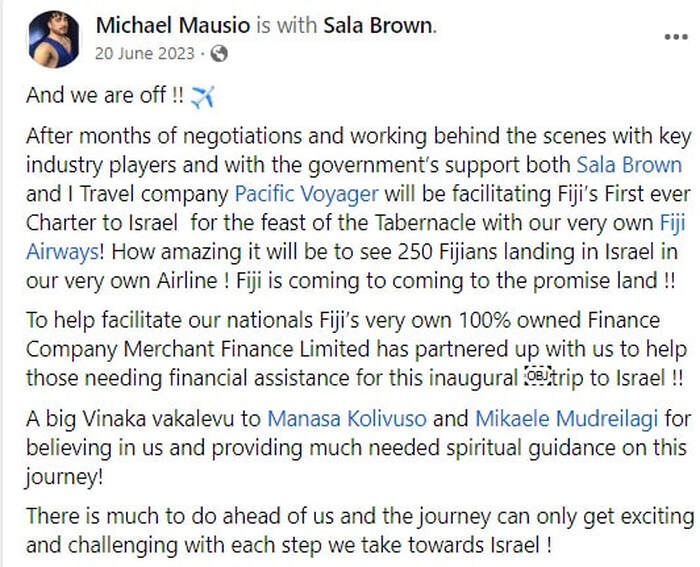

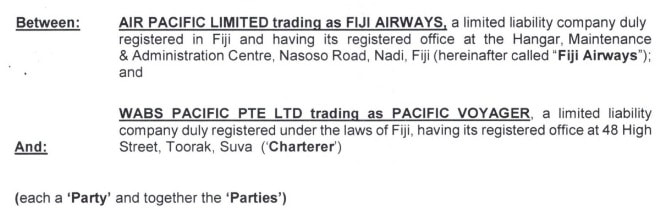

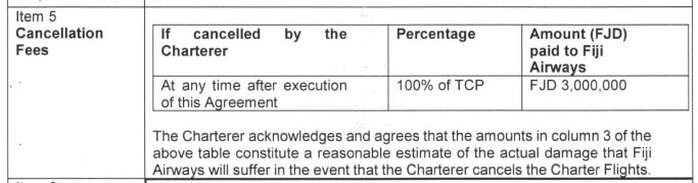

FLY IN THE SKY SCAM. Despite MANOA KAMIKAMICA claiming that Fiji Airways is a private entity that was operating a commercial flight to Israel, the Fiji Airways Board of Directors MUST be taken into police custody to establish how one of its planes was approved to fly nearly 200 'pilgrims' to Israel after receiving merely $400,000 out of the $3million, and also returned to the war-zone to fetch the 'pilgrims fleeing from Hamas terrorists'.

*Who forked out the insurance on behalf of Fiji Airways, for we may recall that several airlines had stopped flying in and out of Israel.

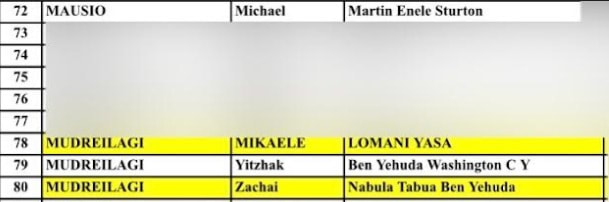

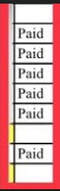

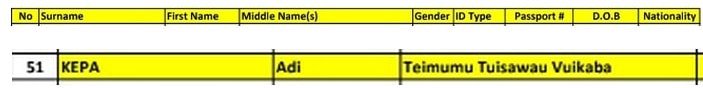

*Among the pilgrims were Ro Teimumu Kepa (listed as unpaid) and Fiji Court of Appeal judge Isikeli Mataitoga (paid his fare). He has been photographed as actively involved in International Christian Embassy Jerusalem (Fiji branch) activities.

*Who arm-twisted Fiji Airways to fly the 'pilgrims' to Israel?

*Was it SODELPA leader and Tourism Minister, Bill GAVOKA?

*Some of the paid 'pilgrims' informed us that they were told that the flight would be carrying additional 'Fijian artefacts and promotional tourism materials' to show case Fiji and that would then allow Gavoka to access the tourism budget to contribute towards the $3million flight cost.

*Since when has Fiji's national airline become a private airline?

*The flag on the wall (in photo below) is the Flag of Jerusalem that Gavoka had decided to have it on the wall in his office. For some years he has been a regular at ICEJ (Fiji) prayer meetings.

