'Madam Speaker, my lawyer friends tell me that the Honourable the Attorney-General and Minister of Finance is a much better politician than he is a lawyer. I am not a lawyer, so I am not in a position to judge that. But I am certainly in a position to judge his economic skills. And I can assure this House that he is certainly a better politician than he is an economist.'

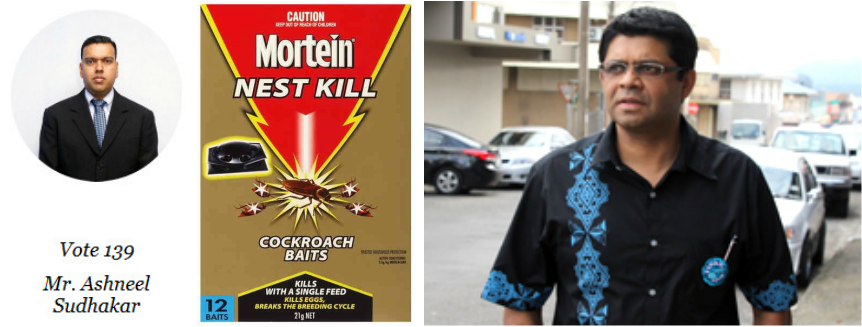

AIYAZ KHAIYUM'S MASOOR 'MORTEIN' GOONDA ASHNEEL SUDHAKAR -

'Mr 895 VOTES' - INTERJECTS:

"Name the lawyers and we will take them to task"

Fijileaks: Fiji's big fat-cat coward lawyers should inflate their b***s and bring a private prosecution against this Masoor Goonda of Fiji; he is not a FOOL, he is Khaiyum's sanctioned 'Merchant of Death'; he should also be reported to the so-called Independent Legal Services Commission for his various murderous Facebook postings against human 'cockroaches'

NFP President Tupou Draunidalo: "Ashneeel Sudhakar is a FOOL"

PROFESSOR BIMAN PRASAD

Introduction

Madam Speaker, before I reply to the Budget 2016, I wish to convey our best wishes to our former President Ratu Epeli Nailatikau and Adi Koila Mara and hope life after Government House will be fruitful and rewarding in all their endeavours.

I also extend our well wishes to the new President His Excellency Jioji Konrote and First Lady Salote Konrote. We are hopeful that the reservoir of goodwill and wisdom our new President accumulated during his distinguished career will greatly assist him in his most important role of being a symbol of unity for our nation.

Madam Speaker I would also like to add our heartfelt commendations to the Fijiana Team for their sterling performance yesterday and for qualifying for the Rio Olympics.

In adding to the Leader of Opposition's statement on Saturday, may I also add our thoughts of profound sympathy for the people of France and extend to them our solidarity and hopes for fortitude and resolve as a nation. The power of humanity always prevails over fear and tyranny, Madam Speaker.

Madam Speaker, I thank the Hon Minister for Finance for his budget address. The formulation requires the input and work of a lot of people and I thank all the civil servants who have contributed towards its formulation.

Madam Speaker, I have called this budget A deceptive budget of a confused government. It has no clear theme or direction. It is all over the place or a political merry go around. VAT is reduced for the rich, but the poorest people will pay more VAT. Last year the Government increased tax incentives for the tourism industry, now it has taken them away. Last year the Government increased duties on luxury items, now it has reduced them again. One year after vehicle imports were relaxed, they are now to be tightened. What is happening, Madam Speaker? To put it simply, this Budget is consistently inconsistent with Government’s proposals, promises, objectives and targeted outputs.

The Minister says that this budget is for “a strong Fiji, a fair Fiji, a healthy Fiji. Last year his budget was supposed to be Turning Promises into Deeds. All politicians use slogans to promote their policies. But this politician seems to be doing things the other way around and the Orwellian “opposite is the truth” reigns in this case. He seems to be using his policies to promote his slogans, buzzwords and tag-lines in the typical fashion of an over-energetic salesperson. But a Budget is not about drama and theatrics.

Madam Speaker, my lawyer friends tell me that the Honourable the Attorney-General and Minister of Finance is a much better politician than he is a lawyer. I am not a lawyer, so I am not in a position to judge that. But I am certainly in a position to judge his economic skills. And I can assure this House that he is certainly a better politician than he is an economist.

In his speech the Minister said that a Budget is more than “money in, money out.” This is correct. A Budget is an important policy instrument. It should tell the people, the business community and other stakeholders in the economy about what the Government is planning and where the Government is heading. Economic policies should be clear and consistent. In that way the nation can plan ahead, work together and achieve long-term economic growth. But this Budget, aside from its slogans and rhetoric, signals nothing more than a Government that is making things up as it goes along.

A politician’s budget speech can make “wow” promises with billions of dollars. But the real question is whether he or she can deliver on those promises. The Minister’s last Budget speech was called “Turning Promises into Deeds”. But just how many of his promises has the Minister of Finance turned into deeds? Dramatic statements about the economy made in this House is not manifesting to what our people out there watching this debate, feel in their wallets, Madam Speaker. A budget must not just look forward and promise. It must look back to what has been achieved. And I will come back to that.

A Good Budget Process

Let me start by talking about the budget process and its formulation.

A national budget is a central political process in any country. Countries have different ways of formulating them. However, before we look forward to the next Budget, we must have the information of our past financial performance. Businessmen have an old saying: “If you can’t measure, you can’t manage.” If we cannot measure where we have been, how can we manage where we are going?

Before the budget is formulated and presented to Parliament, these are some of the things we need to know.

First, what was the performance against the Budget of the past year – that is, 2014? And what has been the performance against the Budget for at least the first six months in the current year, that is in 2015? This would allow Parliament to understand how well the Government has performed on its earlier Budget promises. How else can we believe whether it will really turn promises into deeds?

Under the 2004 Finance Management Act and Regulations - the Minister of Finance must table in parliament the quarterly appropriation statements and the mid-year fiscal statement within two months of the end of those periods. This data used to be a regular feature on the Ministry of Finance web-site but no longer. Quite troubling however is that the Minister of Finance missed all of those deadlines, and what has been tabled for the first time at the last sitting is a poor reproduction.

On 21st May 2007 the Financial Management Act (Amendment) Promulgation changed the Act and required reporting by the Minister to Cabinet. However Madam Speaker, the Promulgation also stated it expires on the date of the next sitting of the House of Representatives. And all amendments made were to be nullified. Therefore the Minister must comply with the reporting provisions of the Act in entirety and in a timely manner.

Next, Madam Speaker, each Budget sector agency – that is, the departments and ministries - must prepare and make publicly available, for each financial year, an annual report which must be tabled in the House of Representatives. This report must:

(a) Demonstrate the agency’s performance during the year

(b) Include its financial statements

(c) Include other information required by the Financial Instructions.

Madam Speaker, in many of the Annual Reports I have seen this past year, that were tabled in the House, I have been overwhelmed by staged glossy pictures struggling to tell a story, but underwhelmed by the facts of the stories themselves, which is how have the people's taxes positively impacted their lives and livelihoods?

Similar accountability requirements are prescribed for off-budget State entities – that is, Commercial Statutory Bodies and Government Commercial Companies - under Regulations 51-53. Most budget sector agencies have failed to do this and this cannot be allowed to continue Madam Speaker.

