STEFAN PICHLER ON THE NAME WAQAVUKA, September 2013

"The company’s name was chosen by Fiji Airways staff to create a unique, truly Fijian link."

Mahendra Chaudhry, September 2013

"Until there is an independent assessment and investigation into it [Waqavuka] we do not know what is the truth behind it. Are these planes really brand new planes or are they refurbished second-hand planes?”

Stefan Pichler, CEO, Fiji Airways, 2013

|

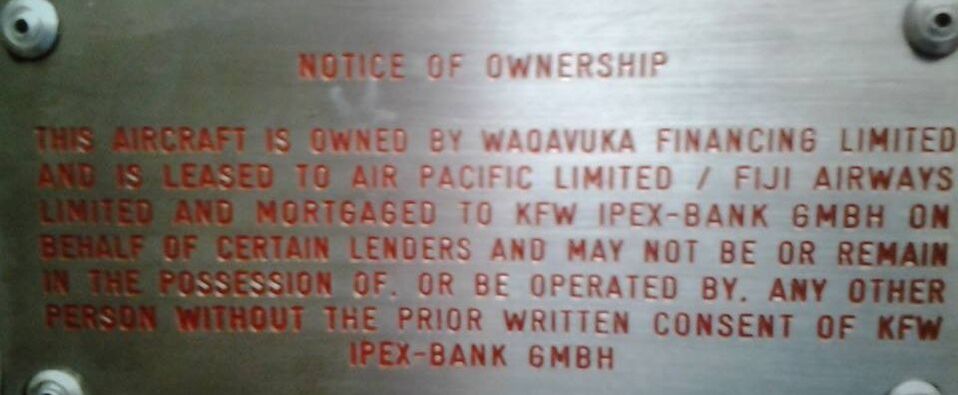

Seven years ago, in 2013, our Founding Editor-in-Chief spoiled the celebrations when he revealed that the new Airbus A330 aircraft was not owned by Fiji Airways but by Waqavuka. For the next seven years, it never fell off our radar, and we are finally revealing all about Waqavuka on Fijileaks. Our story will take us far back as 2011 when the former CEO David Pflieger decided to ditch Boeing for Airbus and the loan Air Pacific obtained from Fiji National Provident Fund. We will examine how Waqavuka was set up in Dublin, Ireland. And expose the lies, cover ups, and rushed ownership explanations as bankruptcy for Fiji Airways hovers above the Fijian sky. While releasing selected details from the 2019 Fiji Airways Annual Report, Aiyaz Sayed Khaiyum claimed Waqavuka Financing is 'public knowledge'. If so, why is he hiding in the Fiji Airways 'cargohold' with his 2019 Annual Report.

How much is Waqavuka being paid to act as "Go Between" the German banks and Fiji Airways? No politicians or

Fiji journalists have asked this fundamental QUESTION?

Civil Aviation Minister Aiyaz Sayed Khaiyum, 19 February 2020

"Fiji Airways on a monthly basis do the repayment of the loans into the special company (Waqavuka), then the company disburses the repayment money to the consortium of banks."

