JETLAG? Oi, Wake Up, Dr Ifereimi Waqainabete and Vijay Nath, FFP MPs The Fijian Taxpayers are not PAYING you to take nap in Fiji Parliament

Professor Wadan Narsey:

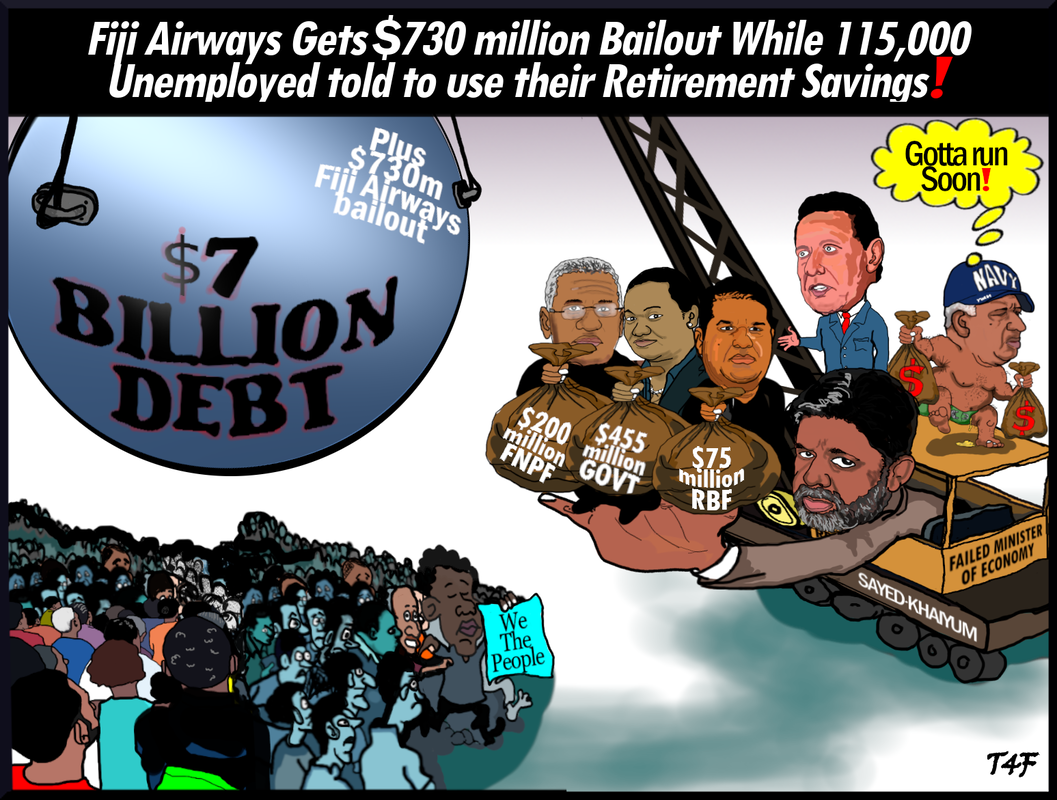

"[The] taxpayers of Fiji, who have been exposed to a $455 million loan guarantee, as well $200 million from FNPF and $75 million from Reserve Bank of Fiji, ought to be having nightmares about the bottomless pit (Fiji Airways) that is currently swallowing up every month somewhere between $20 million (according to CEO Viljoen two days ago) to $38 million (according to CEO Viljoen two weeks ago) of the airline’s cash with absolutely no idea when its passenger planes will fly again or when it will return to profitability. Minister for Economy Aiyaz Khaiyum disparagingly labelled as “irresponsible” the dire but sensible warnings from political leaders like Professor Prasad, Sitiveni Rabuka, Savenaca Narube and Mahendra Chaudhry. Khaiyum also disparagingly labeled (shooting the messenger) the media (aka Fiji Times) and other commentators as “unprofessional” alleging that they “have suddenly become aviation experts, with absolutely no understanding of the aviation sector itself, absolutely no understanding of how financing is done in the aviation sector”, with the unspoken sentiment that he is such an expert."

