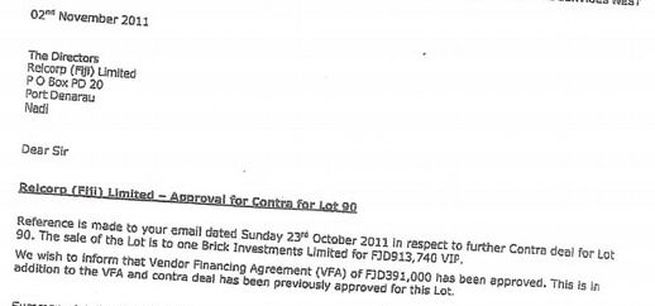

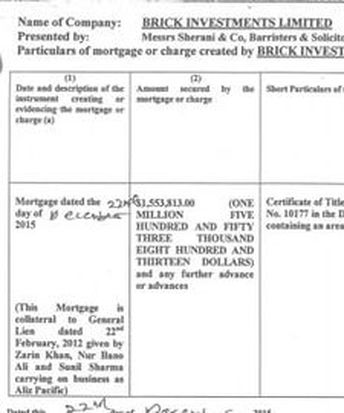

NAISOSOGATE 2: Did Bob Lowres undersell a plot of land to Nur Bano Ali's Brick Investments Ltd; Aliz Pacific handles Relcorp (Fiji) Ltd and Lowres business empire in Fiji

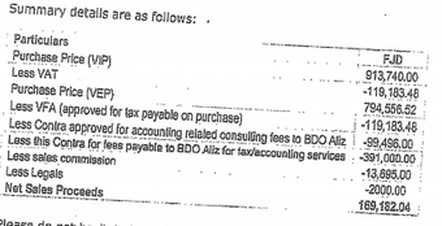

The $391,000 (see details below) is unbelievably unusual so

what services could possibly warrant this kind of payment?

In essence, that is a massive discount for

'Future Services' outside of accounting

Fijileaks: The first three are normal: Purchase Price, VEP, and VIP.

The fourth one of $119, 183.48 is also normal. But a few purchasers of plots at Naisoso did this and then immediately claimed VAT.

We ask FFP Minister for Finance Aiyaz Sayed Khaiyum:

Why should VAT be claimed when it is just a block of land?

It is not an income producing activity!

The $99,496 is unusual but it could be argued that it is also normal; simply part of the payment if Contra for accounting fees which obviously get charged monthly.

The $391,000 is unbelievably unusual so

what services could possibly warrant this kind of payment.

In essence, that is a massive discount for

"Future Services outside of accounting"

'GIVE ME BACK MY $A1.5MILLION WHICH I GAVE YOU SIX YEARS AGO TO DEVELOP NAISOSO ISLAND':

SUPREME COURT OF QUEENSLAND

REGISTRY:

Brisbane NUMBER: -57.23 of 2016

Plaintiff __________, an individual resident in the State of Queensland

AND

First Defendant: Relcorp No 23 Pty Ltd (A.C.N. 106 394 343) AND

Second Defendant: Robert Edward Lowres

CLAIM

The plaintiff claims:

1. $1,353,817.34 from the first defendant as a debt;

2. $10,895.50 from the first defendant as a debt for expenses incurred to 24 May 2016;

3. $1,364,712.84 from the second defendant as money payable under the Guarantees;

4. Interest pursuant to the terms of the Loans at the rate of $223.60 per day, or in the alternative pursuant to section 58 of the Civil Proceedings Act 2011; and

5. Costs, on the indemnity basis:

(a) from the first defendant under the Second Loan; and

(b) from the second defendant, under the Guarantees, or on such other basis as the Court considers appropriate.

The plaintiff makes this claim in reliance on the facts alleged in the attached Statement of Claim.

The Supreme Court of Queensland, Brisbane Registry has the jurisdiction to decide this claim.