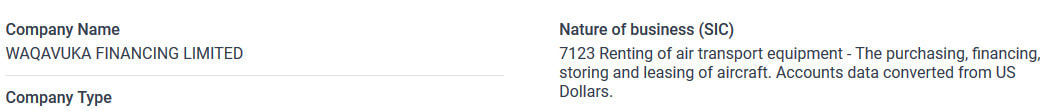

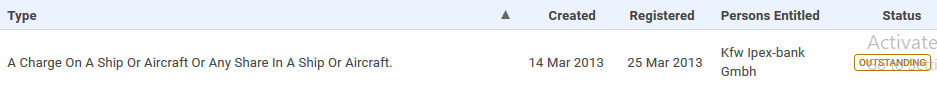

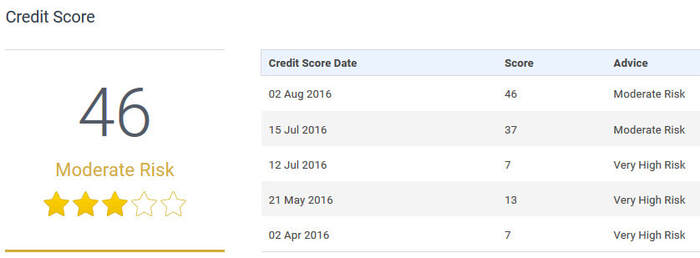

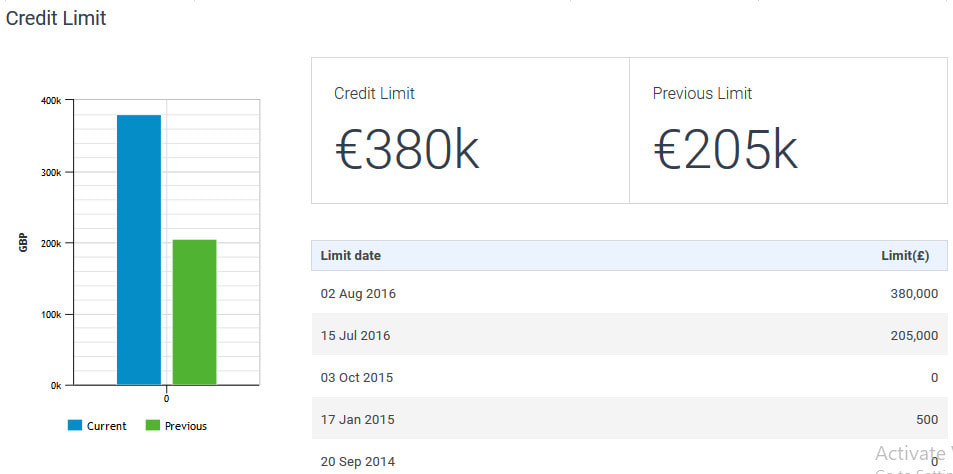

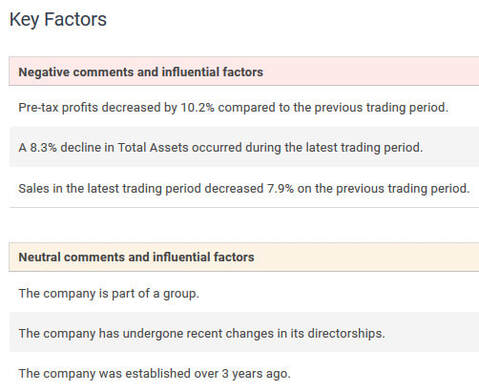

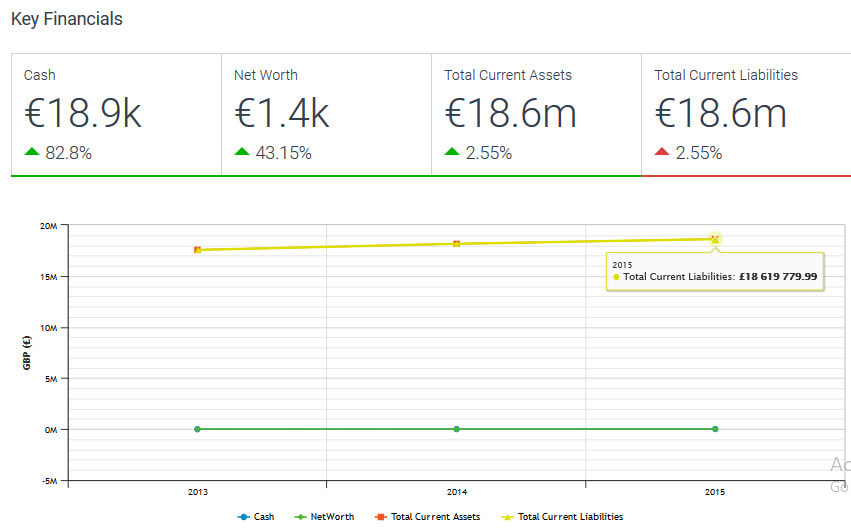