The arithmetic of the hangman’s noose

“If the monthly leakage is indeed $20 million (and not $38 million as earlier revealed by Viljoen), then any secondary school student can estimate that by the end of this year, Fiji Airways will have used up their own $150 million cash buffer. Thereafter, they will be calling on the $450 million sovereign guarantee of taxpayers’ money that the Bainimarama Government passed through Parliament in the last budget. If the airline still does not start flying passengers by the end of December 2021, the Minister for Economy will come cap in hand for yet more from taxpayers, at least $240 million (at $20 million per month) or $456 million at $38 million per month. What all these add up to is anyone’s guess, but will be way over the $200 million that the NBF disaster cost, even if today’s prices.”

Narsey

Narsey

Since Independence in 1970, Fiji Airways (aka Air Pacific) has been one of the few success stories among its public enterprises, a David battling the Goliaths of the international aviation industry.

It has succeeded largely because of the gritty commitment and proficiency of its pilots and cabin crews, and despite frequent interference by meddling Ministers, the occasional hoopla of cosmetic rebranding exercises and the premature departure of a few adventurous CEOs.

But today, taxpayers of Fiji, who have been exposed to a $455 million loan guarantee, as well $200 million from FNPF and $75 million from Reserve Bank of Fiji, ought to be having nightmares about the bottomless pit (Fiji Airways) that is currently swallowing up every month somewhere between $20 million (according to CEO Viljoen two days ago) to $38 million (according to CEO Viljoen two weeks ago) of the airline’s cash with absolutely no idea when its passenger planes will fly again or when it will return to profitability.

Minister for Economy Aiyaz Khaiyum disparagingly labelled as “irresponsible” the dire but sensible warnings from political leaders like Professor Prasad, Sitiveni Rabuka, Savenaca Narube and Mahendra Chaudhry.

Khaiyum also disparagingly labeled (shooting the messenger) the media (aka Fiji Times) and other commentators as “unprofessional” alleging that they “have suddenly become aviation experts, with absolutely no understanding of the aviation sector itself, absolutely no understanding of how financing is done in the aviation sector”, with the unspoken sentiment that he is such an expert.

But the Minister for Economy, once a lawyer but long a politician by trade, can hardly make the same criticisms of the CEO of Fiji Airways (Andre Viljoen), who warned the Business Forum of the Nadi Chamber of Commerce and Industry that the lease agreements that Fiji had signed for the three Airbus A350 aircraft were like a “noose and there is no way you can wriggle out of it” (Fiji Times, 11 August 2020).

The Fiji Airways CEO pointed out that $1 billion of revenue had suddenly become zero (and with the bulk of their staff already laid off) he asked “how long can we survive” given that “one of the major problems was to fix our recurring costs of $38 million a month”. A few days ago he claimed that the leakage was now only $20 million per month, and I comment below on his change of numbers.

He has also revealed one positive (FT 26 Aug. 2020) that Fiji Airways had built up some $150 million in cash reserves of which $60 million was from profits in 2019.

Simple arithmetic suggests that this latter figure gives them a cash buffer of about seven months, but thereafter they will be calling on Fiji taxpayers, with no end in sight.

Despite Viljoen’s valiant attempt to reassure the public (what else can he do if he wants to keep his job and pay?), the numbers are still a nightmare for Fiji taxpayers.

The arithmetic of the hangman’s noose

If the monthly leakage is indeed $20 million (and not $38 million as earlier revealed by Viljoen), then any secondary school student can estimate that by the end of this year, Fiji Airways will have used up their own $150 million cash buffer.

Thereafter, they will be calling on the $450 million sovereign guarantee of taxpayers’ money that the Bainimarama Government passed through Parliament in the last budget.

If the airline still does not start flying passengers by the end of December 2021, the Minister for Economy will come cap in hand for yet more from taxpayers, at least $240 million (at $20 million per month) or $456 million at $38 million per month.

What all these add up to is anyone’s guess, but will be way over the $200 million that the NBF disaster cost, even if today’s prices.

