"What they didn't count on was that I would actually not accept that as so many others did and had and that I would dare to return to my office from my enforced leave "without their permission".....!! Of course I stage-managed the return by alerting the media to be present on the day for a "surprise" and to ensure my personal safety just in case matters got out of hand as they were prone to during those early days.....!!

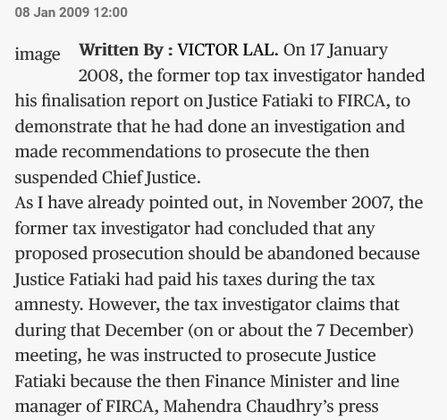

Deposed Chief Justice Daniel Fatiaki to Victor Lal in 2008. Our Founding Editor-in-Chief had Fatiaki's entire TAX File, FIRCA Investigation Report into His Tax Matters. He also had (and still has in his possession) Mahendra Chaudhry's Tax File

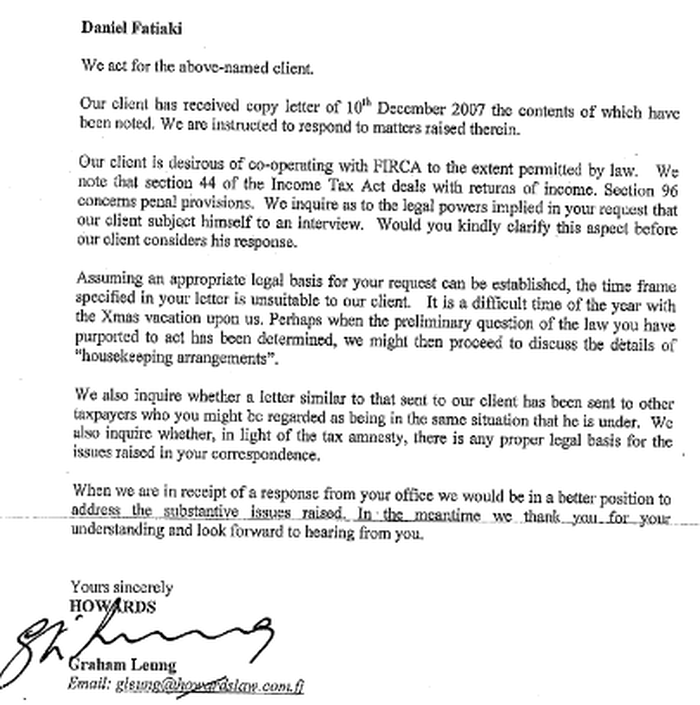

FATIAKI is currently the CHIEF JUSTICE OF NAURU ISLANDS. Fijileaks: Our Founding Editor-in-Chief (an old friend of Fatiaki) had taken up on Fatiaki's behalf the fight for REDRESS through the Fiji Sun but only to learn later that Fatiaki had cut a deal with the then Interim Attorney-General Aiyaz Khaiyum and had taken off to Vanuatu as its new Chief Justice. Et tu, Brute! Lesson: Think twice or even thrice before taking sides in liu muri or aage piche Fiji

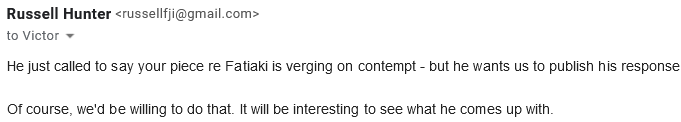

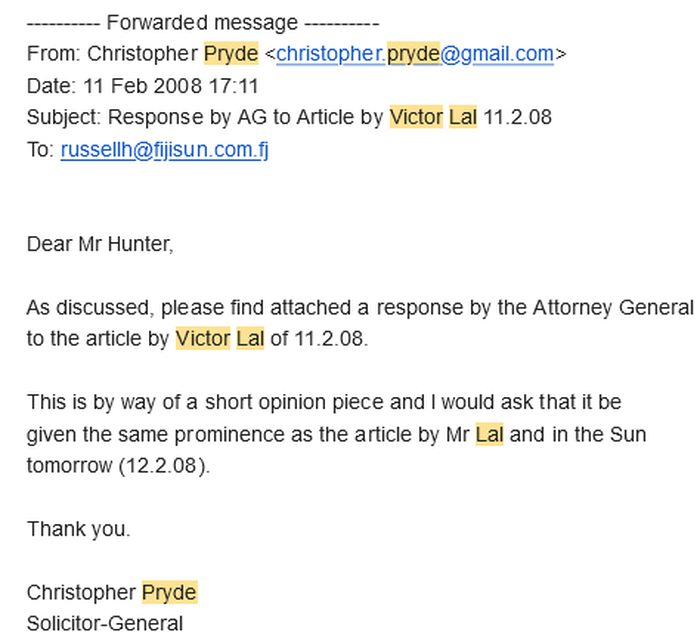

PUBLISH OR BE DAMNED: Solicitor-General Christopher Pryde to the late Fiji Sun publisher RUSSELL HUNTER and Hunter to VICTOR LAL

