*Sources in the Fiji Ministry of Foreign Affairs claimed to Fijileaks that the Ministry objected to the failed SODELPA 2022 general election candidate to take a woman, which they claim is NOT his WIFE or was his co-habiting PARTNER, to London when he was appointed Fiji's new high commissioner to the UK.Bula High Commissioner

HALLELUJAH, ITS RAINING MONEY MAN FROM THE CANADIAN CHAP"The primary responsibility must clearly rest with Prime Minister Sitiveni Rabuka who appointed the Special Emoluments Committee drawn from Parliament itself with NFP strangely not a member. Secondary responsibility must rest with the members of this Special Committee comprising Chairperson Linda [Lynda} Tabuya, Ro Filipe Tuisawau, Aseri Radrodro, Alvick Maharaj and Mosese Bulitavu, all of whom have tarnished their reputations. Thirdly, this debacle has been unprofessionally facilitated by a supposedly “independent” UNDP consultant (Ken Deveaux). But his Report was firstly not independent of the Tabuya Committee and secondly, his tables of statistics and analysis were professionally “shoddy”. This is a bad reflection on UNDP, his employer, who should have been concerned that good governance practices were undermined by their consultant’s Report, paid for using UNDP funds." All of Fiji, including responsible senior social leaders, have been up in arms over the fast-tracked decision of the Fiji Parliament on the 24th May 2024, in a specially extended sitting, to exorbitantly increase the emoluments of Ministers, Opposition Leader, MPs, the President and Speaker. Cunningly quiet has been the Employers’ Federation. The critics include The Fiji Council of Social Servies Executive Director (Vani Catanisiga), Dialogue Fiji (Nilesh Lal), the NGO Coalition on Human Rights, the FPSA General Secretary (Judith Kotobalavu), Unity Fiji leader and former Governor of the Reserve Bank (Savenaca Narube), FLP Leader (Mahendra Chaudhry), WCC head Shamima Ali and Jioji Kotobalavu (former senior civil servant). Dozens of very sensible Letters to the Editor in Fiji Times also continue to attack the Parliamentary decision. This entire debacle reflects very badly on Prime Minister Sitiveni Rabuka for approving the appointment of the Tabuya Committee in the first place, his brazen defence of the Report recommendations, the fast-tracking of the Parliamentary approval, then his ill-considered public threat to discipline his Coalition partner, the National Federation Party whose principled position has been internationally reported and respected throughout Fiji. Rabuka has now back-tracked considerably (FT 30/5/2024 “PM to listen to the people: Have your say”) but he is still deliberately fuzzy about how his Government will save its reputation. The public cannot forget his quiet opportunistic use of Bainimarama’s exorbitant per diems ($3,000 plus per day) with overseas jaunts for a whole year after becoming Prime Minister in 2022. Then just yesterday (31/5/2024) came the bombshell that the increase has already been gazetted and PM Rabuka is now saying that the changes will have to be implemented from 1 August 2024 but that he wont accept any rise personally. Hullo? This is not about you, Prime Minister. This is about the proper process and everyone’s remunerations in Parliament. AND there are two months remaining till 1 August 2024. This article focuses briefly on the process of decision-making by the Tabuya Committee but more the shoddy analysis and Report by the UNDP consultant (Deveaux) who connived to facilitate the Tabuya Committee Report. Nine years ago I had written a prophetic article (Fiji Times, 7 Feb, 2015) “The People’s Parliament: Letters to the Editor” and published also in Pacific Scoop (AUT): https://pacific.scoop.co.nz/2015/02/fiji-democracy-letters-to-the-editor-and-battling-censorship/ Today, it is abundantly clear that in this major test for the Rabuka Government, it is Fiji Times that is holding it to account, not the Fiji Parliament and certainly not the Opposition FFP which disgracefully collaborated with Rabuka’s People’s Alliance Party and Gavoka’s SODELPA for their own mutual selfish interests. But first, readers should watch this video clip of a former Prime Minister, the late Mr Laisenia Qarase very humbly answering questions about his own salary as Prime Minister (a mere $106 thousand), just before he was treasonously deposed by Voreqe Bainimarama in 2006, supported by other senior RFMF officers, some in the Fiji Parliament today as FFP MPs. https://www.facebook.com/FijianChiefs/videos/what-was-your-salary-mr-qarase-when-you-were-the-pm-and-what-is-the-salary-of-th/1773903689563594/ Public Popular Uproar and Parliamentary fast tracking First, why was the parliamentary decision fast-tracked and voting done through an extended Friday afternoon session? Remember FTUC General Secretary (Felix Anthony) came out with “tongue in cheek” support demanding that the outrageous increases must be extended to all the workers of Fiji who were fighting for a decent Minimum Wage and Wages Councils Orders? Given that Government is currently considering (and taking its time) the setting of Minimum Wages and the Wages Councils Orders, the threat of escalation of general wage and salary demands must mean fuelling a wage-price spiral which would hurt those in the informal sector and the poorest the most. But as important, any comparable increases to the public service salaries, must also scupper any attempt by the Minister of Finance to control public expenditure which is the only hope for reducing Fiji’s massive Public Debt curse left by the Bainimarama Government (see Graph 4 below). It is no wonder that the Minister of Finance said on Friday morning “it is still a Report and if we need to shelve it, we can”. But lo and behold, that very afternoon the Chairperson of the Emoluments Committee (Linda Tabuya) called for a special extension of the parliamentary sitting and zipped the Bill through with most FFP MPs also supporting Government, a unique moment of co-operation- in their own selfish interests. Responsibility for this debacle? There have been no positive comments on this debacle, other than by the Prime Minister Sitiveni Rabuka and the Leader of the Opposition (Inia Seruiratu), both of whom stand to gain massively in comparison to the salaries and remuneration what prevailed under the Government of the late Laisenia Qarase (before the Bainimarama/Khaiyum Government escalated their own benefits. See my graphs 1, 2 and 3 below). The primary responsibility must clearly rest with Prime Minister Sitiveni Rabuka who appointed the Special Emoluments Committee drawn from Parliament itself with NFP strangely not a member. Secondary responsibility must rest with the members of this Special Committee comprising Chairperson Linda Tabuya, Ro Filipe Tuisawau, Aseri Radrodro, Alvick Maharaj and Mosese Bulitavu, all of whom have tarnished their reputations. Thirdly, this debacle has been unprofessionally facilitated by a supposedly “independent” UNDP consultant (Ken Deveaux). But his Report was firstly not independent of the Tabuya Committee and secondly, his tables of statistics and analysis were professionally “shoddy”. This is a bad reflection on UNDP, his employer, who should have been concerned that good governance practices were undermined by their consultant’s Report, paid for using UNDP funds. First go back to the 2014 precedent, facilitated by the same consultant. The disgraceful 2014 precedent In 2014, the Fiji Parliamentary Remunerations Decree 2014 (No. 29) set out the fine principles supposed to be followed (also quoted by Deveaux in his Report): * be transparent in the use of public money, with no hidden perks (OK); * be competitive with both the private and public sectors so as to attract persons of the right calibre to lead the country (HA HA HA); * be fair to the person or incumbent for the work they do (HA HA HA); * be fair to taxpayers and take account of prevailing economic conditions (HA HA HA); * reflect the ethos of political service which entails making sacrifices (HA HA HA); * maintain the confidence in and integrity of Parliament (HA HA HA); * and set the remuneration at a rate lower if necessary (HA HA HA). BUT were these principles put in practice by either the Bainimarama Government in 2014 or the Rabuka Government in 2024? HA HA HA. For a start, contrary to good governance practice, this Decree astonishing stated (paragraph 3) that Parliament itself, would set the remuneration for members of parliament. The 2014 Decree published a Schedule of salaries and was "signed into law" by the illegally appointed President of Fiji then, former RFMF Commander Ratu Epeli Nailatikau. What happened in 2014 has happened again in 2024 under PM Rabuka, except