FLP: "In a lengthy article posted on his website on 3 May 2017 titled "Fiji not between the devil and the deep blue sea" Wadan Narsey, a former National Federation Party politician who lost his seat to Labour in the 1999 general elections, tries to bolster the position of NFP going into the next elections. In doing so, he resorts to blatant lies to slander Labour Leader Mahendra Chaudhry. Narsey claims:

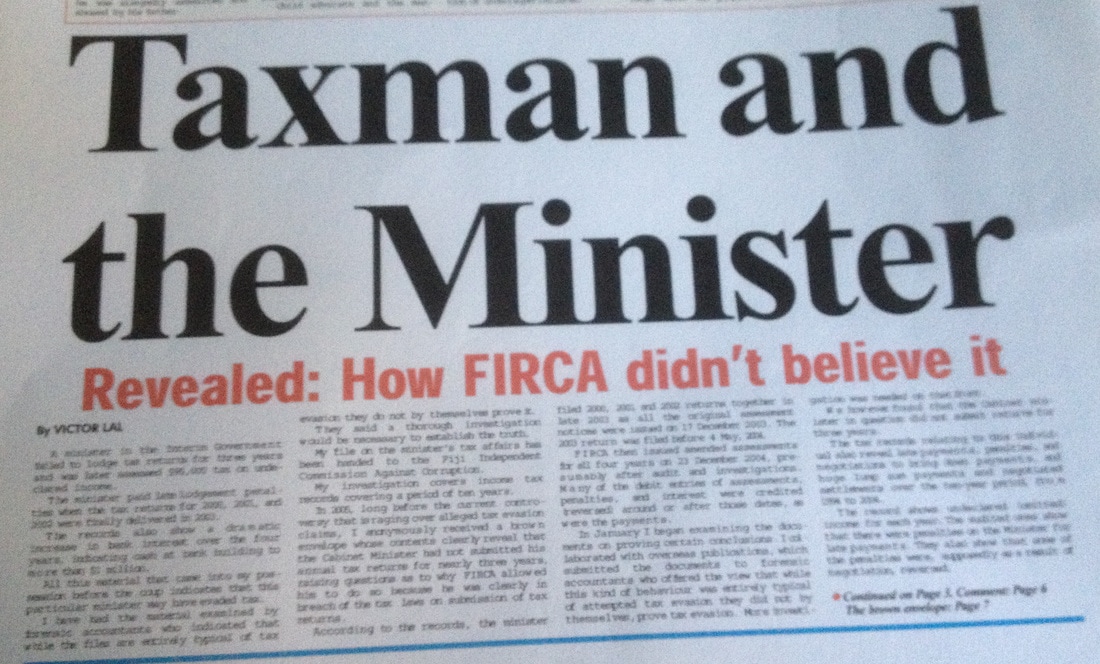

1.That Mahendra Chaudhry personally benefited from a tax amnesty he declared as Finance Minister in the interim administration in 2007.

#FLP #reply: Mr Chaudhry categorically denies the allegation. “My tax returns are, and have been, up to date. So the question of benefiting personally does not arise. In fact, the amnesty was so successful we raked in millions of dollars at a time when the State’s financial position was pretty critical.”

Fijileaks: A FIRCA source to Victor Lal, 20 August 2012: "Yes, the idea of amnesty came from the political ranks - am not sure who - it did not come from the senior civil servants in FIRCA - as part of a cash grab to make Frank's first post-coup Budget look good."

____________________________________________________

30 August 2012

Dear Mr Chaudhry

Greetings. I am writing to inquire from you if you owed $57,000 to FIRCA in outstanding tax debt in August 2007? If so, when did you settle the debt? Did you settle it during the tax amnesty period?

Documents on me reveal that in August 2007 FIRCA was still pursuing you for the sum of $57,000 and one Puspha Singh was repeatedly suspended by the FIRCA Board Member Arvind Datt who had wrongly accused her of "leaking" your tax details to the media.

I look forward to hearing from you.

