"If a robber accosted a decent law-abiding citizen on the street and violently stole $40 from him, the police would be on him like a ton of bricks. He would be arrested, charged with the unlawful theft of property, and fined or jailed or both, for his obvious crime. But between 2020 and 2021 (FNPF Annual Reports), by forcibly reducing the rate of FNPF contributions from 18% to 10%, $168 million have already been transferred from hardworking law-abiding employees FNPF funds, to employers' pockets...The Bainimarama Government has not only betrayed the employees of Fiji, but they have put a downward pressure on the Fiji economy into the future. Will this have any impact on the next General Elections? [People with short memories may be asking why I titled this article |

If a robber accosted a decent law-abiding citizen on the street and violently stole $40 from him, the police would be on him like a ton of bricks. He would be arrested, charged with the unlawful theft of property, and fined or jailed or both, for his obvious crime.

But between 2020 and 2021 (FNPF Annual Reports), by forcibly reducing the rate of FNPF contributions from 18% to 10%, $168 million have already been transferred from hardworking law-abiding employees FNPF funds, to employers' pockets.

My rough estimates indicate that even though the rate of contribution has been slightly raised to 12%, by 31 December 2022, somewhere up to $382 million of employees' retirement funds, will have been transferred to employers.

There has been no uproar from the police or the judiciary or even employees who have been brutally intimidated these last fourteen years.

Of course, there will be no protest from employers who are gaining these massive sums of money without any effort on their part.

But the Fiji public must ask: have any members of the FNPF Board, expressed any concern whatsoever on the impact on the future welfare of the FNPF Members?

The Fiji public must ask: do any of the Members of the FNPF Board have any conflicts of interest with the transfer of this massive amount from employees to employers?

The Fiji public must ask: has the FNPF Board or any of them individually, expressed any concerns whatsoever on the negatives impacts of the robbery on the FNPF's finances?

The employees of Fiji must demand to know why there are no employee representatives on the FNPF Board.

What has occurred to the employees' FNPF retirements funds is truly tragic, "legal robbery" as I personally call it.

The sacredness of FNPF Contribution

I remind readers of the legal sacredness of the FNPF contribution.

By law, all registered employers have for several years been required to contribute 18% of their wage bill to the FNPF, with 10% supposedly coming from employers and 8% supposedly coming from employees.

If any employer unilaterally chose not to pay their required FNPF contributions, this is seen as "breaking the law" seen effectively as the employer "stealing" from the employees.

Such employers would be prosecuted by government (police and judiciary), fined, and forced to pay the required contributions into the employees' accounts.

Except that the Bainimarama Government has legally allowed the employer to keep a large part of the employees' contributions in his own pockets, and to keep doing so until 31 December 2022.

By doing so, not only has the FNPF been put under great financial stress, but the Fiji economy has also been deprived of that much development funds.