that a supposedly “independent” foreign consultant (Deveaux) was used to do the dirty work (no doubt for a fat consultancy fee). Can you imagine what Fiji (and the Fiji Employers Association) would say if FPSA and FTUC were to announce that from hence forth their wages and salaries would be set by a committee appointed by themselves? It is no wonder the Employers Federation is deathly quiet. Deveaux very selectively chose “comparator” countries out of thin air with no rhyme or reason, including NZ and Australia- both developed high income countries, whose higher incomes he did not adjust for at all. Deveaux also very strategically chose not to ask: what process do NZ and Australia follow in setting the remuneration of their MPs? I just give NZ’s excellent example (which any decent Fiji Parliament should follow). Process followed by NZ? NZ has a permanent Remuneration Authority (NZRA) which regularly determines the salaries and allowances of all Members of Parliament, including the Prime Minister, Leader of Opposition and Speaker. Fiji Times readers can visit this website: https://www.legislation.govt.nz/regulation/public/2020/0327/latest/LMS438252.html The three members of the NZRA are highly competent in their own rights, at or above the levels of the persons whose salaries they are setting. Three years ago, the Chair (Hon Dame Fran Wilde) was a former Minister in the NZ Government, former Mayor of Wellington, CEO of the NZ Trade Development Board, and experienced company director in both the private and public sectors. The second member was the owner, director and Principal Consultant for a company that specialised in advising private and public sector companies in setting salaries and remuneration for their top executives. The third member had been the National Statistician of UK and NZ itself, and a past President of NZ's Institute of Public Administration. In contrast, the public can ask: what exactly are the credentials of the Fiji’s Tabuya Committee? Credentials of the Tabuya Committee? Why did the Rabuka Government not select a professional external committee from the private sector (perhaps corporate leaders), accounting and auditing firms, public enterprises, important NGOs, and past senior civil servants? If you are going to unwisely draw from your MPs, why would you ignore the Minister of Minister of Finance, Planning and Statistics responsible for the Fiji budget that pays the remuneration of parliament, and who is moreover a Professor of Economics? But then, NFP had opposed this Committee from the beginning and its submission was conveniently ignored by the Tabuya Committee, PM Rabuka, Opposition Leader (Inia Seruiratu) and the consultant Deveaux. Chair Linda (Lynda) Tabuya’s suitability for her role can be seen in her disingenuous arguments since the Report was released. She first argued that her Ministry’s Budget was bigger than that of the Minister of Finance and so her salary should be the same as his. How can Tabuya not understand that the Minister of Finance is responsible not only for setting the budgets for all the Ministries (including hers) but also setting the economic environment for the entire country? How can Tabuya not understand that there are other much larger Ministries (like Education and Health) whose Minister should be paid more because the workload is more. Linda (Lynda) Tabuya also complained that her own salary was lower than that of her Permanent Secretary. But as has been pointed out by the public, this is the case in most developed countries, simply because of the rigorous criteria that have to be satisfied before a person was appointed to the highest civil service position in a ministry. I suspect that some Ministers can be sent home on full pay for the full term of parliament, and their Ministries would continue operating quite efficiently under the Permanent Secretaries; or do even better in some without the interfering perpetually grandstanding Ministers in salusalus (you fill in the names). The flawed Committee-Consultant Process While even the 2014 Legislation states that the Tabuya Committee could have obtained independent advice, it chose not to, but it allegedly “requested the assistance of an independent consultant to conduct an analysis of the current remuneration for all of the offices noted above and to report to the Committee with specific findings and recommendations”. The consultant (Deveaux) just ever so conveniently happened to be one who had already been used by the Bainimarama Government to escalate their salaries. HA HA HA. It is clear from Deveaux’s Report that it was NOT at arms length. Deveaux himself states that he prepared a Preliminary Report and: “Once the consultant received feedback from the Committee on the preliminary findings provided, the consultant conducted an analysis of the data and evidence collected and produced a draft of the report with recommendations. The draft report was presented to the Committee at the start of November. Based on the feedback provided by the Committee (YIPPEE?), the consultant finalised this report.” It is abundantly clear that the Tabuya Committee had a continuous strong input into the Draft Report AND the Final Report. Deveaux’s flawed selection of countries Deveaux reports he chose the following jurisdictions for the comparative analysis of salaries and remuneration: New South Wales State, South Australia State, Victoria State, New Zealand Papua New Guinea and Trinidad & Tobago. He argued “All of these jurisdiction have a similar parliamentary system as, with Fiji, they are members of the Commonwealth Parliamentary Association and their systems have evolved from the Westminster model of parliamentary democracy. For the first five noted above, they are jurisdictions in the Pacific region. Papua New Guinea is a developing country. For Trinidad & Tobago, there are remarkable similarities to Fiji, with regard to demographics, culture, population, historic colonial impact, and development status (middle income).” But why would you select the developed countries or states from the Pacific with massively different GDP per capita and different fiscal situations compared to Fiji? Why choose to list developing countries for which you did not even have data? Deveaux compares the parliamentary salaries with that of “Average Incomes” of some countries (not all) for which he gives no authoritative sources. His estimate for Fiji ($22,097) is way above my estimate for Fiji from FBS data ($14,562). He claims that he had no data for Papua New Guinea or Trinidad and Tobago, so compared their parliamentary salaries with that of “Teachers". How utterly ridiculous. Then when he has some salaries in the table for Fiji and the developed countries, he makes no further analysis allowing for their different average incomes, just implying that the Fiji emoluments should be higher, towards that of NZ or Australia. Then in another Table where he lists all the salaries of the Presidents, Prime Ministers, Speakers, and MPs, again, he draws no comparison with the Average Incomes. Finally, the consultant boldly claims “However, it is possible to see from Victoria State, New South Wales State, and New Zealand, where full data sets were available, the ability to compare to Fiji office holders.” WOW. How pathetic is it that this UNDP Consultant compares Fiji parliamentary emoluments with those of developed countries like Australia and NZ, simply because there was data available for the developed countries but not the developing countries (which he previously selected out of the blue then ignored thereafter). Even a USP junior economist would not make these methodological mistakes which the Tabuya Committee clearly had no inkling of. My crude analysis: comparing NZ with Fiji Any economist worth his/her salt would know that to compare parliamentary salaries of NZ and Fiji, one must take into account the capacity of those countries’ taxpayers to pay those salaries. Good economists would usually public sector salaries compare with GDP per capita (as even Rick Rickman, an elderly FNPF pensioner pointed out on social media). Graph 1 compares the salaries of the Prime Minister in NZ, with that of the late Qarase, then of PM Bainimarama which PM Rabuka is also on. The GDP per capita data in Constant Local Dollars (not perfect but will do roughly) is derived from World Bank’s development database. * The NZ Prime Minister had 8 times the NZ GDP per capita. * Prime Minister Qarase had 12 times the Fiji GDP per capita. * But Bainimarama increased his PM salary to 30 times that of Fiji’s GDP per capita. Under the Tabuya Committee recommendation will be ever so slightly reduced to 29 times the GDP per capita still massively higher than the Qarase relativity.