Yours sincerely

Victor Lal

_________

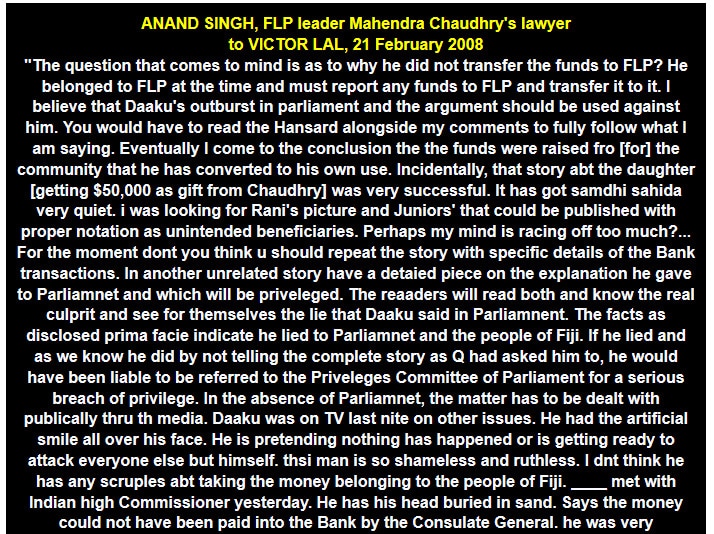

Daaku perjured himself by saying that his bank accounts did not come from Harayana, then later changing his story to say they were held in trust for the Indo-Fijian community... In theory, in democratic times such as when Qarase was in power, the Minister of Finance in Fiji did not actually control FIRCA - no "line management" - it fell under his portfolio but he was not allowed to interfere with operational issues such as tax assessments. There are one or two cases where he can "forego" withholding taxes for the economic benefit of Fiji, but otherwise we were not allowed to discuss taxpayers affairs or operational matters with him. The FIRCA board was also not allowed to interfere with operational issues - only "governance" issues. I swore to uphold tax secrecy laws of Fiji by way of affirmation in the Magistrate's Court. However, since the Dec 2006 coup and particularly over the course of the second half of 2007, FIRCA changed from a tax office to an arm of the military government. People like myself were required to use tax powers to attack the enemies of the interim government. One tax evader, Daniel Fatiaki, was subject to investigation while another, Mahendra Chaudry, was not. This selective application of the tax laws was not tax administration and so I don't feel bound by the secrecy provisions. In fact, it amounts to criminal use of the tax system and I am duty bound as a tax official to expose it. I therefore don't feel guilty about breaching tax secrecy...Daaku's nephew on the FIRCA Board certainly ensured that a climate of fear in FIRCA existed about daaku's tax file. Innocent people (like Pushpa and Mahen Singh) were sent home because of the file. People were afraid to do anything like issue a refund, or print a statement of tax account, for any taxpayer, for fear that they would suffer the same fate as the Singhs, by accidentally doing something which might blow up...[1] Puspha was destroyed by Arvin [Datt] for doing her job. For trying to collect Daaku's outstanding tax debt. Arvin repeatedly suspended her. [2] Daaku's nephew on the FIRCA Board certainly ensured that a climate of fear in FIRCA existed about daaku's tax file. The climate of fear effectively stopped any invetsigation of daaku's stash of money in Australia, and stopped any recovery of his tax debt. His tax bill overall for all years was about $120,000. He had paid off about half of it by mid last year. His Statement of Tax Account showed tax and penalties of $59,000. This was the balance that DMU officer Pushps Singh tried to clelct [collect] off him before Arvin sent her home for 'leaking' Daaku's details. I did the investigation on Pushpa and advised Arvin there was no evidence of her being the leak. Since no one has been allowed to chase Daaku's debt since last year, the balance (assuming he hasn't made any payments) would still be $59,000 or higher if further late payment penalties have been added by the computer. "

One of many FIRCA Deep Throats who had assisted VICTOR LAL

Fijileaks: Professor Wadan Narsey is not privy to the 60 pages of documents Victor Lal and Russell Hunter submitted to DPP and Director of CID in September 2012: "Perjury probe request in Mahendra Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court and call for other criminal investigations arising out of Mr Chaudhry’s income tax file".

We have documentary evidence that in August 2007 Mr Chaudhry still owed FIRCA $57,000 in tax debt, due to be paid on 9 August 2007. His own $57,000 could have fitted into insufficient advance payment or even late payment amnesty.