ISSUED WITH THE AUTHORITY OF THE SUPREME COURT OF QUEENSLAND And filed in the Brisbane Registry on 7 May 2016:

STATEMENT OF CLAIM

The claim in this proceeding is made in reliance on the following facts:

1. At all material times, the plaintiff was and is an individual resident in the State of Queensland.

2. At all material times, the first defendant: (a) was and is a company duly incorporated pursuant to the Corporations Act 2001 (Cth) (b) carried on a business of property development; (c) was and is part of the Relcorp group of companies.

3. At all material times, Relcorp No. 3 Pty Ltd (A.C.N. 093 651 328) ("Relcorp No 3"): (a) was a company duly incorporated pursuant to the Corporations Act 2001 (Cth) (b) carried on a business of property development;

At all material times, the second defendant:

(a) was and is an individual who has resided in the State of Queensland, the State of Melbourne and in the Republic of Fiji;

(b) was and is a director of the first defendant;

(c) was and is the sole shareholder of the first defendant;

(d) was the sole director and company secretary of Relcorp No 3;

(e) was a shareholder of Relcorp No 3;

(f) was the sole director and company secretary of Relcorp No 6;

(g) engaged in the activity of property development through the Relcorp group of companies.

The First Loan

On or about 15 August 2001 the plaintiff, Relcorp No 3 and the second defendant entered into an agreement in the State of Queensland (the "First Loan"), relevantly under which:

(a) the plaintiff agreed to loan to Relcorp No 3 the sum of $145,000 for a term of 12 months from the date of the loan of the funds;

(b) Relcorp No 3 agreed to pay the plaintiff a 30% return on the loaned funds; and

(c) the second defendant guaranteed the performance of the obligations of Relcorp No 3 (the "First Loan Guarantee").

Pursuant to the First Loan, the plaintiff loaned to Relcorp No 3 the sum of $145,000 on 24 August 2001.

In breach of the First Loan, Relcorp No 3 failed to repay the amount of the loan and the 30% return (or any part thereof) on or by 24 August 2002.

In or about August or September 2002 the plaintiff and the second defendant, on behalf of Relcorp No 3 on his own behalf as guarantor, agreed to continue the First Loan on the same terms and conditions at an ongoing rate of 30% per annum.

On 11 August 2006 Relcorp No 3 paid to the plaintiff the sum of $150,000 in part payment of the outstanding balance of the First Loan.

As at the date of 11 August 2006, the debt of Relcorp No 3 to the plaintiff under the First Loan was as follows:

Loan Principal: $145,000.00

Accrued Interest: $215,950.68

Total: $360,950.98

Part payment 11/08/2006: ($150,000.00)

Outstanding as at 11/08/2006: $210,950.68

The Second Loan

In or about March or April 2002 the plaintiff, Relcorp No 6 and the second defendant entered into a loan agreement in the State of Queensland (the "Second Loan" and, collectively with the First Loan, the "Loans"), relevantly under which:

(a) the plaintiff (defined under the Second Loan as "Lender") agreed to loan to Relcorp No 6 (defined under the Second Loan as "Borrower") the sum of $500,000 (defined under the Second Loan as the "advance") for a term of 12 months from the date of the loan of the funds;

(b) Relcorp No 6 agreed to pay the plaintiff interest on the secured money (as defined) at the rate of 20% per annum;

(c) the second defendant guaranteed the performance of the obligations of Relcorp No 6 (the "Second Loan Guarantee" and collectively with the First Loan Guarantee, the "Guarantees");

(d) by the terms of a written agreement signed by the plaintiff, Relcorp No 6 and the second defendant, titled "Loan Agreement": "

Pursuant to the Second Loan, the plaintiff loaned to Relcorp No 6 the sum of $500,000 on 11 April 2002.

In breach of the Second Loan, Relcorp No 6 failed to repay the secured money, including the advance and the interest (or any part thereof), on or by 11 April 2003. Such failure was an event of default under the Second Loan. 15.

