By PROFESSOR WADAN NARSEY

Fiji's Public Debt Disaster: who to blame?

There are many government policies which can be reversed when a new government comes in. But sadly and disastrously, Fiji's massive Public Debt which has grown astronomically under this Bainimarama Government, is not a policy that can be reversed at the stroke of a pen or putting a vote in the ballot box.

Public Debt which is created by the previous and current generations, must be paid for by the future generations.

I have previously warned Fiji Times readers about the terrible dangers of Fiji's Public Debt ("Fiji's Sleeping Public Debt Nightmares" FT 3 Dec. 2016). That article is still relevant.

Except that Fiji's voters today faces the painful prospect of choosing between two coup leaders, Rabuka and Bainimarama, who have both contributed to increasing Fiji's Public Debt.

Among other important criteria, the Fiji public might want to ask in the coming elections: what exactly has been their record on the Public Debt?

More importantly for the future, do they have a professional Team to deal with the massive Public Debt that burdens Fiji today.

For consistency, I use Public Debt data available on the Reserve Bank of Fiji website, starting from 1992, around the time that Rabuka was elected as Prime Minister.

But first, I remind readers, voters and Fiji's future generations, about the potential nastiness of Public Debt.

How is “public” debt created and paid?

Normal elected governments have the "supernatural authority” to tax, borrow and spend, if necessary by increasing the “Public Debt” on behalf of tax payers, not just of today, but of future generations, who have no say in the matter at all, who yet must pay the debt when it comes due.

If a government borrows sensibly on behalf of taxpayers to invest in infrastructure (roads, schools, hospitals etc.) whose returns more than justify the borrowing, then the country's GDP (and people's incomes) grows healthily enough to repay the principal and interest on the Public Debt, while maintaining a reasonable or even improving standard of living for the taxpayers.

The Public Debt: GDP ratio remains about the same or rises slowly or even falls in some cases.

BUT at every annual Budget, Public Debt Charges (principal and interest) MUST BE PAID before the government can allocate a single penny to other items such as education or health or social welfare.

Given any particular level of government revenue, the larger the charges on Public Debt, the lower is the amount available for other government expenditure, such as education or health or social welfare.

If the Public Debt becomes too large relative to GDP, then the whole of Government Revenue (and hence Government Expenditure) MUST be squeezed to pay for the Public Debt.

Sometimes, irresponsible Ministers (who may not be economists) will callously borrow even more, increase the Public Debt even more, all to be paid for by future governments and generations.

My previous warnings

I have previously warned Fiji Times readers about the dangers of Fiji's escalating Public Debt: "Fiji's Sleeping Public Debt Nightmares" (FT 3 Dec. 2016) and again "Government expenditure, public debts and public intellectuals" (FT 20 April 1919). The situation is even worse today (January 2022).

In my 2016 FT article I had asked how politicians got away with burdening the taxpayers with Public Debt and I had noted "People and voters have a short memory, or they only look at their short term benefits (the hand-outs), or they don’t care, because Public Debt is an invisible evil not to be seen or felt immediately".

I had concluded then that "Fiji is destined to stumble along until one day, its Public Debt nightmare becomes the reality for its future generations, by which time most of those in power will have left to enjoy their ill-gotten gains, some stashed away in tax havens abroad."

Except that at least two (or three) politicians who have been responsible for Fiji's current level of Public Debt will be asking voters to vote for them again.

Apart from many other governance issues and even the personal pain that many have felt from all of Fiji's coups, today's voters must compare these Prime Ministers' actual record (the "facts"?) on Fiji's Public Debt and vote accordingly, for their children's sake.

The Record of Rabuka, Qarase and Bainimarama

Of course, Prime Ministers rely on Ministers of Finance or Economy to guide the government on how much to borrow and how much to spend.

Rabuka had the late Paul Manueli, the late Vunibobo and Mr Jim Ah Koy. Bainimarama, while initially the Minister of Finance, quickly handed over all authority to his Minister of Economy (Aiyaz Khaiyum).