10. We therefore request the DPP to establish whether Mr Chaudhry had taxes or returns outstanding and paid during the amnesty period he had ordered and hence gained avoidance of penalties, and if so, then a case for Abuse of Office as Finance Minister and line manager of FIRCA could be made against him.

In their submission, the following details were included by VICTOR LAL to DPP's Ofifce

In Victor Lal’s article of 17 February 2008 headlined “India link to Fiji Minister's $2million deposit: Political sympathisers channelled money through Sydney consulate” he had alleged that in 2007 “the Interim Cabinet Minister [Mr Chaudhry] had still owed $57,672.09 in taxes to FIRCA”.

Victor Lal had provided no evidence to support his claim that Mr Chaudhry still owed taxes in 2007. He, however, had evidence on him based on an internal investigation that was carried out against a particular FIRCA staff member who was accused of “leaking” Mr Chaudhry’s tax details to the media.

According to FIRCA sources, whom we would describe as Victor Lal’s highly reliable “Deep Throats”, borrowing the code name of such sources from the “Watergate Scandal”, one of the post-coup appointed FIRCA Board members Arvind Datt, a relative of Mr Chaudhry, had allegedly made “life hell” for certain FIRCA staff members, especially one Mrs Puspha Singh, who was repeatedly suspended for trying to collect Mr Chaudhry’s outstanding tax debt

In their anger and frustration, the Deep Throats referred to Mr Chaudhry as “daaku” – a term we deployed throughout our investigation to refer to him during our search for his secret millions overseas.

One FIRCA source alleged: “His [Mr Chaudhry’s] tax bill overall for all years was about $120,000. He had paid off about half of it by mid last year (2007). I had a copy of his Statement of Tax Account which showed tax and penalties of $57,000. This was the balance that DMU officer Pushps[a] Singh tried to clelct [collect] off him before Arvin sent her home for 'leaking' Daaku's details.”

Who is Puspha?

In August 2007 Puspha Singh was assigned to recover from Mr Chaudhry his outstanding tax debt to FIRCA, contrary to his claim in his affidavit that he had paid his outstanding debt in 2004.

We will let the two documents speak to us:

Document One

Notes of Interview – Pushpa Wati Singh

Date: 30 August 2007

Time: 2.35 to 2.50pm

Place: GMDS Office, 5th Floor Dominion House, Suva

Ms Singh was informed at the outset that this was not a caution interview, and was invited to make a statement. This follows.

Ms Singh received a suspension latter (tabled) with the date “19/07”. This is incorrect as it should have been “7th August 2007”.

Ms Singh was called to the A/CEO’s office and asked by A/CEO if she had given any information regarding Mr Mahendra Chaudry’s tax file to the newspapers. A record from the IT section showed that she had been the last person to print the STA. Ms Singh agrees that she printed the STA.

Ms Singh was allocated the Mahendra Chaudry case as a new case by the system. She then received a letter from HR section on 17 July that she was to commence in Small/Medium on 19 July 2007. Ms Singh reallocated all her cases to one of her team members Ms Anshu Chand. Other cases allocated were Max Marketing and Fiji Hardwood.

Mr Chaudry’s tax debt was about $57,000, due on 9 August 2007 (Our emphasis in red). The STA and the amounts stated in the newspaper did not tie up.

As there was no DMU file on Mr Chaudry so they had to work off the STA. Ms Singh printed the STA and gave it to Ms Chand for action. Ms Singh had a second meeting with the A/CEO where she once again was accused of leaking information and again denied the allegation. Ms Singh was subsequently emailed by the manager DMU Mr Moala Nata and asked to put in writing her answer to the same allegation that A/CEO had made.

Ms Singh asked why she was targeted with this allegation and not Ms Chand who had been given the STA. Ms Singh suggested that I check the DMU file on Mr Chaudry to see if the debt has been actioned.

The statement ended. I then asked Ms Singh some questions.

Q: Did you release any confidential information regarding Mahendra Chaudry to anyone outside FIRCA?

A: No.

Q: Did your husband Mahen Singh release any information about Mr Chaudry to anyone outside FIRCA?

A: No, we never discuss work matters.

Q: Who else apart from Ms Chand was in your DMU team at the time of these events?