In late April 2003, the plaintiff and the second defendant, on behalf of Relcorp No 6 and on his own behalf as guarantor, agreed to continue the Second Loan on the same terms and conditions at an ongoing rate of 20% per annum.

As at the date of 21 March 2007, the debt of Relcorp No 6 to the plaintiff under the Second Loan was as follows:

Loan Principal: $500,000.00

Accrued Interest: $494,246.58

Outstanding as at 21/03/2007: $994,246.58

Partial Repayment and Recapitalization of the Loans

In or about December 2006, the plaintiff requested that the Loans be repaid in full by Relcorp No 3 and Relcorp No 6.

In or about January 2007, the plaintiff, Relcorp No 3, Relcorp No 6 and the second defendant agreed to amend the Loans, on the following basis:

(a) Relcorp No 6 would make a payment to the plaintiff under the Second Loan of $600,000;

(b) Upon the making of the payment referred to in subparagraph (a):

(i) the balance of the First Loan, including accrued interest, would be re-capitalised with interest thereafter payable at the reduced rate of 20% per annum;

(ii) the balance of the Second Loan, including accrued interest, would be re-capitalised with interest thereafter payable at the reduced rate of 10% per annum;

(c) the Loans would be repayable on 60 days notice from the plaintiff.

On 21 March 2007, pursuant to the Loans as amended:

(a) Relcorp No 6 paid to the plaintiff the sum of $600,000 in part payment of the outstanding balance of the Second Loan;

(b) The outstanding balance of the First Loan, $210,950.68, was recapitalised under the First Loan;

(c) The outstanding balance of the Second Loan, $394,246.58 (being $994,246.58 less the payment of $600,000 on 21 March 2007) was re-capitalised under the Second Loan.

Restructure and Acknowledgment of Debt 20.

On or about 19 September 2003 the first defendant was incorporated.

On or prior to 24 September 2007 the first defendant agreed to assume the obligations of Relcorp No 6 to the plaintiff under the Second Loan (the "Second Loan Assumption").

The plaintiff: (a) is a beneficiary of the Second Loan Assumption; and (b) accepted the Second Loan Assumption; or (c) further or in the alternative, hereby accepts the Second Loan Assumption.

In the premises, pursuant to section 55 of the Property Law Act (Qld) 1974 the plaintiff is entitled to enforce the Second Loan Assumption against the first defendant.

On or about 24 September 2007 Relcorp No 6 was voluntarily deregistered.

On or prior to 29 March 2010 the first defendant agreed to assume the obligations of Relcorp No 3 to the plaintiff under the Second Loan (the "First Loan Assumption").

The plaintiff:

(a) is a beneficiary of the First Loan Assumption; and

(b) accepted the First Loan Assumption;

or (c) further or in the alternative, hereby accepts the First Loan Assumption.

In the premises, pursuant to section 55 of the Property Law Act (Qld) 1974 the plaintiff is entitled to enforce the First Loan Assumption against the first defendant. 28.

On or prior to 29 March 2010 Relcorp No 3 was voluntarily deregistered.

The second defendant, on behalf of the first defendant and on his own behalf as guarantor:

(a) Acknowledged and affirmed the debt of the first defendant to the plaintiff for the Loans;

(b) Acknowledged and affirmed his obligations as guarantor to the plaintiff for the Loans under the Guarantees;

Particulars

(i) By email from the second defendant to the plaintiff on 18 October 2013;

(ii) Verbally from the second defendant to the plaintiff on or about: (A) late October 2013, (B) early 2014; (C) mid 2014; and (D) December 2015.

Demand and Debt

On 23 July 2013 the plaintiff gave written notice to the second defendant on behalf of each of the Relcorp group companies, including the first plaintiff, and in his personal capacity as guarantor, demanding payment of the Loans within 60 days.

In breach of the Loans as amended, the first defendant failed to pay to the plaintiff the debt payable thereunder within the time stipulated or at all. The failure is a default event under the Second Loan.