Mon, 11 Feb 2008, 00:16

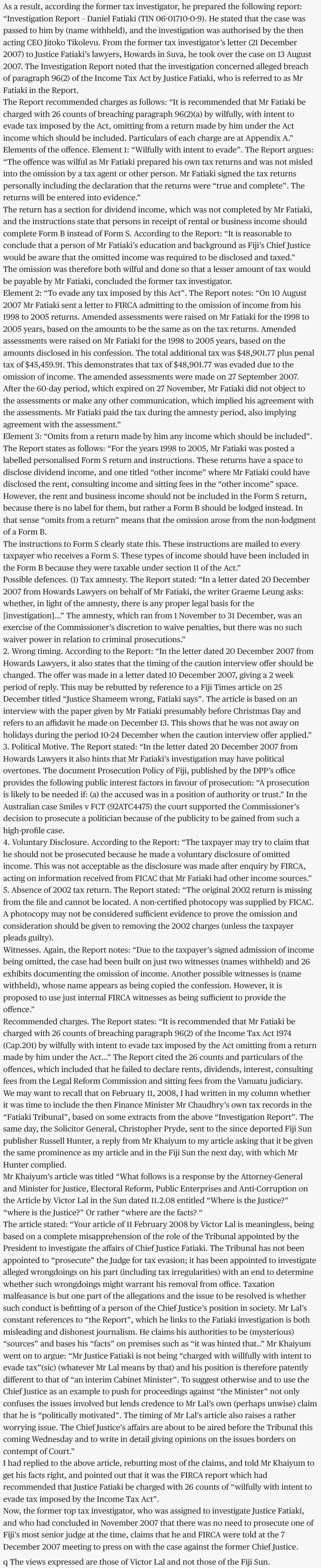

What follows is a response by the Attorney-General and Minister for Justice, Electoral Reform, Public Enterprises and Anti-Corruption on the Article by Victor Lal in the Sun dated 11.2.08 entitled “Where is the Justice?”

"where is the Justice?"

Or rather "where are the facts?

Your article of 11 February 2008 by Victor Lal is meaningless, being based on a complete misapprehension of the role of the Tribunal appointed by the President to investigate the affairs of Chief Justice Fatiaki. The Tribunal has not been appointed to "prosecute "the Judge for tax evasion; it has been appointed to investigate alleged wrongdoings on his part (including tax irregularities) with an end to determine whether such wrongdoings might warrant his removal from office.

Taxation malfeasance is but one part of the allegations and the issue to be resolved is whether such conduct is befitting of a person of the Chief Justice's position in society. Mr Lal's constant references to "the Report" , which he links to the Fatiaki investigation is both misleading and dishonest journalism. He claims his authorities to be (mysterious)"sources" and bases his "facts" on premises such as "it was hinted that.."

Mr Justice Fatiaki is not being "charged with willfully with intent to evade tax"(sic) (whatever Mr Lal means by that) and his position is therefore patently different to that of "an interim Cabinet Minister". To suggest otherwise and to use the Chief Justice as an example to push for proceedings against "the Minister" not only confuses the issues involved but lends credence to Mr Lal's own (perhaps unwise) claim that he is "politically motivated".

The timing of Mr Lal's article also raises a rather worrying issue. The Chief Justice's affairs are about to be aired before the Tribunal this coming Wednesday and to write in detail giving opinions on the issues borders on contempt of Court.

"where is the Justice?"

Or rather "where are the facts?

Your article of 11 February 2008 by Victor Lal is meaningless, being based on a complete misapprehension of the role of the Tribunal appointed by the President to investigate the affairs of Chief Justice Fatiaki. The Tribunal has not been appointed to "prosecute "the Judge for tax evasion; it has been appointed to investigate alleged wrongdoings on his part (including tax irregularities) with an end to determine whether such wrongdoings might warrant his removal from office.

Taxation malfeasance is but one part of the allegations and the issue to be resolved is whether such conduct is befitting of a person of the Chief Justice's position in society. Mr Lal's constant references to "the Report" , which he links to the Fatiaki investigation is both misleading and dishonest journalism. He claims his authorities to be (mysterious)"sources" and bases his "facts" on premises such as "it was hinted that.."

Mr Justice Fatiaki is not being "charged with willfully with intent to evade tax"(sic) (whatever Mr Lal means by that) and his position is therefore patently different to that of "an interim Cabinet Minister". To suggest otherwise and to use the Chief Justice as an example to push for proceedings against "the Minister" not only confuses the issues involved but lends credence to Mr Lal's own (perhaps unwise) claim that he is "politically motivated".

The timing of Mr Lal's article also raises a rather worrying issue. The Chief Justice's affairs are about to be aired before the Tribunal this coming Wednesday and to write in detail giving opinions on the issues borders on contempt of Court.