A: Only Jone Vula.

Ms Singh suggested that in future investigations should be done before suspension letters are sent. The last 3 weeks had been very traumatic for her and her husband.

I concluded the interview and informed Ms Singh that we would be in touch shortly.

………………………. 4.10pm 30/08/07

Document Two

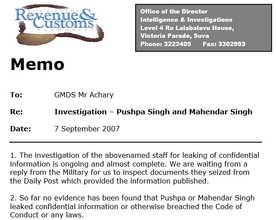

Memo To: GMDS Mr Achary

Re: Investigation – Pushpa Singh and Mahendar Singh

Date: 7 September 2007

1. The investigation of the abovenamed staff for leaking of confidential information is ongoing and almost complete. We are waiting from a reply from the Military for us to inspect documents they seized from the Daily Post which provided the information published.

2. So far no evidence has been found that Pushpa or Mahendar Singh leaked confidential information or otherwise breached the Code of Conduct or any laws.

3. If the officers are returned from suspension to the workplace this will not compromise the finalisation of the investigation.

_______________

On 30 August 2012 Victor Lal wrote to Mr Chaudhry, “Tax arrears of $57,000 in 2007” but to date there has been no reply from him:

Dear Mr Chaudhry

Greetings. I am writing to inquire from you if you owed $57,000 to FIRCA in outstanding tax debt in August 2007? If so, when did you settle the debt? Did you settle it during the tax amnesty period?

Documents on me reveal that in August 2007 FIRCA was still pursuing you for the sum of $57,000 and one Puspha Singh was repeatedly suspended by the FIRCA Board Member Arvind Datt who had wrongly accused her of "leaking" your tax details to the media.

I look forward to hearing from you.

Yours sincerely

Victor Lal

________________

As we can see from the above two documents, Ms Puspha Singh was cleared of any wrong-doing, and was definitely not one of Victor Lal’s many “Deep Throats” inside FIRCA.

The investigation, however, reveals that in August 2007 Mr Chaudhry still allegedly owed FIRCA $57,000, due to be paid by 9 August 2007.

If he cleared all his taxes in 2004 then for what years was FIRCA pursuing him to pay up the outstanding tax debt? Why was Ms Puspha Singh tasked to recover from him the outstanding debt of the same sum, and from what year [years]?

Most importantly, we call upon the Director of Public Prosecutions to establish if, and when, Mr Chaudhry settled the outstanding tax debt of $57,000.

2: Request for criminal investigation to ascertain whether Mr Chaudhry abused office as Finance Minister and line-manager of FIRCA by benefitting from the Tax Amnesty in 2007

If the above outstanding sum is true, which we have no doubt that it is, then we would like to invite the Director of Public Prosecutions to investigate whether Mr Chaudhry might have abused his position as Minister of Finance, National Planning and Sugar Industry, and inter-alia as line manager of FIRCA, when he persuaded the Interim Cabinet of Commodore Bainimarama to endorse his tax amnesty plan – grace period for taxpayers.

We would like to invite the Director of Public Prosecutions to also investigate whether Mr Chaudhry committed a second offence of perjury in his affidavit by claiming that he had cleared all his taxes by 2004 when we have evidence that in 2007 he still owed $57,000 which Ms Puspha Singh was trying to recover from him.

On 9 October 2007 the Interim Cabinet announced that FIRCA will undertake the tax amnesty from October 15 to November 16. The amnesty period will be extended to December if the need arises.

Cabinet endorsed the tax amnesty based on a submission by Mr Chaudhry. He explained that a tax amnesty was generally defined as a limited-time opportunity where tax defaulters have the chance to absolve their interest and penalties relating to overdue tax without prosecution.

We may recall that FIRCA had issued detailed Tax Amnesty Guidelines: Fiji Islands Revenue & Customs Authority, TAX AMNESTY October 15th to December 31st 2007. Also, a Tax Amnesty Unit was set up within FIRCA.

http://www.frca.org.fj/docs/firca/tax_amnesty/TAX_AMNESTY_GUIDELINES%28amended_Dec07%29.pdf

The tax amnesty was designed to assist taxpayers in three ways:

- To enable them to get up to date with the lodgement of returns for Income Tax, Value Added Tax (VAT) and Gambling Turnover Tax;

- To enable taxpayers to amend returns that have previously been lodged with FIRCA and where the information returned is incorrect;

- To allow taxpayers that had fallen behind in the payment of taxes, the opportunity to pay those tax arrears.