The facts from the FNPF Annual Reports

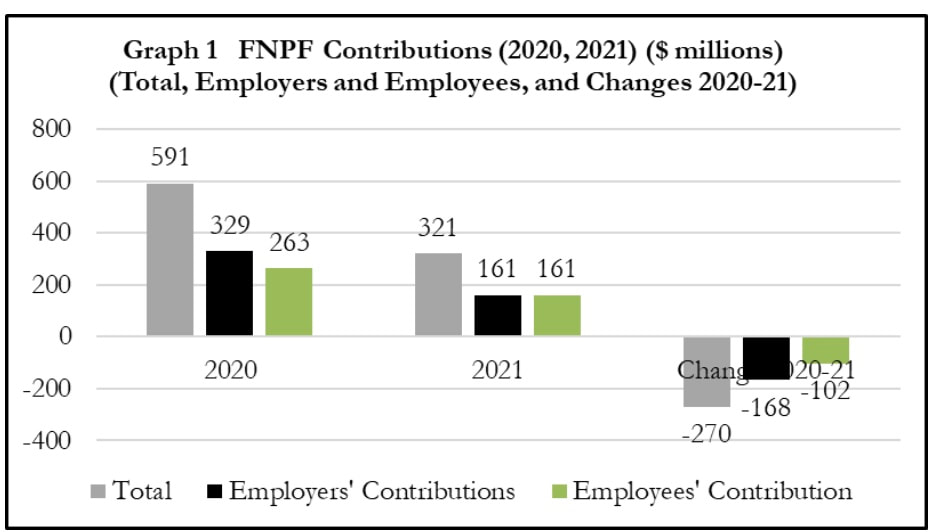

The massive reductions in contributions to FNPF are fully documented in the 2021 FNPF Annual Report which covers the period 1 July 2020 to 31 June 2021.

Total Contributions to FNPF over this one year alone have declined by a massive $270 million (the grey bars in the graph).

But between 2020 and 2021 (FNPF Annual Reports), by forcibly reducing the rate of FNPF contributions from 18% to 10%, $168 million have already been transferred from hardworking law-abiding employees FNPF funds, to employers' pockets.

My rough estimates indicate that even though the rate of contribution has been slightly raised to 12%, by 31 December 2022, somewhere up to $382 million of employees' retirement funds, will have been transferred to employers.

There has been no uproar from the police or the judiciary or even employees who have been brutally intimidated these last fourteen years.

Of course, there will be no protest from employers who are gaining these massive sums of money without any effort on their part.

But the Fiji public must ask: have any members of the FNPF Board, expressed any concern whatsoever on the impact on the future welfare of the FNPF Members?

The Fiji public must ask: do any of the Members of the FNPF Board have any conflicts of interest with the transfer of this massive amount from employees to employers?

The Fiji public must ask: has the FNPF Board or any of them individually, expressed any concerns whatsoever on the negatives impacts of the robbery on the FNPF's finances?

The employees of Fiji must demand to know why there are no employee representatives on the FNPF Board.

What has occurred to the employees' FNPF retirements funds is truly tragic, "legal robbery" as I personally call it.

The sacredness of FNPF Contribution

I remind readers of the legal sacredness of the FNPF contribution.

By law, all registered employers have for several years been required to contribute 18% of their wage bill to the FNPF, with 10% supposedly coming from employers and 8% supposedly coming from employees.

If any employer unilaterally chose not to pay their required FNPF contributions, this is seen as "breaking the law" seen effectively as the employer "stealing" from the employees.

Such employers would be prosecuted by government (police and judiciary), fined, and forced to pay the required contributions into the employees' accounts.

Except that the Bainimarama Government has legally allowed the employer to keep a large part of the employees' contributions in his own pockets, and to keep doing so until 31 December 2022.

By doing so, not only has the FNPF been put under great financial stress, but the Fiji economy has also been deprived of that much development funds.

The facts from the FNPF Annual Reports

The massive reductions in contributions to FNPF are fully documented in the 2021 FNPF Annual Report which covers the period 1 July 2020 to 31 June 2021.

Total Contributions to FNPF over this one year alone have declined by a massive $270 million (the grey bars in the graph).

Employers' Contributions (black columns) have declined by $168 million (which they have kept in their pockets).

Employees' contributions have declined by $102 million.

How has this historic reductions come about?

The first reduction

In the 2020 COVID-19 Supplementary Budget, the Minister for Economy (Aiyaz Khaiyum) announced that from April 1 2020 to 31 December 2020, FNPF contributions would be reduced from 18% to 10%.

Employees' contribution to their FNPF would be reduced from 8% to 5%, thereby putting $80 million into their pocket (presumably for spending or saving), which most sensible economists would be deeply concerned about.

But of greater concern is that by law employers' contributions would be reduced from 10% to 5% with Khaiyum announcing that "Over the next 9 months, this will keep $130 million in their accounts".

What Khaiyum did not say was that by law, this effectively would move over the nine months, $130 million from employees' FNPF retirement funds, into the employers' pockets, forever: I call it "legal robbery".

Khaiyum justified it as "helping them sustain their business and cash flow and minimize job losses and hour reductions”.