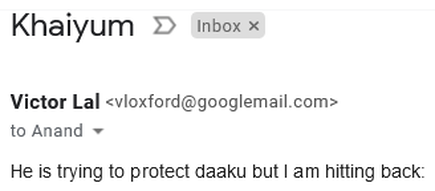

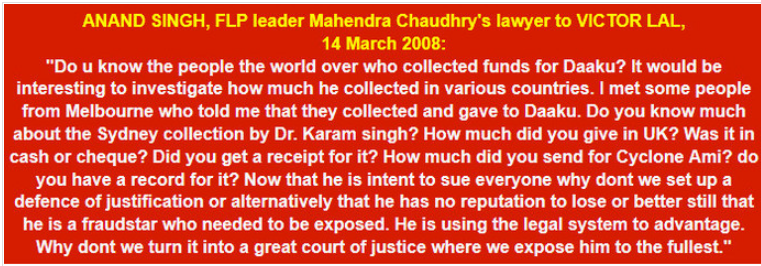

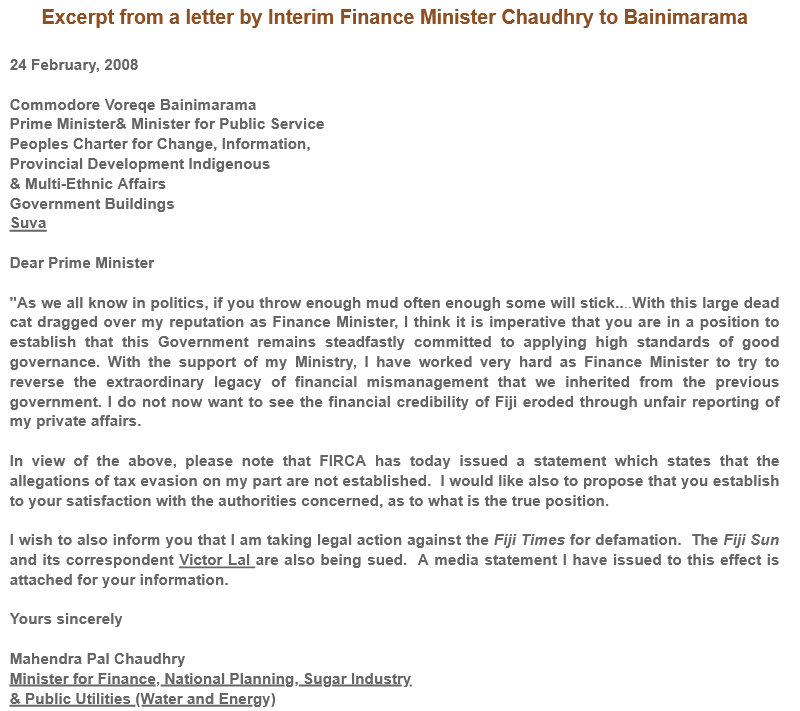

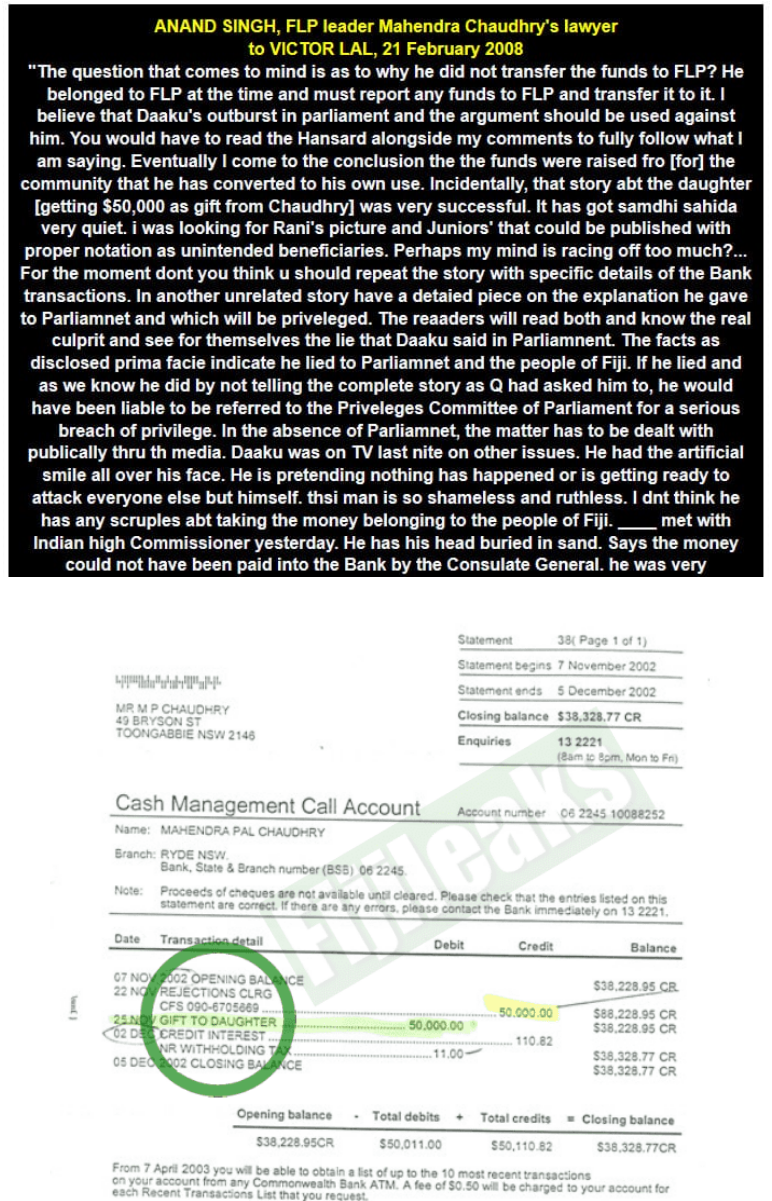

Victor Lal to the late lawyer ANAND SINGH (12 February 2008) who (along with Dr GANESH CHAND) was in the background, helping us to expose his FLP leader Mahendra Chaudhry's secret $2million in a Sydney bank account in Australia. In our exchanges, Khaiyum was referred to as Blunder Boy and Pryde as Thunder Boy, for constantly trying to stifle our pursuit of Chaudhry's secret millions, and their frantic search for our FIRCA moles. In the end, the late Singh liu muried us by representing Chaudhry in the Fiji High Court over the tax charges

Dear Mr Pryde

I would be extremely grateful if you could issue a public retraction and an apology to me on behalf of the Attorney-General Mr Khaiyum for patently and falsely attributing to me comments, which I had not written in the Fiji Sun article.

At no point did I admit or confess that "I was politically motivated" against the interim Cabinet Minister who stands accused of tax evasion.

I am sure you have Mr Russell Hunter's e-mail detail, for you sent your reply previously. If not, I am re-attaching his contact detail: [email protected]

Thank You

Victor Lal

I would be extremely grateful if you could issue a public retraction and an apology to me on behalf of the Attorney-General Mr Khaiyum for patently and falsely attributing to me comments, which I had not written in the Fiji Sun article.

At no point did I admit or confess that "I was politically motivated" against the interim Cabinet Minister who stands accused of tax evasion.