The following questions and answers are of relevance for the purpose of our submission for a criminal investigation on the question of abuse of office, if any, on Mr Chaudhry’s part.

Q: Does the tax amnesty apply to persons whose tax affairs are under investigation or have been referred for recovery through the courts?

A: Yes. In such cases the taxpayer is encouraged to make a complete disclosure of facts. This is the condition under which any existing or legal action will be withdrawn. For existing audits the case can be withdrawn provided both the Auditor and the Team leader responsible for the case are satisfied with the additional information returned.

Q: Where FIRCA has instigated recovery action against a taxpayer for unpaid tax will recovery action cease and the later payment penalty remitted if the taxpayer pays the overdue tax during the amnesty period?

A: Yes. Recovery action will cease and the penalty will be remitted provided the entire overdue tax for which the recovery action has been instigated is paid. Recovery action will continue where the taxpayer has made only part of the overdue tax.

Mr Chaudhry said tax arrears as at August 31, 2007 was $168million, an increase of about 33.5 per cent from that recorded for the same period in 2006.

We do not know if he was among those owing taxes at August 31, 2007; for Ms Singh was suspended on 7 August 2007, two days before Mr Chaudhry was due to pay his own taxes on 9 August.

FIRCA is a statutory corporation constituted by Fiji Islands Revenue and Customs Authority Act 1998 (The Act). It is charged with inter-alia, administering and enforcing various tax revenue/collecting statutes being principally the Income Tax and Customs Act and Value Added Tax Decree, and; The Process of collecting revenue requires the mandatory filing of tax and other returns and associated information by corporate entities and individuals (The Taxpayer) with FIRCA.

We agree that amnesty is a legitimate way of collecting taxes and getting returns lodged in many countries around the world. The point is: you still have to pay the tax, but the amnesty is to let you out of paying the penalty for not paying that tax in the first place.

We do accept that Mr Chaudhry could only have used the amnesty for his penalties not the alleged primary tax due which would have been most of his tax debt. The penalty is a flat 10 per cent.

We are yet to research into the background leading to the tax amnesty announcement in September 2007. There is evidence, however, that in August 2007 Mr Chaudhry still allegedly owed unpaid tax of $57,000 to FIRCA – see contents of interview report on Pushpa Singh.

We believe that only a thorough investigation by the DPP or other appointed bodies on the background to his amnesty tax submission will establish whether Mr Chaudhry paid his alleged outstanding debts during the amnesty period.

If he settled his alleged tax debt during the amnesty period, he definitely gained avoidance of penalties and hence a case for abuse of office could be made against him.

For being in charge of FIRCA - anything which could benefit him personally is presumably a conflict of interest even if it can’t be exactly pinned on him as the initiator of the tax amnesty project.

To summarize, Justice Goundar observed in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012):

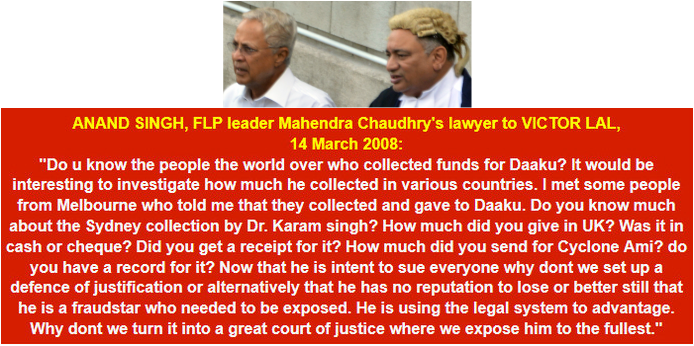

“The applicant says he later found out that a former editor of the Fiji Sun obtained his confidential tax details from FIRCA and released it to Victor Lal, a former Fiji journalist residing overseas. Victor Lal published those details in anti-government websites.” We have demonstrated that we never published Mr Chaudhry’s tax details in any anti-government websites but in the Sunday Sun dated 24 February 2008, including the first tax story in the Fiji Sun, on 15 August 2007.