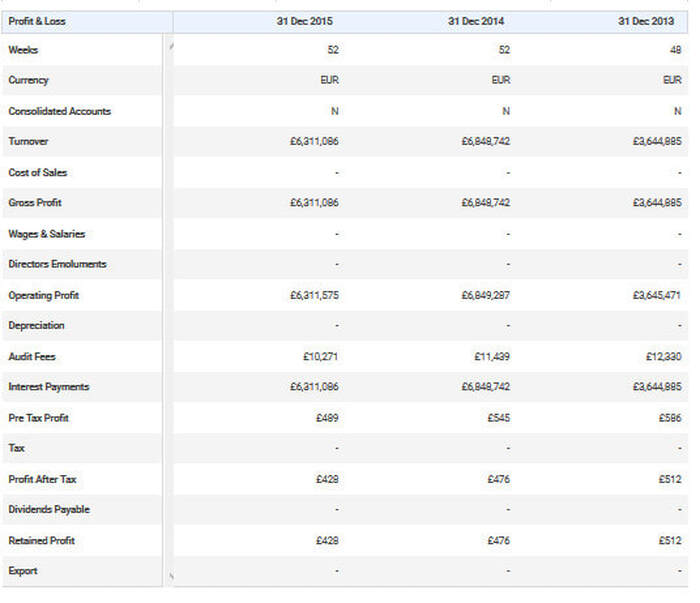

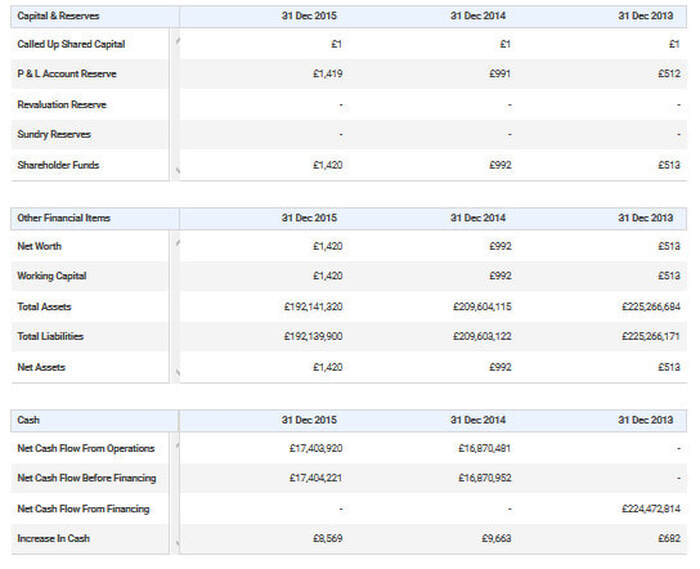

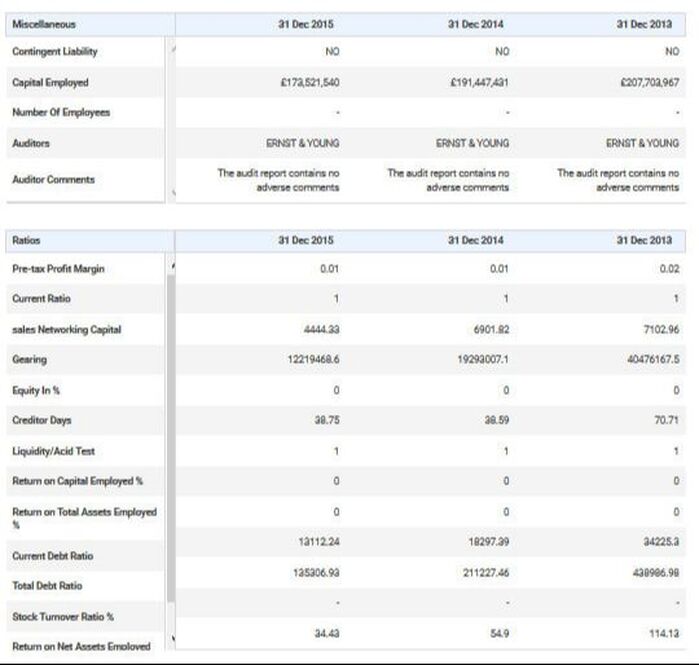

The following details from Waqavuka's 2016 Annual Report (But we will publish more recent ones later on)