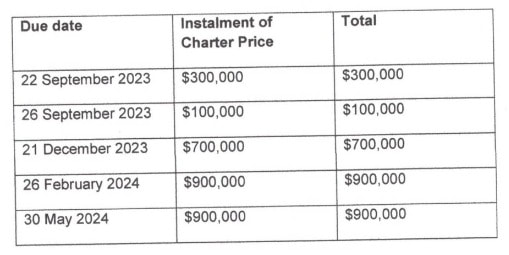

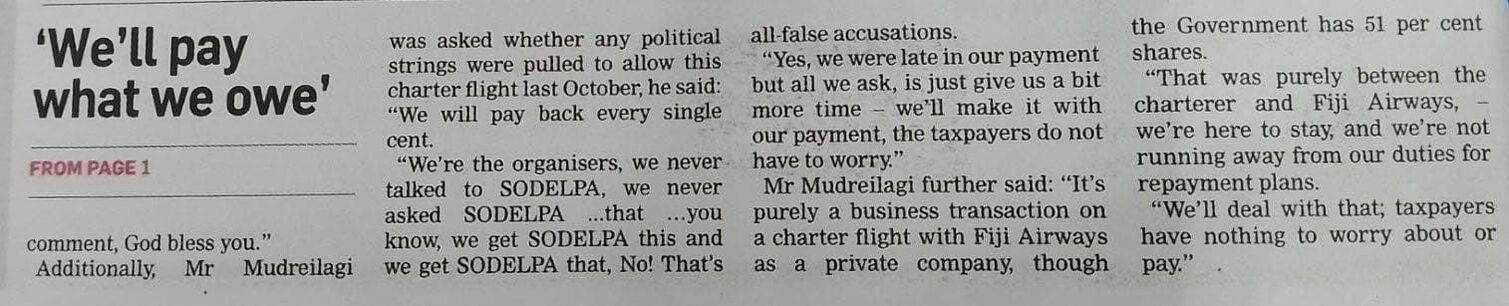

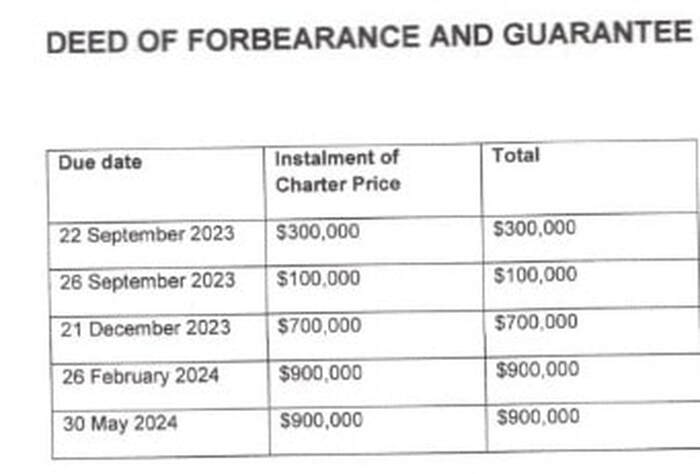

To Fiji Sun, 'Give us time, we will pay back what we owe'. But how?

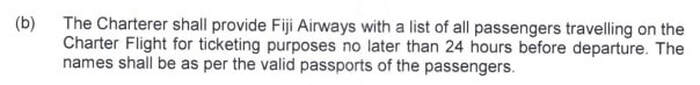

FLY NOW, PAY LATER. 24 hours before the Israel flight - the passenger list

Fiji Airways took delivery of its first A330-200 in 2013 to coincide with its rebranding efforts from Air Pacific to its original name Fiji Airways strengthening the national airlines position as the flag carrier of the Fiji Islands. The aircraft was a landmark acquisition for the airline being the first ever owned wide-body airplanes.

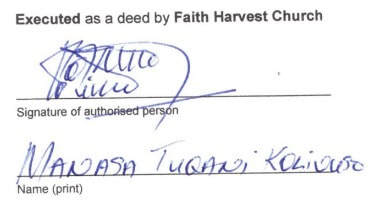

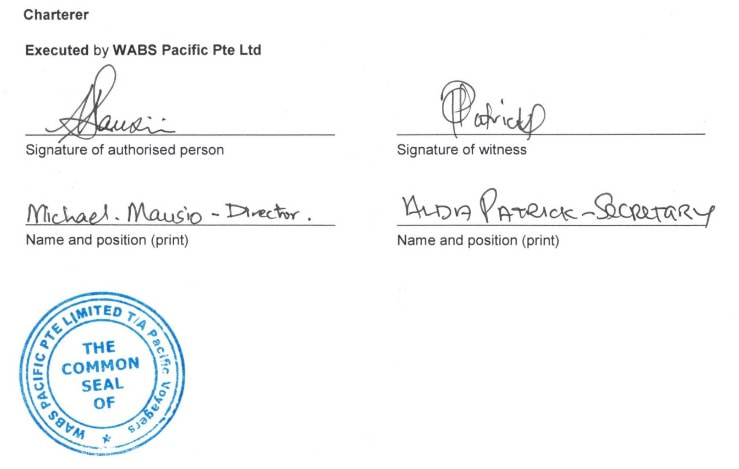

A Deed of Forbearance arrangement is a critical aspect of loan agreements that holds great relevance for borrowers facing financial challenges or default. It refers to an agreement between the lender and borrower that grants an extension and temporary relief to the borrower in fulfilling their repayment obligations. In essence, when a borrower encounters difficulties in making timely payments or faces imminent default, a forbearance arrangement comes into play. Rather than immediately initiating legal actions or enforcing penalties, the lender and borrower negotiate and establish a forbearance agreement. This agreement provides the borrower with additional time and flexibility to address their financial situation.