I am sure you have Mr Russell Hunter's e-mail detail, for you sent your reply previously. If not, I am re-attaching his contact detail: [email protected]

Thank You

Victor Lal

The following opinion column in the Fiji Sun, based on hard documents on our Founding Editor-in-Chief and then Opinion Columnist for Fiji Sun had irked them

FATIAKI TRIBUNAL should include other TAX EVADERS:

Minister, consultant, and board member, say FIRCA sources

By VICTOR LAL

It is only right, fair and proper that the Interim Cabinet Minister, the FIRCA consultant, and one of its board members who are all accused of tax evasion, were also directed to appear, alongside the suspended Chief Justice Daniel Fatiaki, before the tribunal set up under the chairmanship of the Australian judge Justice Robert Ellicott, argue sources inside FIRCA.

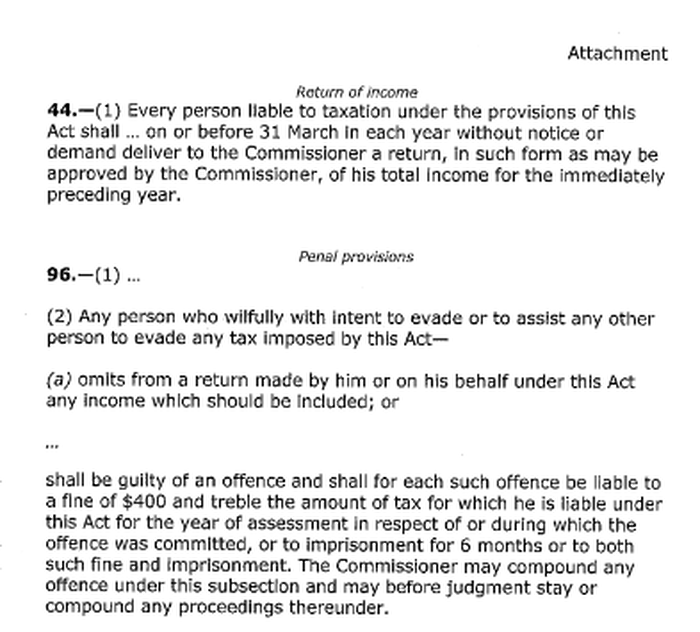

They are basing their demand on the findings and recommendations of an internal audit that was carried out into Justice Fatiaki’s tax records on the orders of FIRCA CEO Jitoko Tikolevu and the Attorney General, Minister for Justice, Electoral Reform & Anti-Corruption, Aiyaz Khaiyum, with a view to prosecuting the Chief Justice for tax avoidance. The report dated 17 January 2008 concluded that Justice Fatiaki be criminally charged with 26 counts of wilfully, with intent to evade, paying taxes to FIRCA. The sources claim that since all the four cases are of a very similar nature, it will save the taxpayers hundreds of thousands of dollars if the other three were also included under the umbrella of one tribunal, and with similar charge sheets.

The main argument for the prosecution of the case against Justice Fatiaki, despite him having paid the tax during the amnesty period, granted by Interim Finance Minister Mahendra Chaudhry, who is the line manager for FIRCA, is that Justice Fatiaki breached the Income Tax Act by wilfully not disclosing his true earnings.

The investigation report into Justice Fatiaki states as follows: “The offence was wilful as Mr Fatiaki prepared his own tax returns and was not misled into the omission by a tax agent or other person. Mr Fatiaki signed the tax returns personally including the declaration that the returns were “true and complete”. The returns will be entered into evidence.”

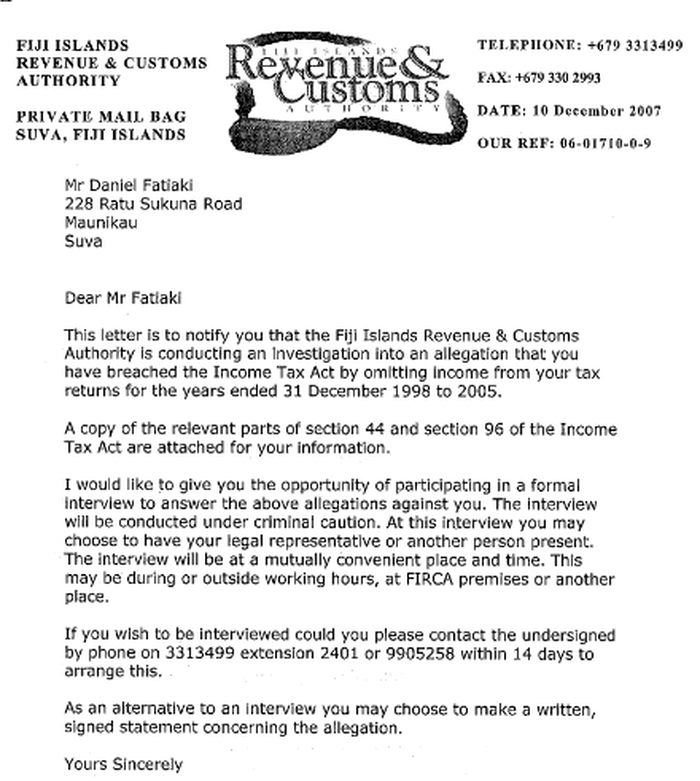

According to the sources, the Fiji Independent Commission Against Corruption (FICAC) found evidence in Justice Fatiaki’s office of income apart from his official salary. FICAC then raised FIRCA to get his tax returns (which showed only his salary). The Attorney-General Khaiyum, according to the sources, ordered FIRCA to prosecute Justice Fatiaki. On 10 August 2007 Mr Fatiaki sent a letter to FIRCA admitting to the omission of income from his 1998 to 2005 returns.