Stefan Pichler, former CEO, Fiji Airways, 19 September 2013

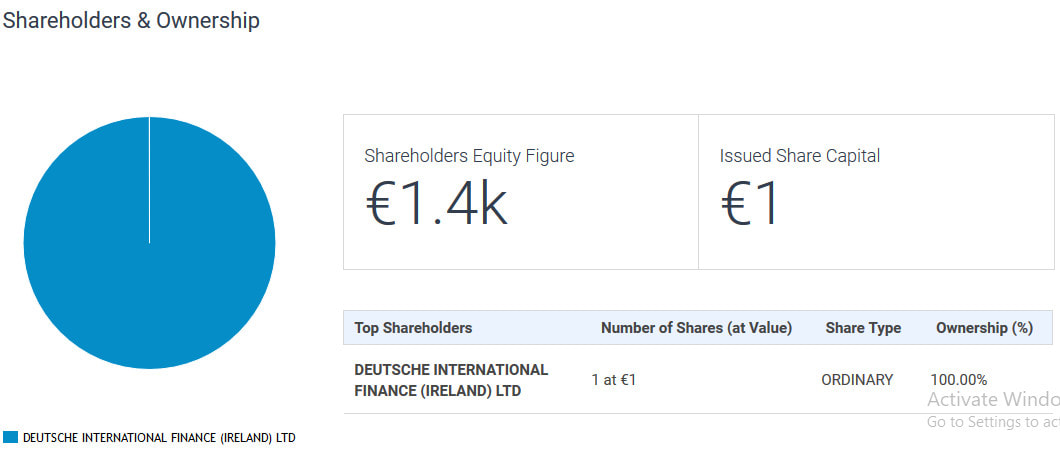

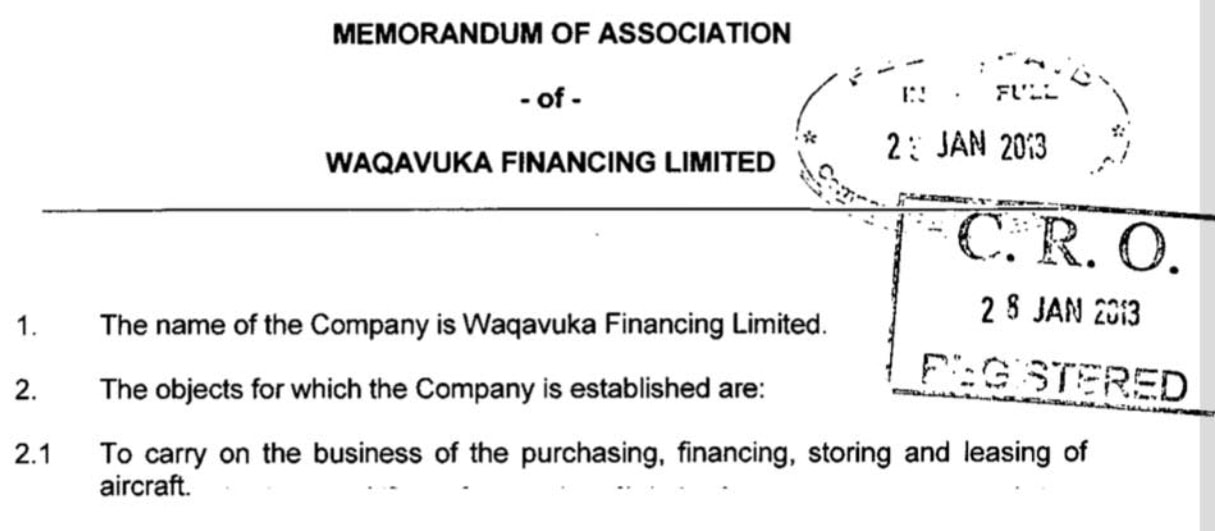

"Waqavuka Financing Ltd is owned by a corporate managing subsidiary of Deutsche Bank. Neither Fiji Airways nor the German banks have any ownership interest in Waqavuka Financing Ltd."

Civil Aviation Minister Aiyaz Sayed Khaiyum LIED to Parliament, 16 March 2018

"WAQAVUKA Holdings Ltd — the offshore company that is leasing Airbus A330 aircraft to Fiji Airways — is 100 per cent owned by the national carrier. As has been explained previously, Waqavuka Holdings is 100 per cent owned by Fiji Airways. The reason why we have a separate company is because to satisfy the financiers offshore. So, you have actually a leasing arrangement with the Waqavuka Holdings and the financial arrangements are with them which is owned, of course, by Fiji Airways. There is nothing untoward about that…” But documents below reveal Deutsche International Finance (Ireland) Ltd had 100 per cent ownership in Waqavuka Financing Ltd

Deutsche International Finance (Ireland) Ltd is headquartered in Ireland. The company's line of business includes providing accounting, bookkeeping, and related auditing service. Basically, asset financing, lending and the provision of trustee services. It was founded on 17 July 1991. Meanwhile, we have decided to answer the queries from The Fiji Times and other Fijian journalists to the elusive Andre Viljoen, the current Fiji Airways CEO and his side-kick motor-mouth Aiyaz Sayed Khaiyum

STEFAN PILCHER TO FIJI SUN (19 September 2013). The paper had approached Pilcher after we had exposed the plague revealing who actually owned the Airbus but in that Fiji Sun story we were completely left out. BUT NO SURPRISE, there!!!

Fiji Sun: Why do Fiji Airways and the German banks need Waqavuka Financing Limited in the middle?

