"Few analysts, if any, will look at Bainimarama’s dangerous long term impact on the welfare of future generations, through unsustainable increases in public debt, just as no one today, remembers the SVT Government’s blow to our public debt twenty years ago, because taxpayers had to pay for the $200 million National Bank of Fiji disaster, caused by Rabuka’s 1987 coup. People and voters have a short memory, or they only look at their short term benefits (the hand-outs), or they don’t care, because Public Debt is an invisible evil not to be seen or felt directly. Did those who recently elected Rabuka as Leader of SODELPA think about his role in losing Fiji taxpayers $200 million some twenty years ago? No one was ever convicted of wrong doing or held responsible for that disaster. Even one of the NBF Chairman at the time (a senior civil servant) publicly alleged that NBF losses were being exaggerated: he has been one of those taking a leading international role in supporting and legitimizing Bainimarama’s Government, and yet another important role in a leading tertiary academic institution in Fiji (birds of a feather….?) One of the bad debtors of NBF, an avowed ethno-nationalist, is even a minister in the Bainimarama Government" - Professor Wadan Narsey

By Professor WADAN NARSEY

Part Two: Fiji’s Sleeping Public Debt Nightmares

This month, a common theme for the local and international media will be the impact of the Bainimarama Government on Fiji since the military coup of 2006 (the fad phrase: “Bainimarama @10”There will be much deserved praise for doing what many of us have been calling for decades- ensuring increased freer access to education, from preschool right up to tertiary; improved access to health care, the frequent public appeal for racial equality and common national identity, and a few others.

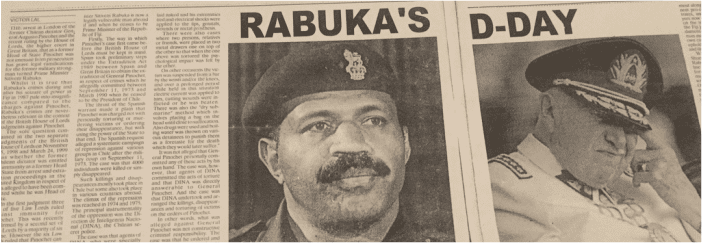

Critics will focus on the many negatives such as the undermining of human rights in so many ways (including the selective application of the law) , the curbing of media freedom, the imposition of a constitution and other institutional changes without people’s consent, nepotism, the lack of accountability and transparency in the use of tax-payers’ funds, the undermining of the indigenous Fijian language, to name just a few.Few analysts, if any, will look at Bainimarama’s dangerous long term impact on the welfare of future generations, through unsustainable increases in public debt, just as no one today, remembers the SVT Government’s blow to our public debt twenty years ago, because taxpayers had to pay for the $200 million National Bank of Fiji disaster, caused by Rabuka’s 1987 coup.

Yet unwise increases in public debt, originating in hasty, unwise and excessive government investments OR investment blunders OR guarantees of bankrupt inefficient public enterprises badly manged by government-appointed boards, will silently but surely erode the welfare of future generations, just as cancers silently destroy the fabric of a human body over time.

The Fiji public ought to learn about the recent experience of bankrupt nations like Greece, whose public debt made them the beggars of Europe.

Here I explain Fiji’s public debt nightmares, that the sleeping Fiji public have not yet dreamed.

The “Supernatural” Public Debt

Normal elected governments have the almost supernatural “authority” to borrow and increase “Public Debt” on behalf of tax payers, not just of today, but of future generations who have no say in the matter at all, yet must pay the debt when it comes due.

Imagine, if you borrowed money from a bank and declared, without their permission, that your wife, children and grandchildren, and others, will repay the debt when you are gone (either dead or emigrated). It is accepted that all governments raise taxes from residents of a country, and spend the revenues on the public service and on productive capital expenditure, such as roads, electricity, sewerage, ports, schools, hospitals. When their planned expenditure is more than their planned revenues, they borrow either domestically, such as from Fiji National Provident Fund, or abroad from international lenders (such as by selling bonds), thereby increasing the “Public Debt”. The increase in public debt is justified if these expenditures lead to increased economic growth and national incomes, which hopefully will pay for the loans, eventually.

But governments can also borrow in order to spend irresponsibly (like increasing civil service salaries just before an election, or excessive and unwise spending on infrastructure) or to clean up after financial disasters of publicly owned state enterprises like the National Bank of Fiji (NBF) or Fiji Sugar Corporation (FSC).

Who gives “governments” the authority to borrow on people’s behalf?

When governments are elected then it is the voters at the election who implicitly give that authority to the government, even if public debt might not even be an important issue in the elections.