He confessed to not declaring rents, dividends, interest, consulting fees from the Legal Reform Commission and sitting fees from the Vanuatu judiciary. Amended assessments were raised on Justice Fatiaki for the 1998 to 2005 years, based on the amounts to be the same as on the tax returns. Amended assessments were raised on Jutsice Fatiaki for the 1998 to 2005 years, based on the amounts disclosed in his confession. The total additional tax was $48,901.77 plus penal tax of $45,459.91. This demonstrates, according to the report, that tax of $48,901.77 was evaded due to the omission of income. The amended assessments were made on 27 September 2007.

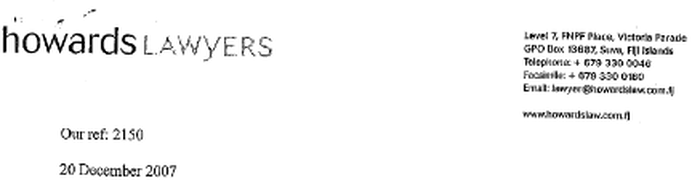

After the 60-day period, which expired on 27 November, Justice Fatiaki did not object to the assessments or make any other communication, which implied, according to the report, his agreement with the assessments. Justice Fatiaki paid the tax during the amnesty period, also implying agreement with the assessment. He was sent a letter on 10 December 2007 informing him that the interview with him would be conducted under caution.

The report into Jusice Fatiaki’s case argues that the return had a section for divided income, which was not completed by Justice Fatiaki, and the instructions state that persons in receipt of rental or business income should complete Form B instead of Form S. “It is reasonable to conclude,” the report noted that, “a person of Mr Fatiaki’s education and background as Fiji’s Chief Justice would be aware that the omitted income was required to be disclosed and taxed. The omission was therefore both wilful and done so that a lesser amount of tax would be payable by Mr Fatiaki”.

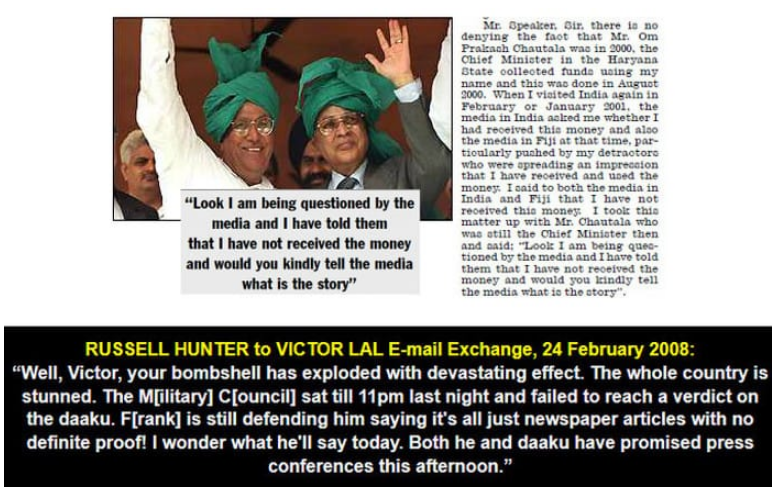

In a similar vein, argue FIRCA sources, the Cabinet minister wilfully with intent to evade tax, failed to declare interests he earned from his Australian bank accounts by falsely claiming that the funds were being held in trust for his community. He also wilfully with intent to evade tax, claimed in his 2000 tax return that his total income was $41,530.00. FIRCA disputed it, claiming it was $44,346.00. In 2001, the minister declared a total income of $46,859.00. But FIRCA disagreed, claiming that it was $81,959.00. In 2002, the minister declared income of $63,614.00, which was later found by FIRCA to be $129,438.00. And, for year 2003, the actual income as per the audit assessment was $176,283.00 but the minister declared only $64,415.00.

Likewise, the FIRCA consultant had failed to declare $629,481 in consulting fees from the tax organisation and the Reserve Bank of Fiji over the period June 2004 to October 2007, and also a board member who claimed rental loss in his tax return, whereas the rental property was owned half by himself and half by his wife, the sources argue. The consultant had claimed that the Finance Section of FIRCA knew they were making payments to him (the consultant), to which the assessing officer that the consultant did not follow the standard procedure, which was to complete the tax return and lodge it with FIRCA.

Meanwhile, the investigation into Justice Fatiaki also addressed the issue of tax amnesty, voluntary disclosure, and political motive. In December 2007 enquiries were made on behalf of Justice Fatiaki whether in light of Mr Chaudhry’s amnesty statement, there was any proper legal basis for the investigation. The report argued that the amnesty, which ran from 1 November to 31 December, was an exercise of the Commissioner’s discretion to waive penalties, but there was no such waiver power in relation to criminal prosecutions.

It was argued or hinted that Justice Fatiaki’s investigation may have political overtones. The document Prosecution Policy of Fiji, the report noted, published by the DPP’s office provides the following public interest factors in favour of prosecution: “A prosecution is likely to be needed if the accused was in a position of authority or trust.” It also cited the 1992 Australian case Smiles v FCT which supported the Commissioner’s decision to prosecute a politician because of the publicity to be gained from such a high-profile case.

The report also pointed out that Mr Justice Fatiaki may try and claim that he should not be prosecuted because he made a voluntary disclosure of omitted income. This was not acceptable, the report contended, as the disclosure was made after enquiry by FIRCA acting on information received from FICAC that Justice Fatiaki had other income sources. As we know now, FICAC forcefully removed Justice Fatiaki’s files from FIRCA despite protestations from the former CEO Tevita Banuve. FICAC chief George Langman said the directions for the investigation came from Mr Khaiyum and the information was intended for the Tribunal, which will investigate allegations against Justice Fatiaki.