The Minister and his leader talk about transparency and accountability all the time. Indeed, if you listened to them long enough, you would believe that they invented the idea. But if the Minister is truly as transparent and accountable as his rhetoric, he would tell us about how well his Government has performed on financial management and reporting. He has a chance to reply in this debate. I challenge him to tell Parliament, in that reply, which of his budget sector agencies have reported and which have not; and which statutory bodies and government companies have reported and which have not.

It is not just Government spending that is important. Information and statistics are also important. If we cannot measure important aspects of our economic performance, how can we build good economic policies? The Government has given a bigger budget allocation to the Bureau of Statistics. It is, quite frankly, more critical that the Bureau be left alone and independent so the nation, especially taxpayers who foot the bill, can receive honest and accurate information, whether that information is good or bad.

We know that the Bureau of Statistics has not released the information from its household income expenditure survey of two years ago, including the number of households now living in poverty. We know that the information is available but we are not being given it. Why? Is it because it does not suit the Finance Minister’s and Fiji First government’s slogans? How can meaningful policies be made for the poorest people in Fiji if we do not know who they are, where they are and how many they are – or even how poor they are?

In a modern Budget process, Government policies should not be a surprise. In a well-run economy, they will have been signalled months, or even years before. Economic policies will change very little, because the policymakers will have a long-term plan and they will stick to it. The word to describe such an approach is a favourite word of the Minister’s. It is transparent. But this Government’s Budget process: secretive, surprising and full of U-turns - is the opposite of transparent.

Trust, Openness, Transparency and Accountability

Madam Speaker the Hon Minister for Finance talked about Government believing in our people. Mighty fine words. But it works both ways. People must also believe in their government.

We are constantly told that we now have “true democracy.” The Minister speaks about “true democracy”, as if he invented it. “True democracy” is not about how people vote once every four years. It is about how the government accounts to people during the whole four years. This, however, is a government feared by the people. Nobody is willing to criticize the government without first lowering their voices and looking over their shoulders. I mentioned this in my budget address last year and not a lot has changed. We are told that there is an “equal citizenry” – but if the Army stops the Police from arresting a soldier suspected of a crime, is that equal citizenry? Regrettably, this Government has created a culture of fear, secretiveness, arrogance and mistrust that is now pervasive in Fiji.

Madam Speaker, we may have become a low trust country. I could not help but feel sadness at the tone of the budget address. The Minister lectured business people and accountants as though they were crooks. Now, he wants to look inside every supermarket cash register. He is threatening business people who do not pass on VAT reductions to consumers with fines and imprisonment. Is this a Government that believes in people? It appears that this Government only believes in people who do not answer back.

In his Budget speech the Minister talked constantly about what previous governments had not done and what needed to be reformed. He has conveniently forgotten that for the best part of the last 10 years, his government has been in power. He complains that previous government inaction means Fiji has no surgeons. But what has his military government done about this since 2007? The Minister says there is a need to reform how the government buys and looks after medicines and medical supplies. But that reform was announced with great fanfare a few years ago by the Minister for Health of the military government, and obviously failed. What kind of message does the Government send when a senior government minister becomes ill, the preference is for the Suva Private Hospital over the public hospital?

Madam Speaker, what we need is not only economic credibility and consistent policies but equally crucial is political credibility. Political credibility is earned through building trust and confidence in every sector of the society. This trust will come through openness, transparency and respect for different views and criticisms of government policy.

This Madam Speaker has been absent in Fiji even after elections. The Government has accumulated its control over the media through cosy deals with the C J Patel Group and the Fijian Holdings takeover of Fiji TV. It's constitutional promises of free speech are empty because it will not repeal the draconian Media Decree. Civil servants are too afraid to use their intellect or make decisions for fear of being sacked. When the Police Commissioner tries to do his duty and prosecute soldiers accused of torture, he is challenged and forced from office. Madam Speaker, unless we create an environment conducive for open debate, disagreements, transparency and accountability of every government action, government’s lofty statements in believing our people will remain elusive. Trust and confidence is only created by being open and transparent. And let me begin by unpacking this confused government’s and politician’s budget.

GDP Growth Forecasts

The Minister is proud of Fiji’s economic growth rate of 5.3 per cent for 2014. We are promised growth of 4.3% in 2015 – declining, but still positive.

Many, including the Minister for Finance, talk about this plus-5 per cent growth as though it has never happened before. In fact, average growth in the 1970s — before military coups was around 5 per cent. Even in 2006, it was heading for 5% mark until the military coup that year.

In truth, 5% growth is still a very ordinary performance. Where did it come from?

First, we have had elections and a return to democracy – at least, some kind of democracy. That has boosted economic confidence. We did not have democracy in the years 2007 to 2012. In those years our average economic growth averaged just 1% per annum. The Minister is very proud of his recent economic growth figures. But he is very quiet about Fiji’s economic growth during his first years in power. If he understood economics, he would know the concept of pent-up demand. All we are now doing is catching up on where we should have been nine years ago. The real question is not 'how well we are doing now'? The real question is how much better we would be doing now if there had been no military coups and eight years of military government. Hundreds of millions of dollars in productivity and economic opportunity have been lost which Fiji will never recover.

Second, we have been borrowing and spending to keep up economic growth. And we all know that this is not sustainable.

Third, we have remittances. Few people understand the importance to our economy of remittances from our people working and living overseas — rugby players, security guards, nurses, and caregivers. Remittances kept the Fiji economy going in the low years of 2007-2010. Today much family expenditure for funerals, marriages, church and religious activities and school and university expenses are funded by our overseas relatives. Madam Speaker, this is a testament of how robust our kinship ties remain regardless of geographical distance.

Last week the Reserve Bank estimated that Fiji would receive F$430 million in remittances for 2015. This does not include the money that our citizens bring with them, in cash, when they return to Fiji. Remittances are our second largest source of foreign exchange income, ahead of sugar and behind only tourism.

We receive remittances from the economic growth of other countries. We receive these remittances because our people can find better jobs overseas than they can find at home. This is a real credit to our people and their marketability, and even when I often lament how much Fiji loses out on in terms of brain drain, I am completely sympathetic to their choices. Our people work overseas because they cannot find opportunities to put their skills, experience and productivity to good use in their own country. The Government can not take credit for this but what the Government should be recording is the wide dynamics of remittances from our people. This is not a soft research need, but if done well with proper trends projections can actively feed into future policies like a transparent national register of offshore Fijian experts that the nation can call on when the need arises. Fundamentally Madam Speaker, it must be made clear that remittances fund only consumption expenditure. Remittances do not multiply growth and jobs in the way proper investment does.

Production in the real goods sectors, such as gold, fish, and garments actually fell in 2014. Agricultural production as a whole fell by about 2.4 per cent in 2014.

So there is no economic miracle. Pent-up demand, Government spending and the sacrifice of Fiji citizens offshore are why our economic growth figures re buoyant.

What about the future? Even after all the borrowing and spending, is the Government’s growth sustainable? Apparently not. 2014 growth was 5.3%. In 2015, it is projected to be 4.3%. It falls further to 3.5% in 2016 and 3.1% in 2017 and 2018. This is at a time when economic growth in the rest of the world will be on the rise. Why is Fiji's growth rate declining? There are a number of reasons.