But when the military seizes the power of government through military coups, then they and their supporters assume that authority and power, by force. In 1987, Rabuka seized power, for all kinds of alleged reasons, but somewhere on the way, he also replaced the manager of NBF by his own chosen bloke (Visanti Makrava), who, with the help of other staff and slumber of board members, ran the NBF into bankruptcy, through corrupt lending to friends and cronies of the Rabuka Government. The depositors in NBF were saved by the Rabuka Government injecting $200 millions of taxpayers funds, which had to be borrowed, thereby increasing Fiji’s Public Debt by $200 million, essentially to cover a man-made disaster.

Fiji’s economic growth was eventually reduced by this wasteful increase in public debt.

And again, Bainimarama

More recently, Bainimarama seized power in 2006 through another military coup, again alleging all kinds of unsubstantiated reasons, and ran Fiji for eight years as an unelected military government.

He eventually became an elected Prime Minister in 2014, through judicious use of hand-outs of tax-payers money, rhetoric of racial equality, draconian curbs on opposition parties, and a docile Electoral Commission and subservient cherubic Supervisor of Elections. Through its spending policies, the Bainimarama Government raised Fiji’s Public Debt from $2,863 million in 2006 to around $4,969 million in 2016-17, an increase of more than $2 billion. Those who supported the 2006 military coup (including many from overseas) and those who voted Bainimarama into power in 2014, never thought of the consequences of this massive increase in public debt, for the future generations, while enjoying all the benefits that Bainimarama threw their way.

No civil servant in the Ministry of Finance or at the Reserve Bank of Fiji has ever enlightened the public, on the grave dangers of this cancerous “public debt”.

How is “public” debt created and paid?

On every annual Budget Estimate document the “Public Debt Charges” are shown on the first page, alongside Total Expenditure and Total Revenue (often not very clearly). Public Debt Charges comprise the principal component which is the return of the original loan amount (depending on the number of years of the loan) and the interest component, which depends on the interest rate agreed to with the lenders. If expected Total Expenditure (including Public Debt Charges) exceeds Expected Total Revenue, there is a “Net Deficit” which must again be borrowed, i.e. thereby increasing Public Debt further.

If you then add the Net Deficit to Public Debt Charges, you get the “Gross Deficit” a better indicator of the current impact of Public Debt, also usually shown on the first page of the Annual Budget Estimates. Sometimes, governments artificially reduce both the Net Deficit and the Gross Deficit by including in recurrent revenues, the proceeds of public asset sales, often deceptively labelled as “proceeds of investments”. But the bottom line is that “demon” of Public Debt Charges MUST be paid annually, before the government can allocate a single penny to other items such as civil service salaries or capital expenditure. The larger the charges on Public Debt, the lower is the amount available for other government expenditure, such as education or health or welfare.

It is fairly easy to understand what happens if you, an ordinary citizen, borrows money from a bank and is unable to repay on time: you lose your assets which you offered as collateral for the loan.

But the nightmare implications of unsustainable Public Debt is enormously difficult to explain, even for the best of economists or accountants.

The Fiji Example

Fiji’s “Public Debt” is comprised of many loans, borrowed from different sources, at many different interest rates, with many different due dates for settlement. Fiji’s average rate of interest has been around 7%, although at times, the Government has unwisely also borrowed at 9%, and from overseas lenders. Between 2006 and 2016, with its free spending policies, the Bainimarama Government increased Fiji’s Public Debt from $2,863 million to $4,969 million, an addition of roughly $2 billions new debt (what we know about).

Table 1 tells you that Fiji’s Public Debt Charges, assuming an interest rate of 7% per annum, with the loans being repaid in equal instalments over 20 years, increased from $246 million in 2006 to $430 millions in 2016.

https://narseyonfiji.wordpress.com/2016/12/03/fijis-sleeping-public-debt-nightmares-ed-in-ft-3122016/

These Public Debt Charges MUST be paid BEFORE government can make any other expenditure allocation to education or health or other capital investments.

If the increases in Public Debt have been used productively and efficiently, the increased economic growth is able to pay the Public Debt Charges.

If the economy does not grow fast enough, then the Public Debt becomes a horrible cancer that quietly eats away at future government revenues and expenditure, and threatens people’s standards of living, as in Greece recently.

What does it mean for you?

To the average person, these big numbers mean nothing. So let me tell you what it means for your household. By 2006, all previous governments had borrowed on your behalf some $17,000 per household, costing you 7% annually, or about $1,190 per year in extra taxes, or some $52,000 over your lifetime (44 years of adult life).