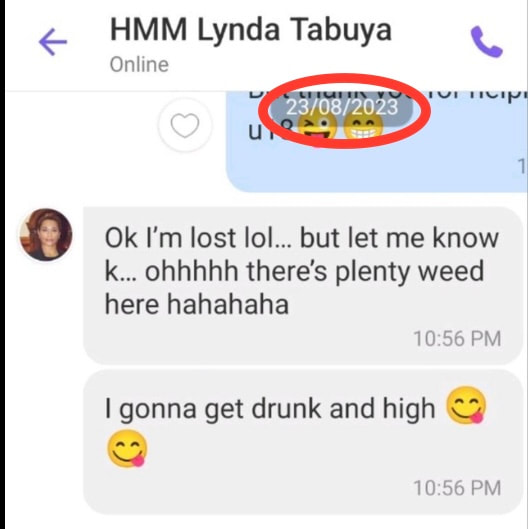

The Fiji public can also ask themselves by reading Hansard or the daily newspapers of the TV and radio transcripts, how many times and how many of Fiji MPs have ever displayed their superior skills in “legal analysis” or “policy analysis” or budget analysis” other then when reading prepared speeches? I suggest that there is more sensible analysis done by the many writers of Letters to the Editor of Fiji Times. Deveau astonishingly claimed that that the closest set of skills in the private sector to that required of MPs in the Fiji Parliament was that of a barrister or solicitor, earning in excess of $100,000 a year. WOW. How many of Fiji’s MPs have ever been employed at these salary levels, with the exception of a few like Professor Biman Prasad. Employment Prospects of Military Prime Ministers? There is little doubt about the market value of the former Prime Minister the late Lasenia Qarase, who left a high paying job as Head of the Fiji Development Bank to become Prime Minister. He is probably the most honest and hard-working PM Fiji has ever had (except that the late Dr Bavadra and Mr Mahendra Chaudhry were never allowed to complete their term). But before setting the remuneration of Prime Ministers, Fiji should ask itself: what is the “market value” to Fiji taxpayers of military prime ministers like Voreqe Bainimarama and Sitiveni Rabuka? Or Leaders of the Opposition Inia Seruiratu or the Speaker of the House Lalabalavu? Think of the billions of dollars damage done by RMF Commanders and officers to the economy and national income of Fiji, starting with the precedence set by the Rabuka coup in 1987. What of Rabuka’s NBF disaster which cost Fiji more than $200 million dollars in 1997 prices (in excess of $500 million in today’s prices). What of the 2000 coup which Bainimarama refused to stop even though he was told about the planning six months before, and the actual CRW coup a week before (but conveniently left the country)? What of former Commander Epeli Nailatikau as President signing Bainimarama's decrees before the 2014 Elections including that robbing FNPF pensioners and stopping the case from being heard in court? Remember when Bainimarama did the coup in 2006, he promised that no military officer would benefit from the coup and that no military officer would ever stand for elections? Really? We can even ask: what jobs can these former military officers get in the private sector and at what salaries, were they not to be in Parliament? Consultant’s Shoddy Reasoning about Current Economic Circumstances Deveaux claimed “The current economic circumstances in Fiji are significantly improving since the catastrophic downturn due to the COVID-19 pandemic. Indeed, it can now be said that Fiji has recovered from the pandemic-induced recession of 2020-21 and with a 20.0% increase in GDP in 2022. In 2023 it is forecasted to grow by another 8.3% and in 2024 another 3.7%”. He completely missed the point that the large increase in 2022 was precisely because the growth was from the low base in 2020 and 2021 due to COVID. Deveaux even notes that the growth rate was predicted to go down to 8.3% in 2023 and 3.7% for 2024. The consultant then lists the rates of inflation for the last three years (4.3%, 3.0% and 3.0%) and then leaps to the grand conclusion “Therefore, it is concluded, for purposes of this report, that the economic conditions in Fiji in 2024 do not warrant a limitation on the salaries and allowances of the office holders”. What pathetic reasoning. * What about the massive Public Debt that the current Fiji Minister of Finance is struggling to bring down: from 89% in 2022 to 80% in mid-2023 and unlike to reduce in 2024 or 2025? (look at Graph 4); or read here: https://narseyonfiji.wordpress.com/2022/11/19/voters-the-ffps-public-debt-and-the-poisoned-chalice-for-the-next-minister-of-finance-ft-19-11-2022/ * What about the massive rates of poverty, especially among the indigenous Fijians? * What about the crumbling public infrastructure in water, sewage, roads? * What about the crumbling health services and public hospitals and health centres? It is utterly disgraceful that the UNDP, a UN organization focused on good governance and a wide range of development indicators (by which Fiji is failing and even regressing), should be associated with a mediocre consultancy Report like that of Deveaux, which undermines Fiji’s parliamentary good governance at the core. Consultant’s Saving Grace: what he should have done The Consultant’s reputation is saved only slightly in that he recommends at the end of his Report that the Parliamentary Remuneration Act (2014) should be amended to require an Independent Review of Office Holders’ Salaries and Allowances to ensure that elected officials have no influence over the determination of their salaries and allowances. He points out that it can be done easily done by amending the Higher Salaries Commission Act or appointing an ad hoc Commission. So WHY, WHY, WHY did he still go ahead and make his own recommendations, with his shoddy analysis, with an equally shoddy input from the Tabuya Committee itself? Even if the recommendations are going to be implemented only between 1 August and 31 December 2024, why would Deveaux make his salary and allowance determinations, given that it must set some kind of precedence? Was this in fact the “Game Plan” of some smart cookie in the Tabuya Committee, having seen the Submission by the National Federation Party. It is no wonder that the Tabuya Report was rushed through Parliament in a special sitting on the Friday afternoon. NFP Submission It is to the credit of the National Federation Party that they gave a principled submission which was clearly ignored by the Tubuya Committee and by the Consultant Deveaux. NFP stated clearly “The Committee must not make any determination whatsoever. It cannot also make recommendations. Otherwise it will be seen as another body which compromised the independence of this crucial process…. Elected legislators must treat any review of salaries and allowances at arms length, because of the self-serving inferences that may be drawn.”. NFP recommended that subject to independent analysis by experts that there be (a) reduction in salaries by 30% of the Prime Minister and Ministers and (b) reduction in overseas travel allowances for the PM, Cabinet Ministers and Members of Parliament (c) reductions to loadings for per diems based on UN DSAs These were all ignored by the Emoluments Committee although Deveaux supported the reduction of per diems correctly noted as incentivising overseas travel. Fiji not out of the woods yet It is clear that PM Rabuka is now thoroughly rattled but he is still fuzzy. He first stated (FT 30/5/2024) that the a Bill to amend the Parliamentary Remunerations Act 2014 will be prepared by the Solicitor General’s Office, and be available for public consultations and independent review before it is considered by Cabinet and Parliament. Rabuka stated that factors to be considered before the Bill is presented to Parliament will be availability of funds and options to minimize impact on the national budget. An annoyed public must of course ask, “why did you not do this in the first place?” But yesterday it came out that the salary changes have been already gazetted and Rabuka now claims they have to be now followed. Hullo? There are two months before the gazette comes into effect and as Mahendra Chaudary demands (FT 31/5/2024), Parliament should suspend that gazette. PM Rabuka can still save his reputation by calling for a special Bill from the Solicitor General’s Office that suspends the previous decision AND establishes a genuinely independent “Parliamentary Salaries Remuneration Authority” (like NZ’s) based on specific nominations by social leaders (unions, NGO Coalition on Human Rights, Employers’ Federation), which will make its specific determinations taking into account all the principles discussed earlier? This parliamentary remunerations exercise will not require any input by the Rabuka Government or Opposition or Parliament or any foreign consultant or party hacks. It can also be implemented from 1 January 2025. Most importantly, if the remunerations are recommended to go back to the relativities of the Qarase years (as I think they should given my analysis above in Graphs 1, 2 and 3 above), the total overall cost to the taxpayers and the Government Budget will be LESS than currently, and the next Budget will have some savings0 to devote to poverty alleviation with most going to the iTaukei poor. BUT the sixty four thousand dollar question: will the Rabuka Government “fast-track” this Bill the way they did the Tabuya Committee recommendations? HA HA HA. Post-script (1 June 2024): My apologies. Before the 2022 Elections I went to considerable lengths through Fiji Times articles and appearances on the influential Sashi Singh’s Talking Points, to support the election of the Rabuka/Prasad Coalition Government, who scraped in by just one vote in Parliament. Since then, although the primary objective of seeing the last of the Bainimarama Government was achieved, like many members of the public I have been steadily disappointed by the Rabuka Government’s poor performance. Source: The Fiji Times Rabuka: "How dare Biman Prasad VOTE against whopping pay rise, house, allowances for the SPEAKER, Tui Cakau, 'my paramount chief'."Fijileaks: It has emerged from the Parliamentary Emoluments Committee Report that the NFP had 'objected' to the pay rise in its letter dated 11 August 2023. Eleven days later, Pio Tikoduadua, the NFP Whip accompanied Tabuya to the conference in Melbourne where she had brutal sex with Aseri Radrodro in Room 233 on 23 August 2023. |