Pilcher: This is a requirement of the European Export Credit Agencies (ECA). Unless an aircraft is owned by a neutral third party, the European Export Credit Agencies will not provide support for the financing. Without support from the European export credit agencies, the interest rate payable by Fiji Airways would be much higher and result in higher airfares for our passengers – something we are always keen to avoid.

The reason that the European Export Credit Agencies insist on the aircraft being owned by a neutral third party is to make it easier to enforce their security/collateral if needed. A neutral third “shelf company” is not likely to take steps to prevent the banks/European Export Credit Agencies from enforcing their security over the financed aircraft. The European Export Credit Agencies require this neutral third party to be located in a neutral jurisdiction to reduce the risk of local courts protecting local interests. Tax reasons make Ireland a good European location for this purpose. The use of an intermediate company is a technique common in aircraft financing transactions, whether or not those financings involve the European or American Export Credit Agencies, whereas the Americans secure the loans for Boeing purchases.

For example, Fiji Airways used a very similar structure when it successfully financed the purchase of three B737s in the late 1990s. (Fijileaks: We will deal with that purchase in our next instalment). This is a standard aircraft financing technique, used by most airlines around the world in such transactions. All parties to the financing agreement used international aviation finance lawyers to verify and facilitate the creation of this financing structure.

Fiji Sun: Why do Fiji Airways and the German banks need Waqavuka Financing Limited in the middle?

Pilcher: This is a requirement of the European Export Credit Agencies (ECA). Unless an aircraft is owned by a neutral third party, the European Export Credit Agencies will not provide support for the financing. Without support from the European export credit agencies, the interest rate payable by Fiji Airways would be much higher and result in higher airfares for our passengers – something we are always keen to avoid.