According to FIRCA sources, despite Justice Fatiaki having paid the tax during FIRCA’s amnesty, and Mr Chaudhry’s announcement at the start of the amnesty that anyone who paid during the amnesty period would not be prosecuted, Mr Khaiyum ordered FIRCA to prosecute Justice Fatiaki anyway. Mr Khaiyum could not be reached for comments. The report had recommended that Justice Fatiaki be charged with 26 counts of breaching 96(2) of the Income Tax Act 1974(Cap.201) by wilfully with intent to evade tax imposed by the Act omitting from a return made by him under the Act income which should be included. The 26 counts of the particulars were cited as evidence.

Although Justice Fatiaki’s legal counsel argued during the preliminary hearing that the Tribunal was unconstitutional, one of the members of the Tribunal, Justice Sears, said everything would be presumed legal until proven illegal and suggested the Tribunal proceed instead of awaiting the results of the civil action. Justice Ellicott also highlighted the allegations against Justice Fatiaki were serious, however, unlike a court of law, the burden of proof did not have to been proven beyond reasonable doubt.

The report into Justice Fatiaki’s tax was compiled on the 17th January 2007. The President by way of an Extraordinary Notice made at Suva had appointed the tribunal to investigate and determine whether Justice Fatiaki should be removed from office for breach of the provision of section 138(1) of the Constitution (“the Tribunal”. According to the FIRCA sources two Hong Kong based investigators were involved in the investigations, and allegations of misbehaviour against Justice Fatiaki now range from failure to uphold the dignity and high standing of the office of a judge and allegations relating to tax matters, as disclosed by counsel to the Tribunal and Queens Counsel Gerard McCoy.

FATIAKI TRIBUNAL should include other TAX EVADERS:

Minister, consultant, and board member, say FIRCA sources

By VICTOR LAL

It is only right, fair and proper that the Interim Cabinet Minister, the FIRCA consultant, and one of its board members who are all accused of tax evasion, were also directed to appear, alongside the suspended Chief Justice Daniel Fatiaki, before the tribunal set up under the chairmanship of the Australian judge Justice Robert Ellicott, argue sources inside FIRCA.

They are basing their demand on the findings and recommendations of an internal audit that was carried out into Justice Fatiaki’s tax records on the orders of FIRCA CEO Jitoko Tikolevu and the Attorney General, Minister for Justice, Electoral Reform & Anti-Corruption, Aiyaz Khaiyum, with a view to prosecuting the Chief Justice for tax avoidance. The report dated 17 January 2008 concluded that Justice Fatiaki be criminally charged with 26 counts of wilfully, with intent to evade, paying taxes to FIRCA. The sources claim that since all the four cases are of a very similar nature, it will save the taxpayers hundreds of thousands of dollars if the other three were also included under the umbrella of one tribunal, and with similar charge sheets.

The main argument for the prosecution of the case against Justice Fatiaki, despite him having paid the tax during the amnesty period, granted by Interim Finance Minister Mahendra Chaudhry, who is the line manager for FIRCA, is that Justice Fatiaki breached the Income Tax Act by wilfully not disclosing his true earnings.

The investigation report into Justice Fatiaki states as follows: “The offence was wilful as Mr Fatiaki prepared his own tax returns and was not misled into the omission by a tax agent or other person. Mr Fatiaki signed the tax returns personally including the declaration that the returns were “true and complete”. The returns will be entered into evidence.”

According to the sources, the Fiji Independent Commission Against Corruption (FICAC) found evidence in Justice Fatiaki’s office of income apart from his official salary. FICAC then raised FIRCA to get his tax returns (which showed only his salary). The Attorney-General Khaiyum, according to the sources, ordered FIRCA to prosecute Justice Fatiaki. On 10 August 2007 Mr Fatiaki sent a letter to FIRCA admitting to the omission of income from his 1998 to 2005 returns.

He confessed to not declaring rents, dividends, interest, consulting fees from the Legal Reform Commission and sitting fees from the Vanuatu judiciary. Amended assessments were raised on Justice Fatiaki for the 1998 to 2005 years, based on the amounts to be the same as on the tax returns. Amended assessments were raised on Jutsice Fatiaki for the 1998 to 2005 years, based on the amounts disclosed in his confession. The total additional tax was $48,901.77 plus penal tax of $45,459.91. This demonstrates, according to the report, that tax of $48,901.77 was evaded due to the omission of income. The amended assessments were made on 27 September 2007.

After the 60-day period, which expired on 27 November, Justice Fatiaki did not object to the assessments or make any other communication, which implied, according to the report, his agreement with the assessments. Justice Fatiaki paid the tax during the amnesty period, also implying agreement with the assessment. He was sent a letter on 10 December 2007 informing him that the interview with him would be conducted under caution.

The report into Jusice Fatiaki’s case argues that the return had a section for divided income, which was not completed by Justice Fatiaki, and the instructions state that persons in receipt of rental or business income should complete Form B instead of Form S. “It is reasonable to conclude,” the report noted that, “a person of Mr Fatiaki’s education and background as Fiji’s Chief Justice would be aware that the omitted income was required to be disclosed and taxed. The omission was therefore both wilful and done so that a lesser amount of tax would be payable by Mr Fatiaki”.

In a similar vein, argue FIRCA sources, the Cabinet minister wilfully with intent to evade tax, failed to declare interests he earned from his Australian bank accounts by falsely claiming that the funds were being held in trust for his community. He also wilfully with intent to evade tax, claimed in his 2000 tax return that his total income was $41,530.00. FIRCA disputed it, claiming it was $44,346.00. In 2001, the minister declared a total income of $46,859.00. But FIRCA disagreed, claiming that it was $81,959.00. In 2002, the minister declared income of $63,614.00, which was later found by FIRCA to be $129,438.00. And, for year 2003, the actual income as per the audit assessment was $176,283.00 but the minister declared only $64,415.00.