Fijileaks: FICAC must investigate whether Biman Prasad, as Finance Minister, embezzled Fiji taxpayers money to bankroll his NFP?"In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. NFP paid itself an extra $240000 without consultation or Cabinet approval." LYNDA TABUYA in her press statement |

"Fiji Labour Party has also consistently questioned the Minister’s tendency to give public money to his own cronies and political allies without expressions of interest being called, eg:

• $200,000 Girmit Funds to the defunct and discredited Global Girmit Institute of which his wife and close ally Ganesh Chand were trustees at the time. We are still awaiting audited detailed accounts for this

• $1m to the Pacific Polytechnic Institute, a virtually bankrupt organization at the time, with which Ganesh Chand was closely associated.

Labour agrees that such “patterns of behaviour” are typical of Minister Prasad and call for a public explanation and response.

He cannot hide behind the claim that he is working on the Budget and is too busy to respond."

Serious allegations have been hurled against Finance Minister Biman Prasad by a fellow Minister in the Coalition government to which he should respond in the interests of accountability and transparency.

In a media release following the debacle over parliamentary pay increases this week, Minister for Women, Children and Social Protection, Lynda Tabuya claims that on several important policy matters the Finance Minister acted unilaterally without getting Cabinet or parliamentary approval.

She also alleged that as NFP leader he made an approach to the Fiji First Party last week to form a coalition government ostensibly to undermine the Rabuka government.

Biman Prasad told the Fiji Sun he was too busy working on the next Budget to respond to such allegations.

While this is definitely a matter for the Prime Minister to handle, if true, it reflects adversely on Mr Prasad’s loyalty to the Coalition and should be cleared up. His silence in the matter can be seen as acquiescence. It undermines political stability and casts doubts on Biman’s integrity as a Coalition minister.

What concerns us more is substantiation by Ms Tabuya of our own allegations (Labour) earlier that the Minister awarded $1.3m a year to the four political parties in Parliament without obtaining parliamentary approval for it. Nor was it mentioned in his 2023/24 Budget address. It was done surreptitiously and was only exposed when the then Fiji First general-secretary Aiyaz Sayed-Khaiyum queried it publicly.

Now we are told by Ms Tabuya that he did not even have Cabinet approval for this move. Not only that. By giving each political party in Parliament an equivalent $325,000 a year regardless of the number of MPs they had, he ensured benefits to NFP and Sodelpa way above what they were entitled to.

Labour had taken this matter up with the Secretary-General to Parliament and with the Electoral Commission, neither of whom have bothered to respond.

Minister Tabuya further alleges that as Finance Minister, Biman Prasad acted without Cabinet approval when he unilaterally:

• #Blocked a 20% pay increase for Prison Officers, earlier this year, awarded to them in a 2018 Job Evaluation exercise but had then been blocked by former PM Bainimarama

• Although several Coalition ministers lobbied for the promised #minimum wage increase to be implemented with immediate effect, NFP which held the Employment portfolio stalled on this to appease their “business backers”.

• Changed the payment of #bus fare subsidies to the elderly and the disabled from $25 a month to that based on usage without Cabinet approval or consulting with the line Minister

These are serious allegations to which Minister Prasad must respond.

Apart from the questions we raised over the unlawful $325,000 a year payment made to each political party in Parliament, Labour has also consistently questioned the Minister’s tendency to give public money to his own cronies and political allies without expressions of interest being called, eg:

• $200,000 Girmit Funds to the defunct and discredited Global Girmit Institute of which his wife and close ally Ganesh Chand were trustees at the time. We are still awaiting audited detailed accounts for this

• $1m to the Pacific Polytechnic Institute, a virtually bankrupt organization at the time, with which Ganesh Chand was closely associated.

Labour agrees that such “patterns of behaviour” are typical of Minister Prasad and call for a public explanation and response.

He cannot hide behind the claim that he is working on the Budget and is too busy to respond.

In a media release following the debacle over parliamentary pay increases this week, Minister for Women, Children and Social Protection, Lynda Tabuya claims that on several important policy matters the Finance Minister acted unilaterally without getting Cabinet or parliamentary approval.

She also alleged that as NFP leader he made an approach to the Fiji First Party last week to form a coalition government ostensibly to undermine the Rabuka government.

Biman Prasad told the Fiji Sun he was too busy working on the next Budget to respond to such allegations.

While this is definitely a matter for the Prime Minister to handle, if true, it reflects adversely on Mr Prasad’s loyalty to the Coalition and should be cleared up. His silence in the matter can be seen as acquiescence. It undermines political stability and casts doubts on Biman’s integrity as a Coalition minister.

What concerns us more is substantiation by Ms Tabuya of our own allegations (Labour) earlier that the Minister awarded $1.3m a year to the four political parties in Parliament without obtaining parliamentary approval for it. Nor was it mentioned in his 2023/24 Budget address. It was done surreptitiously and was only exposed when the then Fiji First general-secretary Aiyaz Sayed-Khaiyum queried it publicly.

Now we are told by Ms Tabuya that he did not even have Cabinet approval for this move. Not only that. By giving each political party in Parliament an equivalent $325,000 a year regardless of the number of MPs they had, he ensured benefits to NFP and Sodelpa way above what they were entitled to.

Labour had taken this matter up with the Secretary-General to Parliament and with the Electoral Commission, neither of whom have bothered to respond.

Minister Tabuya further alleges that as Finance Minister, Biman Prasad acted without Cabinet approval when he unilaterally:

• #Blocked a 20% pay increase for Prison Officers, earlier this year, awarded to them in a 2018 Job Evaluation exercise but had then been blocked by former PM Bainimarama

• Although several Coalition ministers lobbied for the promised #minimum wage increase to be implemented with immediate effect, NFP which held the Employment portfolio stalled on this to appease their “business backers”.

• Changed the payment of #bus fare subsidies to the elderly and the disabled from $25 a month to that based on usage without Cabinet approval or consulting with the line Minister

These are serious allegations to which Minister Prasad must respond.

Apart from the questions we raised over the unlawful $325,000 a year payment made to each political party in Parliament, Labour has also consistently questioned the Minister’s tendency to give public money to his own cronies and political allies without expressions of interest being called, eg:

• $200,000 Girmit Funds to the defunct and discredited Global Girmit Institute of which his wife and close ally Ganesh Chand were trustees at the time. We are still awaiting audited detailed accounts for this

• $1m to the Pacific Polytechnic Institute, a virtually bankrupt organization at the time, with which Ganesh Chand was closely associated.

Labour agrees that such “patterns of behaviour” are typical of Minister Prasad and call for a public explanation and response.

He cannot hide behind the claim that he is working on the Budget and is too busy to respond.