The reason that the European Export Credit Agencies insist on the aircraft being owned by a neutral third party is to make it easier to enforce their security/collateral if needed. A neutral third “shelf company” is not likely to take steps to prevent the banks/European Export Credit Agencies from enforcing their security over the financed aircraft. The European Export Credit Agencies require this neutral third party to be located in a neutral jurisdiction to reduce the risk of local courts protecting local interests. Tax reasons make Ireland a good European location for this purpose. The use of an intermediate company is a technique common in aircraft financing transactions, whether or not those financings involve the European or American Export Credit Agencies, whereas the Americans secure the loans for Boeing purchases.

For example, Fiji Airways used a very similar structure when it successfully financed the purchase of three B737s in the late 1990s. (Fijileaks: We will deal with that purchase in our next instalment). This is a standard aircraft financing technique, used by most airlines around the world in such transactions. All parties to the financing agreement used international aviation finance lawyers to verify and facilitate the creation of this financing structure.

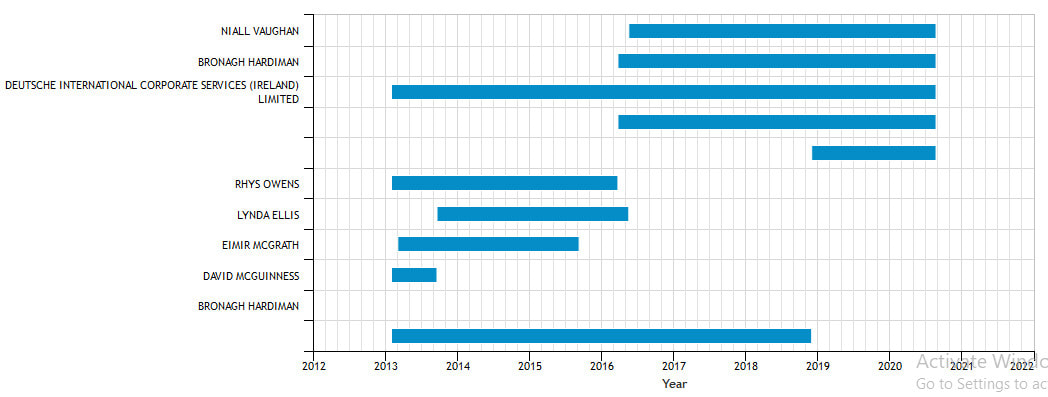

LIST OF WAQAVUKA DIRECTORS (2013-2020)

Below are the list of Waqavuka directors since 2013. On 28 Janaury 2013, Deutsche International Corporate Services (Ireland) Ltd was cited as company secretary in the documents. Rhys Owens was one of two directors from Janaury 2013 to 22 March 2016. The other was David McGuinness, from 28 Janaury 2013 to 16 September 2013. One Eimir McGrath was listed as Director from 1 March 2013 to 7 September 2015. Another, Lynda Ellis, was Director from 16 September 2013 to 16 May 2016. On 18 March 2016, Bronagh Hardiman was appointed director but resigned on 22 March 2016. On the same day, however, she was re-appointed Director. One Niall Vaughan was appointed Director on 16 May. The present Directors are Bronagh Hardiman and John Paul Maguire. Hardiman and Maguire are with VISTRA (Transaction Managment Group, Dublin, Ireland). Maguire, senior manager at Vistra, lists his role as follows: 'I am primarily focused on corporate law and structed finance and I currently manage a large portfolio of structured finance special purpose companies (involved in CDO/CLO/LPN/NPL, aircract financing and other transactions) and provide directorship services.' Besides Waqavuka, Hardiman is also listed as director of over 100 companies. She joined Vistra Alternative Investments (Ireland) Ltd as a Director in 2018. Prior to joining Vistra, Hardiman was General Counsel (2015-18) with Deutsche Bank in Ireland. Both are yet to reply to Fijileaks.