But ultimately, the "buck" for the Public Debt must stop with the Prime Minister (some might say metaphorically, some say literally) who from 2014 was elected by the voters to lead the country.

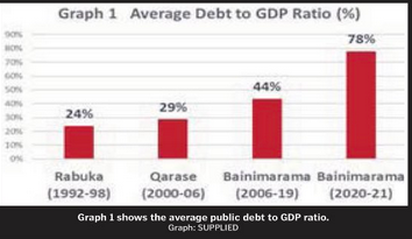

One useful measure is the Public Debt to GDP ratio which the average citizen can easily understand as the ratio of "how much a household borrows" (Debt), compared to its "annual income" (GDP).

If your borrowings outstrips your income, you are in trouble indeed.

Fiji's Public Debt Disaster: who to blame?

There are many government policies which can be reversed when a new government comes in. But sadly and disastrously, Fiji's massive Public Debt which has grown astronomically under this Bainimarama Government, is not a policy that can be reversed at the stroke of a pen or putting a vote in the ballot box.

Public Debt which is created by the previous and current generations, must be paid for by the future generations.

I have previously warned Fiji Times readers about the terrible dangers of Fiji's Public Debt ("Fiji's Sleeping Public Debt Nightmares" FT 3 Dec. 2016). That article is still relevant.

Except that Fiji's voters today faces the painful prospect of choosing between two coup leaders, Rabuka and Bainimarama, who have both contributed to increasing Fiji's Public Debt.

Among other important criteria, the Fiji public might want to ask in the coming elections: what exactly has been their record on the Public Debt?

More importantly for the future, do they have a professional Team to deal with the massive Public Debt that burdens Fiji today.

For consistency, I use Public Debt data available on the Reserve Bank of Fiji website, starting from 1992, around the time that Rabuka was elected as Prime Minister.

But first, I remind readers, voters and Fiji's future generations, about the potential nastiness of Public Debt.

How is “public” debt created and paid?

Normal elected governments have the "supernatural authority” to tax, borrow and spend, if necessary by increasing the “Public Debt” on behalf of tax payers, not just of today, but of future generations, who have no say in the matter at all, who yet must pay the debt when it comes due.

If a government borrows sensibly on behalf of taxpayers to invest in infrastructure (roads, schools, hospitals etc.) whose returns more than justify the borrowing, then the country's GDP (and people's incomes) grows healthily enough to repay the principal and interest on the Public Debt, while maintaining a reasonable or even improving standard of living for the taxpayers.

The Public Debt: GDP ratio remains about the same or rises slowly or even falls in some cases.

BUT at every annual Budget, Public Debt Charges (principal and interest) MUST BE PAID before the government can allocate a single penny to other items such as education or health or social welfare.

Given any particular level of government revenue, the larger the charges on Public Debt, the lower is the amount available for other government expenditure, such as education or health or social welfare.

If the Public Debt becomes too large relative to GDP, then the whole of Government Revenue (and hence Government Expenditure) MUST be squeezed to pay for the Public Debt.

Sometimes, irresponsible Ministers (who may not be economists) will callously borrow even more, increase the Public Debt even more, all to be paid for by future governments and generations.

My previous warnings

I have previously warned Fiji Times readers about the dangers of Fiji's escalating Public Debt: "Fiji's Sleeping Public Debt Nightmares" (FT 3 Dec. 2016) and again "Government expenditure, public debts and public intellectuals" (FT 20 April 1919). The situation is even worse today (January 2022).

In my 2016 FT article I had asked how politicians got away with burdening the taxpayers with Public Debt and I had noted "People and voters have a short memory, or they only look at their short term benefits (the hand-outs), or they don’t care, because Public Debt is an invisible evil not to be seen or felt immediately".