First, the Minister knows that the Government cannot keep borrowing and spending its way to economic growth. Like every household, you can borrow to have a party, and everyone feels good for a while. But pretty soon the party ends and then it is time to pay the bills. We cannot have a Government spending party on roads and airports every year. Yes, infrastructure is critical but not at the expense of three square meals a day of the taxpayers. The very same taxpayers who pay the bills for the party and for whom much is demanded every budget session.

Second, the Minister is running out of tax tricks to keep spending consumer high. For 2014, he reduced income tax. This pleased many people – particularly the richest people, whose tax bills went down. But it also put money in taxpayers’ pockets to spend. So increased consumer spending boosted the growth figures. But the Minister cannot cut income taxes again. That is a one-time trick.

So this year, the Minister has cut VAT and import duties on luxury items. This is the real reason he has reduced VAT so that people supposedly have more money to spend. Their spending will, again, boost the growth figures. But he cannot cut VAT again. That is also a one-time trick. And there are no more one-time tax tricks left.

Third, disaster is looming for our sugar industry. In 2017, prices for our sugar will fall to less than half of what we are earning now. We all know this. We have known this for many years. And in 2017, the collapse in the cane belt economy will begin. The incomes of farmers, canecutters, rural shopkeepers and their families will be slashed. There are no tax tricks to turn this around. And Government has no plans ready for this.

Madam Speaker, the Government is hoping its spending and tax tricks will create a growth cycle that will encourage private sector investment. This is a gamble. If it fails, Fiji will be deeper in debt with bigger bills to pay. Private sector investment will not follow unless our politics is stable, our economic fundamentals are right and our economic policies are consistent. More on this later.

Employment, Wages and Salaries and Poverty

Any growth in an economy is good. There are always some benefits from it. But the most important question is who is getting the benefit of this growth? Has growth created jobs? Have wages and salaries of workers gone up? And what has growth done for the poorest people in our society? The widening disparity between the have's and have not's, added to a thinning middle class sector will continue to weigh the economy down. This is basic economics Madam Speaker and is why I continue to raise the issue about poverty. It is either we all grow together, or we don't.

We do not have the poverty figures for 2013/2014 because the Government is hiding them from us. But we should not expect any difference in the poverty rate compared to the 2008/2009 survey.

It is likely that at least 30 per cent of our people – that is, one in three of Fiji’s citizens - live in poverty, possibly more. It will be difficult for Qorvis to put a spin on that reality Madam Speaker.

Rural poverty has probably increased, because of the declining agricultural sector and the sugar industry. This poverty will increase sharply in 2017 when sugar’s day of reckoning arrives.

Madam Speaker, the Minister of Finance’s budget address took nearly three hours. And yet, only once did he mention jobs. When he did mentioned jobs, it was no indication of real jobs. He told us that Investment Fiji had received investment proposals for 2,903 promised new jobs.

The Minister’s Budget is an endless list of promises. But what are the facts? Between 2010 and June 2015 46,000 people registered at the National Employment Centre (NEC) looking for jobs. How many permanent jobs could the NEC find them? Only 5600 – that is, about 1,000 jobs every year.

12,000 of our young people will leave school this year, as they do every year. And what plans does the Government have for them? Where will they find them? The Minister of Finance is so fixated on his growth figures, he has forgotten that growth must mean something to our people. He has a slogan. But the people he serves can't eat slogans.

Suva’s latest new retail centre is Damodar City in Raiwaqa. It is very impressive. It has upmarket groceries, bars, restaurants and movie theatres. You can buy the best clothes, electronic and sports goods there. This represents investment, and those who shop there create economic growth. But the only poor people you will see at Damodar City are the children selling roti parcels or pie or bu in the carpark. This investment, this economic growth, has done nothing for them. In fact, for them, the biggest impact of this Budget on the poor is the additional VAT that they will now have to pay.

Revenue Measures in 2016 Budget

The key revenue measures in the 2016 Budget is a strange and contradictory smorgasbord. From the viewpoint of fiscal management they make no sense at all. Indeed, I can only think that the Minister of Finance is looking for another slogan – “I lowered VAT more than the NFP promised.” This too would be a fine slogan, but in return one is expected to trade in one's sense of rational logic.

We welcome the reduction in VAT. It is no secret that NFP campaigned vigorously in the 2014 election to reduce VAT from 15% to 10%. But here is the funny thing. Every argument that we put forward in favour of VAT reduction was rubbished by the Fiji First Party at the time. For example, in August 2014, Hon Mahendra Reddy said (and I quote) “The reduction of VAT is not helping the poor because it is helping the rich and business people. These are the people who are paying most of VAT”[1].

The Finance Minister was also at the forefront to condemn any reduction. In September last year he told his favourite newspaper, The Fiji Sun, the following (and I quote) “By reducing VAT from 15 to 10%, the tourists and big businesses will be benefitting”[2]

Clearly, Madam Speaker, the Minister of Finance has had a change of heart. Of course, we are happy that the Minister of Finance is actually trying to learn something from the Opposition. That it is not a bad thing in a democracy Madam Speaker and VAT which applies to everybody, is not something we choose merely for political upmanship. But it seems that the Minister of Finance is not a very good student. He obviously slept through some of the lectures. Because he has forgotten a critical element in the policy mix, which is that when you remove zero-rating from essential VAT items, you must give extra financial support to the poor.

There is good, simple economic logic for removing zero-rating from essential food items and prescription drugs. It does simplify the VAT collection process for FRCA. And it means that those of us who can afford to pay VAT on those essential items -- like the Minister of Finance and me -- will pay, and Government will get more revenue. But it leaves out the poor people for whom the zero-rating was originally intended. What will happen to them?

I will quote a letter-writer in The Fiji Times last week. This is what he said:

Everyone is happy that VAT has been reduced from 15 per cent to 9 per cent, but forget one very minor thing. That 9 per cent VAT will now be charged on basic food items and medicine, which was not previously charged. I believe that many of Fiji’s population live under the poverty line. As it is they find it hard to survive, now with VAT charged on basic food items, it is back to one meal per day. Even a cent can make a lot of difference. Thanks Government, like you say, Fiji First[3].

That is not a Minister talking. It is not a politician talking. It is a member of the Fiji public talking. And he has more commonsense than the Minister of Finance.

More on this Madam Speaker. A person with a wage rate of $4 per hour working for 50 hours per week will earn $200 dollars per week, $800 per month and $9,600 per year minus $768 FNPF contribution, the net per week is $170 and if that person is a single earner in the household of 4 then it is estimated then this household will spend about 60-70% of its income on basic food items whereas anyone earning over $20,000, they probably spend only 8-10% on basic food items. Madam Speaker, a dollar is squeezed, stretched and pulled further when there is less of it in the first place. For Fiji's population the majority are in that income bracket. Once again, this reality is a difficult spin for Qorvis even if the grand handing out ceremonies look nice and colourful.

Madam Speaker, an estimated 72% of the population earn below the income tax threshold and therefore the majority of them would be hit by the imposition of 9% VAT on basic food items.

It is simple. If you are going to hit the poorest people in this way, it is the obligation of any responsible Government to cushion the blow. But Social Welfare payments are not increasing. And what will happen to those people who do not receive any Social Welfare payments, pensioners and those on fixed incomes? Madam Speaker, we are talking about the 60,000 households that are on or below the poverty line.