Australia also helped many employers maintain their cash flow during COVID, but they used their Jobkeeper Allowances paid for by taxpayers in general. It was not taken out of employees' super contributions or retirement funds.

Then in July 2020, that reduction of Employers' FNPF contributions from 10% to 5% was continued from 1 January 2021 to 31 December 2021, proportionately putting for the calendar year 2021, another $140 million into employers' pockets.

Last week, the Bainimarama Government announced an "increase" of contributions to 12% (6% from employers and 6% from employees) to go from 1 January 2022 to 31 December 2022: effectively transferring another $112 million from employees to employers.

Altogether, the employees will have forever lost up to $382 million (=130+140+112) into the pockets of employers, by strokes of the pen of the Minister of Economy.

Given the size of these "benefits" for the employers, the contributions to the FFP revealed by Victor Lal's website Fijileaks would seem to be fantastic investments by the employers.

Note also that by 31 December 2022, the FNPF retirement funds will have roughly lost up to $658 million creating enormous liquidity problems, because of historically high withdrawals by members.

Given that the actual contributions would have been somewhat lower because of the contraction of the economy, the public can call upon FNPF to give far more accurate estimates than my rough numbers here.

FNPF Under Pressure

It is critical that the FNPF members understand how the nation's retirement funds have been badly dented by the Bainimarama Government policies.

Not only have they massively cut employer contributions (which have gone into their pockets) but they have very unwisely encouraged the FNPF members to draw down their savings.

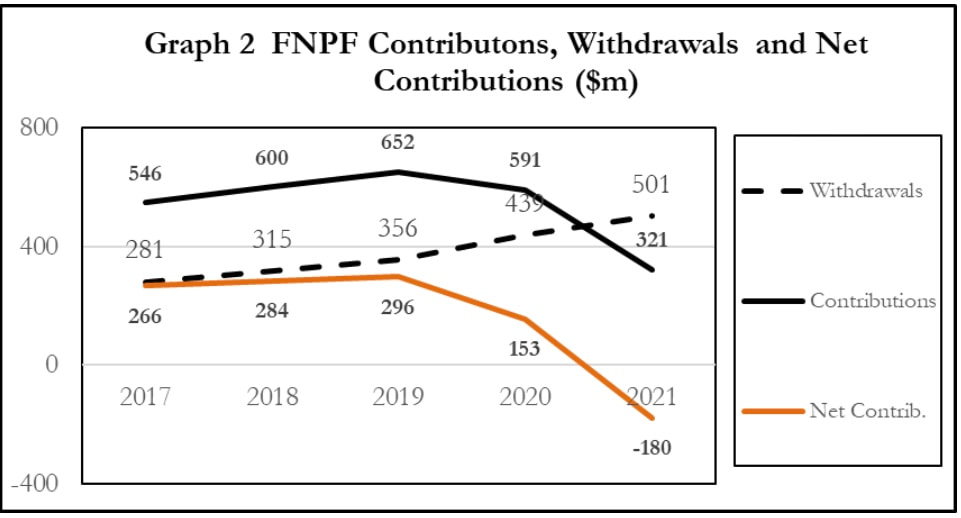

Graph 2 shows these declines.

Employees' contributions have declined by $102 million.

How has this historic reductions come about?

The first reduction

In the 2020 COVID-19 Supplementary Budget, the Minister for Economy (Aiyaz Khaiyum) announced that from April 1 2020 to 31 December 2020, FNPF contributions would be reduced from 18% to 10%.

Employees' contribution to their FNPF would be reduced from 8% to 5%, thereby putting $80 million into their pocket (presumably for spending or saving), which most sensible economists would be deeply concerned about.

But of greater concern is that by law employers' contributions would be reduced from 10% to 5% with Khaiyum announcing that "Over the next 9 months, this will keep $130 million in their accounts".

What Khaiyum did not say was that by law, this effectively would move over the nine months, $130 million from employees' FNPF retirement funds, into the employers' pockets, forever: I call it "legal robbery".