What was this debt for? The Suva-Nadi highway; the Monosavu Dam; a few hospitals; a port or two; not forgetting Rabuka’s blunder with the National Bank of Fiji. Then the Bainimarama Government increased your household debt to $24,800, with you paying $1,736 per year, or some $76,000 over your life time. Ask yourself, what has been this increase in your household debt due to? I suggest that it has been due to massive hasty increases in expenditure on roads and the numerous wasteful hand-outs (not the free education and medicines schemes).

The inefficient investment nightmare

Fiji’s increase of $2 billion in Public Debt is largely due to the massive increase in taxpayers’ funds allocated to in road building, in just four brief years, which the small Fiji economy could not absorb efficiently.

When an expensive road is built somewhere, in a rural area or to a tourist destination, of course, the beneficiaries naturally and profusely thank the government ministers (with salusalus and feasts), all duly reported by the media. Few people ever ask if these were wise investments justified by economic returns. Responsible international organizations like the Asian Development Bank, before they make any loans, usually conduct thorough Cost Benefit Analyses to make sure that the economic rate of return on the investments is higher than the interest rate on the loan.

Did the Bainimarama Government do detailed rates of return analysis on their many hurried investments? I doubt it. My personal assessment is that the sum aggregate of the benefits of these hurried and excessive investments do not justify massive increase in Public Debt and increased annual Public Debt Charges of $184 million. There have been revelations that some foreign companies have been making a killing, even leading to the Fiji Roads Authority refusing to pay some exorbitant invoices.

There is anecdotal but credible evidence that many of the expatriate contracting companies (not the Chinese ones) have been making so much profits that they have been able to pay exorbitant salaries, massive rents for accommodation, new four wheel drives, and high education allowances for children, not to mention their house-girls, gardeners and cooks.

The Fiji public has so easily forgotten that once upon a time our Public Works Department, every if inefficient, used to do similar work for one tenth the budget that the Bainimarama Government has splashed on these expatriate roads companies, whose senior salaries are in the hundreds of thousands of dollars, in addition to their profit margins.

Fiji’s gullible public are impressed with press releases by expatriate experts on how many potholes have been filled, and how Fiji’s weather conditions explain why newly built roads are easily washed away, requiring more taxpayers’ funds.

The borrowing overseas nightmare

For most countries, borrowing locally is more manageable for governments since they can totally control lenders like FNPF (even if it is fundamentally wrong for a borrower to control the lender).

Or governments can just “print money” to pay local lenders (even if it is morally wrong as it leads to inflation and reduces the value of everyone’s savings.

But borrowing internationally can be a nightmare, because international lenders demand internationally competitive interest rates, and they must be repaid in foreign exchange, not local currency.

Not too long ago, the Bainimarama Government went on an international roadshow (led strangely by ANZ Bank), and borrowed more than $500 million internationally through bonds costing us 9% interest. IMF had offered the same loans at 2% interest. Fiji taxpayers have been unnecessarily paying $40 million extra in interest.

So who made this horrible decision that will cost Fiji taxpayers more than $400 million extra over ten years? The Prime Minister and Finance Minister then (Bainimarama)? Or the Attorney General then and current Finance Minister (Aiyaz Khaiyumm)?

Or was it the PS Finance then (Filimone Waqabaca), who in 2011 informed the packed USP lecture theatre that the deal was made in heaven and he was being guided by God? (apparently God has now guided him to take a appointment as Fiji’s High Commissioner in NZ).

Was that highly costly external loan encouraged by the ANZ CEO who, when asked why the mighty ANZ did not itself lend the money to Fiji, left in the middle of the USP panel discussion stating he had dinner commitments at home (would he treat an elite audience so contemptuously in Australia)?

Whoever made this disastrous financial decision, taxpayers can imagine what difference it would make to the Health Department to receive $40 million extra annually for ten years, amounting to $400 million altogether. How many more hospitals, doctors, nurses, free medicines, surgeries could taxpayers have received, had the Bainimarama Government not made the stupid decision to borrow internationally when IMF funds were available at lower cost?

The state enterprise nightmare

How many of you taxpayers have worried about your pockets when the bad news have dribbled out about the losses being made by state enterprises like Fiji Sugar Cooperation?

Yet the Bainimarama Government not only appointed him as Executive Chairman without going through due process, but also guaranteed FSC’s loans, which I suspect FSC is never going to be able to repay. This Executive Chairman and CEO has for several years kept issuing optimistic announcements and thanking Bainimarama for his visionary leadership of the sugar industry which has totally collapsed, while refusing public calls for him to reveal his salaries and perks.

But this CEO has recently and suddenly resigned, supposedly for health reasons but simultaneously stating that he would like to devote more of his allegedly sick time, to personal business interests. Whatever, you taxpayers are going to repay all the debts that have been incurred by this state enterprise and its unaccountable but well paid management.