1: We therefore call upon the Director of Public Prosecutions to investigative whether Mr Chaudhry committed the offence of “perjury in a false affidavit”.

2: We call upon the Director of Public Prosecutions to investigate whether Mr Chaudhry’s legal representatives in offering his affidavit to the Fiji High Court are also guilty of aiding and abetting the offence of perjury in a false affidavit, for it is abundantly clear that we did not publish Mr Chaudhry’s tax details in any anti-government websites.

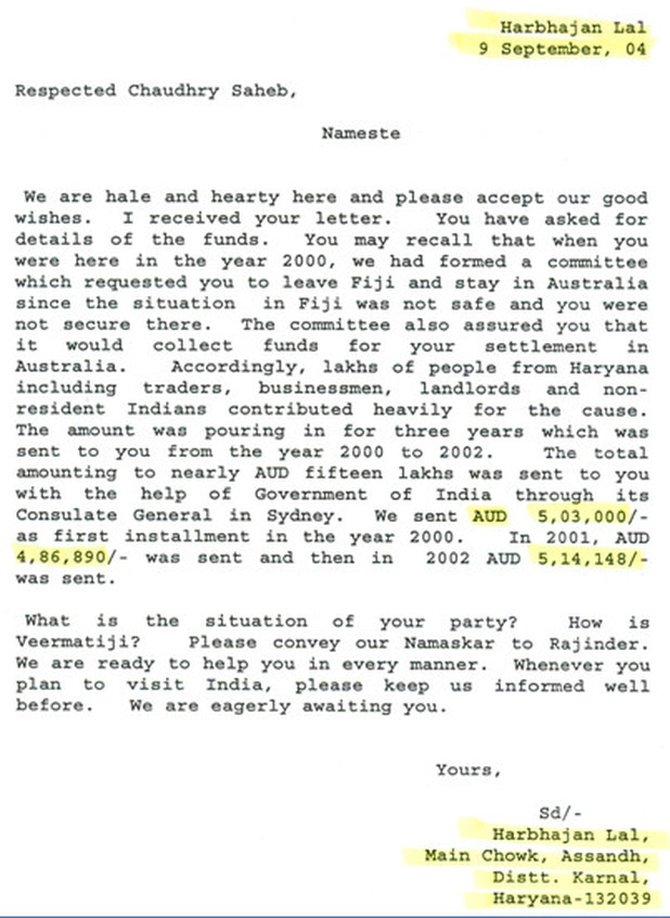

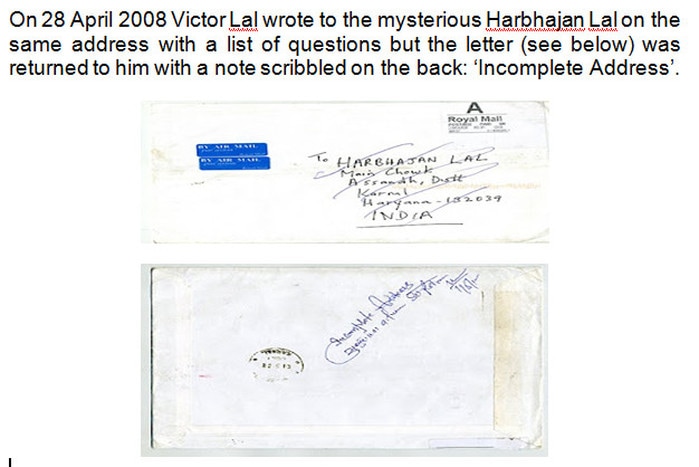

3: We request the Director of Public Prosecutions to establish on what grounds the original letter tendered from one Harbhajan Lal dated 9 September 2004 to FIRCA from Haryana in India was withheld [if it was] and a new letter from Delhi Study Group dated 12 October 2004 substituted in Mr Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court.