In the premises the first defendant is indebted to the plaintiff for the amount of $1,353,817.34 (as at 24 May 2016), as set out in Schedule A.

The second defendant has not paid that amount or any part of it to the plaintiff.

That amount is due and payable by the second defendant to the plaintiff pursuant to the Guarantees.

Pursuant to the Loans, the first defendant's debt to the plaintiff continues to accrue interest at $223.60 per day, as set out in Schedule A, which interest is due and payable by the first defendant and the second defendant to the plaintiff.

Recovery of Costs

To the date hereof, the plaintiff has incurred the following expenses in connection with a default event (as particularised in paragraph 31 of this Statement of Claim), within the meaning of clause 8.3 of the Second Loan:

(a) Accountancy fees and expenses: $1,710.50

(b) Legal fees and expenses (on an indemnity basis): $9,185.00

("Recovery Costs to Date")

In the premises, the first defendant is indebted to the plaintiff for the amount of the Recovery Costs to Date.

The second defendant has not paid that amount or any part of it to the plaintiff.

That amount is due and payable by the second defendant to the plaintiff pursuant to the Guarantees.

As to the plaintiff's future expenses in recovery of the debt due and payable under the Loans:

(a) such expenses will be incurred by the plaintiff in connection with a default event within the meaning of clause 8.3 of the Second Loan;

(b) in the premises, the plaintiff is entitled to be indemnified for those expenses from the first defendant; and

(c) the plaintiff is entitled to be indemnified for those expenses from the second defendant pursuant to the Guarantees.

The plaintiff claims the following relief:

1. $1,353,817.34 from the first defendant as a debt;

2. $10,895.50 from the first defendant as a debt for expenses incurred to 24 May 2016;

3. $1,364,712.84 from the second defendant as money payable under the Guarantees;

4. Interest pursuant to the terms of the Loans at the rate of $223.60 per day, or in the alternative pursuant to section 58 of the Civil Proceedings Act 2011; and

5. Costs, on the indemnity basis:

(a) from the first defendant under the Second Loan; and

(b) from the second defendant, under the Guarantees,

or on such other basis as the Court considers appropriate. Signed: Description:

CARTER NEWELL, solicitors for the Plaintiff

Signed: Description: CARTER NEWELL solicitors for the Plaintiff

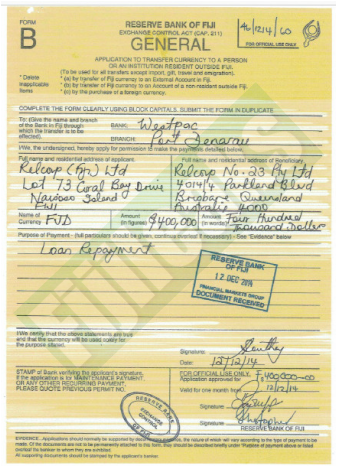

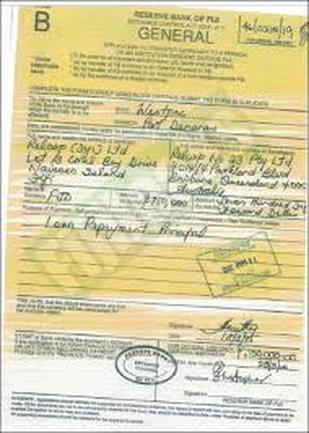

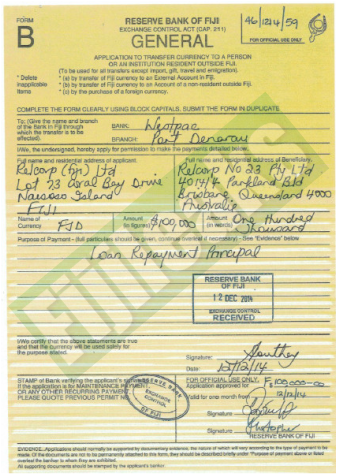

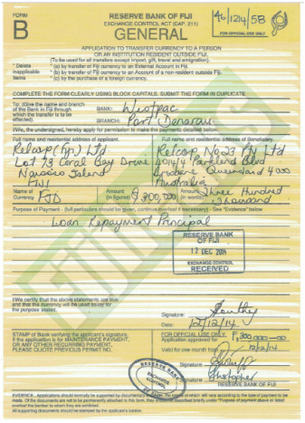

Fijileaks: RESERVE BANK OF FIJI nor NUR BANO ALI have commented on these money transfers