How much will you be paying? Who knows. Ask the Minister for Sugar or the Minister of Economy (and All Things Important in Fiji). There is similarly no knowledge about taxpayer liabilities at another government guaranteed entity, the Fiji Development Bank. Nor has the public been given the reports on some investments incurred by the Fiji National Provident Fund in Natadola and Momi, with large “write-downs” of asset values. You taxpayers, who are going to foot the bill eventually, have no say whatsoever on the management of these state companies and their board membership.

Like lambs to the slaughter, you accept blindly and meekly, the dictates of a military leader (who once promised that no military personnel will ever benefit from his military coup) and those who ride joyously on his shoulders.

There is no universal standard

Whatever advice the “expert” international organisations give, there is no universal standard for Public Debt as a Percentage of GDP or even of Government Revenue.

There are many highly indebted countries (like United States, Australia. NZ and Canada) which have borrowed heavily for more than two centuries, spending the funds very productively on good public infrastructure which today contributes to their high incomes, productivity and ability to service their debts.There are also countries with low Debt to GDP ratios, whose governments have squandered their borrowings, resulting in low economic growth.Unfortunately, governments can be elected for any number of reasons, nothing to do with its financial responsibility in running the country.

Yes, they may be elected for bringing development benefits to the voters such as freeing up education through grants and loans, building new roads, providing water services, sewerage, etc. But governments can also be elected for giving handouts, or generous increases in civil service salaries just before an elections. Governments can also be popular with some ethnic groups for insisting that all people be called “Fijians” in order to make them feel they belong; or for apologizing for past coups which drove people out of Fiji, such as the 1987 and 2000 coups (even if key figures in the government may themselves have been involved in some of the coups).

A militarized government may received votes if voters think that this would prevent another coup (a bit like allowing a gang of thieves to control your house so that other thieves do not rob you).

No government in Fiji has ever been elected or opposed on the basis of their policies on Public Debt.

Who Bears the Burden of Public Debt?

The burden of the public debt will be paid by:

* those who pay taxes, which is increasingly Value Added Tax falling on the poor and middle classes. The rich and the companies are paying less and less because the Bainimarama Government has been reducing their tax rates;

* workers whose wages are restricted by government to please employers;.

* people who do not receive expenditure benefits which go to the rich;

* future generations whose public assets are sold off by governments today in order to reduce net deficits;

* All those with their FNPF savings whose returns were forcibly reduced by the Bainimarama Government from 15% to 9%, thereby giving Government even more access to our savings, at low interest rates.

Who will NOT bear the burden of Public Debt

Looking at the experience of Fiji these last thirty years since Rabuka’s 1987 coup, one can make a few generalizations about who will not be bearing the debt burden:

* foreign businesses and their employees;

* large local businesses (who shift their profits abroad);

* all the military and political leaders who have gained financially from the coups;

* all those former Fiji residents who came to Fiji, for whatever reason, and provided crucial support to a n unelected and fiscally irresponsible government in Fiji between 2006 and 2014;

* all those who are planning to emigrate;

There is no escape from Public Debt, except by emigrating (which educated and smart Fiji people will keep doing), or by dying (which is happening more frequently with reducing life expectancies in Fiji).

How do politicians get away with it?

People and voters have a short memory, or they only look at their short term benefits (the hand-outs), or they don’t care, because Public Debt is an invisible evil not to be seen or felt directly.

Did those who recently elected Rabuka as Leader of SODELPA think about his role in losing Fiji taxpayers $200 million some twenty years ago? No one was ever convicted of wrong doing or held responsible for that disaster.

Even one of the NBF Chairman at the time (a senior civil servant) publicly alleged that NBF losses were being exaggerated: he has been one of those taking a leading international role in supporting and legitimizing Bainimarama’s Government, and yet another important role in a leading tertiary academic institution in Fiji (birds of a feather….?)

One of the bad debtors of NBF, an avowed ethno-nationalist, is even a minister in the Bainimarama Government: http://www.coupfourandahalf.com/2010/05/bainimaramas-foreign-minister-inoke.html

A major problem is that military governments, however irresponsible financially, have easily received support and legitimization from powerful social forces such as corporate bodies (who benefit from massive tax cuts or lucrative contracts), religious organisations, social leaders, senior managers of universities (Vice Chancellors, Deans etc.) who not only openly support coup leaders but also suppress critical debate in their universities.

Some countries (for instance US) impose legal restrictions on how much the government can borrow on taxpayers’ behalf, and any excess must be specifically applied for to parliament, which can of course refuse.