And then, even if international tourism gets going, Fiji Airways will still struggle to return to adequate profitability, given that all competing airlines and especially Qantas (more on that below) and Air New Zealand) will be desperately fighting for the same customers. Cutting wages to laid-off Fiji Airways workers may help a little bit, even if callously done. In the worst case scenario, Fiji Airways may still go bankrupt, wasting all the taxpayer funds. It is not just Fiji Airways that has the noose around its head, but courtesy of the Minister for Economy, so also does FNPF, the Reserve Bank and ultimately, all the taxpayers of Fiji.

Loans from FNPF and RBF.

Note that FNPF, currently struggling under COVID-19 withdrawals, has also given a massive $200 million loan to Fiji Airways which has apparently returned some $70 million in interest, although the public has not been told how much of the principal has been repaid.

Continuing its recent questionable trend of assisting state enterprises in dire straits (like FSC), the Reserve Bank of Fiji, the sacred regulator of Fiji’s money and money-lenders, has also lent an additional $75 million to Fiji Airways, through the Fiji Development Bank, thereby also becoming a money lender (regulating itself? duh? not a problem in the Fiji of today).

None of these loans are at “arms length” because they are all authorized (or rubber stamped?) by boards which are all appointed by the Minister for Economy.

In the last few days, the Minister of Economy has appointed the CEO of Fiji Airways as the Chairman of Fiji Development Bank, which is the channel through which the Reserve Bank of Fiji is granting $75 million of Fiji’s money to FDB which will then lend to Fiji Airways at 3% interest. As pointed out by others, how on earth could a borrower become a lender?

One can only wonder why the CEO Andre Viljoen accepted this onerous appointment in the first place given that his airline is struggling to survive?

Or is this appointment part of a Plan B by the Minister for Economy whereby the FDB Chairman (Viljoen) will be able to grant a moratorium on loans to Fiji Airways (CEO Viljoen) just as FNPF has granted a moratorium on some payments to Fiji Airways.

Perhaps this is part of the smoke and mirrors mumbo jumbo that explains why Fiji Airways’ monthly cash leakage had been reported by CEO Viljoen to have reduced from $38 million (a few weeks ago) to $20 million (a few days ago)?

A Last Tango with Qantas?

The current crisis at Fiji Airways becomes even more ominous when the CEO of Fiji Airways revealed that despite it having a 49% (or 46%?) stake in Fiji Airways, Qantas from July 2019 to July 2020, took away 95,000 passengers and $65 million in revenue from Fiji Airways.

While he had expected that Qantas, as a major strategic partner, would help Fiji Airways “with procurement… acquire aircraft… help train our pilots.. [etc.], Viljeon complained that “on the contrary they became a major competitor”.

Then the CEO of Fiji Airways gave a fantastic “applied economics” lesson to Fiji’s secondary school and university students on the concepts of “economies of scale” and “economies of scope” which fundamentally disadvantaged Fiji Airways.

CEO Viljoen lamented (FT 26/8/2020) Fiji Airways was operating under a severe technical operational disadvantage relative to large airlines in that they had only 20 aircraft but “in five types, which means five engineers, five lots of spares, five lots of everything”.

But a much larger airline [like Qantas] not only has “deeper pockets” but also can spread their costs over “200 aircraft … and they typically have [only] one, two or three types which makes them have a size and scale advantage”. Which makes sense to this simple economist (a simpleton, says my legal adviser).

But that only begs the question: who out of all the Great Leaders in the Air Pacific/Fiji Airways Boards or revolving door CEOs or the Minister for Economy or Prime Minister made the decision to purchase five different types of aircraft in the first place?

Fiji Times readers might remember a former Fiji Airways CEO who used to profusely praise the great leadership of the Prime Minister, the Minister for Economy and the Board Chairman for their vision in helping in the purchase of a new aircraft type, resigned and departed before the new aircraft had even flown one flight.

Why expect Qantas to help?

But there are even more awkward questions that simple economists (not aviation experts) can ask Viljoen about the expected role of Qantas.