*We must not conflate Lynda Tabuya's bonking and drug-taking in Room 233 with her scathing attack on BIMAN PRASAD and the NFP MPs. |

*In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. Hon Prasad paid his own party an extra $240000 without consultation or Cabinet approval. This is a figure that is more than the total increase in salaries for ministers recommended by the independent consultant $175000, just to put things in perspective." |

*In my own ministry (Ministry of Women, Children and Poverty Alleviation) Hon Prasad unilaterally changed the payment of bus fare subsidies to our elderly and disabled in the current budget from $25 a month to utilisation basis without consultation with me as the line minister or Cabinet approval.

Other ministers may have their own experiences which is theirs to tell."

"The draft report of the independent consultant was ready in March and it was circulated to the three political party leaders in government. Members of the Fiji First party in the committee also shared it with their party.

*The leader of NFP Hon Biman Prasad lied in parliament and to the public in stating that he and his party only got notice of the report 48 hours before I moved the motion in parliament. NFP chose not to be members of the Emoluments Committee.

*I raised the membership in caucus and spoke with the NFP Whip Hon Tikoduadua who stated for us to go ahead and that they did not need to be in it. At no time did they protest or raise the concern to be a member of the committee. They endorsed the motion for the review to be undertaken when the motion was moved in Parliament last year. They have been part of the process every step of the way. To change their stance last minute and vote against the motion because of a party directive is simply an excuse to stall the parliamentary process when he had the time from March to take the report back to his party. There was nothing rushed about the tabling of the motion for debate last week.

"This parliamentary process of emoluments is out of his [Biman Prasad's] control and in my opinion I have seen the frustration and anger in his demeanor and that is the reason why he and his MPs have opposed this motion, aside from the fact that he is opposing the reduction of his own salary from $235,000 to $200,000." |

*In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. Hon Prasad paid his own party an extra $240000 without consultation or Cabinet approval. This is a figure that is more than the total increase in salaries for ministers recommended by the independent consultant $175000, just to put things in perspective.

*In my own ministry, Hon Prasad unilaterally changed the payment of bus fare subsidies to our elderly and disabled in the current budget from $25 a month to utilisation basis without consultation with me as the line minister or Cabinet approval. Other ministers may have their own experiences which is theirs to tell.

LYNDA TABUYA

TERA Kya Hoga Kalia, Biman Prasad? Aab Lynda Ke Goli Khao?

*Tabuya strips NFP leader and Finance Minister down to his 'underwear'.

*Ironically, NFP and Prasad had chosen to remain silent when Lynda Tabuya and Aseri Radrodro, in August 2023, had pulled down their own 'underwear' in Room 233, brutally bonking on Fiji Taxpayers money, that the next day she could not walk properly on the streets of Melbourne.

*It was one month after she had been appointed Chair of the Parliamentary Emoluments Committee in July 2023.

*Tabuya BRUTALLY savages Prasad over Pay Rise and Allowance Report

*When NFP did not get their way at the Wednesday caucus meeting last week, I was reliably informed that NFP allegedly approached Fiji First to open discussions on an NFP/FFP coalition, and Hon Prasad issued a warning to the Hon Prime Minister about the coalition agreement. I will categorically state here that at no time during this entire process from July 2023 did NFP oppose the recommendations or raise any objections from March when they had over two months to consider it."

LYNDA TABUYA: NFP glorifies itself in being principled but this is not about principles, this is about control, the need for Hon Prasad to control what is paid out, when it is not his place to do so. This parliamentary process of emoluments is out of his control and in my opinion I have seen the frustration and anger in his demeanor and that is the reason why he and his MPs have opposed this motion, aside from the fact that he is opposing the reduction of his own salary from $235000 to $200000. They were never going to oppose the recommendations, but wanted more time and used the party directive as an excuse to try to control the process. NFP was given ample time to consider the report from 9th of March, and Hon Prasad has lied to the public about only getting notice of it 48 hours before the motion was moved.

*He [Biman Prasad] blocked the 20 per cent payment earlier this year owed to prison officers after the Job Evaluation Exercise in 2018 which the then Prime Minister Frank Bainimarama stopped the payment which the prison officers felt was because he found out that they voted for the opposition in the 2018 general elections.

*Several coalition members lobbied for the minimum wage increase to be implemented with immediate effect last year when the coalition government came into power, but this in my opinion has been stalled by NFP who hold the employment portfolio and continue to appease their party backers who are business owners as well as using it as their own political platform.

*In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament.

"Hon Prasad has lied to the public that no independent consultant was engaged. There have been a lot of attacks on the committee members and the praising of NFP for their vote against the motion. However, this is the process of parliament and it was my duty to table the report and move the motion for debate. I was to do this on Wednesday of parliament week last week but NFP tried to stall it with no good reason to disrupt the processes of parliament. I reconsidered my duty and proceeded to give notice for the motion to be tabled and debated as that is the proper parliament procedure and I could be referred to Privileges Committee by any MP for a possible breach of the standing orders. When NFP did not get their way at the Wednesday caucus meeting last week, I was reliably informed that NFP allegedly approached Fiji First to open discussions on an NFP/FFP coalition, and Hon Prasad issued a warning to the Hon Prime Minister about the coalition agreement. I will categorically state here that at no time during this entire process from July 2023 did NFP oppose the recommendations or raise any objections from March when they had over two months to consider it."

"He [Biman Prasad] blocked the 20 per cent payment earlier this year owed to prison officers after the Job Evaluation Exercise in 2018 which the then Prime Minister Frank Bainimarama stopped the payment which the prison officers felt was because he found out that they voted for the opposition in the 2018 general elections."

Dear NFP, the prison officers and high ranking officials in the Corrections Service already knew about it and expressed their deep hurt and disappointment to me that PAP who stood for them allowed for NFP to stop it.

So NFP that didn’t come from me. So don’t hide behind cabinet confidentiality now to answer for what they already know Hon Prasad and which Fiji has a right to know. Respond to the allegations and do not hide now behind cabinet confidentiality as it does not apply here, because nowhere in my media release did I ever refer to a cabinet deliberation or decision on this issue.

Dear Fiji, here is the full media release I gave out yesterday to media outlets that contains the explanation of the parliamentary processes as well as the allegations I have made against Hon Prasad and NFP.

MEDIA RELEASE BY HON TABUYA ON TUESDAY 27th May 2024

I am responding to explain the parliamentary process as well as I feel the need for the public to know the truth about the involvement of all MPs, including NFP.

The Emoluments Committee was a committee established by Parliament under the Standing Order 129 to be tasked to review the Parliamentary Remunerations Act and the Parliamentary Retirement Allowances Act. This committee was established under the Standing Orders of Parliament which all 55 members of parliament unanimously endorsed in July 2023. It is a parliamentary process that reports to parliament, not to cabinet, not to a political party, not to Government or opposition. The committee decided to engage an Independent consultancy firm or individual as it strongly felt it should not be reviewing its own salaries and allowances. The Committee published an advertisement calling for independent consulting firms or individuals to undertake the review and make recommendations to the committee. With no success locally, we reached out to UNDP to assist us to find an independent consulting firm, noting that UNDP would be funding the independent consulting firm, they identified Mr Kevin Deveaux. After conducting the review, the independent consultant reported back to the Emoluments Committee, which endorsed the recommendations. There were some increases, some reductions and some retained.

The legal process of the Emoluments Committee is that it is part of the parliamentary process and reports to Parliament. It does not report to the government or to cabinet. It is for parliament to reject or approve the recommendations. Should it be approved, then the committee will work with Parliament and the Solicitor General’s office on the proposed amendments to the Acts to give effect to the recommendations, but the proposed laws will go through the normal consultation process of any proposed bills.