But that in Fiji’s current situation would be a farce anyway, with the Opposition totally neutralized under an imposed constitution, and a Speaker exercising punitive powers over the Opposition.

Fiji’s senior public servants in the Ministry of Finance refuse to release what ought to be public reports on public debt.

The Reserve Bank of Fiji, while publishing useful information, is silent in the public domain despite.

Fiji’s senior economists (except for Dr Neelesh Gounder and Professor Biman Prasad) and senior accountants and auditors (too many to name) have silenced themselves, while enjoying the perks that come with their collaborative silence.

It seems that Fiji is destined to stumble along until one day, it’s Public Debt nightmare becomes the reality for its future generations, by which time most of those in power will have left to enjoy their ill-gotten gains, some stashed away in tax havens abroad.

Part One: http://www.fijileaks.com/home/professor-wadan-narsey-fijis-public-debt-and-the-sleeping-monitors

Part Two: Fiji’s Sleeping Public Debt Nightmares

This month, a common theme for the local and international media will be the impact of the Bainimarama Government on Fiji since the military coup of 2006 (the fad phrase: “Bainimarama @10”There will be much deserved praise for doing what many of us have been calling for decades- ensuring increased freer access to education, from preschool right up to tertiary; improved access to health care, the frequent public appeal for racial equality and common national identity, and a few others.

Critics will focus on the many negatives such as the undermining of human rights in so many ways (including the selective application of the law) , the curbing of media freedom, the imposition of a constitution and other institutional changes without people’s consent, nepotism, the lack of accountability and transparency in the use of tax-payers’ funds, the undermining of the indigenous Fijian language, to name just a few.Few analysts, if any, will look at Bainimarama’s dangerous long term impact on the welfare of future generations, through unsustainable increases in public debt, just as no one today, remembers the SVT Government’s blow to our public debt twenty years ago, because taxpayers had to pay for the $200 million National Bank of Fiji disaster, caused by Rabuka’s 1987 coup.

Yet unwise increases in public debt, originating in hasty, unwise and excessive government investments OR investment blunders OR guarantees of bankrupt inefficient public enterprises badly manged by government-appointed boards, will silently but surely erode the welfare of future generations, just as cancers silently destroy the fabric of a human body over time.

The Fiji public ought to learn about the recent experience of bankrupt nations like Greece, whose public debt made them the beggars of Europe.

Here I explain Fiji’s public debt nightmares, that the sleeping Fiji public have not yet dreamed.

The “Supernatural” Public Debt

Normal elected governments have the almost supernatural “authority” to borrow and increase “Public Debt” on behalf of tax payers, not just of today, but of future generations who have no say in the matter at all, yet must pay the debt when it comes due.

Imagine, if you borrowed money from a bank and declared, without their permission, that your wife, children and grandchildren, and others, will repay the debt when you are gone (either dead or emigrated). It is accepted that all governments raise taxes from residents of a country, and spend the revenues on the public service and on productive capital expenditure, such as roads, electricity, sewerage, ports, schools, hospitals. When their planned expenditure is more than their planned revenues, they borrow either domestically, such as from Fiji National Provident Fund, or abroad from international lenders (such as by selling bonds), thereby increasing the “Public Debt”. The increase in public debt is justified if these expenditures lead to increased economic growth and national incomes, which hopefully will pay for the loans, eventually.

But governments can also borrow in order to spend irresponsibly (like increasing civil service salaries just before an election, or excessive and unwise spending on infrastructure) or to clean up after financial disasters of publicly owned state enterprises like the National Bank of Fiji (NBF) or Fiji Sugar Corporation (FSC).

Who gives “governments” the authority to borrow on people’s behalf?

When governments are elected then it is the voters at the election who implicitly give that authority to the government, even if public debt might not even be an important issue in the elections.

But when the military seizes the power of government through military coups, then they and their supporters assume that authority and power, by force. In 1987, Rabuka seized power, for all kinds of alleged reasons, but somewhere on the way, he also replaced the manager of NBF by his own chosen bloke (Visanti Makrava), who, with the help of other staff and slumber of board members, ran the NBF into bankruptcy, through corrupt lending to friends and cronies of the Rabuka Government. The depositors in NBF were saved by the Rabuka Government injecting $200 millions of taxpayers funds, which had to be borrowed, thereby increasing Fiji’s Public Debt by $200 million, essentially to cover a man-made disaster.

Fiji’s economic growth was eventually reduced by this wasteful increase in public debt.

And again, Bainimarama

More recently, Bainimarama seized power in 2006 through another military coup, again alleging all kinds of unsubstantiated reasons, and ran Fiji for eight years as an unelected military government.

