Narsey

Narsey But there is no uproar when every year, by the laws of Fiji, millions of dollars are taken from the life savings of 300,000 members of the National Provident Fund (FNPF), without their permission.

These millions are effectively “stolen” because the RBF restricts the amounts of money that FNPF can invest overseas, where the investment returns are higher.

As a result, large amounts of FNPF money either

- lie idle in bank accounts earning zero interest, or

- are lent to Government or put on term deposits with commercial banks at extremely low rates of interest.

The Fiji Government is able to borrow a lot, and a lot of it at very low rates of interest, while much money is placed by FNPF in term deposits, not paying high rates of interest either.

FNPF has had great difficulty finding good commercial borrowers, and much of its own investments in the market, such as at Natadola, Momi Bay, and GPH, have not been given high returns, while some have resulted in very high “write-downs”.

But if FNPF was allowed to take this money overseas (where there will always be stronger demand for its money) it would be able to obtain higher returns – for the benefit of FNPF’s members.

Sometimes, as in 2009 when Fiji’s foreign reserves had dropped to extremely low levels, the RBF Board (appointed by the Minister of Finance) can decide, in the “national interest”, to instruct FNPF to bring back large amounts of its foreign investments, thereby placing them in RBF reserves.

FNPF brings back its foreign currency and exchanges it with RBF for Fiji currency. FNPF is stuck with the low-earning Fiji dollars while RBF invests the foreign currency in overseas markets, thereby earning the higher interest “for itself”.

Legally, FNPF has to ask the RBF for permission to invest overseas. This permission is given now and then, but not as much as FNPF wants.

The net result is that RBF shows a good level of foreign reserves (usually expressed as months of imports), but it also receives the interest and dividends from holding the money that FNPF had originally invested overseas.

These extra profits are then part of the healthy dividend cheque that the Government, which is RBF’s main and only shareholder.

So, imagine a “heist” that goes as follows

- the RBF board (solely appointed by the Fiji Government) instructs FNPF to bring back its foreign investments or limits how much it can invest overseas

- as a result, FNPF “loses” the income it would have earned had they been free to invest overseas like Tapoos or Punjas

- RBF, having ordered FNPF to hand over the foreign currency, now gains the returns on its increased reserves of foreign currency

- and hence is able to hand a higher dividend cheque to the Fiji Government.

The real question is: why does no one from the FNPF Board (or the recently hyperactive management) complain publicly on the owners’ behalf?

Because for the last 50 years, the real owners of the FNPF have never elected a single representative to the FNPF Board, which continues to be totally controlled by the Fiji Government, elected or unelected.

Sadly, the FNPF has always been a “cash cow” to be milked at every government’s convenience (not just the Bainimarama Government) but more blatantly “robbed by Decree”, as in 2012.

FNPF is a private corporation – it is not owned by Government

If any Tappoo or Patel or Punja owned $100 million, they would themselves decide how to invest their money, not RBF or the Fiji Government.

Such good businessmen do not invest unless they earn at least 15% return per year.

Certainly no one could force them to hold large amounts of cash (earning zero interest) or low rates of return like 1% or 3% per year such as from short term Fiji Government bonds and Treasury Bills.

If these three families formed a company, they are still a private company, and the same principle applies.

If 10,000 people got together to invest, as does Fiji Public Service Association in Sports City, they also are, legally, a private corporation.

If 300,000 persons in Fiji (mostly employees) are by law put together, in order to compulsorily save and invest $4 billion of their income, they are still a private corporation, and should be left alone to maximize the income for their shareholders.

But that is not the case with FNPF, which has the sacred duty of looking after the retirement funds of all the employees in Fiji (and voluntary contributors).

I emphasize, the owners of FNPF are not the same as taxpayers or residents of Fiji or the voters of Fiji who elect a Fiji government, although there may be some who belong to all three groups.

There is no question whatsoever that all the assets of the FNPF belong to the employees with account balances at FNPF, and no portion belongs to the Fiji Government.

Yet the Fiji Government – which is actually the biggest borrower from FNPF – behaves as if it is the owner, appointing all the Board members.