The Minister of Finance says that the price of rice, cooking oil, fish, flour, tea, milk and prescription drugs will go up by 9 per cent, but the prices of meat, furniture and hardware will come down. I have breaking news for the Minister. The majority of the poor cannot afford meat. They cannot afford furniture. And they cannot afford hardware.

But this is why this VAT reduction is such a slap in the face to poor people, Madam Speaker. The rich can afford meat. They can afford furniture. And the rich can afford hardware. They can also afford luxury cars and flat-screen TVs. All of these things will now be cheaper for wealthy people, and the Government will collect less VAT from them. That is this Government’s gift to the richest people in Fiji, while it takes away more money from the poorest people.

Why is the Government doing this? Because poor people do not matter. It is rich people’s spending that matters, because these will make the Minister’s economic growth figures go up. “The more you spend,” he tells them, “the more you save!” That is a silly statement, which makes government propaganda sound like a sales pitch from Rups Big Bear. But it is the Minister’s and government’s slogans, and his economic growth figures that matter most to him – not jobs, and not the poor.

But the Government is also playing with fire. VAT is an increasing proportion of Government revenue. If the Government has got its maths wrong – and it usually does – then we will end up deeper in debt.

The Minister says that the VAT rate reduction will result in a loss of $316m in revenue but that he will be able o recover more than this. First he says he will gain $108.6m because he is now charging VAT on basic food items. Then he says he will take $127.5m from STT and the Environmental Levy. Then he says he will get $120m from so-called “VAT compliance initiatives”.

Like every politician the Minister is saying “I am sure I can collect $120 million by making VAT collection more efficient.” That is hope. It is not a policy. It is not based on any evidence or reality. You cannot just pretend that $120 million will turn up if you look under the bed. If the Minister has got this wrong and other amounts from other new revenue measures, then his budget deficit will possibly increase to more than 4% of GDP as it happened in 2014 and revenue collectors will pull their hair out trying to realize this pipedream projections.

Tourism, STT and the Environment Levy

Now, let us talk about the increase in STT and the so-called environmental levy. Because the Minister thinks that whatever tax money he gives back to Fiji citizens, he can arm-twist our tourists. Again, he is playing with fire, because he is threatening the stability of the tourism industry, one of Fiji’s biggest employers and biggest earners of foreign exchange.

There were many silly things in the Ministers’s Budget speech. But one of the silliest was his statement about tourists. He said that tourists will “willingly pay a small additional charge to support environmental protection programmes”.

First, tourists are not paying to support environmental protection programmes. They are paying to make up for the gap in VAT. This so-called environmental levy is not going to the environment or the most direct custodians of our environment. It is going straight into the gaping hole in the Minister’s budget.

Second, it is not a “small additional charge”. Together with the increase in STT, tourists who come to Fiji must now pay 11% more for their holidays. How can Fiji stay competitive when our own Government is adding these costs to our biggest industry? How can tourists enjoy their chill-out time in Fiji when they know they're being strong-armed into coughing up for the Government's fiscal inadequacies that has nothing to do with their holiday expenses? Let me quote from a speech made one year ago:

“There are many tourist destinations in the world competing for the interest, attention and dollars of the affluent travelling public. Fiji needs to stay on top.”

The Minister may recognize those words, Madam Speaker. They came from his Budget speech last year.

The Minister’s economic policy on tourism investment is perhaps the most confusing of all.

In last year’s Budget, tax incentives for tourism were increased. The definition of “project” was widened under the Eleventh Schedule of the Income Tax Act. The Short Life Investment Package (SLIP) was extended to include the building of short-stay apartments. Now, this year, the Minister has said he will phase out these allowances altogether.

Why is he doing this? The Minister says this is because Fiji has a “mature, world class hospitality sector” and it no longer needs these tax incentives. He must be living on another planet. Let me give the Minister of Finance another short lecture in economics.

Our tourism industry has a long way to go before it is considered mature. In the last five years our tourist numbers have increased from 630,000 to 690,000 tourists – an increase of about 2% a year. Smaller and more isolated island countries like Mauritius, and even the Maldives, are rapidly increasing their tourist numbers. They have hit the million-tourist mark. Why? Because these nations have investor-friendly policies, including strong tax incentives, and they apply them consistently and predictably. Why do they do this? Is it because they want to give foreign investors tax free income? No. It is because they recognize that tourism creates real and permanent jobs. Jobs, you will recall, is what the Minister of Finance has said nothing about. The hospitality industry is labour intensive. It requires skilled and experienced people. The industry is competitive. It trains its people and pays them better than other sectors. In fact Madam, Speaker they could be paid even better. Competition for good employees is high. That, Madam Speaker, is why the tourism industry should be supported.

Finally, tourism investors are hit harder than other businesses. This is because the so-called 6% environment levy is not the same as VAT. When a business returns for VAT on its gross income, it can claim VAT input credits on its expenses. The environment levy does not allow for input credits. So the additional costs for the tourism investors are even higher than they look.

I can only imagine that being a tourism investor in Fiji is like riding a very bad roller coaster. Tax breaks come and go. Tax definitions change from year to year. Duty is imposed on the goods they need, then it is taken off. Taxes for their guests rise every year, whether it is departure tax at the airport or Service Turnover Tax on meals.

Tourism is one of the few industries where Fiji has a comparative advantage. Not only do we have an ideal natural environment for tourism. Our people are truly first-class hosts. It is a pity that their industry can only be supported by a third-class government.

Debt and Borrowing

Madam Speaker, now we come to another worrying problem – Government debt. Between 2006 and 2014 government debt rose by $1.136 billion — nearly 40 per cent.

This does not include government guarantees for statutory bodies and government companies. These are contingent liabilities. They are not budgeted and accounted for. If any of these guarantees were called on, government debt would again go up. These liabilities were $2.4 billion in June 2014 — that is, another 30 per cent of GDP. These contingent liabilities are real exposures.

Government debt is now around 50% of GDP. This is about 10% higher than it should be in a well-ordered economy. In many countries it is of course worse than this. But we should not be measuring our economic performance against those countries.

Total debt increased from $ 3.7 billion to an estimated $4.4 billion. This means that every year we could be paying more than 30% our total revenue for debt repayment. For every three dollars we raise in revenue, we pay one dollar to our creditors in interest and debt repayments. That is money that is denied to the people for health, education and other services. So when we borrow money, we must know that we are borrowing for good purpose and not just to pay for another of the Minister of the Finance’s slogans.

When are we going to pay back this debt? And when are we going to stop the spending party?

Madam Speaker, this Government is spending hundreds of millions of dollars on roads. Roads seem to be its particular obsession. Roads are no doubt a good thing. But so too is education, health and social welfare. My main concern about the obsessive spending on roadworks is that no-one knows how well the money is being used. In the 2015 budget a total of $653 million was allocated. Actual expenditure to date is only about $237 million. Does this mean that the balance of $416 million will be used in the fourth quarter. In fact the Minister for Infrastructure should provide a detail breakdown of how the balance will be spent and what sort of oversight we have to ensure that we are getting value for money. It is almost certain that a lot of funds are being wasted towards the end because of the haste to spend it.