Likewise, the FIRCA consultant had failed to declare $629,481 in consulting fees from the tax organisation and the Reserve Bank of Fiji over the period June 2004 to October 2007, and also a board member who claimed rental loss in his tax return, whereas the rental property was owned half by himself and half by his wife, the sources argue. The consultant had claimed that the Finance Section of FIRCA knew they were making payments to him (the consultant), to which the assessing officer that the consultant did not follow the standard procedure, which was to complete the tax return and lodge it with FIRCA.

Meanwhile, the investigation into Justice Fatiaki also addressed the issue of tax amnesty, voluntary disclosure, and political motive. In December 2007 enquiries were made on behalf of Justice Fatiaki whether in light of Mr Chaudhry’s amnesty statement, there was any proper legal basis for the investigation. The report argued that the amnesty, which ran from 1 November to 31 December, was an exercise of the Commissioner’s discretion to waive penalties, but there was no such waiver power in relation to criminal prosecutions.

It was argued or hinted that Justice Fatiaki’s investigation may have political overtones. The document Prosecution Policy of Fiji, the report noted, published by the DPP’s office provides the following public interest factors in favour of prosecution: “A prosecution is likely to be needed if the accused was in a position of authority or trust.” It also cited the 1992 Australian case Smiles v FCT which supported the Commissioner’s decision to prosecute a politician because of the publicity to be gained from such a high-profile case.

The report also pointed out that Mr Justice Fatiaki may try and claim that he should not be prosecuted because he made a voluntary disclosure of omitted income. This was not acceptable, the report contended, as the disclosure was made after enquiry by FIRCA acting on information received from FICAC that Justice Fatiaki had other income sources. As we know now, FICAC forcefully removed Justice Fatiaki’s files from FIRCA despite protestations from the former CEO Tevita Banuve. FICAC chief George Langman said the directions for the investigation came from Mr Khaiyum and the information was intended for the Tribunal, which will investigate allegations against Justice Fatiaki.

According to FIRCA sources, despite Justice Fatiaki having paid the tax during FIRCA’s amnesty, and Mr Chaudhry’s announcement at the start of the amnesty that anyone who paid during the amnesty period would not be prosecuted, Mr Khaiyum ordered FIRCA to prosecute Justice Fatiaki anyway. Mr Khaiyum could not be reached for comments. The report had recommended that Justice Fatiaki be charged with 26 counts of breaching 96(2) of the Income Tax Act 1974(Cap.201) by wilfully with intent to evade tax imposed by the Act omitting from a return made by him under the Act income which should be included. The 26 counts of the particulars were cited as evidence.

Although Justice Fatiaki’s legal counsel argued during the preliminary hearing that the Tribunal was unconstitutional, one of the members of the Tribunal, Justice Sears, said everything would be presumed legal until proven illegal and suggested the Tribunal proceed instead of awaiting the results of the civil action. Justice Ellicott also highlighted the allegations against Justice Fatiaki were serious, however, unlike a court of law, the burden of proof did not have to been proven beyond reasonable doubt.

The report into Justice Fatiaki’s tax was compiled on the 17th January 2007. The President by way of an Extraordinary Notice made at Suva had appointed the tribunal to investigate and determine whether Justice Fatiaki should be removed from office for breach of the provision of section 138(1) of the Constitution (“the Tribunal”. According to the FIRCA sources two Hong Kong based investigators were involved in the investigations, and allegations of misbehaviour against Justice Fatiaki now range from failure to uphold the dignity and high standing of the office of a judge and allegations relating to tax matters, as disclosed by counsel to the Tribunal and Queens Counsel Gerard McCoy.