First, if Fiji taxpayers who own 51% of Fiji Airways are forking out $450 million of loan guarantees (and other effective subsidies from FNPF and RBF) to try and save the enterprise, what is Qantas (with 49% shareholding) forking out, if anything?

Second, any good economics student would remind Viljoen that if Qantas shareholders get 100% of every dollar of profit from a passenger on Qantas but only 49% (or 46%) of every dollar of profit from the same passenger on Fiji Airways, Qantas must surely want that passenger to fly on Qantas seats, not on a Fiji Airways seat.

If this logic held between July 2019 to July 2020, when Qantas took away passengers and revenue from Fiji Airways, then it would be even more powerful given that Qantas today is itself struggling to survive, letting go another 2400 of its staff a few days ago.

Even though many international airlines have collapsed, experts expect that when international travel begins in the future (whenever) fares will be higher, services trimmed back, and small airlines which totally depend on international travel (like Fiji Airways) will still be struggling. Qantas will have a sizeable domestic Australian market and perhaps the NZ market and the trans-Tasman Bubble to fall back on.

Consider this scenario: if Fiji Airways goes bankrupt, despite having a 49% (or 46%) stake in Fiji Airways, might Qantas gain financially in the long run by not just taking over the Fiji Airways market for travel, but even pick up cheap Fiji Airways planes and other assets for a song?

Where does the buck stop?

Fiji taxpayers need to ask who is really responsible for major policy decisions at Fiji Airways and who should be accountable to Parliament and taxpayers for their money? While the Minister for Economy has a pervasive media presence (with lovely pictures taken) when cash grants or bonuses are being distributed to staff, why is the Fiji Airways Board Chairman (Mr. Rajesh Punja) not making any statements whatsoever to the public whose interests he is legally bound to protect?

Why are Fiji’s taxpayers not demanding that the Annual Reports for Fiji Airways must be presented to Parliament and posted on the website, which is singularly lacking even basic information such as who is on the Fiji Airways Board? Note that Opposition Parties have tried their best to demand accountability. For instance, in a parliamentary debate in 2017, NFP’s Professor Biman Prasad had requested that the Annual Reports of Fiji Airways be tabled in Parliament given that $18 million of taxpayers money was being given to them to fly new routes that would be otherwise unprofitable.

The Minister for Economy is reported by FBC’s Rachael Nath to have said that the Fiji Airways Annual Report “does not need” to be table in Parliament and scornfully advised the Opposition MPs and any member of the public in the gallery to go to the Registrar of Companies Office “like any Tom, Dick and Harry and get the accounts”.

Presumably he would give the same advice to all the citizens of Fiji.

Fiji’s taxpayers should note that ever since the Bainimarama Government took over, large sections of the Civil Service which used to be audited by the Auditor General (such as PWD) were corporatized (eg. Fiji Roads Authority) and hundreds of millions of taxpayers’ money annually became out of bounds to the Auditor General with only the Minister for Economy presumably having access to their finances. They were also expected to operate independently of goverment, but ministerial interference continued unabated.

One sad result of the Bainimarama Government’s “Clean Up” coup has been a massive “Cover-Up” of what happens to large proportions of taxpayers’ money.

It is therefore utterly scandalous that Fiji Airways does not have any Annual Report on their webpage, and interestingly, does not even have any information on who are the Board Members who supposedly have oversight on the management of Fiji Airways.

Whose responsibility are these glaring omissions?

But a Board exists, out of sight and mind

A Fiji Airways news item on 14th December 2015 informed that previous Chairman (Nalin Patel) had been replaced by Rajesh Punja (a Director of the Punja Group of Companies). Also continuing were Shaheen Ali (Permanent Secretary for Industry, Trade and Tourism), Aslam Khan (former CEO of Vodaphone), Sharvada Sharma (Solicitor General) and CEO Andre Viljoen himself.

Rajesh Punja and Aslam Khan would have some general business knowledge and experience, but apart from the CEO himself, but intelligent taxpayers can ask what expertise these other board members have in aviation and the financing of aviation, criteria that Khaiyum himself demanded of the Opposition MPs.