We have all been down pitted, potholed roads – the same roads that just a few years ago the Government pointed to with pride, after a Malaysian or Chinese contractor merely applied a coat of tar to it. How much did this cost, and what value did we get for what we paid? The Auditor-General’s report for 2014 has just been published. In it the Auditor-General gives only a qualified opinion of the accounts of the Fiji Roads Authority. Why? Because the FRA’s own information about its road system is so poor that its accounts cannot be made accurate. If you can’t measure, you can’t manage. But has the Fiji Roads Authority audited the quality of the roadworks that have been done over the last 10 years to see how well all the Government’s road expenditure has been spent? If not, it should, so we can learn the lessons from the past. Or is it, perhaps, like the poverty statistics - the audit has been done but the information does not match the Minister’s slogans so it is not being released?

In 2014, the Government said it would raise $415m in revenue by selling government assets. But few if any of these assets have been sold as I cautioned in my budget response last year, because no one wants to buy these assets at the price Government wants. In 2015, the Finance Minister promised to raise $507 million in asset sales. He did not turn that promise into a deed. He has so far raised only $100m and even that is raised mostly by raiding the Government’s favourite piggy-bank, the Fiji National Provident Fund, an organisation the Government controls but that workers in this country own.

The government continues to ignore with impunity the input of the workers who own the FNPF. Since the military coups of 2006, FNPF pensioners and workers have continued to suffer. Pension rates were unilaterally reduced and many pensioners are still suffering today. A legal contract between them and the FNPF was illegally terminated. Worse still, the pensioners were denied justice through a decree where they could not challenge that decision and all this happened under the current Minister of Finance who was the Attorney General at that time.

Let me give a real example as to how some of the pensioners were affected. Mr. X went on pension with a legal contract. This was terminated and his pension reduced. He decided to go for a 5 year term pension. This term will end in 2017. He is a healthy man living with his wife and children. In 2017 his term pension will end and he will have nothing thereafter to survive. He will not be eligible for the $50 pension under the current rule. The lives of some these pensioners have been shattered and it will show. I can almost predict that before 2018 I will be bringing those grim tales to this House. We should take more than a passing interest because many of us in this House will be, or are, ourselves pensioners.

Government together with FNPF should urgently review some of those decisions and find ways in which pensioners who lost out be compensated. A legal contract was violated.

Why is government not appointing workers and employers reps to the FNPF Board?

About 80 per cent of Fiji National Provident Fund members retiring over the next four years will have balances of less than $50,000. The 2015 Annual Report shows that only 5% opted for pension. The recent announcement for increased rate for term annuities is a joke and quite simply, criminal. Why would any retiree want to opt for any of those options? In fact with the current pension rate most retirees would opt for lump sum payment. A large majority of these pensioners would not be able to make any significant amounts of investment with less than $50,000 and in fact would fall below poverty line in the years to come. In the end government would be burdened with the responsibility of looking after many of these people.

Madam Speaker, I suggest that government appoint a joint parliamentary committee look at the operations of FNPF and have a thorough discussion with all stakeholders, especially members to see how best we can restructure FNPF and relook at the retirement options, use of FNPF fund by members for housing and social development. FNPF should not be used to support this Government's overzealous operating expenditure. If anything FNPF should be investing in housing development projects and help increase home ownership of its members. I also call upon the government to immediately change the board of FNPF so that representative of workers are appointed on the board. This government cannot ignore the wishes of the members of FNPF.

Singapore used its Central Provident Fund only for social and retirement benefits. In fact Singapore used its CPF to provide home ownership to its workers. FNPF should do the same. It should not become piggy bank for the government.

Madam Speaker, two days ago the chief fnancial officer of FNPF is quoted in a local daily as saying the FNPF would review the death benefit payment of $8500 because it had become unsustainable. This is adding salt to injury of the FNPF members. FNPF now intends to reduce this to a partial payment of $2,000 with the balance of $6,500 put into the deceased member’s account for the benefit of the nominee.

Madam Speaker, the administrator or nominee of a deceased need money for funeral expenses. I am sure all of us in agreement that a funeral and performance of final rites cost much, much more than $2000. FNPF cannot claim that it does not have funds to make the payout.

For example, if 400,000 members are registered and pay an annual sum of $35, the Fund would accumulate $14,000,000 per annum. And if for example 1,000 members die each year, the Fund would pay out only $8.5 million. Therefore how can payout of this benefit become unsustainable?

Death benefit, Madam Speaker, is not a hand-out by FNPF. It is not Government’s money but money of the FNPF members. The Fund requires members to comply with nomination criteria as well as an annual payment of $35.

The Minister’s promise for 2015 was for a deficit of F$161 million. In fact, it will be at least $350 million. One more promise has not turned into deeds. The interest costs alone of this failed promise will be in the order of $10 million that the people of Fiji will have to pay. That is $10 million that could have been spent on a school, a hospital, the cottage industry, agriculture or to support Fiji’s poorest people.

Similarly, the Government has, once again, budgeted for asset sale revenues of $320 million in 2016. But if this is not achieved we will again end with a higher deficit. And we will have to borrow more in 2016.

Overseas Borrowing

Another notable but concerning trend is the steady increase in Fiji's overseas borrowings. We borrow in US dollars, meaning we have to pay the debt back in US dollars. In the next five years it is almost certain that our currency will fall against the US dollar. So we will have to find even more Fiji dollars to repay the same debt.

In 2006, under the SDL Government, the global bond of $US150m ($F326m) was raised at a 6.8% interest rate. The military government used all of it. When it was time to pay it back in 2011, they went and borrowed more money — $US250m ($F543m). But on the new borrowing we paid a 9 per cent interest rate. Everybody in the finance sector knows that other institutions offered loans at lower interest rates. But these loans were offered on conditions requiring the Government to manage the economy prudently. The Government would not accept these conditions.

Government has now refinanced its US$250 million global bond through another international bond with a coupon rate of 6.625%. The Government has made a big deal of its reduced coupon rate - but this interest rate is payable in rising US dollars. It is more expensive than borrowing in Fiji.

Government has not told us that it paid close to $200 million interest on this bond in the last 5 years. That interest could have gone towards state services such as education and health, or welfare payments. We did not get these services because we had to pay interest. This is why, when Government borrows, every Fiji citizen pays, by sacrificing the services we cannot afford. Meanwhile, our interest bill is growing. Interest must be paid from higher taxes or reduced spending. So it is Fiji's people who will be shackled by the burden of this debt, the largest that Fiji has ever had.

But the most shocking thing about the sale of Government assets – the FEA, Airports Fiji, Fiji Ports Company Limited – is that the money we will collect will not be used to reduce debt. It will be used to fund ordinary Government annual spending. It is like selling your house so you can pay for your groceries. When we are left with no assets, what will we do then? This is akin to selling one’s soul for 30 pieces of silver.

How Can We Keep Growth Going?

Madam Speaker, it is clear that economic growth is necessary for extra jobs. Continued consumption-driven demand can help for a while, but not in the long term. We need to ensure that productive sectors such as agriculture, mining, fisheries, forestry and manufacturing pick up. Why have these sectors not picked up?

Another of the Minister of Finance’s silly moments came when he talked about implementing reforms to improve the business climate. This is what the IMF has told him. And this, he says, is “music to our ears.”

If that is true, the government must be tone deaf. For nine years we have been told that Fiji is “improving the climate for investment.” New laws are passed and new changes are promised. And every so-called reform has failed. Madam Speaker, the World Bank uses a measuring tool – the Ease of Doing Business Index – which ranks every country in the world for ease of doing business and investment. For nine years, Fiji’s ranking has gone down this index. It started in 2007 at No 56. Now it is No 82. But for ease of starting a business, Fiji ranks a shocking 160 out of 189 countries in the world.