The draft report of the independent consultant was ready in March and it was circulated to the three political party leaders in government. Members of the Fiji First party in the committee also shared it with their party. The leader of NFP Hon Biman Prasad lied in parliament and to the public in stating that he and his party only got notice of the report 48 hours before I moved the motion in parliament. NFP chose not to be members of the Emoluments Committee. I raised the membership in caucus and spoke with the NFP Whip Hon Tikoduadua who stated for us to go ahead and that they did not need to be in it. At no time did they protest or raise the concern to be a member of the committee. They endorsed the motion for the review to be undertaken when the motion was moved in Parliament last year. They have been part of the process every step of the way. To change their stance last minute and vote against the motion because of a party directive is simply an excuse to stall the parliamentary process when he had the time from March to take the report back to his party. There was nothing rushed about the tabling of the motion for debate last week. It is simply me doing my job as the chair to follow the parliamentary process under the Standing Orders to table the report and to be debated. That is the legal process. The motion approved on Friday stipulates the effective date from 1st August to 31st December 2024. The next step in the process is for Parliament to work with the Solicitor General’s office and it will go through the process normally laid out for proposed bills. Then it will be brought back to parliament for debate and decision. This will be undertaken in that six month period stipulated in the motion. Members of the public are free to submit their views during this period.

Now I wish to respond to all the criticisms leveled at members of Parliament who voted for the motion by NFP. Hon Prasad has lied to the public that no independent consultant was engaged. There have been a lot of attacks on the committee members and the praising of NFP for their vote against the motion. However, this is the process of parliament and it was my duty to table the report and move the motion for debate. I was to do this on Wednesday of parliament week last week but NFP tried to stall it with no good reason to disrupt the processes of parliament. I reconsidered my duty and proceeded to give notice for the motion to be tabled and debated as that is the proper parliament procedure and I could be referred to Privileges Committee by any MP for a possible breach of the standing orders. When NFP did not get their way at the Wednesday caucus meeting last week, I was reliably informed that NFP allegedly approached Fiji First to open discussions on an NFP/FFP coalition, and Hon Prasad issued a warning to the Hon Prime Minister about the coalition agreement. I will categorically state here that at no time during this entire process from July 2023 did NFP oppose the recommendations or raise any objections from March when they had over two months to consider it.

But in my opinion this is not a new pattern of behavior for Hon Prasad. He blocked the 20 per cent payment earlier this year owed to prison officers after the Job Evaluation Exercise in 2018 which the then Prime Minister Frank Bainimarama stopped the payment which the prison officers felt was because he found out that they voted for the opposition in the 2018 general elections. Several coalition members lobbied for the minimum wage increase to be implemented with immediate effect last year when the coalition government came into power, but this in my opinion has been stalled by NFP who hold the employment portfolio and continue to appease their party backers who are business owners as well as using it as their own political platform. In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. NFP paid itself an extra $240000 without consultation or Cabinet approval. This is a figure that is more than the total increase in salaries for ministers recommended by the independent consultant $175000, just to put things in perspective. In my own ministry, Hon Prasad unilaterally changed the payment of bus fare subsidies from $25 a month to utilisation without consultation with me as the line minister or Cabinet approval.

NFP glorifies itself in being principled but this is not about principles, this is about control, the need for Hon Prasad to control what is paid out, when it is not his place to do so. This parliamentary process of emoluments is out of his control and in my opinion I have seen the frustration and anger in his demeanor and that is the reason why he and his MPs have opposed this motion, aside from the fact that he is opposing the reduction of his own salary from $235000 to $200000. They were never going to oppose the recommendations, but wanted more time and used the party directive as an excuse to try to control the process. NFP was given ample time to consider the report from 9th of March, and Hon Prasad has lied to the public about only getting notice of it 48 hours before the motion was moved.

The Hon Prime Minister is correct in stating that the increases have not been implemented yet. There is still the process of changing the laws to give it legal effect, which in the normal process of any proposed law, public consultations and views will be received by the Solicitor General’s office before it is brought to Parliament for debate and passing. That is why the motion gives up to 6 months from 1st August for this process to take place.

The public have the right to know the full story of the Emoluments Committee’s duty to follow parliament processes as well as the accusations being leveled at those that voted for the motion by NFP. I would implore members of the public to obtain a copy of the Emoluments Report which is public record, and note the the reductions as well as things that did not change. You will have the opportunity to be heard when the normal process of proposed laws are undertaken, which includes public consultation.

Hon Lynda Tabuya

Chair Emoluments Committee

Minister for Women, Children and Social Protection

So NFP that didn’t come from me. So don’t hide behind cabinet confidentiality now to answer for what they already know Hon Prasad and which Fiji has a right to know. Respond to the allegations and do not hide now behind cabinet confidentiality as it does not apply here, because nowhere in my media release did I ever refer to a cabinet deliberation or decision on this issue.

Dear Fiji, here is the full media release I gave out yesterday to media outlets that contains the explanation of the parliamentary processes as well as the allegations I have made against Hon Prasad and NFP.

MEDIA RELEASE BY HON TABUYA ON TUESDAY 27th May 2024

I am responding to explain the parliamentary process as well as I feel the need for the public to know the truth about the involvement of all MPs, including NFP.

The Emoluments Committee was a committee established by Parliament under the Standing Order 129 to be tasked to review the Parliamentary Remunerations Act and the Parliamentary Retirement Allowances Act. This committee was established under the Standing Orders of Parliament which all 55 members of parliament unanimously endorsed in July 2023. It is a parliamentary process that reports to parliament, not to cabinet, not to a political party, not to Government or opposition. The committee decided to engage an Independent consultancy firm or individual as it strongly felt it should not be reviewing its own salaries and allowances. The Committee published an advertisement calling for independent consulting firms or individuals to undertake the review and make recommendations to the committee. With no success locally, we reached out to UNDP to assist us to find an independent consulting firm, noting that UNDP would be funding the independent consulting firm, they identified Mr Kevin Deveaux. After conducting the review, the independent consultant reported back to the Emoluments Committee, which endorsed the recommendations. There were some increases, some reductions and some retained.

The legal process of the Emoluments Committee is that it is part of the parliamentary process and reports to Parliament. It does not report to the government or to cabinet. It is for parliament to reject or approve the recommendations. Should it be approved, then the committee will work with Parliament and the Solicitor General’s office on the proposed amendments to the Acts to give effect to the recommendations, but the proposed laws will go through the normal consultation process of any proposed bills.

The draft report of the independent consultant was ready in March and it was circulated to the three political party leaders in government. Members of the Fiji First party in the committee also shared it with their party. The leader of NFP Hon Biman Prasad lied in parliament and to the public in stating that he and his party only got notice of the report 48 hours before I moved the motion in parliament. NFP chose not to be members of the Emoluments Committee. I raised the membership in caucus and spoke with the NFP Whip Hon Tikoduadua who stated for us to go ahead and that they did not need to be in it. At no time did they protest or raise the concern to be a member of the committee. They endorsed the motion for the review to be undertaken when the motion was moved in Parliament last year. They have been part of the process every step of the way. To change their stance last minute and vote against the motion because of a party directive is simply an excuse to stall the parliamentary process when he had the time from March to take the report back to his party. There was nothing rushed about the tabling of the motion for debate last week. It is simply me doing my job as the chair to follow the parliamentary process under the Standing Orders to table the report and to be debated. That is the legal process. The motion approved on Friday stipulates the effective date from 1st August to 31st December 2024. The next step in the process is for Parliament to work with the Solicitor General’s office and it will go through the process normally laid out for proposed bills. Then it will be brought back to parliament for debate and decision. This will be undertaken in that six month period stipulated in the motion. Members of the public are free to submit their views during this period.