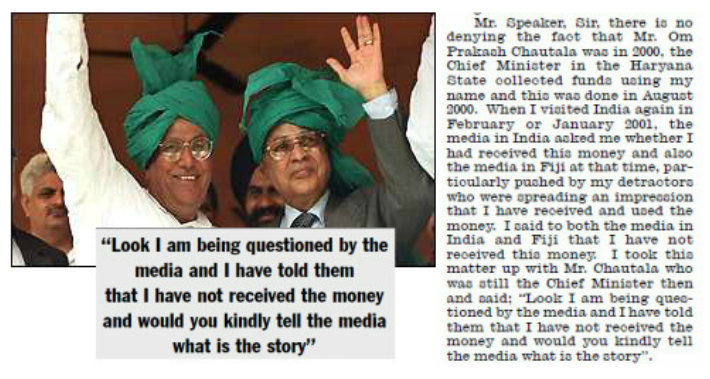

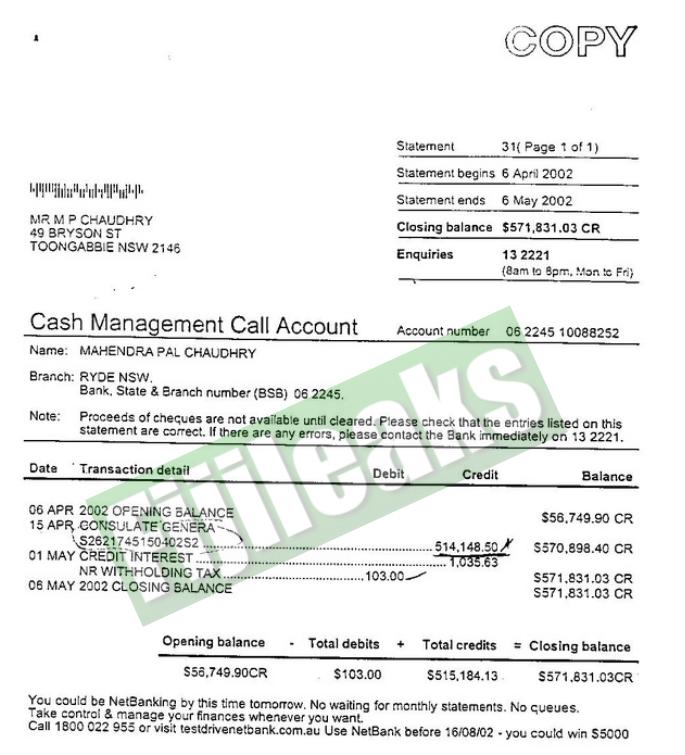

4. The “Harbhajan Lal Letter” of 9 September 2004 states the money was collected in Haryana and part of it was transacted through the Indian Consulate in Sydney, Australia. Harbhajan Lal wrote from Haryana:

“Respected Chaudhry Saheb, Nameste. We are hale and hearty here and please accept our good wishes. I received your letter. You have asked for details of the funds. You may recall that when you were here in the year 2000, we had formed a committee, which requested you to leave Fiji and stay in Australia since the situation in Fiji was not safe and you were not secure there. The committee also assured you that it would collect funds for your settlement in Australia.Lakhs of people from Haryana including traders, businessmen, landlords and non-resident Indians contributed heavily for the cause. The amount was pouring in for three years, which was sent to you from the year 2000 to 2002. The total amounting to nearly AUD fifteen laks was sent to you with the help of Government of India through its Consulate General in Sydney. We sent AUD 503,000/- as first instalment in the year 2000. In 2001, AUD $486,890/- was sent and then in 2002 AUD $514, 149/- was sent.”

The “Delhi Study Group Letter” states, “This is to confirm that funds were collected in New Delhi and other parts of India, including NRI's (Non-Resident Indians) to assist Hon'ble Mahendra Pal Chaudhry, Former Prime Minister of Fiji in 2000-2002.”

5: We call upon the Director of Public Prosecutions to ask Mr Chaudhry who transferred the money from India – Delhi Study Group based in New Delhi or Harbahajan Lal in Haryana, India?

6: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

7: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent to deal with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Support Group letter dated 12 October 2004.

8: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account.