REGISTRY:

Brisbane NUMBER: -57.23 of 2016

Plaintiff __________, an individual resident in the State of Queensland

AND

First Defendant: Relcorp No 23 Pty Ltd (A.C.N. 106 394 343) AND

Second Defendant: Robert Edward Lowres

CLAIM

The plaintiff claims:

1. $1,353,817.34 from the first defendant as a debt;

2. $10,895.50 from the first defendant as a debt for expenses incurred to 24 May 2016;

3. $1,364,712.84 from the second defendant as money payable under the Guarantees;

4. Interest pursuant to the terms of the Loans at the rate of $223.60 per day, or in the alternative pursuant to section 58 of the Civil Proceedings Act 2011; and

5. Costs, on the indemnity basis:

(a) from the first defendant under the Second Loan; and

(b) from the second defendant, under the Guarantees, or on such other basis as the Court considers appropriate.

The plaintiff makes this claim in reliance on the facts alleged in the attached Statement of Claim.

The Supreme Court of Queensland, Brisbane Registry has the jurisdiction to decide this claim.

ISSUED WITH THE AUTHORITY OF THE SUPREME COURT OF QUEENSLAND And filed in the Brisbane Registry on 7 May 2016:

STATEMENT OF CLAIM

The claim in this proceeding is made in reliance on the following facts:

1. At all material times, the plaintiff was and is an individual resident in the State of Queensland.

2. At all material times, the first defendant: (a) was and is a company duly incorporated pursuant to the Corporations Act 2001 (Cth) (b) carried on a business of property development; (c) was and is part of the Relcorp group of companies.

3. At all material times, Relcorp No. 3 Pty Ltd (A.C.N. 093 651 328) ("Relcorp No 3"): (a) was a company duly incorporated pursuant to the Corporations Act 2001 (Cth) (b) carried on a business of property development;

At all material times, the second defendant:

(a) was and is an individual who has resided in the State of Queensland, the State of Melbourne and in the Republic of Fiji;

(b) was and is a director of the first defendant;

(c) was and is the sole shareholder of the first defendant;

(d) was the sole director and company secretary of Relcorp No 3;

(e) was a shareholder of Relcorp No 3;

(f) was the sole director and company secretary of Relcorp No 6;

(g) engaged in the activity of property development through the Relcorp group of companies.

The First Loan

On or about 15 August 2001 the plaintiff, Relcorp No 3 and the second defendant entered into an agreement in the State of Queensland (the "First Loan"), relevantly under which:

(a) the plaintiff agreed to loan to Relcorp No 3 the sum of $145,000 for a term of 12 months from the date of the loan of the funds;

(b) Relcorp No 3 agreed to pay the plaintiff a 30% return on the loaned funds; and

(c) the second defendant guaranteed the performance of the obligations of Relcorp No 3 (the "First Loan Guarantee").

Pursuant to the First Loan, the plaintiff loaned to Relcorp No 3 the sum of $145,000 on 24 August 2001.

In breach of the First Loan, Relcorp No 3 failed to repay the amount of the loan and the 30% return (or any part thereof) on or by 24 August 2002.

In or about August or September 2002 the plaintiff and the second defendant, on behalf of Relcorp No 3 on his own behalf as guarantor, agreed to continue the First Loan on the same terms and conditions at an ongoing rate of 30% per annum.

On 11 August 2006 Relcorp No 3 paid to the plaintiff the sum of $150,000 in part payment of the outstanding balance of the First Loan.