He eventually became an elected Prime Minister in 2014, through judicious use of hand-outs of tax-payers money, rhetoric of racial equality, draconian curbs on opposition parties, and a docile Electoral Commission and subservient cherubic Supervisor of Elections. Through its spending policies, the Bainimarama Government raised Fiji’s Public Debt from $2,863 million in 2006 to around $4,969 million in 2016-17, an increase of more than $2 billion. Those who supported the 2006 military coup (including many from overseas) and those who voted Bainimarama into power in 2014, never thought of the consequences of this massive increase in public debt, for the future generations, while enjoying all the benefits that Bainimarama threw their way.

No civil servant in the Ministry of Finance or at the Reserve Bank of Fiji has ever enlightened the public, on the grave dangers of this cancerous “public debt”.

How is “public” debt created and paid?

On every annual Budget Estimate document the “Public Debt Charges” are shown on the first page, alongside Total Expenditure and Total Revenue (often not very clearly). Public Debt Charges comprise the principal component which is the return of the original loan amount (depending on the number of years of the loan) and the interest component, which depends on the interest rate agreed to with the lenders. If expected Total Expenditure (including Public Debt Charges) exceeds Expected Total Revenue, there is a “Net Deficit” which must again be borrowed, i.e. thereby increasing Public Debt further.

If you then add the Net Deficit to Public Debt Charges, you get the “Gross Deficit” a better indicator of the current impact of Public Debt, also usually shown on the first page of the Annual Budget Estimates. Sometimes, governments artificially reduce both the Net Deficit and the Gross Deficit by including in recurrent revenues, the proceeds of public asset sales, often deceptively labelled as “proceeds of investments”. But the bottom line is that “demon” of Public Debt Charges MUST be paid annually, before the government can allocate a single penny to other items such as civil service salaries or capital expenditure. The larger the charges on Public Debt, the lower is the amount available for other government expenditure, such as education or health or welfare.

It is fairly easy to understand what happens if you, an ordinary citizen, borrows money from a bank and is unable to repay on time: you lose your assets which you offered as collateral for the loan.

But the nightmare implications of unsustainable Public Debt is enormously difficult to explain, even for the best of economists or accountants.

The Fiji Example

Fiji’s “Public Debt” is comprised of many loans, borrowed from different sources, at many different interest rates, with many different due dates for settlement. Fiji’s average rate of interest has been around 7%, although at times, the Government has unwisely also borrowed at 9%, and from overseas lenders. Between 2006 and 2016, with its free spending policies, the Bainimarama Government increased Fiji’s Public Debt from $2,863 million to $4,969 million, an addition of roughly $2 billions new debt (what we know about).

Table 1 tells you that Fiji’s Public Debt Charges, assuming an interest rate of 7% per annum, with the loans being repaid in equal instalments over 20 years, increased from $246 million in 2006 to $430 millions in 2016.

https://narseyonfiji.wordpress.com/2016/12/03/fijis-sleeping-public-debt-nightmares-ed-in-ft-3122016/

These Public Debt Charges MUST be paid BEFORE government can make any other expenditure allocation to education or health or other capital investments.

If the increases in Public Debt have been used productively and efficiently, the increased economic growth is able to pay the Public Debt Charges.

If the economy does not grow fast enough, then the Public Debt becomes a horrible cancer that quietly eats away at future government revenues and expenditure, and threatens people’s standards of living, as in Greece recently.

What does it mean for you?

To the average person, these big numbers mean nothing. So let me tell you what it means for your household. By 2006, all previous governments had borrowed on your behalf some $17,000 per household, costing you 7% annually, or about $1,190 per year in extra taxes, or some $52,000 over your lifetime (44 years of adult life).

What was this debt for? The Suva-Nadi highway; the Monosavu Dam; a few hospitals; a port or two; not forgetting Rabuka’s blunder with the National Bank of Fiji. Then the Bainimarama Government increased your household debt to $24,800, with you paying $1,736 per year, or some $76,000 over your life time. Ask yourself, what has been this increase in your household debt due to? I suggest that it has been due to massive hasty increases in expenditure on roads and the numerous wasteful hand-outs (not the free education and medicines schemes).

The inefficient investment nightmare

Fiji’s increase of $2 billion in Public Debt is largely due to the massive increase in taxpayers’ funds allocated to in road building, in just four brief years, which the small Fiji economy could not absorb efficiently.

When an expensive road is built somewhere, in a rural area or to a tourist destination, of course, the beneficiaries naturally and profusely thank the government ministers (with salusalus and feasts), all duly reported by the media. Few people ever ask if these were wise investments justified by economic returns. Responsible international organizations like the Asian Development Bank, before they make any loans, usually conduct thorough Cost Benefit Analyses to make sure that the economic rate of return on the investments is higher than the interest rate on the loan.