Small and medium enterprises suffer from unbelievable bureaucratic obstacles. Let me give you just one example. How hard should it be to get a business licence from the Suva City Council? The Business Licensing Act is simple – fill out a form, pay the licence fee, get your licence. But this not what the Council says. This is what you need to produce to get your business licence, Madam Speaker. If you think I am joking, I am not. I am reading from the Suva City Council business licence application form:

- a thoroughly filled application form

- 1 copy of Business Registration Certificate

- 1 copy of FTIB certificate (if a foreign investor)

- 1 copy of TIN registration letter (from FRCA)

- 1 copy of health licence if operating a restaurant, takeaway bar, butcher, nightclub, hair salon or food business

- Directors’ names and contacts including 1 copy of their photo ID

- 1 copy of consent letter from landlord (if renting premises)

- 1 copy of liquor licence (if applicable)

- 1 copy of OHS letter from Ministry of Labour

- 1 copy of National Fire Authority certificate

- 1 copy of building completion certificate

- 1 copy of permit to store controlled substances (if applicable)

- 1 copy of copyright licence from Fiji Intellectual Property Office (for sale or hire of DVDs.

What was the Minister’s clever idea for reform? To create a three-year business licence. So now we need only to run around chasing paper once every three years! But why are we running around at all? The information is useless to the Council. It does not need it and it will never use it!

This is the same bureaucracy that every business complains about in every regulatory agency – Investment Fiji, FRCA, city councils, the Immigration Department. This happens because Fiji has a command and control bureaucracy. From the Minister of Finance down, the Government has the paranoid need to control everything. The Minister of Finance wants to use his computer link to look into supermarket cash registers. He wants to use his Consumer Council hotline to catch shopkeepers who sell goods 1% above the price he wants them to sell at. The Minister, who has never run a business in his life, even lectures businessmen on how to operate – he tells them to charge lower margins to get higher volumes. Little wonder, then, that the bureaucracy he heads behaves in the same controlling way. Madam Speaker how is this a government which “believes in the people”?

Civil Service Reforms

Madam Speaker, this brings me to the so-called civil service reforms. The Minister promised these reforms last year. These promises, again, were not turned into deeds. For this the Minister blames the World Bank. Apparently it is the World Bank’s fault in a fashion symptomatic of this government’s blame game. Blame it on everyone under the sun except themselves!

Madam Speaker the Minister has given a very fine speech about civil service reform. This is a little bit surprising, because I thought that the military government he joined in 2007 had solved all the problems of corruption and inefficiency. But nine years after he came to power FICAC still seems to be busy. Corruption still seems to be there. Whose fault, I wonder, is that?

In truth, it does not matter what fancy plans the Minister has for the civil service. The change must come from the top. The entire public service is run in a culture of fear, paranoia and suspicion. Any civil servant who disagrees with the Prime Minister or the Minister of Finance is dealt with in one of the following two ways. Either they are deemed to be serving a corrupt interest, so FICAC is called in. Otherwise, the civil servant is deemed to be a supporter of an opposition political party, in which case he or she is terminated. Some of the finest public servants I know have been reduced to mute paper-shufflers. Those who try to be helpful to the public will lower their voices and check that no one is listening. Civil servants are not even allowed to talk to the Leader of the Opposition if she visits them at their posts.

One has only to look at the recent experience of the Commissioner of Police. If a senior and professional policeman can be undermined and interfered with to the point of resignation, what hope is there for a middle-ranking public servant? Mr Ben Groenewald will leave Fiji and take his considerable skills to another senior posting. A Fiji civil servant cannot do the same.

The 2013 Constitution gives powers to the public service minister to have the final say on all appointments and promotions. What is happening - and will happen - is the ministers will turn the civil service into Fiji First party apparatchiks. This destruction of one of the key institutions of government is the worst and most dangerous legacy that this Government and their imposed 2013 Constitution will leave for the people of Fiji. Only those with the arrogance, ignorance and a god-like complex will not see it.

I therefore propose Madam Speaker that government does not set up this ministry but continue to strengthen PSC and make it responsible for the civil service.

Sugar Industry

Madam Speaker, for more than 100 years the sugar industry has been the backbone of our economy. This stopped after the turn of the century when tourism and later Fiji Water overtook sugar as the largest foreign exchange earner.

For more than 100 years, including the indenture period, the sugar industry has weathered many storms and defined the national landscape. It has survived cyclones, floods, droughts, two World Wars, industrial and political strikes, and political upheavals.

But finally, an industry which has directly or indirectly supported a quarter of Fiji’s population across races, throughout history is now bleeding to death, Madam Speaker. Industry stakeholders have run out of answers on how to revive it.

The industry’s best hope of recovery 10 years ago was derailed by the December 2006 coup. The military government deliberately sacrificed the injection of a $350 million grant to the industry by the European Union. Had this materialized, Madam Speaker, Fiji from 2011 onwards would have been producing a minimum of 4 million tonnes of cane and 400,000 tonnes of sugar, using more efficient methods than we are using now.

Madam Speaker, sugar is a “lifeblood ” industry. It is far too important for it to be allowed to die. But this government, both as a military regime and now as the Fiji First administration, instead of providing both theoretical and practical solutions, it is adopting a fire-fighting approach, which in reality just like most fires witnessed in the country this year, is destroying the properties.

And, as I have said right from the beginning of this address, this is how the Fiji First Government operates. It makes it up as it goes along. It is shocking to me that the sugar industry is facing the greatest threat to its survival in less than two years and the Government has no vision and no plan for it. If it does have one, then certainly the 200,000 people who directly depend on it do not know it.

These people – the cane farmers, their families, the cane cutters, lorry operators, lorry drivers, labourers and farm hands – are demoralized and in need of encouragement. High costs of production are their biggest disincentive and danger. For the last nine years or so, they have continued to faithfully perform their duties to the industry and the nation despite the tumultuous times that the country has undergone and despite having the full knowledge that the price of sugar would go down massively after 30th September 2017.

And when they are in desperate need of financial and technical assistance, the government is seemingly clueless on how to provide constructive solutions instead of the current band-aid solutions.

Madam Speaker, last season we produced 1.83 million tonnes of cane. We are still a long way from achieving a production of more than 3 million tonnes of cane and 300,000 tonnes of sugar, the minimum required for the long-term viability of the industry.

If the TCTS ratio of 8 tonnes to one tonne to sugar is maintained from last season, then three million tonnes of sugar cane will produce 375,000 tonnes of sugar. This will be the ideal minimum benchmark.

But not only are we 1 million tonnes away from this minimum target, we have no margin for error. This year, drought will severely impact cane production so, again, we will fall very short.

We put a lot of effort into bringing foreign investors into Fiji. But what have we done to encourage our own Fiji people to re-enter the sugar industry? Madam Speaker, farming is hard and physically demanding. Farmers are subject to the whims of weather and the prices on the world market. Life is insecure. This is why they encourage their children to do something else. No one is joining the cane farming community. Why would they do so?

