within the statement period being the 1st of January to the 31st December of the year. I state Lynda Diseru Tabuya did not declare that her spouse Rob Semaan entered into a business transaction under the Coalition Government pertaining to School Recovery Project awarded by the Minister of Education (This can be verified by pursuing through the said person’s declaration).

12. That under section 24 (1a) (a) which stipulates that total assets must be declared (including money and other property under each of them). I therefore, argue that Lynda Diseru Tabuya did not declare the properties her spouse owns under Pacific Building Solutions which are Uduya Point Apartments which is rented out on AirBnB- the income from that rental is not declared.

13. That under section 24 (1a) (a) which stipulates that total assets must be declared (including money and other property under each of them. I therefore argue that Lynda Diseru Tabuya did not declare vehicle held under Pacific Building Solutions which are Chey Captiva Reg No IH221, Land Rover Reg No HJ314, Nissan Navara Reg No MB442 and Isuzu Truck MJ352 (which may now have been sold), nonetheless it should have been declared as an asset.

14. That under 24 (1a) (b) Lynda Diseru Tabuya failed to declare that her spouse (Rob Semaan) is the Director of Kaiviti Corporations (Attached as exhibit 4 Kaiviti Corporations Business Registration).

15. That under 24 (1a) (b) which states that the total income and the source of income must be declared. I therefore argue that Lynda Diseru Tabuya failed to declare her spouse Rob Semaan’s income received from Kaiviti Corporations.

16. That Lynda Diseru Tabuya failed to declare the bank accounts of her spouse and the value of the Bank accounts he possesses (This can be verified by pursuing through the said person’s declaration).

17. That under section 24 (1a) (h) which stipulates a political member must declare their spouse’s expenditure and liability including the amount of each liability. I therefore submit that Lynda Diseru Tabuya failed to declare that Rob Semaan paid (liability/expenditure) of $4000 one way airfare for their daughter one Mercedes Tabuya and her spouse Brendon from Israel to Fiji in October 2023 (Attached as exhibit 5 is the receipt obtained pertaining the amount Rob Semaan paid to WABS Trading as Pacific Voyager for the Israeli Charter- currently under investigation at FICAC).

18. That under section 24 (1) (a) (b) (vi) any gift received by each of them whether in Fiji or abroad must be declared. I declare that Lynda Diseru Tabuya failed to declare that she received an all-expenses trip paid for to attend the Fiji Day (October) Celebrations 2023 as a Chief Guest in the United States of America.

I subsequently state that should Lynda Tabuya claim she paid for the trip of the Fiji Day Celebration in October 2023- she did not declare the liability in relation to the said claim under section 24 (1) (a) (b) (viii).

I therefore submit this complaint for the breaches under the Political Parties Act 2014 upon which I understand that whilst some elements of this complaint cannot be handled by your office.

You must, therefore, refer the matter to FICAC under section 18 of the Political Parties Act. Should you require any further information please do not hesitate to contact me directly as I am happy to assist in any matter.

Fijileaks: We have withheld the name of the complainant but the Acting Supervisor of Elections has accepted the Letter of Complaint and is acting on it,