As at the date of 11 August 2006, the debt of Relcorp No 3 to the plaintiff under the First Loan was as follows:

Loan Principal: $145,000.00

Accrued Interest: $215,950.68

Total: $360,950.98

Part payment 11/08/2006: ($150,000.00)

Outstanding as at 11/08/2006: $210,950.68

The Second Loan

In or about March or April 2002 the plaintiff, Relcorp No 6 and the second defendant entered into a loan agreement in the State of Queensland (the "Second Loan" and, collectively with the First Loan, the "Loans"), relevantly under which:

(a) the plaintiff (defined under the Second Loan as "Lender") agreed to loan to Relcorp No 6 (defined under the Second Loan as "Borrower") the sum of $500,000 (defined under the Second Loan as the "advance") for a term of 12 months from the date of the loan of the funds;

(b) Relcorp No 6 agreed to pay the plaintiff interest on the secured money (as defined) at the rate of 20% per annum;

(c) the second defendant guaranteed the performance of the obligations of Relcorp No 6 (the "Second Loan Guarantee" and collectively with the First Loan Guarantee, the "Guarantees");

(d) by the terms of a written agreement signed by the plaintiff, Relcorp No 6 and the second defendant, titled "Loan Agreement": "

Pursuant to the Second Loan, the plaintiff loaned to Relcorp No 6 the sum of $500,000 on 11 April 2002.

In breach of the Second Loan, Relcorp No 6 failed to repay the secured money, including the advance and the interest (or any part thereof), on or by 11 April 2003. Such failure was an event of default under the Second Loan. 15.

In late April 2003, the plaintiff and the second defendant, on behalf of Relcorp No 6 and on his own behalf as guarantor, agreed to continue the Second Loan on the same terms and conditions at an ongoing rate of 20% per annum.

As at the date of 21 March 2007, the debt of Relcorp No 6 to the plaintiff under the Second Loan was as follows:

Loan Principal: $500,000.00

Accrued Interest: $494,246.58

Outstanding as at 21/03/2007: $994,246.58

Partial Repayment and Recapitalization of the Loans

In or about December 2006, the plaintiff requested that the Loans be repaid in full by Relcorp No 3 and Relcorp No 6.

In or about January 2007, the plaintiff, Relcorp No 3, Relcorp No 6 and the second defendant agreed to amend the Loans, on the following basis:

(a) Relcorp No 6 would make a payment to the plaintiff under the Second Loan of $600,000;

(b) Upon the making of the payment referred to in subparagraph (a):

(i) the balance of the First Loan, including accrued interest, would be re-capitalised with interest thereafter payable at the reduced rate of 20% per annum;

(ii) the balance of the Second Loan, including accrued interest, would be re-capitalised with interest thereafter payable at the reduced rate of 10% per annum;

(c) the Loans would be repayable on 60 days notice from the plaintiff.

On 21 March 2007, pursuant to the Loans as amended:

(a) Relcorp No 6 paid to the plaintiff the sum of $600,000 in part payment of the outstanding balance of the Second Loan;

(b) The outstanding balance of the First Loan, $210,950.68, was recapitalised under the First Loan;

(c) The outstanding balance of the Second Loan, $394,246.58 (being $994,246.58 less the payment of $600,000 on 21 March 2007) was re-capitalised under the Second Loan.

Restructure and Acknowledgment of Debt 20.

On or about 19 September 2003 the first defendant was incorporated.

On or prior to 24 September 2007 the first defendant agreed to assume the obligations of Relcorp No 6 to the plaintiff under the Second Loan (the "Second Loan Assumption").

The plaintiff: (a) is a beneficiary of the Second Loan Assumption; and (b) accepted the Second Loan Assumption; or (c) further or in the alternative, hereby accepts the Second Loan Assumption.

In the premises, pursuant to section 55 of the Property Law Act (Qld) 1974 the plaintiff is entitled to enforce the Second Loan Assumption against the first defendant.