Khaiyum justified it as "helping them sustain their business and cash flow and minimize job losses and hour reductions”.

Australia also helped many employers maintain their cash flow during COVID, but they used their Jobkeeper Allowances paid for by taxpayers in general. It was not taken out of employees' super contributions or retirement funds.

Then in July 2020, that reduction of Employers' FNPF contributions from 10% to 5% was continued from 1 January 2021 to 31 December 2021, proportionately putting for the calendar year 2021, another $140 million into employers' pockets.

Last week, the Bainimarama Government announced an "increase" of contributions to 12% (6% from employers and 6% from employees) to go from 1 January 2022 to 31 December 2022: effectively transferring another $112 million from employees to employers.

Altogether, the employees will have forever lost up to $382 million (=130+140+112) into the pockets of employers, by strokes of the pen of the Minister of Economy.

Given the size of these "benefits" for the employers, the contributions to the FFP revealed by Victor Lal's website Fijileaks would seem to be fantastic investments by the employers.

Note also that by 31 December 2022, the FNPF retirement funds will have roughly lost up to $658 million creating enormous liquidity problems, because of historically high withdrawals by members.

Given that the actual contributions would have been somewhat lower because of the contraction of the economy, the public can call upon FNPF to give far more accurate estimates than my rough numbers here.

FNPF Under Pressure

It is critical that the FNPF members understand how the nation's retirement funds have been badly dented by the Bainimarama Government policies.

Not only have they massively cut employer contributions (which have gone into their pockets) but they have very unwisely encouraged the FNPF members to draw down their savings.

Graph 2 shows these declines.

FNPF contributions fell from $652 million per year in 2019 to $321 million in 2021 (solid line in the graph).

Withdrawals rose from $356 million in 2019 to a record $501 million in 2021 (dotted line in the graph).

Net Contributions to the FNPF which had been positive $296 million in 2019, had declined to $153 million in 2020, and became a massive NEGATIVE $180 million in 2021.

I suspect that it will still be negative when the 2022 Annual Report is written.

But the FNPF contributors must ask: who in the FNPF Board have been looking after their financial interests while their retirement funds have been raided?

What of the FNPF Board Members?

One of the fiduciary duties of the FNPF Board Members is to look after the interests of the FNPF contributors- most of whom are employees in the formal sector of the Fiji economy.

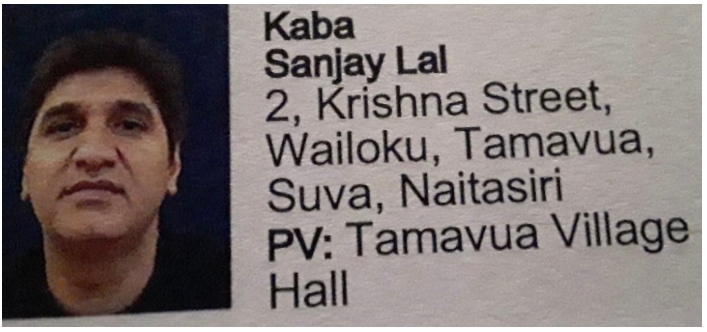

Did any of the current Board Members (Dakshesh Patel, Sanjay Kaba, Mukhtar Ali, Shiri Gounder, Joel Abraham and Kalpana Lal) make known any concerns about the welfare impact of these FNPF contributions?

Indeed, do they have any conflicts of interest in these adverse developments for employees?

It is public knowledge that Daksesh Patel has significant interests in major Fiji employer Vinod Patel.

Does Sanjay Kaba and his company have corporate dealings with FNPF investments?

The public can see that one of the members (Shiri Gounder) is PS of Economy and another is an executive in a public enterprise, both under the direction of Minister of Economy who made the legislative changes reducing the FNPF contributions.

Workers of Fiji should be actively protesting that since the 2006 Bainimarama coup, all union representatives have been removed from the FNPF Board so today there is no Board Member who employees can hold responsible for speaking up for their interests.