I had concluded then that "Fiji is destined to stumble along until one day, its Public Debt nightmare becomes the reality for its future generations, by which time most of those in power will have left to enjoy their ill-gotten gains, some stashed away in tax havens abroad."

Except that at least two (or three) politicians who have been responsible for Fiji's current level of Public Debt will be asking voters to vote for them again.

Apart from many other governance issues and even the personal pain that many have felt from all of Fiji's coups, today's voters must compare these Prime Ministers' actual record (the "facts"?) on Fiji's Public Debt and vote accordingly, for their children's sake.

The Record of Rabuka, Qarase and Bainimarama

Of course, Prime Ministers rely on Ministers of Finance or Economy to guide the government on how much to borrow and how much to spend.

Rabuka had the late Paul Manueli, the late Vunibobo and Mr Jim Ah Koy. Bainimarama, while initially the Minister of Finance, quickly handed over all authority to his Minister of Economy (Aiyaz Khaiyum).

But ultimately, the "buck" for the Public Debt must stop with the Prime Minister (some might say metaphorically, some say literally) who from 2014 was elected by the voters to lead the country.

One useful measure is the Public Debt to GDP ratio which the average citizen can easily understand as the ratio of "how much a household borrows" (Debt), compared to its "annual income" (GDP).

If your borrowings outstrips your income, you are in trouble indeed.

The Graph shows the Average Public Debt to Gross Domestic Product ratio under Prime Ministers Rabuka, Qarase, Bainimarama (2006-2019) and Bainimarama (2020-21). I separate out the last two abnormal COVID-19 years.

Graph 1 makes clear that Rabuka's record as Prime Minister (despite the NBF $200 million disaster under his watch) was the "best" out of these three Prime Ministers in controlling Public Debt relative to GDP. His Average Debt:GDP ratio for 1992 to 1998 was a mere 24%.

Under Qarase for the period 2000 to 2006, the ratio rose slightly to 29%, still manageable.

But under Bainimarama the Average Debt:GDP Ratio shot up to 44% for 2006-2019, and then for the last two years to a monstrous 78% of GDP.

So what does this horrendous increase in Public Debt mean for Government Expenditures?

Squeezing Government Revenue and Expenditure

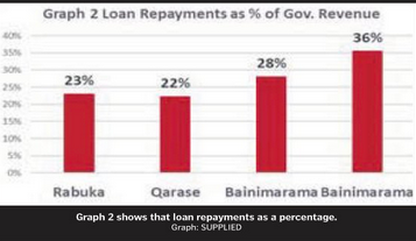

Remember that Public Debt charges MUST be paid first of all out of Government Revenue, before the remainder can be spent on normal expenditure.

Just as borrowers from a commercial bank MUST pay the bank before they spend on household consumption (or they will lose their collateral to the bank).

Graph 2 shows that Loan Repayments as a percentage of Government Revenue fell slightly from 23% under Rabuka to 22% under Qarase.

But with the massive increase in Public Debt after 2006, it rose to 28% under Bainimarama (average for 2006-2019) and even higher to 36% for the last two years.

Graph 1 makes clear that Rabuka's record as Prime Minister (despite the NBF $200 million disaster under his watch) was the "best" out of these three Prime Ministers in controlling Public Debt relative to GDP. His Average Debt:GDP ratio for 1992 to 1998 was a mere 24%.

Under Qarase for the period 2000 to 2006, the ratio rose slightly to 29%, still manageable.

But under Bainimarama the Average Debt:GDP Ratio shot up to 44% for 2006-2019, and then for the last two years to a monstrous 78% of GDP.

So what does this horrendous increase in Public Debt mean for Government Expenditures?

Squeezing Government Revenue and Expenditure

Remember that Public Debt charges MUST be paid first of all out of Government Revenue, before the remainder can be spent on normal expenditure.

Just as borrowers from a commercial bank MUST pay the bank before they spend on household consumption (or they will lose their collateral to the bank).