How much does FNPF lose?

Currently by law, 18% of Fiji’s total wage bill pours into FNPF coffers every year, without fail, amounting to hundreds of millions (more than $400 million in 2015). All of Fiji’s banks drool with envy at FNPF’s guaranteed cash inflows. But because of FNPF’s inability to find good reliable commercial borrowers, hundreds of millions of dollars lie around as cash (earning no interest) or as Government Treasury Bills or short term Government bonds at low interest rates. Even low interest Term Deposits amounted to $600 million in 2015.

[Note: It is no big sacrifice for FNPF to give out relief funds for Cyclone Winston: because these amounts are not earning much anyway. Indeed, if FNPF is able to get rid of some of the idle money it is holding, its economic performance appears better. Effectively FNPF’s Rate of Return increases, totally artificially, because the same annual income is divided by a lower amount of total investible funds (now that cyclone victims have withdrawn money previously not earning any interest or low interest).

FNPF has always tried to invest as much as it could overseas (sometimes more than $400 million) where safe “blue chip” investments earn at least 4% return per year (FNPF and RBF would have more accurate figures).

When FNPF is required to invest money locally, FNPF earnings are reduced while RBF returns increase, by the difference between overseas returns and domestic returns.

Sometimes, the FNPF loss is larger because of devaluation after it has brought back its foreign investments. As a very rough estimate, FNPF, since 1987, FNPF may have lost more than $100 million in foreign earnings because RBF has restricted its investments abroad.

RBF is not the “thief”

I must reassure my RBF friends that I am not being “harsh” as they, as professional law-abiding employees, they have to do whatever the Board and the laws that govern RBF, require them to do. Although it is RBF which instructs the FNPF to reduce or limit its foreign holdings, RBF is merely the “accessory to the crime” since by instruction of the RBF Board, all RBF surpluses are paid to it legal shareholder, the Government of Fiji.

On the other side, the Fiji Government also benefits financially as a result, because it makes a huge interest saving by being able to borrow from FNPF (which it also controls) at extremely low rates of interest, through the issue of short-term Government stock paying low interest rates, rolled over continuously. So the Fiji Government gains from a higher dividend cheque from RBF, and lower borrowing costs, because it does not have to borrow from the commercial banks (you can work that saving if you like). For sure, ANZ or Westpac or Baroda would never hold the kind of investment portfolio that FNPF holds.

The central problem is that the biggest borrower and beneficiary of FNPF money, is the Fiji Government itself, which appoints all the members of FNPF and the Board of RBF.

Other financial losses

Since the 2006 Bainimarama coup there have been other major unexplained financial losses such as at FNPF’s investments in Natadola Bay Resorts Limited company which was strangely granted an indefinite loan of $200 million at zero interest, and FNPF made a “write-down” of more than $300 million.