Did the Bainimarama Government do detailed rates of return analysis on their many hurried investments? I doubt it. My personal assessment is that the sum aggregate of the benefits of these hurried and excessive investments do not justify massive increase in Public Debt and increased annual Public Debt Charges of $184 million. There have been revelations that some foreign companies have been making a killing, even leading to the Fiji Roads Authority refusing to pay some exorbitant invoices.

There is anecdotal but credible evidence that many of the expatriate contracting companies (not the Chinese ones) have been making so much profits that they have been able to pay exorbitant salaries, massive rents for accommodation, new four wheel drives, and high education allowances for children, not to mention their house-girls, gardeners and cooks.

The Fiji public has so easily forgotten that once upon a time our Public Works Department, every if inefficient, used to do similar work for one tenth the budget that the Bainimarama Government has splashed on these expatriate roads companies, whose senior salaries are in the hundreds of thousands of dollars, in addition to their profit margins.

Fiji’s gullible public are impressed with press releases by expatriate experts on how many potholes have been filled, and how Fiji’s weather conditions explain why newly built roads are easily washed away, requiring more taxpayers’ funds.

The borrowing overseas nightmare

For most countries, borrowing locally is more manageable for governments since they can totally control lenders like FNPF (even if it is fundamentally wrong for a borrower to control the lender).

Or governments can just “print money” to pay local lenders (even if it is morally wrong as it leads to inflation and reduces the value of everyone’s savings.

But borrowing internationally can be a nightmare, because international lenders demand internationally competitive interest rates, and they must be repaid in foreign exchange, not local currency.

Not too long ago, the Bainimarama Government went on an international roadshow (led strangely by ANZ Bank), and borrowed more than $500 million internationally through bonds costing us 9% interest. IMF had offered the same loans at 2% interest. Fiji taxpayers have been unnecessarily paying $40 million extra in interest.

So who made this horrible decision that will cost Fiji taxpayers more than $400 million extra over ten years? The Prime Minister and Finance Minister then (Bainimarama)? Or the Attorney General then and current Finance Minister (Aiyaz Khaiyumm)?

Or was it the PS Finance then (Filimone Waqabaca), who in 2011 informed the packed USP lecture theatre that the deal was made in heaven and he was being guided by God? (apparently God has now guided him to take a appointment as Fiji’s High Commissioner in NZ).

Was that highly costly external loan encouraged by the ANZ CEO who, when asked why the mighty ANZ did not itself lend the money to Fiji, left in the middle of the USP panel discussion stating he had dinner commitments at home (would he treat an elite audience so contemptuously in Australia)?

Whoever made this disastrous financial decision, taxpayers can imagine what difference it would make to the Health Department to receive $40 million extra annually for ten years, amounting to $400 million altogether. How many more hospitals, doctors, nurses, free medicines, surgeries could taxpayers have received, had the Bainimarama Government not made the stupid decision to borrow internationally when IMF funds were available at lower cost?

The state enterprise nightmare

How many of you taxpayers have worried about your pockets when the bad news have dribbled out about the losses being made by state enterprises like Fiji Sugar Cooperation?

Yet the Bainimarama Government not only appointed him as Executive Chairman without going through due process, but also guaranteed FSC’s loans, which I suspect FSC is never going to be able to repay. This Executive Chairman and CEO has for several years kept issuing optimistic announcements and thanking Bainimarama for his visionary leadership of the sugar industry which has totally collapsed, while refusing public calls for him to reveal his salaries and perks.

But this CEO has recently and suddenly resigned, supposedly for health reasons but simultaneously stating that he would like to devote more of his allegedly sick time, to personal business interests. Whatever, you taxpayers are going to repay all the debts that have been incurred by this state enterprise and its unaccountable but well paid management.

How much will you be paying? Who knows. Ask the Minister for Sugar or the Minister of Economy (and All Things Important in Fiji). There is similarly no knowledge about taxpayer liabilities at another government guaranteed entity, the Fiji Development Bank. Nor has the public been given the reports on some investments incurred by the Fiji National Provident Fund in Natadola and Momi, with large “write-downs” of asset values. You taxpayers, who are going to foot the bill eventually, have no say whatsoever on the management of these state companies and their board membership.

Like lambs to the slaughter, you accept blindly and meekly, the dictates of a military leader (who once promised that no military personnel will ever benefit from his military coup) and those who ride joyously on his shoulders.

There is no universal standard

Whatever advice the “expert” international organisations give, there is no universal standard for Public Debt as a Percentage of GDP or even of Government Revenue.