On or about 24 September 2007 Relcorp No 6 was voluntarily deregistered.

On or prior to 29 March 2010 the first defendant agreed to assume the obligations of Relcorp No 3 to the plaintiff under the Second Loan (the "First Loan Assumption").

The plaintiff:

(a) is a beneficiary of the First Loan Assumption; and

(b) accepted the First Loan Assumption;

or (c) further or in the alternative, hereby accepts the First Loan Assumption.

In the premises, pursuant to section 55 of the Property Law Act (Qld) 1974 the plaintiff is entitled to enforce the First Loan Assumption against the first defendant. 28.

On or prior to 29 March 2010 Relcorp No 3 was voluntarily deregistered.

The second defendant, on behalf of the first defendant and on his own behalf as guarantor:

(a) Acknowledged and affirmed the debt of the first defendant to the plaintiff for the Loans;

(b) Acknowledged and affirmed his obligations as guarantor to the plaintiff for the Loans under the Guarantees;

Particulars

(i) By email from the second defendant to the plaintiff on 18 October 2013;

(ii) Verbally from the second defendant to the plaintiff on or about: (A) late October 2013, (B) early 2014; (C) mid 2014; and (D) December 2015.

Demand and Debt

On 23 July 2013 the plaintiff gave written notice to the second defendant on behalf of each of the Relcorp group companies, including the first plaintiff, and in his personal capacity as guarantor, demanding payment of the Loans within 60 days.

In breach of the Loans as amended, the first defendant failed to pay to the plaintiff the debt payable thereunder within the time stipulated or at all. The failure is a default event under the Second Loan.

In the premises the first defendant is indebted to the plaintiff for the amount of $1,353,817.34 (as at 24 May 2016), as set out in Schedule A.

The second defendant has not paid that amount or any part of it to the plaintiff.

That amount is due and payable by the second defendant to the plaintiff pursuant to the Guarantees.

Pursuant to the Loans, the first defendant's debt to the plaintiff continues to accrue interest at $223.60 per day, as set out in Schedule A, which interest is due and payable by the first defendant and the second defendant to the plaintiff.

Recovery of Costs

To the date hereof, the plaintiff has incurred the following expenses in connection with a default event (as particularised in paragraph 31 of this Statement of Claim), within the meaning of clause 8.3 of the Second Loan:

(a) Accountancy fees and expenses: $1,710.50

(b) Legal fees and expenses (on an indemnity basis): $9,185.00

("Recovery Costs to Date")

In the premises, the first defendant is indebted to the plaintiff for the amount of the Recovery Costs to Date.

The second defendant has not paid that amount or any part of it to the plaintiff.

That amount is due and payable by the second defendant to the plaintiff pursuant to the Guarantees.

As to the plaintiff's future expenses in recovery of the debt due and payable under the Loans:

(a) such expenses will be incurred by the plaintiff in connection with a default event within the meaning of clause 8.3 of the Second Loan;

(b) in the premises, the plaintiff is entitled to be indemnified for those expenses from the first defendant; and

(c) the plaintiff is entitled to be indemnified for those expenses from the second defendant pursuant to the Guarantees.

The plaintiff claims the following relief:

1. $1,353,817.34 from the first defendant as a debt;

2. $10,895.50 from the first defendant as a debt for expenses incurred to 24 May 2016;

3. $1,364,712.84 from the second defendant as money payable under the Guarantees;

4. Interest pursuant to the terms of the Loans at the rate of $223.60 per day, or in the alternative pursuant to section 58 of the Civil Proceedings Act 2011; and

5. Costs, on the indemnity basis:

(a) from the first defendant under the Second Loan; and

(b) from the second defendant, under the Guarantees,

or on such other basis as the Court considers appropriate. Signed: Description:

CARTER NEWELL, solicitors for the Plaintiff

Signed: Description: CARTER NEWELL solicitors for the Plaintiff

Fijileaks: RESERVE BANK OF FIJI nor NUR BANO ALI have commented on these money transfers