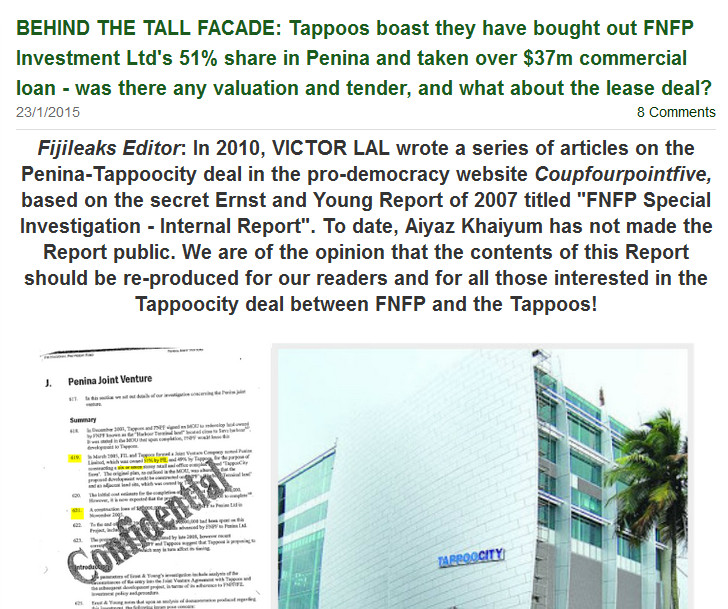

Despite FNPF claims of transparency and accountability, the FNPF Board refuses to release the audit reports such as those by Ernst and Young concerning some of FNPF’s stranger decisions. In one case FNPF agreed with one of its investment partners that the investment partner could build their jointly owned property at a low tender price, which was increased soon after to more than that tendered by other companies who had been eliminated on unusual grounds. FNPF still refuses to release the consultancy reports used to justify the unilateral 2012 breaking of pensioners’ contracts, reductions of future pensions from 15% of members’ account balances to 9%, and even refusing to allow their court case to be heard.

Government’s total control and the banking irrationality

The primary cause of governance failure at FNPF is that the Fiji Government (elected or unelected) has always appointed and totally controlled the Board of the FNPF since its inception. Once upon a time, there were “employers’ representatives” and “employee representatives” as well as government representatives. The employers’ organization usually nominated their representative; always, the Fiji Government decided which of their favorite union representatives would be on the board; and the Chairman was always appointed by the Government, usually a Permanent Secretary.

If the Chairman was the Permanent Secretary of Finance, he was simultaneously borrowing money from FNPF on behalf of Government, and on the FNPF Board side, lending money to Government. Of course, he would declare his interest at the FNPF meetings, but it is difficult to argue that the total amount lent and the interest rates charged, were all determined at “arms length”. No commercial bank would ever allow its largest borrower to sit on and control its Board and decide at what interest rate it would borrow. But effectively this is what happens on the FNPF Board. I doubt very much if any commercial bank would lend such huge amounts as FNPF does to Fiji Government, at the low rates of interest currently prevailing.

Why Government control?

Government control is entirely due to the historical origins of FNPF.

It was a Fiji Government which set up the FNPF more than 40 years ago and which has appointed and controlled the boards since then. Over the decades the unions, despite some calls, have failed to ensure that workers elect at least some of the Board Members, who can then appoint a genuine independent Chairman.

This failure has meant that when the Bainimarama Government decided unilaterally in 2012 to reduce all pension rates (existing and new ones to come) to 9%, there was no Board protest, even when the contracts of existing pensioners were broken and their legal challenge was thrown out by a Decree, thereby denying them their basic human right to go to court.

There are many decent law-abiding pensioners (they now think there were bloody fools) who assumed that legislation passed by the Fiji Parliament in 1998 was law, that a form that they signed with the FNPF was a lawful binding contract which bound not just them for their remaining life (including the prospect that they could die soon after taking the pension option and lose all their pension savings), but also bound FNPF to respect their contract; and they planned the rest of their life according to that sacred contract; and some even put their hands up to support the Bainimarama Government in December 2006 because they believed in his rhetoric of anti-corruption and justice for all.

Sadly, they were kicked in the teeth by not just the Bainimarama/Khaiyum Governemnt but the FNPF Board, and FNPF management, led by Taito Aisake. Sadly, some of them, like Rick, are struggling to make ends meet on their reduced pensions.

Note that thhe FNPF Board and the senior FNPF management actively collaborated with the Government decision. They did not fight for FNPF members (according to the Mission and Vision principles they falsely claim to follow) and they did not even allow the pensioners’ case to be heard – even in court – on the loss their life time savings.

There is no transparent process for appointing board members now, meaning that the Government can, if it chooses, appoint its own political supporters to the board, some of whom may have potential conflicts of interest (at least perceived by the public, if not realized in practice) in major FNPF investments.

Thus the Chairman of FBPF is Ajit Kodagoda, who is the Sri Lankan financial controller of CJ Patel, which has received preferential treatment as the owner of Rewa Dairy and the Fiji Sun newspaper, in return for favorable media treatment of the Bainimarama Government and a dilution of its “watchdog” function.