There are many highly indebted countries (like United States, Australia. NZ and Canada) which have borrowed heavily for more than two centuries, spending the funds very productively on good public infrastructure which today contributes to their high incomes, productivity and ability to service their debts.There are also countries with low Debt to GDP ratios, whose governments have squandered their borrowings, resulting in low economic growth.Unfortunately, governments can be elected for any number of reasons, nothing to do with its financial responsibility in running the country.

Yes, they may be elected for bringing development benefits to the voters such as freeing up education through grants and loans, building new roads, providing water services, sewerage, etc. But governments can also be elected for giving handouts, or generous increases in civil service salaries just before an elections. Governments can also be popular with some ethnic groups for insisting that all people be called “Fijians” in order to make them feel they belong; or for apologizing for past coups which drove people out of Fiji, such as the 1987 and 2000 coups (even if key figures in the government may themselves have been involved in some of the coups).

A militarized government may received votes if voters think that this would prevent another coup (a bit like allowing a gang of thieves to control your house so that other thieves do not rob you).

No government in Fiji has ever been elected or opposed on the basis of their policies on Public Debt.

Who Bears the Burden of Public Debt?

The burden of the public debt will be paid by:

* those who pay taxes, which is increasingly Value Added Tax falling on the poor and middle classes. The rich and the companies are paying less and less because the Bainimarama Government has been reducing their tax rates;

* workers whose wages are restricted by government to please employers;.

* people who do not receive expenditure benefits which go to the rich;

* future generations whose public assets are sold off by governments today in order to reduce net deficits;

* All those with their FNPF savings whose returns were forcibly reduced by the Bainimarama Government from 15% to 9%, thereby giving Government even more access to our savings, at low interest rates.

Who will NOT bear the burden of Public Debt

Looking at the experience of Fiji these last thirty years since Rabuka’s 1987 coup, one can make a few generalizations about who will not be bearing the debt burden:

* foreign businesses and their employees;

* large local businesses (who shift their profits abroad);

* all the military and political leaders who have gained financially from the coups;

* all those former Fiji residents who came to Fiji, for whatever reason, and provided crucial support to a n unelected and fiscally irresponsible government in Fiji between 2006 and 2014;

* all those who are planning to emigrate;

There is no escape from Public Debt, except by emigrating (which educated and smart Fiji people will keep doing), or by dying (which is happening more frequently with reducing life expectancies in Fiji).

How do politicians get away with it?

People and voters have a short memory, or they only look at their short term benefits (the hand-outs), or they don’t care, because Public Debt is an invisible evil not to be seen or felt directly.

Did those who recently elected Rabuka as Leader of SODELPA think about his role in losing Fiji taxpayers $200 million some twenty years ago? No one was ever convicted of wrong doing or held responsible for that disaster.

Even one of the NBF Chairman at the time (a senior civil servant) publicly alleged that NBF losses were being exaggerated: he has been one of those taking a leading international role in supporting and legitimizing Bainimarama’s Government, and yet another important role in a leading tertiary academic institution in Fiji (birds of a feather….?)

One of the bad debtors of NBF, an avowed ethno-nationalist, is even a minister in the Bainimarama Government: http://www.coupfourandahalf.com/2010/05/bainimaramas-foreign-minister-inoke.html

A major problem is that military governments, however irresponsible financially, have easily received support and legitimization from powerful social forces such as corporate bodies (who benefit from massive tax cuts or lucrative contracts), religious organisations, social leaders, senior managers of universities (Vice Chancellors, Deans etc.) who not only openly support coup leaders but also suppress critical debate in their universities.

Some countries (for instance US) impose legal restrictions on how much the government can borrow on taxpayers’ behalf, and any excess must be specifically applied for to parliament, which can of course refuse.

But that in Fiji’s current situation would be a farce anyway, with the Opposition totally neutralized under an imposed constitution, and a Speaker exercising punitive powers over the Opposition.

Fiji’s senior public servants in the Ministry of Finance refuse to release what ought to be public reports on public debt.

The Reserve Bank of Fiji, while publishing useful information, is silent in the public domain despite.

Fiji’s senior economists (except for Dr Neelesh Gounder and Professor Biman Prasad) and senior accountants and auditors (too many to name) have silenced themselves, while enjoying the perks that come with their collaborative silence.

It seems that Fiji is destined to stumble along until one day, it’s Public Debt nightmare becomes the reality for its future generations, by which time most of those in power will have left to enjoy their ill-gotten gains, some stashed away in tax havens abroad.

Part One: http://www.fijileaks.com/home/professor-wadan-narsey-fijis-public-debt-and-the-sleeping-monitors