Two of them (Shaheen Ali and Sharvada Sharma) are civil servants, neither known to be an aviation expert, but totally beholden to Aiyaz Khaiyum their Line Minister (in more ways than one if the blog Grubsheet Feejee is to be believed).

Despite the frequent assertion by the Minister for Economy that Fiji Airways was critical to Fiji’s tourism industry, there are no independent representatives of the tourism industry on the Fiji Airways Board. Why not?

It is no surprise that the current Fiji Airways CEO like other previous CEOs, when announcing the good financial results for 2016 made the by now obligatory statement “We are grateful in particular for the consistent support of our Prime Minister, the Honourable Voreqe Bainimarama, and our Line Minister, the Hon. Aiyaz Sayed-Khaiyum”

So if there is a financial disaster at Fiji Airways, for whatever reason, will the buck stop with the Prime Minister or will he blame someone else?

How will this sad saga end?

If Fiji Airways is still afloat when passengers start flying again, you can be sure that it will take more than a decade for profits (if any) to return to their pre-COVID levels and probably more than twenty years for all the loans to be repaid to FNPF, RBF and taxpayers.

If Fiji Airways still goes bankrupt, it may have swallowed up more than a billion (or two) of taxpayers’ money, with that amount added to the already massively inflated public debt which is currently 80% of GDP and may reach in excess of 100% of GDP, and join the ranks of bankrupt nations like Greece.

Andre Viljoen has revealed that of the $38 million (today magically $20 million) recurrent expenditure per month, some $7.5 million are going to employees who remain. Perhaps the media can ask the Fiji Airways Board Chairman to reveal how much of that $7.5 million is going to the top management and whether any of them have taken any pay cuts during the duration of this crisis just as hundreds of thousands of ordinary taxpayers have had to, and while the Fiji Airways cabin crew all lost their jobs and pay altogether.

But whatever the outcome, one must not forget that Fiji’s tiny national airline has had a fascinating record of withstanding competition from much larger airlines and overcoming other challenges including interfering Ministers.

Hopefully, they will overcome this last global COVID-19 pandemic as well, OR Fiji’s tourism industry will have to depend completely on global airlines for tourist arrivals.

Some in the tourist industry might not mind that as some feel that Fiji Airways may have restricted tourism arrivals at times (is that why there are no tourism representatives on the Fiji Airways board?).

The Never Ending Story (so far) of Fiji Airways should be a good topic for a PhD in political economy.

It has succeeded largely because of the gritty commitment and proficiency of its pilots and cabin crews, and despite frequent interference by meddling Ministers, the occasional hoopla of cosmetic rebranding exercises and the premature departure of a few adventurous CEOs.

But today, taxpayers of Fiji, who have been exposed to a $455 million loan guarantee, as well $200 million from FNPF and $75 million from Reserve Bank of Fiji, ought to be having nightmares about the bottomless pit (Fiji Airways) that is currently swallowing up every month somewhere between $20 million (according to CEO Viljoen two days ago) to $38 million (according to CEO Viljoen two weeks ago) of the airline’s cash with absolutely no idea when its passenger planes will fly again or when it will return to profitability.

Minister for Economy Aiyaz Khaiyum disparagingly labelled as “irresponsible” the dire but sensible warnings from political leaders like Professor Prasad, Sitiveni Rabuka, Savenaca Narube and Mahendra Chaudhry.

Khaiyum also disparagingly labeled (shooting the messenger) the media (aka Fiji Times) and other commentators as “unprofessional” alleging that they “have suddenly become aviation experts, with absolutely no understanding of the aviation sector itself, absolutely no understanding of how financing is done in the aviation sector”, with the unspoken sentiment that he is such an expert.

But the Minister for Economy, once a lawyer but long a politician by trade, can hardly make the same criticisms of the CEO of Fiji Airways (Andre Viljoen), who warned the Business Forum of the Nadi Chamber of Commerce and Industry that the lease agreements that Fiji had signed for the three Airbus A350 aircraft were like a “noose and there is no way you can wriggle out of it” (Fiji Times, 11 August 2020).