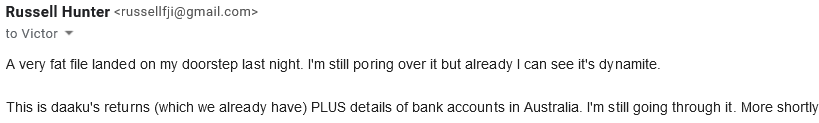

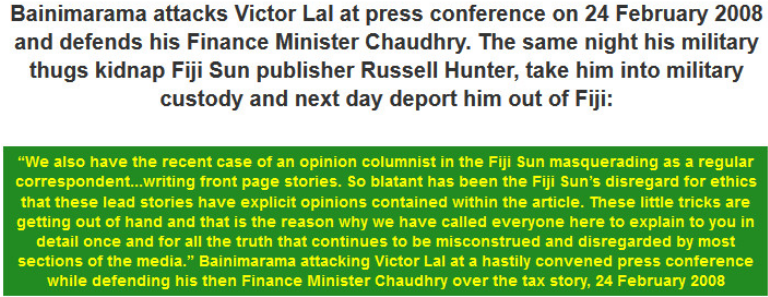

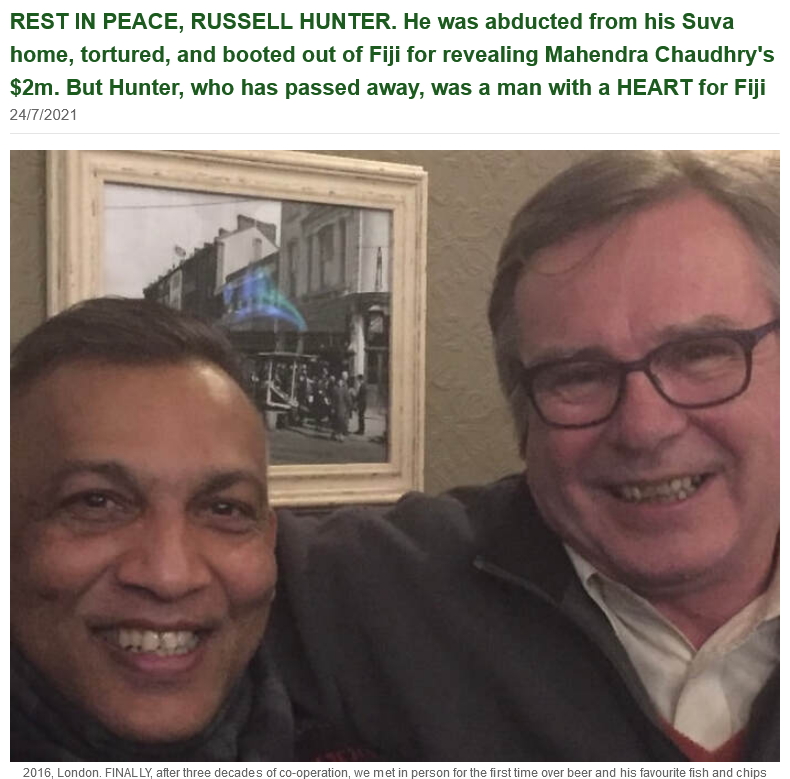

Fijileaks: The late Russell Hunter and our Founding Editor-in-Chief were writing a book about Chaudhry's secret two million dollars and the role of investigative journalism in 'Coup Fiji' when Hunter suddenly passed away in July. But it was always agreed that whoever passed away first, the other was free to reveal the correspondence. RIP Russell Hunter.

Wednesday, 6 February 2008:

"A very fat file landed on my doorstep last night. I'm still poring over it but already I can see it's dynamite. This is daaku's returns (which we already have) PLUS details of bank accounts in Australia. I'm still going through it. More shortly."

* RH: It's a different DT. [Deep Throat]. This is amazing stuff. There's just too much to scan. An example; In a letter to daaku's accountant FIRCA asks for details of how funds were remitted "from India to Australia". There's also correspondence from a lackey in Haryana. I have to attend a meeting now. It won't take long. I'll need a name (not yours) and an address that I can have this safely couriered to.

VL, Send on to: *T. M*****

**P**** Street

Oxford OX4 3AF

England

Write it out: Copies of old Fiji SUN 2002/4. Will give full details on phone

*RH: The same letter in October 2004 states: We also wish to inform you that despite amending the returns, will will still pursue the "source of funds" issue... Would you please forward details of remittances made from India to Australia." So the dosh was moved. There seems to have been no response to this letter (from *************). Perhaps madam would know.

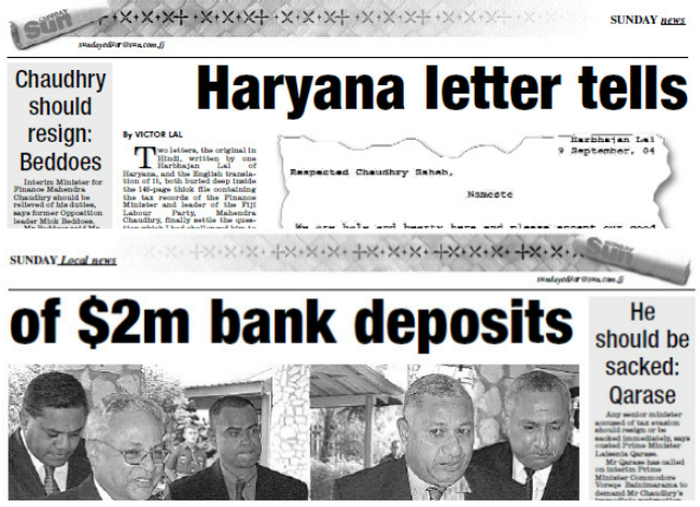

Also a letter from Harbhajan Lal in Haryana appears to indicate that A$1.5 million was sent in three amounts in 2000, 2001 and 2002. He gives this address: H Lal, Main Chowk, Assandh

Distt. Karnal, Haryana - 132039. Also bank statements show withdrawals fvor EFTPOS payment at a range of Sydney stores. If he was keeping this money in trust, he cheated.

Suggest you ask madam if there's any knowledge on whether he responded to ********* request.. moce

*RH: Oh there's also a letter here that is written in sanskrit. I can't give to anybody here to translate.

The file will be on its way to you this afternoon - DHL Courier.

**I will have to take refuge in the Australian High Commission for a few days because I have been tipped off that the Boot Boys have been ordered to kidnap me from my house.

But rest assured, I will publish your analysis and findings and I am ready to

face the consequences.

VL, Send on to: *T. M*****

**P**** Street

Oxford OX4 3AF

England

Write it out: Copies of old Fiji SUN 2002/4. Will give full details on phone

*RH: The same letter in October 2004 states: We also wish to inform you that despite amending the returns, will will still pursue the "source of funds" issue... Would you please forward details of remittances made from India to Australia." So the dosh was moved. There seems to have been no response to this letter (from *************). Perhaps madam would know.

Also a letter from Harbhajan Lal in Haryana appears to indicate that A$1.5 million was sent in three amounts in 2000, 2001 and 2002. He gives this address: H Lal, Main Chowk, Assandh

Distt. Karnal, Haryana - 132039. Also bank statements show withdrawals fvor EFTPOS payment at a range of Sydney stores. If he was keeping this money in trust, he cheated.

Suggest you ask madam if there's any knowledge on whether he responded to ********* request.. moce

*RH: Oh there's also a letter here that is written in sanskrit. I can't give to anybody here to translate.

The file will be on its way to you this afternoon - DHL Courier.

**I will have to take refuge in the Australian High Commission for a few days because I have been tipped off that the Boot Boys have been ordered to kidnap me from my house.

But rest assured, I will publish your analysis and findings and I am ready to

face the consequences.