Now I wish to respond to all the criticisms leveled at members of Parliament who voted for the motion by NFP. Hon Prasad has lied to the public that no independent consultant was engaged. There have been a lot of attacks on the committee members and the praising of NFP for their vote against the motion. However, this is the process of parliament and it was my duty to table the report and move the motion for debate. I was to do this on Wednesday of parliament week last week but NFP tried to stall it with no good reason to disrupt the processes of parliament. I reconsidered my duty and proceeded to give notice for the motion to be tabled and debated as that is the proper parliament procedure and I could be referred to Privileges Committee by any MP for a possible breach of the standing orders. When NFP did not get their way at the Wednesday caucus meeting last week, I was reliably informed that NFP allegedly approached Fiji First to open discussions on an NFP/FFP coalition, and Hon Prasad issued a warning to the Hon Prime Minister about the coalition agreement. I will categorically state here that at no time during this entire process from July 2023 did NFP oppose the recommendations or raise any objections from March when they had over two months to consider it.

But in my opinion this is not a new pattern of behavior for Hon Prasad. He blocked the 20 per cent payment earlier this year owed to prison officers after the Job Evaluation Exercise in 2018 which the then Prime Minister Frank Bainimarama stopped the payment which the prison officers felt was because he found out that they voted for the opposition in the 2018 general elections. Several coalition members lobbied for the minimum wage increase to be implemented with immediate effect last year when the coalition government came into power, but this in my opinion has been stalled by NFP who hold the employment portfolio and continue to appease their party backers who are business owners as well as using it as their own political platform. In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. NFP paid itself an extra $240000 without consultation or Cabinet approval. This is a figure that is more than the total increase in salaries for ministers recommended by the independent consultant $175000, just to put things in perspective. In my own ministry, Hon Prasad unilaterally changed the payment of bus fare subsidies from $25 a month to utilisation without consultation with me as the line minister or Cabinet approval.

NFP glorifies itself in being principled but this is not about principles, this is about control, the need for Hon Prasad to control what is paid out, when it is not his place to do so. This parliamentary process of emoluments is out of his control and in my opinion I have seen the frustration and anger in his demeanor and that is the reason why he and his MPs have opposed this motion, aside from the fact that he is opposing the reduction of his own salary from $235000 to $200000. They were never going to oppose the recommendations, but wanted more time and used the party directive as an excuse to try to control the process. NFP was given ample time to consider the report from 9th of March, and Hon Prasad has lied to the public about only getting notice of it 48 hours before the motion was moved.

The Hon Prime Minister is correct in stating that the increases have not been implemented yet. There is still the process of changing the laws to give it legal effect, which in the normal process of any proposed law, public consultations and views will be received by the Solicitor General’s office before it is brought to Parliament for debate and passing. That is why the motion gives up to 6 months from 1st August for this process to take place.

The public have the right to know the full story of the Emoluments Committee’s duty to follow parliament processes as well as the accusations being leveled at those that voted for the motion by NFP. I would implore members of the public to obtain a copy of the Emoluments Report which is public record, and note the the reductions as well as things that did not change. You will have the opportunity to be heard when the normal process of proposed laws are undertaken, which includes public consultation.

Hon Lynda Tabuya

Chair Emoluments Committee

Minister for Women, Children and Social Protection

From: Lynda Tabuya <[email protected]>

Sent: Tuesday, May 28, 2024 7:19 PM

To: Rosi Doviverata <[email protected]>

Cc: Sosiveta Korobiau <[email protected]>

Subject: Response to Emoluments issue and NFP accusations

Bula Rosi

Though Fiji Sun has not reached out to obtain a response from me as emoluments chair and minister, I am forwarding this response to Fiji Sun which I have provided to Fiji Times and ABC Pacific Beat.

I am responding to explain the parliamentary process as well as the need for the public to know the truth about the involvement of all MPs, including NFP. If NFP had just let the public make its own judgment based on their vote, then there would have been no need for me to respond. But NFP and Hon Prasad have chosen to go on the offence and criticise the parliamentary process and the emoluments committee, as well as giving their opinions as well, so I feel the need to speak up so the public has all the facts to make a proper judgment.

The Emoluments Committee was a committee established by Parliament under Standing Order 129 to be tasked to review the Parliamentary Remunerations Act and the Parliamentary Retirement Allowances Act. This committee was established under the Standing Orders of Parliament which all 55 members of parliament unanimously endorsed in July 2023. It is a parliamentary process that reports to parliament, not to cabinet, not to a political party, not to Government or opposition. The committee decided to engage an Independent consultancy firm or individual as it strongly felt it should not be reviewing its own salaries and allowances. The Committee published an advertisement in the dailies calling for independent consulting firms or individuals to undertake the review and make recommendations to the committee. With no success locally, we reached out to UNDP to assist us to find an independent consulting firm, noting that UNDP would be funding the independent consulting firm, they identified Mr Kevin Deveaux who is based in Canada. After conducting the review over the course of eight months the independent consultant reported back to Emoluments Committee. There were some increases, some reductions and some retained.

The legal process of the Emoluments Committee is that it is part of the parliamentary process and reports to Parliament. It does not report to the government or to cabinet. It is for parliament to reject or approve the recommendations. Should it be approved, then the committee will work with Parliament and the Solicitor General’s office on the proposed amendments to the Acts to give effect to the recommendations, but the proposed laws will go through the normal consultation process of any proposed bills.

The draft report of the independent consultant was ready in March and it was circulated to the three political party leaders in government, because political parties represented in parliament made submissions to the committee which were forwarded to the independent consultant. Members of the Fiji First party in the committee also shared it with their party. The leader of NFP Hon Biman Prasad lied in parliament and to the public in stating that he and his party only got notice of the report 48 hours before I moved the motion in parliament. NFP chose not to be members of the Emoluments Committee. They endorsed the motion for the review to be undertaken when the motion was moved in Parliament last year. They have been part of the process every step of the way. To change their stance last minute and vote against the motion because of a party directive is simply an excuse to stall the parliamentary process when he had the time from March to take the report back to his party. There was nothing rushed about the tabling of the motion for debate last week. It is simply me doing my job as the chair to follow the mandated parliamentary process under the Standing Orders to table the report and to be debated. That is the legal process. The motion approved on Friday stipulates the effective date from 1st August to 31st December 2024. The next step in the process is for Parliament to work with the Solicitor General’s office with the proposed amendments to the Acts. It will go through the process normally laid out for proposed bills. Then it will be brought back to parliament for debate and decision. This will be undertaken in that six month period stipulated in the motion. Members of the public will be consulted on these proposed bills and are free to submit their views during this period.

Now I wish to respond to all the criticisms leveled at members of Parliament who voted for the motion by NFP. Hon Prasad has lied to the public that no independent consultant was engaged. There have been a lot of attacks on the committee members and the praising of NFP for their vote against the motion. However, there is a general lack of understanding of parliamentary processes. This is the process of parliament and it was my duty to table the report and move the motion for debate. I was to do this on Wednesday of parliament week last week but NFP tried to stall it with no good reason to disrupt the processes of parliament. I reconsidered my duty and proceeded to give notice for the motion to be tabled and debated as that is the proper parliament procedure and I could be referred to Privileges Committee by a member under the Standing Orders for a possible breach of the standing orders. When NFP did not get their way after protesting, I was reliably informed that NFP allegedly approached Fiji First members to open discussions on an NFP/FFP coalition, and Hon Prasad issued a warning to the Hon Prime Minister about the coalition agreement. I will categorically state here that at no time during this entire process did NFP oppose the recommendations or raise any objections from March when they had over two months to consider it.