The Fiji Airways CEO pointed out that $1 billion of revenue had suddenly become zero (and with the bulk of their staff already laid off) he asked “how long can we survive” given that “one of the major problems was to fix our recurring costs of $38 million a month”. A few days ago he claimed that the leakage was now only $20 million per month, and I comment below on his change of numbers.

He has also revealed one positive (FT 26 Aug. 2020) that Fiji Airways had built up some $150 million in cash reserves of which $60 million was from profits in 2019.

Simple arithmetic suggests that this latter figure gives them a cash buffer of about seven months, but thereafter they will be calling on Fiji taxpayers, with no end in sight.

Despite Viljoen’s valiant attempt to reassure the public (what else can he do if he wants to keep his job and pay?), the numbers are still a nightmare for Fiji taxpayers.

The arithmetic of the hangman’s noose

If the monthly leakage is indeed $20 million (and not $38 million as earlier revealed by Viljoen), then any secondary school student can estimate that by the end of this year, Fiji Airways will have used up their own $150 million cash buffer.

Thereafter, they will be calling on the $450 million sovereign guarantee of taxpayers’ money that the Bainimarama Government passed through Parliament in the last budget.

If the airline still does not start flying passengers by the end of December 2021, the Minister for Economy will come cap in hand for yet more from taxpayers, at least $240 million (at $20 million per month) or $456 million at $38 million per month.

What all these add up to is anyone’s guess, but will be way over the $200 million that the NBF disaster cost, even if today’s prices.

And then, even if international tourism gets going, Fiji Airways will still struggle to return to adequate profitability, given that all competing airlines and especially Qantas (more on that below) and Air New Zealand) will be desperately fighting for the same customers. Cutting wages to laid-off Fiji Airways workers may help a little bit, even if callously done. In the worst case scenario, Fiji Airways may still go bankrupt, wasting all the taxpayer funds. It is not just Fiji Airways that has the noose around its head, but courtesy of the Minister for Economy, so also does FNPF, the Reserve Bank and ultimately, all the taxpayers of Fiji.

Loans from FNPF and RBF.

Note that FNPF, currently struggling under COVID-19 withdrawals, has also given a massive $200 million loan to Fiji Airways which has apparently returned some $70 million in interest, although the public has not been told how much of the principal has been repaid.

Continuing its recent questionable trend of assisting state enterprises in dire straits (like FSC), the Reserve Bank of Fiji, the sacred regulator of Fiji’s money and money-lenders, has also lent an additional $75 million to Fiji Airways, through the Fiji Development Bank, thereby also becoming a money lender (regulating itself? duh? not a problem in the Fiji of today).

None of these loans are at “arms length” because they are all authorized (or rubber stamped?) by boards which are all appointed by the Minister for Economy.

In the last few days, the Minister of Economy has appointed the CEO of Fiji Airways as the Chairman of Fiji Development Bank, which is the channel through which the Reserve Bank of Fiji is granting $75 million of Fiji’s money to FDB which will then lend to Fiji Airways at 3% interest. As pointed out by others, how on earth could a borrower become a lender?

One can only wonder why the CEO Andre Viljoen accepted this onerous appointment in the first place given that his airline is struggling to survive?

Or is this appointment part of a Plan B by the Minister for Economy whereby the FDB Chairman (Viljoen) will be able to grant a moratorium on loans to Fiji Airways (CEO Viljoen) just as FNPF has granted a moratorium on some payments to Fiji Airways.

Perhaps this is part of the smoke and mirrors mumbo jumbo that explains why Fiji Airways’ monthly cash leakage had been reported by CEO Viljoen to have reduced from $38 million (a few weeks ago) to $20 million (a few days ago)?

A Last Tango with Qantas?

The current crisis at Fiji Airways becomes even more ominous when the CEO of Fiji Airways revealed that despite it having a 49% (or 46%?) stake in Fiji Airways, Qantas from July 2019 to July 2020, took away 95,000 passengers and $65 million in revenue from Fiji Airways.