Until we have a strategy for mechanisation, for improving farm productivity and providing technical and administrative support for farmers, this situation will not change. But this is too serious a problem to ignore. I have asked the Government to set up a task force involving all political parties in Parliament to work on this problem. So far I have been ignored. But if Government does not have the solution, why will it not accept our help?

The Prime Minister, while addressing the 46th session of the ISO Council in London on November 29th last year said and I quote: -

"The abolition of EU sugar production quotas post 30 September, 2017 and the consequent adverse implications on sugar prices pose a very big challenge indeed. Moreover, EU sugar prices have already come under pressure, with significant falls compared to prevailing prices over a year ago. So suppliers like Fiji are having to prepare for a reduction in our export revenues even before 2017 — a sobering prospect for any developing nation". - unquote

A sobering prospect indeed, Madam Speaker. But what is the Government doing about it?

In the 2015 Budget about $36 million was listed under Head Number 35 as “Aid in kind from the European Union” for social mitigation. There has been no explanation in the Budget Estimates or in the Supplement as to what this means. Until now nobody from Government, including the Prime Minister has clarified this, despite it being raised in Parliament.

Now this year Madam Speaker, we are told that $5 million has been allocated for the cane planting assistance programme. We are also told that it would cost $400 to plough an acre of land ready for planting of cane – this also includes fallow land.

Madam Speaker, anyone well-versed with cane farming will tell you that currently it costs $120 to get an acre of land ploughed by a tractor. For fallow land, it is vital that the block is ploughed three times and harrowed thrice as well. This alone will cost a grower $720. So the fact that it is so costly to prepare fallow land for cane planting is proof enough of failure of Government’s cane planting programme.

Government also says that the sugar budget for 2016 has increased by more than $12 million. The real increase is not $12 million but $600,000. And this amount, Madam Speaker, has been allocated as grant to the Sugar Cane Growers Council in place of the levy paid by growers. This after Government decided to end all semblance of democracy in the Growers Council by legislating appointment of a nine-member Council instead of restoring elections and democratising the Council.

Madam Speaker, the Government seems to think that it can solve the problems of the sugar industry by itself. It cannot. Less than two years from September 2017, it has no plan. It must work with the stakeholders to find a way. It may already be too late to save the industry from disaster.

A sum of $9.7 million is listed as “subsidy” to South Pacific Fertilizers Limited. However this will be administered by the FSC. Last year his amount was listed under Head 50 and not the sugar industry.

And again Madam Speaker, is this a subsidy or a loan? In last year’s budget this was listed as a loan. Therefore growers end up repaying the amount as 100% of SPFL is owned by growers. So who is Government trying to fool Madam Speaker?

Furthermore, why should the FSC control this subsidy or loan and not the growers themselves? FSC has no stake whatsoever in SPFL, yet its executive Chairman also heads the Fertilizer Company. This is the height of injustice.

A sum of over 33 million dollars is listed as aid-in-kind. Last year an amount of 36 million dollars was similarly listed as aid. But what is this money? I repeat, the Minister failed to clarify our queries as to what the 36 million dollars was going to be used for. And it hasn’t seen the light of the day. Now this year we have the Budget documents stating a sum of over 33 million dollars. Again Madam Speaker, who is going to benefit from this aid? Is it the growers, the FSC or no one because there is no explanation about these funds.

Health and Education Reforms

Madam Speaker, I want to make a few comments about health and education. We all understand the importance of human capital. For our people, there is no point having a government if it cannot provide these basic services. From an economic point of view, there is no point spending hundreds of millions of dollars on roads if there are no healthy and productive people to use them.

Madam Speaker, we have spent hundreds of millions of dollars on reforming our roads. But when will we do this for our education system?

Recently the Education Minister made some shocking admissions about the quality of our education system. I pause here to thank him for that. Unlike many of his colleagues, who wish to pretend that there is no bad news, he at least is prepared to identify a problem.

Madam Speaker, the problem he identified was this: only 15% of our secondary school students achieve a “raw” pass rate in maths and 20% in the sciences. This now moves from shocking to deplorable. Here we have the Minister of Finance fantasizing about Fiji becoming a new Singapore or a new Mauritius – or, his latest dream, a new Geneva – when people who are leaving school without basic literacy skills. The deplorable state of our education system and the cost to Fiji will rear its head 5-10 years down the line if it is not arrested and addressed urgently and decisively. Not only will our productivity be seriously affected. So will social equality. Education is the surest way out of poverty for our poorest people. But now a mediocre education system threatens to trap them there. The rich will flee to private schools, as they are doing now, and the education gap between the rich and poor will become wider. That will heighten economic inequality and social instability. Madam Speaker, unless we can quickly get education back on track, we will never achieve our dreams of real, sustainable economic growth. Government’s neglect of this issue, like the sugar industry, is a ticking time bomb.

Madam Speaker, I commended the Minister of Education for his honesty. I am once again underwhelmed by his solutions. He appears to be suffering from the same disease as the Minister of Finance – too afraid to listen to critical comment and unwilling to engage with anyone whose views differ from his. I am asking him, for the sake of every school student in this country, to show that he is a bigger person than that. I am pleading that he ask for views especially those that he doesn't like, and urgently set up a process from which he can take the best ideas for reform. Nothing may be more critical than to get basic education back on track.

Madam Speaker, I turn now to health. The health budget, we are told, has been increased by to $280million, an increase of $11.2 million. But that is not enough. In 2009, the World Health Organisation recommended that governments increase their health budgets progressively by 0.5% of GDP annually. This was with the aim of increasing it to 5% of GDP. Unfortunately, the 2016 allocation represents a decrease in health spending as a percentage of GDP - from 3% of GDP to 2.9%. So we are going backwards.

However, Madam Speaker, in 2015 Budget, government promised to recruit 150 additional doctors and again promises to recruit the same number in 2016. However, the only 126 new doctor graduates have been recruited so far and we are told no expatriate doctors have been recruited. So we still have a shortfall of 24 for this year and yet we have allocated budget for another 150 for 2016. The Health Minister ought to come out clearly and explain the situation with the number of Doctors: how many have left the service this year, how many will graduate from medical schools this year and whether we will be able hire the additional 150 plus 24 in 2016.

Despite the increased allocation of the budget for the ministry, health services have been a major concern for the people of Fiji. From, poor services, long waiting lists and time, lack of drugs, non-functioning medical equipment, unavailability of doctors and nurses and timely diagnosis for patients with serious illness.

The introduction of a health levy is positive, but has the revenue collected from this been earmarked for specific health initiatives? We need to know this or we will assume that it is just another revenue measure by government.

At this Madam Speaker, I would also like raise the issue of Annual Tobacco Registration where government was collecting about $700,000 annually of which $400,000 was to be directed to NCD initiatives. This I am told was withdrawn in 2015 and has not been reinstated in the 2016 budget. Let us not pay lip service to the reduction of NCD related diseases and do something serious. All the amount collected should be directed to specific NCD activities.

Madam Speaker, we should review the nature of support through TELS and scholarship for medical courses. Typically, a doctor needs five years to complete the study, spends two years in rural service and then possibly undertake 4 years of specialty training and may be another two years for further specialty training abroad before being eligible for a specialist status. This a long and expensive investment for an individual. Therefore Madam Speaker, we need to review not only the conditions for training support but also urgently review the salaries of not only doctors but also for the nurses and other allied health workers.