A new member is Sanjay Kaba, who, after the Bainimarama coup in 2006, was part of the company that took over the very lucrative management of the FNPF investments at Natadola and Momi Bay; he was also involved in the Tappoo City construction; and was apparently an incredibly successful fund-raiser, especially among the Gujarati businesses, for the Fiji First Party in preparation for the 2014 Elections. The public might want to ask if he is linked in any way to FNPF investments and whether companies owned by him or any of his family members receive financial benefits from the Bainimarama Government in the form of duty protection or other incentives.

Another new appointee is Ms Konrote, who is the Acting PS Finance.

By no stretch of the imagination can an ordinary onlooker feel that these board members have no interest whatsoever in policy decisions by the FNPF Board,

It may be pointed out that most of the FNPF board members have held, and some continue to hold multiple board memberships, which Bainimarama criticized in the previous Qarase Government, and which clearly compromise the independence of the companies concerned, some supposed to directly compete in the market (such as Vodaphone and Telecom Fiji).

The track record of some previous FNPF board members, in their other activities outside, would not be something to be proud of. One recent board member, readily supported the trashing the illegal reduction of Fiji pensioners’ property rights by a Bainimarama Decree, and the denial of Fiji pensioners’ basic human right to go to court with their grievances, while himself enjoying the protection of the rule of law for his own family and property in NZ. He of course, also has his own business interests in Fiji.

FNPF Board and Supervisor of Elections

Next to the national elections, the most important election for the largest numbers of people in Fiji who are employees, ought to be for the Board of the FNPF.

I suggest that it is for the workers of Fiji to demand that the majority of the FNPF Board be elected, under the scrutiny of the Supervisor of Elections, Mr Mohammed Saneem (this might be a better use of his time than conducting union elections and unreasonably suspending political parties for what many good accountants and auditors would consider an unimportant triviality).

Of course, the candidates do not have to be unionists (although most will vie for the positions, as always).

Such an election would now be very easy, given that the FNPF has already registered and given cards and IDs to all the contributors. To ensure that there is independent financial advice, there could be three independent members. For example there could be one nominated by the Employers’ Association; one by the Institute of Accountants; and perhaps a senior economist appointed collectively by the three universities.

I urge that this does not become a political issue between parties, as the FNPF contributors come from all the political party supporters.

Challenges for an Independent FNPF Board

There would be many immediate questions for an independent FNPF Board to answer:

- Why FNPF investments abroad cannot be considered part of RBF reserves, but with the income going completely to FNPF (“i.e. earmarking” these reserves for FNPF with interest paid to FNPF even if the reserves are considered as part of RBF reserves);

- Why are the inquiries into the causes of the $300 million write down at the Natadola and Momi Bay investments not being made public;

- Whether FNPF is no longer a “pension fund”, but a compulsory savings fund for workers, controlled completely by the Fiji Government, without a single representative of the real owners, the workers.

- To investigate how much FNPF is distorting the Fiji money market through its non-commercial, government-led lending patterns (which reduce normal money market discipline on Government deficit spending and thereby also encourage Government borrowings and public indebtedness).

- Whether in hind-sight, the massive reductions of pension rates in 2012 was at all justified?

- Why is the FNPF Board and management not publicizing the following facts

- In 2006, 25% of FNPF’s new retirees were taking the pension option (at the single 15% pension rat

- in the last three years, a miserable 4% of new retirees have been taking the pension option at the reduced pension rate of 9%). In other words, 96% of new retirees do not choose the pension option that the Fiji Government and the FNPF Board and Management, have forced on to them.

- To what extent should the management of FNPF (or indeed any Public Enterprise) have justified the illegal decisions of their Boards and the Fiji Government? Where is the dividing line between “following legitimate orders” and “following illegal orders which take away the basic human rights of Fiji citizens. How justified are the FNPF Board and Management self-praise for their 2012 “restructuring” exercise (which can be called other things). This of course applies equally to the military, police and prisons personnel, who are asked by their superiors to do fundamentally illegal things. The Yash Ghai Draft Constitution required all who wanted immunity for their actions between 2000 and 2014 to take an oath that they would not obey unjust orders.

I emphasize “good” and “impartial” and “scholarly”.

I [will] write soon on the sad absence of these qualities at USP.