9: We request the Director of Public Prosecutions to investigative whether Mr Chaudhry, in presenting the Tax Amnesty submission to the Cabinet in September 2007 for endorsement, might have abused office as Interim Finance Minister and direct line manager of Fiji Island Revenue and Customs Authority (FIRCA), to benefit himself, and to escape any future criminal prosecutions for submitting late tax returns between 2000 and 2003.We have documentary evidence that in August 2007 Mr Chaudhry still owed FIRCA $57,000 in tax debt, due to be paid on 9 August 2007. His own $57,000 could have fitted into insufficient advance payment or even late payment amnesty.

10. We therefore request the DPP to establish whether Mr Chaudhry had taxes or returns outstanding and paid during the amnesty period he had ordered and hence gained avoidance of penalties, and if so, then a case for Abuse of Office as Finance Minister and line manager of FIRCA could be made against him.

11: We call upon the Director of Public Prosecutions to plead with the Fiji High Court to expunge the patently false claims made against us in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012) – re that we published Mr Chaudhry’s tax details in anti-government websites.

In conclusion, we leave you with the words of the great English judge, the late Lord Denning in King v Victor Parsons & Co [1973] 1 WLR 29, 33-34:

“The word 'fraud' here is not used in the common law sense. It is used in the equitable sense to denote conduct by the defendant or his agent such that it would be 'against conscience' for him to avail himself of the lapse of time. The cases show that, if a man knowingly commits a wrong (such as digging underground another man's coal); or a breach of contract (such as putting in bad foundations to a house), in such circumstances that it is unlikely to be found out for many a long day, he cannot rely on the Statute of Limitations as a bar to the claim: see Bulli Coal Mining Co v Osborne [1899] AC 351 and Applegate v Moss [1971] 1 QB 406. In order to show that he 'concealed' the right of action 'by fraud', it is not necessary to show that he took active steps to conceal his wrongdoing or breach of contract.

It is sufficient that he knowingly committed it and did not tell the owner anything about it. He did the wrong or committed the breach secretly. By saying nothing he keeps it secret. He conceals the right of action. He conceals it by 'fraud' as those words have been interpreted in the cases. To this word 'knowingly' there must be added recklessly': see Beaman v ARTS Ltd [1949] 1 KB 550, 565-566. Like the man who turns a blind eye. He is aware that what he is doing may well be a wrong, or a breach of contract, but he takes the risk of it being so. He refrains from further inquiry least it should prove to be correct: and says nothing about it. The court will not allow him to get away with conduct of that kind. It may be that he has no dishonest motive: but that does not matter. He has kept the plaintiff out of the knowledge of his right of action: and that is enough: see Kitchen v Royal Air Force Association [1958] 1 WLR 563.”

The limitation statute’s aim is to prevent citizens from being oppressed by stale claims, to protect settled interests from being disturbed, to bring certainty and finality to disputes and so on. These are, as legal commentators have pointed out, laudable aims but they can conflict with the need to do justice in individual cases where an otherwise unmeritorious defendant can play the limitation trump card and escape liability.

We call upon the Director of Public Prosecutions to ask Mr Chaudhry which of the two letters – Harbhajan Lal or Delhi Study Group – is the lie – as they both can’t be genuine. Apart from the false accusations against us in his affidavit, the contents of the Harbhajan Lal letter dated 9 September 2004 does not accord with his bank statements from the Commonwealth Bank of Australia which he offered to FIRCA.

In our humble submission we beg the Director of Prosecutions to call upon the Fiji High Court to waiver the statute of limitation for prima facie there is evidence in the “Harbhajan Lal” letter that Mr Chaudhry obtained a favourable decision from FIRCA (an oversight on the part of FIRCA tax officers) through alleged fraud – the contents of the Harbhajan Lal letter does not square with his Australian bank statements.

Moreover, although we do not have a copy of Mr Chaudhry’s affidavit cited by Justice Goundar (despite requests for one from the Director of the Public Prosecutions) we call upon the Director of Public Prosecutions to examine the contents of both the Harbhajan Lal and the Delhi Support Group letters.

If there are glaring disparities in the two letters than Mr Chaudhry must be deprived of the statute of limitation for the “fraud”, if any on his part, would be a continuing “fraud” since 2004 when he first offered Harbhajan Lal’s letter and now the Delhi Study Group letter in 2012 to explain away the $2million is his Australian bank account.

VICTOR LAL and RUSSELL HUNTER, 4 September 2012