On free medicine, I see that list has been increased to 142 items. However, we are told that this year only 20 items on the list were intermittently available. Is this announcement another gimmick to fool the people? The Minister for Health should just front up and tell us if whether the scheme is working or not. The politicking only gets one so far, because our people tuning in today are already lamenting the gross gaps between what they are told and what they actually experience. And these laments only appear to be growing louder by the day. Of course, if one is tone deaf that is easy to ignore.

Capital works allocation is another deception. We are told that many of the capital projects such as maternity ward in CWM, new Naulu Health Centre, Nausori Hospital and Mokoi Maternity unity in 2015 are languishing. What has happened to the allocation for the new tertiary hospital in Lautoka?

SDGs and Climate Change

Madam Speaker, the Budget documents show that Government is at least considering sound advice from the Opposition. Hon Nawaikula had made a public statement about the turf wars between the various government entities on Climate Change and thankfully it now appears that the Ministry of Finance's Strategic Planning Office will “holistically coordinate” as the new national focal point on all technical, policy development, and administrative functions related to climate change.

On the new role of the Strategic Planning Office, the AG states in his budget address that this office will hire “13 new staff to assist with the Climate Change section”. Madam Speaker, Climate Change is a very specialized field that is greatly dependent on institutional knowledge of the very fluid global developments especially in the technical and policy areas. A good portion of this expertise already resides in both the Environment Department and very recently the Ministry of Foreign Affairs, yet sadly we have not been able to retain some of that expertise as many of our homegrown experts have moved on. However, since Fiji has just recently appointed a Climate Change & Oceans Ambassador coming under the Ministry of Foreign Affairs, this move to bring Climate Change under the Ministry of Finance through the Strategic Planning Office, does not feel like it has been itself coordinated well.

Not surprisingly, the Office of the Attorney General has a separate “legal” climate change function to look into the issue of Pacific climate change refugees that will cost taxpayers $50,000. We would question why the Office of the Attorney General needs to have this separate function. Any legal implications on climate change will be very much tied to the Strategic Planning Office's policy developments, that inevitably cascade from developments at the international climate change talks that we already participate in. International media reports state that the Paris climate change talks may consider an International Climate Justice Tribunal. Therefore if the Office of the Attorney General intends that this isolated legal issue on climate change is to assess international legal redress mechanisms such as the International Court of Justice then quite simply, this is a Foreign Policy matter first and foremost. These administrative tricks should not be used to mission-creep for control into another government portfolio, because the list of items under Requisition this year already point to concerning trends on that front.

It is also worrying that despite the Prime Minister's statements in the UN General Assembly in September, particularly in support of SDG14 on Oceans, there is no mention of this coordination function of SDG's by the Strategic Planning Office into national plans. Neither, for that matter does “Green Growth”, the overnight buzzword of the Government.

Madam Speaker, this out of kilter coordination driven by a communications purpose but lagging behind on the policy front merely serves to highlight that the issues are important to the Government not because of the substantive relevance to our people, but simply because it serves another purpose such as the Government's desire to sit on the Human Rights Council.

Earning a seat on the Human Rights Council or presiding over the UNGA must not simply be for tokenistic profile-raising purposes. If Fiji wants to take these international roles seriously and be respected for what we can offer the world, then we must lead by example. The ILO proceedings; the continued human rights violations; and the ever restrictive environments of the media; all do nothing in our favour on this front.

Concluding Comments

Madam Speaker, time is running against my speech today. But in the long term, time is running against Fiji.

We cannot continue to leave economic policymaking to a confused politician, who changes his mind every time he thinks of a new slogan. We need policies that are clearly thought out and do not change with every new fashion he discovers.

This is what we are asking the Government to do:

- First, improve its own economic management and reporting. If the Budget it to be a meaningful exercise, and not a three hour monologue of political rhetoric, we must have facts and figures – as the law requires them to be delivered to us.

- Second, to develop a vision for economic management. We do not mean the tired old slogans about democracy and transparency and accountability. We mean a clear vision which the Government is prepared to commit to implement consistently. Government should become fully transparent on its spending and economic policies. The Budget should not be a surprise. It should be an opportunity for Parliament to critically review Government policy.

- If the Government will now remove the VAT exemption on basic food items, kerosene and prescription drugs, ensures that the poorest 60,000 households in Fiji receive compensating cash benefits. Otherwise, they will be condemned to even greater poverty. The Minister of Finance should remember – the poor do not buy hardware. They are not saving 6%

- Reverse the increase in STT and the imposition of the environmental levy to make up the shortfall in revenue, and protect the competitiveness of our tourism industry and the jobs it creates. Carefully review the tax incentives to the tourism industry.

- Terminate the services of Qorvis Communications immediately and save a few million dollars and save the country from false propaganda even if it means that the Finance Minister and his leader will not look so good and may have to write their own speeches.

- Decide upon a strategy to save the sugar industry. We in the Opposition are ready to help. Once that strategy is developed, we will need to act urgently to implement it.

- Review the budget for the Fiji Roads Authority and audit the work done for the last five years to see where we are going and what should be our priorities.

Madam Speaker, I will finish on this note. In a parliamentary system, the side which is not the government is known as “the loyal opposition.” We are loyal to Fiji and want the best for it. That is why we choose to sit here to make good on our promises to represent our voters. We may differ with the government of the day and how to achieve those results. But it is airing those differences and sharing ideas that yields the best decisions. If the Government is firm in its belief of its standing, they have no reason to fear such a process. Dissent, after all, is the highest form of patriotism.

The Minister of Finance has difficulty with the idea of consultation. He wants to be seen as the only brilliant person in the room. After all, if he cannot be seen as such, would there be any use for him? But that desire, too, is a fantasy. No one person has a monopoly over ideas. Madam Speaker, it may enlighten the Minister to learn that even I, as an economics expert, never stop learning and from even the most unconventional means... speaking to people, the “ordinary people” on the streets, in the teitei, in the markets, the buses, the rice and sugarcane fields. As confronting as this may seem to him, he is well advised to spend less time lecturing people and more time listening. He does not have all the answers. Indeed, as this Budget shows, he seems to have very few.

The economy may have surged for a while through borrowing and remittances. But we all know that this is not enough. We will need to re-look at our strategy and approach. We need political reform to restore trust and faith in our people and the international community. Without this we will be continuing to muddle through on the economy.

Madam Speaker, the Fiji First government should move away from its petulant politics where it wants to win every argument and decide every point. It appears that they once again seek to replace me as Chairman of the Public Accounts Committee as evident in the Standing Order amendments that it has tabled. What are they afraid of? Instead of trying to work hard to remove me as Chairman, they would do better to provide all the information in a timely manner that public accounts committee. Madam Speaker, if I don’t stay as Chairman, at least I will be free and be out of this sham that Fiji First Government is currently engaged in.

If it wants to establish genuine democracy, inclusive economic growth and improve the livelihoods of families we can help. We will not always agree, but if the Government is honest about its weaknesses, we can help. Let us as lawmakers leave a future that our children will be proud. We need to strengthen our intangible assets, our laws on property rights, efficient law and justice systems, skills, knowledge and trust, transparency, accountability and freedom.

Thank You and God Bless Fiji.

[1] [Fiji One News, August 5, 2014]

[2] [Fiji Sun, September 1, 2014]

[3] Fiji Times, 10 November 2015