Note that among the employees who have lost large amounts from their retirements are all civil servants of Fiji, including those who work for the RFMF, the Police and Prisons.

Also adversely affected are journalists in some media companies who have been uncritically pro-Bainimarama Government.

FNPF and Development Funds

The Fiji public must understand that the reduction of FNPF contributions does not just hurt employees but also the Fiji economy in the long run.

One of the massive national benefits of the FNPF is that has more funds to lend out than all the commercial banks put together.

The Fiji Government and many public enterprises are the largest borrowers from the FNPF, largely investing their loans for Fiji's development (though sometimes mistakes are made).

There are also many private enterprises which borrow from FNPF and help to grow the Fiji economy.

Reduced contributions to FNPF thereby inevitably reduces the funds available for FNPF to invest into Fiji's economy and future growth.

The Bainimarama Government has not only betrayed the employees of Fiji, but they have put a downward pressure on the Fiji economy into the future.

Will this have any impact on the next General Elections?

[People with short memories may be asking why I titled this article "The 2nd Great FNPF Robbery"?]

Withdrawals rose from $356 million in 2019 to a record $501 million in 2021 (dotted line in the graph).

Net Contributions to the FNPF which had been positive $296 million in 2019, had declined to $153 million in 2020, and became a massive NEGATIVE $180 million in 2021.

I suspect that it will still be negative when the 2022 Annual Report is written.

But the FNPF contributors must ask: who in the FNPF Board have been looking after their financial interests while their retirement funds have been raided?

What of the FNPF Board Members?

One of the fiduciary duties of the FNPF Board Members is to look after the interests of the FNPF contributors- most of whom are employees in the formal sector of the Fiji economy.

Did any of the current Board Members (Dakshesh Patel, Sanjay Kaba, Mukhtar Ali, Shiri Gounder, Joel Abraham and Kalpana Lal) make known any concerns about the welfare impact of these FNPF contributions?

Indeed, do they have any conflicts of interest in these adverse developments for employees?

It is public knowledge that Daksesh Patel has significant interests in major Fiji employer Vinod Patel.

Does Sanjay Kaba and his company have corporate dealings with FNPF investments?

The public can see that one of the members (Shiri Gounder) is PS of Economy and another is an executive in a public enterprise, both under the direction of Minister of Economy who made the legislative changes reducing the FNPF contributions.

Workers of Fiji should be actively protesting that since the 2006 Bainimarama coup, all union representatives have been removed from the FNPF Board so today there is no Board Member who employees can hold responsible for speaking up for their interests.

Note that among the employees who have lost large amounts from their retirements are all civil servants of Fiji, including those who work for the RFMF, the Police and Prisons.

Also adversely affected are journalists in some media companies who have been uncritically pro-Bainimarama Government.

FNPF and Development Funds

The Fiji public must understand that the reduction of FNPF contributions does not just hurt employees but also the Fiji economy in the long run.

One of the massive national benefits of the FNPF is that has more funds to lend out than all the commercial banks put together.

The Fiji Government and many public enterprises are the largest borrowers from the FNPF, largely investing their loans for Fiji's development (though sometimes mistakes are made).

There are also many private enterprises which borrow from FNPF and help to grow the Fiji economy.

Reduced contributions to FNPF thereby inevitably reduces the funds available for FNPF to invest into Fiji's economy and future growth.

The Bainimarama Government has not only betrayed the employees of Fiji, but they have put a downward pressure on the Fiji economy into the future.

Will this have any impact on the next General Elections?

[People with short memories may be asking why I titled this article "The 2nd Great FNPF Robbery"?]

Fijileaks Archive, October 2020 But did SANJAY KABA donate to FFP. YES, he did. He didn't donate as Sanjay Kaba but as SANJAY LAL. We were able to track his donation through our Fijileaks database that we have created out of FFP donations lists, supplied by Mohammed Saneem. | Fijileaks: Why is this MAN directing FNFP affairs from California? |