Graph 2 shows that Loan Repayments as a percentage of Government Revenue fell slightly from 23% under Rabuka to 22% under Qarase.

But with the massive increase in Public Debt after 2006, it rose to 28% under Bainimarama (average for 2006-2019) and even higher to 36% for the last two years.

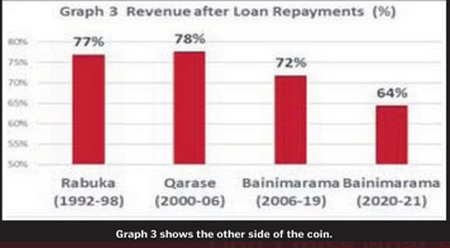

The other side of it is that the proportion of Government Revenue left to pay for all the normal Government Expenditure was 77% under Rabuka but rose slightly to 78% under Qarase.

But the proportion of Revenue left after loan repayments fell to 72% under Bainimarama for the years 2006 to 2019, and plummeted to 64% these last two years.

But the proportion of Revenue left after loan repayments fell to 72% under Bainimarama for the years 2006 to 2019, and plummeted to 64% these last two years.

Can you imagine what happens to a household's standard of living, if their level of debt means that after making their debt repayment, they have left only 64% of their household income? When under Qarase, it used to be 78% of the household income.

This massive decline under COVID happened under the orders of the Minister for Economy (a former lawyer), who refused adamantly to economize even though Government's revenues had plummeted because of the collapse of tourism.

Khaiyum deliberately chose to pass on the burden of current Expenditure levels on to the Public Debt, to be paid for by future generations, whatever their pain.

What a gift to future political leaders and the future generations.

External Debt and FNPF

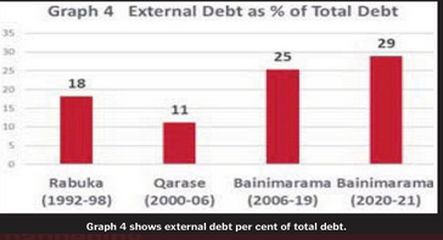

There is another aspect of Public Debt that the future generations must be concerned about- the proportion of Public Debt owed overseas.

Foreign debt MUST be paid with foreign currency which must be earned. Foreign borrowers do not want to be paid in Fijian dollars.

This massive decline under COVID happened under the orders of the Minister for Economy (a former lawyer), who refused adamantly to economize even though Government's revenues had plummeted because of the collapse of tourism.

Khaiyum deliberately chose to pass on the burden of current Expenditure levels on to the Public Debt, to be paid for by future generations, whatever their pain.

What a gift to future political leaders and the future generations.

External Debt and FNPF

There is another aspect of Public Debt that the future generations must be concerned about- the proportion of Public Debt owed overseas.

Foreign debt MUST be paid with foreign currency which must be earned. Foreign borrowers do not want to be paid in Fijian dollars.

Worryingly, Fiji's External Debt share has risen from 11% under Qarase to 25% and 29% under Bainimarama/Khaiyum.

The problem is that the major foreign exchange earners (such as tourism) are in deep trouble and the traditional sugar industry has been on life support ever since the 2006 coup.

The Domestic component of Fiji's debt may be owed to commercial banks (who not surprisingly decline to lend to the Fiji Government) or borrowed from FNPF (whose subservient Board and management usually say "Yes Sir" to the Minister of Economy who appoints them).

Perhaps some bright young Fijian economist might like to do another article on how much the Fiji Government has borrowed from Fiji's commercial banks and FNPF.

Who Will Bear the Burden?

Fiji is slightly fortunate today that some donors and multilateral agencies are providing budgetary support, because of COVID-19 (and perhaps fear of China's influence).

But there is a limit to what they can provide and Fiji will ultimately have to pay out if its own budget.

I have previous pointed out (and it is worth repeating) that the burden of the public debt will ultimately be paid by:

* those who pay taxes, which is increasingly Value Added Tax, falling on the poor and middle classes. Under Bainimarama the rich and the companies have been paying less tax.