While he had expected that Qantas, as a major strategic partner, would help Fiji Airways “with procurement… acquire aircraft… help train our pilots.. [etc.], Viljeon complained that “on the contrary they became a major competitor”.

Then the CEO of Fiji Airways gave a fantastic “applied economics” lesson to Fiji’s secondary school and university students on the concepts of “economies of scale” and “economies of scope” which fundamentally disadvantaged Fiji Airways.

CEO Viljoen lamented (FT 26/8/2020) Fiji Airways was operating under a severe technical operational disadvantage relative to large airlines in that they had only 20 aircraft but “in five types, which means five engineers, five lots of spares, five lots of everything”.

But a much larger airline [like Qantas] not only has “deeper pockets” but also can spread their costs over “200 aircraft … and they typically have [only] one, two or three types which makes them have a size and scale advantage”. Which makes sense to this simple economist (a simpleton, says my legal adviser).

But that only begs the question: who out of all the Great Leaders in the Air Pacific/Fiji Airways Boards or revolving door CEOs or the Minister for Economy or Prime Minister made the decision to purchase five different types of aircraft in the first place?

Fiji Times readers might remember a former Fiji Airways CEO who used to profusely praise the great leadership of the Prime Minister, the Minister for Economy and the Board Chairman for their vision in helping in the purchase of a new aircraft type, resigned and departed before the new aircraft had even flown one flight.

Why expect Qantas to help?

But there are even more awkward questions that simple economists (not aviation experts) can ask Viljoen about the expected role of Qantas.

First, if Fiji taxpayers who own 51% of Fiji Airways are forking out $450 million of loan guarantees (and other effective subsidies from FNPF and RBF) to try and save the enterprise, what is Qantas (with 49% shareholding) forking out, if anything?

Second, any good economics student would remind Viljoen that if Qantas shareholders get 100% of every dollar of profit from a passenger on Qantas but only 49% (or 46%) of every dollar of profit from the same passenger on Fiji Airways, Qantas must surely want that passenger to fly on Qantas seats, not on a Fiji Airways seat.

If this logic held between July 2019 to July 2020, when Qantas took away passengers and revenue from Fiji Airways, then it would be even more powerful given that Qantas today is itself struggling to survive, letting go another 2400 of its staff a few days ago.

Even though many international airlines have collapsed, experts expect that when international travel begins in the future (whenever) fares will be higher, services trimmed back, and small airlines which totally depend on international travel (like Fiji Airways) will still be struggling. Qantas will have a sizeable domestic Australian market and perhaps the NZ market and the trans-Tasman Bubble to fall back on.

Consider this scenario: if Fiji Airways goes bankrupt, despite having a 49% (or 46%) stake in Fiji Airways, might Qantas gain financially in the long run by not just taking over the Fiji Airways market for travel, but even pick up cheap Fiji Airways planes and other assets for a song?

Where does the buck stop?

Fiji taxpayers need to ask who is really responsible for major policy decisions at Fiji Airways and who should be accountable to Parliament and taxpayers for their money? While the Minister for Economy has a pervasive media presence (with lovely pictures taken) when cash grants or bonuses are being distributed to staff, why is the Fiji Airways Board Chairman (Mr. Rajesh Punja) not making any statements whatsoever to the public whose interests he is legally bound to protect?

Why are Fiji’s taxpayers not demanding that the Annual Reports for Fiji Airways must be presented to Parliament and posted on the website, which is singularly lacking even basic information such as who is on the Fiji Airways Board? Note that Opposition Parties have tried their best to demand accountability. For instance, in a parliamentary debate in 2017, NFP’s Professor Biman Prasad had requested that the Annual Reports of Fiji Airways be tabled in Parliament given that $18 million of taxpayers money was being given to them to fly new routes that would be otherwise unprofitable.

The Minister for Economy is reported by FBC’s Rachael Nath to have said that the Fiji Airways Annual Report “does not need” to be table in Parliament and scornfully advised the Opposition MPs and any member of the public in the gallery to go to the Registrar of Companies Office “like any Tom, Dick and Harry and get the accounts”.