But in my opinion this is not a new pattern of behavior for Hon Prasad. Earlier this year Hon Prasad was instrumental in blocking the 20 per cent outstanding pay owed to prison officers after the Job Evaluation Exercise in 2018 which the then Prime Minister Frank Bainimarama stopped the payment. The prison officers felt it was because Frank found out that they voted for the opposition in the 2018 general elections. Several coalition members lobbied for the minimum wage increase to be implemented with immediate effect last year when the coalition government came into power as promised in our manifestos, but the general feeling amongst the majority of government members is that it has been stalled by NFP who hold the employment portfolio and continue to appease their party backers who are business owners as well as using it as their own political platform. In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. Hon Prasad paid his own party an extra $240000 without consultation or Cabinet approval. This is a figure that is more than the total increase in salaries for ministers recommended by the independent consultant $175000, just to put things in perspective. In my own ministry, Hon Prasad unilaterally changed the payment of bus fare subsidies to our elderly and disabled in the current budget from $25 a month to utilisation basis without consultation with me as the line minister or Cabinet approval. Other ministers may have their own experiences which is theirs to tell.

NFP glorifies itself in being principled in their vote but this is not about principles, this is about control. This parliamentary process of emoluments is out of his control and I shockingly witnessed the frustration and anger in his demeanor aside from the fact that he is opposing the reduction of his own salary from $235000 to $200000. At no point did they oppose the recommendations, but used the party directive as an excuse to try to control the process. NFP was given ample time to consider the report from 9th of March, and Hon Prasad has lied to the public about only getting notice of it 48 hours before the motion was moved.

The Hon Prime Minister is correct in stating that the increases have not been implemented yet. There is still the process of changing the laws to give it legal effect, which in the normal process of any proposed law, public consultations and views will be received by the Solicitor General’s office before it is brought to Parliament for debate and passing. That is why the motion gives up to 6 months from 1st August for this process to take place.

The public have the right to know the full story of the Emoluments Committee’s duty to follow parliament processes as well as the accusations by NFP being levelled at members of the Emoluments Committee and those that voted for the motion. I would implore members of the public to obtain a copy of the Emoluments Report which is public record, and note the the reductions as well as things that did not change. You will have the opportunity to be heard when the normal process of proposed laws are undertaken, which includes public consultation.

Vinaka

Hon Lynda Tabuya

Chair

Sent: Tuesday, May 28, 2024 7:19 PM

To: Rosi Doviverata <[email protected]>

Cc: Sosiveta Korobiau <[email protected]>

Subject: Response to Emoluments issue and NFP accusations

Bula Rosi

Though Fiji Sun has not reached out to obtain a response from me as emoluments chair and minister, I am forwarding this response to Fiji Sun which I have provided to Fiji Times and ABC Pacific Beat.

I am responding to explain the parliamentary process as well as the need for the public to know the truth about the involvement of all MPs, including NFP. If NFP had just let the public make its own judgment based on their vote, then there would have been no need for me to respond. But NFP and Hon Prasad have chosen to go on the offence and criticise the parliamentary process and the emoluments committee, as well as giving their opinions as well, so I feel the need to speak up so the public has all the facts to make a proper judgment.

The Emoluments Committee was a committee established by Parliament under Standing Order 129 to be tasked to review the Parliamentary Remunerations Act and the Parliamentary Retirement Allowances Act. This committee was established under the Standing Orders of Parliament which all 55 members of parliament unanimously endorsed in July 2023. It is a parliamentary process that reports to parliament, not to cabinet, not to a political party, not to Government or opposition. The committee decided to engage an Independent consultancy firm or individual as it strongly felt it should not be reviewing its own salaries and allowances. The Committee published an advertisement in the dailies calling for independent consulting firms or individuals to undertake the review and make recommendations to the committee. With no success locally, we reached out to UNDP to assist us to find an independent consulting firm, noting that UNDP would be funding the independent consulting firm, they identified Mr Kevin Deveaux who is based in Canada. After conducting the review over the course of eight months the independent consultant reported back to Emoluments Committee. There were some increases, some reductions and some retained.

The legal process of the Emoluments Committee is that it is part of the parliamentary process and reports to Parliament. It does not report to the government or to cabinet. It is for parliament to reject or approve the recommendations. Should it be approved, then the committee will work with Parliament and the Solicitor General’s office on the proposed amendments to the Acts to give effect to the recommendations, but the proposed laws will go through the normal consultation process of any proposed bills.

The draft report of the independent consultant was ready in March and it was circulated to the three political party leaders in government, because political parties represented in parliament made submissions to the committee which were forwarded to the independent consultant. Members of the Fiji First party in the committee also shared it with their party. The leader of NFP Hon Biman Prasad lied in parliament and to the public in stating that he and his party only got notice of the report 48 hours before I moved the motion in parliament. NFP chose not to be members of the Emoluments Committee. They endorsed the motion for the review to be undertaken when the motion was moved in Parliament last year. They have been part of the process every step of the way. To change their stance last minute and vote against the motion because of a party directive is simply an excuse to stall the parliamentary process when he had the time from March to take the report back to his party. There was nothing rushed about the tabling of the motion for debate last week. It is simply me doing my job as the chair to follow the mandated parliamentary process under the Standing Orders to table the report and to be debated. That is the legal process. The motion approved on Friday stipulates the effective date from 1st August to 31st December 2024. The next step in the process is for Parliament to work with the Solicitor General’s office with the proposed amendments to the Acts. It will go through the process normally laid out for proposed bills. Then it will be brought back to parliament for debate and decision. This will be undertaken in that six month period stipulated in the motion. Members of the public will be consulted on these proposed bills and are free to submit their views during this period.

Now I wish to respond to all the criticisms leveled at members of Parliament who voted for the motion by NFP. Hon Prasad has lied to the public that no independent consultant was engaged. There have been a lot of attacks on the committee members and the praising of NFP for their vote against the motion. However, there is a general lack of understanding of parliamentary processes. This is the process of parliament and it was my duty to table the report and move the motion for debate. I was to do this on Wednesday of parliament week last week but NFP tried to stall it with no good reason to disrupt the processes of parliament. I reconsidered my duty and proceeded to give notice for the motion to be tabled and debated as that is the proper parliament procedure and I could be referred to Privileges Committee by a member under the Standing Orders for a possible breach of the standing orders. When NFP did not get their way after protesting, I was reliably informed that NFP allegedly approached Fiji First members to open discussions on an NFP/FFP coalition, and Hon Prasad issued a warning to the Hon Prime Minister about the coalition agreement. I will categorically state here that at no time during this entire process did NFP oppose the recommendations or raise any objections from March when they had over two months to consider it.

But in my opinion this is not a new pattern of behavior for Hon Prasad. Earlier this year Hon Prasad was instrumental in blocking the 20 per cent outstanding pay owed to prison officers after the Job Evaluation Exercise in 2018 which the then Prime Minister Frank Bainimarama stopped the payment. The prison officers felt it was because Frank found out that they voted for the opposition in the 2018 general elections. Several coalition members lobbied for the minimum wage increase to be implemented with immediate effect last year when the coalition government came into power as promised in our manifestos, but the general feeling amongst the majority of government members is that it has been stalled by NFP who hold the employment portfolio and continue to appease their party backers who are business owners as well as using it as their own political platform. In the national budget last year, it came as a shock when Hon Prasad unilaterally gave $325,000 to each political party without consultation or cabinet approval even though it is supposed to be $15,000 per Member of Parliament. This is calculated as follows: Fiji First 26 MPs x $15000 = $390000, PAP 21 MPs x $15000 = $315,000, NFP 5 MPs x $15000 = $75000, Sodelpa 3 MPs x $15000 = $45000. Hon Prasad paid his own party an extra $240000 without consultation or Cabinet approval. This is a figure that is more than the total increase in salaries for ministers recommended by the independent consultant $175000, just to put things in perspective. In my own ministry, Hon Prasad unilaterally changed the payment of bus fare subsidies to our elderly and disabled in the current budget from $25 a month to utilisation basis without consultation with me as the line minister or Cabinet approval. Other ministers may have their own experiences which is theirs to tell.