* workers whose wages are restricted by government to please employers;

* future generations whose public assets are sold off to reduce net deficits;

* Those with their FNPF savings which are being increasingly used by Government at low interest rates.

Not bearing the burden

One can also make a few generalizations about who will not be bearing the public debt burden even if they have benefited from it.

Prominent among them are large businesses who have received profitable contracts out of government and public enterprise expenditure (using borrowed money).

The names of many of them have been revealed on Victor Lal's Fijileaks website as being massive donors openly and easily circumventing the $10,000 limit allegedly set by the Fiji Elections Office, by donating in the names of family members and even employees.

There are also many political and military leaders (and their families) who have gained financially in recent years, far more than any previous political leaders since Independence in 1970.

Conclusion

There is no escape from Public Debt, except by emigrating which educated and smart Fiji people of all races (but especially Indo-Fijians), will keep doing.

Going by current population projections it would seem that the Public Debt will be paid for by the vast majority of the iTaukei and the poorest and uneducated Indo-Fijians who cannot emigrate. Many of them will be voting in Fiji's next elections.

Today's voters are fortunate that there are at least two Opposition Party leaders, Professor Biman Prasad and Mr Savenaca Narube, who understand the severity of the current Public Debt problem and how it may be tackled, however painfully.

But voters must ask: will they have an influential voice in the next government? Or will they remain voices in the wilderness because of egotistic electoral choice.

The problem is that the major foreign exchange earners (such as tourism) are in deep trouble and the traditional sugar industry has been on life support ever since the 2006 coup.

The Domestic component of Fiji's debt may be owed to commercial banks (who not surprisingly decline to lend to the Fiji Government) or borrowed from FNPF (whose subservient Board and management usually say "Yes Sir" to the Minister of Economy who appoints them).

Perhaps some bright young Fijian economist might like to do another article on how much the Fiji Government has borrowed from Fiji's commercial banks and FNPF.

Who Will Bear the Burden?

Fiji is slightly fortunate today that some donors and multilateral agencies are providing budgetary support, because of COVID-19 (and perhaps fear of China's influence).

But there is a limit to what they can provide and Fiji will ultimately have to pay out if its own budget.

I have previous pointed out (and it is worth repeating) that the burden of the public debt will ultimately be paid by:

* those who pay taxes, which is increasingly Value Added Tax, falling on the poor and middle classes. Under Bainimarama the rich and the companies have been paying less tax.

* workers whose wages are restricted by government to please employers;

* future generations whose public assets are sold off to reduce net deficits;

* Those with their FNPF savings which are being increasingly used by Government at low interest rates.

Not bearing the burden

One can also make a few generalizations about who will not be bearing the public debt burden even if they have benefited from it.

Prominent among them are large businesses who have received profitable contracts out of government and public enterprise expenditure (using borrowed money).

The names of many of them have been revealed on Victor Lal's Fijileaks website as being massive donors openly and easily circumventing the $10,000 limit allegedly set by the Fiji Elections Office, by donating in the names of family members and even employees.

There are also many political and military leaders (and their families) who have gained financially in recent years, far more than any previous political leaders since Independence in 1970.

Conclusion

There is no escape from Public Debt, except by emigrating which educated and smart Fiji people of all races (but especially Indo-Fijians), will keep doing.

Going by current population projections it would seem that the Public Debt will be paid for by the vast majority of the iTaukei and the poorest and uneducated Indo-Fijians who cannot emigrate. Many of them will be voting in Fiji's next elections.

Today's voters are fortunate that there are at least two Opposition Party leaders, Professor Biman Prasad and Mr Savenaca Narube, who understand the severity of the current Public Debt problem and how it may be tackled, however painfully.

But voters must ask: will they have an influential voice in the next government? Or will they remain voices in the wilderness because of egotistic electoral choice.