Presumably he would give the same advice to all the citizens of Fiji.

Fiji’s taxpayers should note that ever since the Bainimarama Government took over, large sections of the Civil Service which used to be audited by the Auditor General (such as PWD) were corporatized (eg. Fiji Roads Authority) and hundreds of millions of taxpayers’ money annually became out of bounds to the Auditor General with only the Minister for Economy presumably having access to their finances. They were also expected to operate independently of goverment, but ministerial interference continued unabated.

One sad result of the Bainimarama Government’s “Clean Up” coup has been a massive “Cover-Up” of what happens to large proportions of taxpayers’ money.

It is therefore utterly scandalous that Fiji Airways does not have any Annual Report on their webpage, and interestingly, does not even have any information on who are the Board Members who supposedly have oversight on the management of Fiji Airways.

Whose responsibility are these glaring omissions?

But a Board exists, out of sight and mind

A Fiji Airways news item on 14th December 2015 informed that previous Chairman (Nalin Patel) had been replaced by Rajesh Punja (a Director of the Punja Group of Companies). Also continuing were Shaheen Ali (Permanent Secretary for Industry, Trade and Tourism), Aslam Khan (former CEO of Vodaphone), Sharvada Sharma (Solicitor General) and CEO Andre Viljoen himself.

Rajesh Punja and Aslam Khan would have some general business knowledge and experience, but apart from the CEO himself, but intelligent taxpayers can ask what expertise these other board members have in aviation and the financing of aviation, criteria that Khaiyum himself demanded of the Opposition MPs.

Two of them (Shaheen Ali and Sharvada Sharma) are civil servants, neither known to be an aviation expert, but totally beholden to Aiyaz Khaiyum their Line Minister (in more ways than one if the blog Grubsheet Feejee is to be believed).

Despite the frequent assertion by the Minister for Economy that Fiji Airways was critical to Fiji’s tourism industry, there are no independent representatives of the tourism industry on the Fiji Airways Board. Why not?

It is no surprise that the current Fiji Airways CEO like other previous CEOs, when announcing the good financial results for 2016 made the by now obligatory statement “We are grateful in particular for the consistent support of our Prime Minister, the Honourable Voreqe Bainimarama, and our Line Minister, the Hon. Aiyaz Sayed-Khaiyum”

So if there is a financial disaster at Fiji Airways, for whatever reason, will the buck stop with the Prime Minister or will he blame someone else?

How will this sad saga end?

If Fiji Airways is still afloat when passengers start flying again, you can be sure that it will take more than a decade for profits (if any) to return to their pre-COVID levels and probably more than twenty years for all the loans to be repaid to FNPF, RBF and taxpayers.

If Fiji Airways still goes bankrupt, it may have swallowed up more than a billion (or two) of taxpayers’ money, with that amount added to the already massively inflated public debt which is currently 80% of GDP and may reach in excess of 100% of GDP, and join the ranks of bankrupt nations like Greece.

Andre Viljoen has revealed that of the $38 million (today magically $20 million) recurrent expenditure per month, some $7.5 million are going to employees who remain. Perhaps the media can ask the Fiji Airways Board Chairman to reveal how much of that $7.5 million is going to the top management and whether any of them have taken any pay cuts during the duration of this crisis just as hundreds of thousands of ordinary taxpayers have had to, and while the Fiji Airways cabin crew all lost their jobs and pay altogether.

But whatever the outcome, one must not forget that Fiji’s tiny national airline has had a fascinating record of withstanding competition from much larger airlines and overcoming other challenges including interfering Ministers.

Hopefully, they will overcome this last global COVID-19 pandemic as well, OR Fiji’s tourism industry will have to depend completely on global airlines for tourist arrivals.

Some in the tourist industry might not mind that as some feel that Fiji Airways may have restricted tourism arrivals at times (is that why there are no tourism representatives on the Fiji Airways board?).

The Never Ending Story (so far) of Fiji Airways should be a good topic for a PhD in political economy.