As we trawl through the Panama Papers for Fijians, it has emerged that ANZ Bank was the leading Australian bank in the world of

offshore accounts

Chenoworth

Chenoworth Financial Review

The Mossack Fonseca files show the critical importance that banks hold in the offshore world – and ANZ is the most visible of the Australian banks in the offshore space.

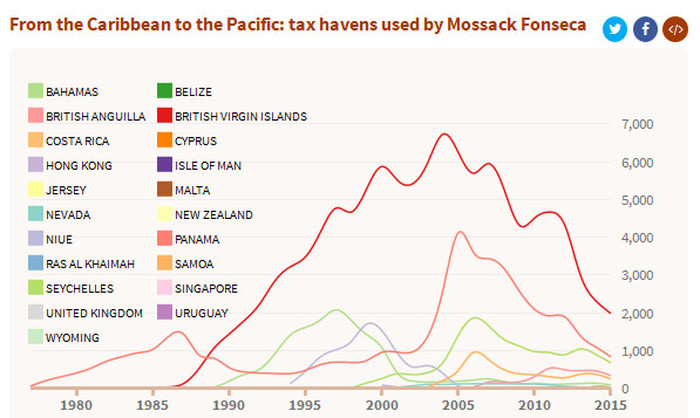

ANZ appears in 7548 of the Mossack documents, reflecting the bank's extensive work in New Zealand, the Cook Islands, Samoa and Jersey.

By comparison, Westpac appears in 995 documents, National Australian Bank 261 documents and Commonwealth Bank just 164 documents. Most of these are references to clients' bank accounts or reference letters written for their clients when they buy a Mossack shelf company.

ANZ's figures are boosted by the Jersey operations of its Grindlays Bank subsidiary in the 1990s. ANZ sold Grindlays in 2000. More recently, ANZ had three times as many references in Mossack Fonseca documents in 2015 as Westpac.

The ANZ remains the dominant force in banking in the Pacific. In Samoa, the ANZ's influence is such that in 2008 when the country's Registrar of International and Foreign Companies, Erna Va'ai, and a director of Samoa International Finance Authority visited Mossack Fonseca's offices to promote business, they were accompanied by the head of ANZ Bank (Samoa), Peter Johnson.

The apparent closeness raises questions as to whether the bank was also advising the Samoan government on Australia's tax information exchange agreement (TIEA) proposal.

Banks are the key to the offshore world because an offshore company is useless until it has a bank account, and under the draconian "know your customer" laws a bank can only open an account if it knows who the name of the company's real owner.

"It is very difficult to open a corporate account," a Mossach Fonseca executive complained in an April 2013 report.

"Unlike before, loads of [Due Diligence] needs to be proceeded before and during the account opening. However, Raymond has recommended a new bank named ANZ BANK. It is an Australian bank but the service is as good as other commercial bank. This is a really good tip."

Three months later the Mossack executive reported meeting an ANZ officer in Hong Kong who said "she would love to assist me to go through with some cases".

An ANZ spokesman told The Australian Financial Review: " We reject the suggestion that ANZ has a 'dominant position' in servicing clients in tax havens or that ANZ is more willing to service such clients."

ANZ conducted extensive ongoing due diligence procedures.

"Customer risk of tax crimes is one of many factors ANZ takes into account when assessing customer risk of money laundering," he said

" We note that the 2013 comment you refer to states that ANZ's 'KYC procedure is very strict'."

The ICIJ's 2012 Offshore Leaks database previously showed several Australian banking employees held investments in Cook Islands and Hong Kong companies, raising the vexed issue of how much banks should know about their employees' personal finances.

Sydney lawyer Debra Lighezzolo told the Financial Review she had not informed the National Australia Bank when she used her NAB email account in December 2007 to order a Seychelles company, Lynus Development Limited from Mossack Fonseca, "to hold investments in private and public companies".

Lynus would be owned by Fencourt Foundation in Panama, which Ms Lighezzolo would control.

The Mossack Fonseca files show she supplied documentation including a copy of her passport and a recommendation from a St George Bank manager, who said Ms Lighezzolo had held her existing account with St George for 20 years.

Ms Lighezzolo's London lawyer, Paul Puxon told Mossack Fonseca at the time: "It is only for the holding of shares in a listed company – the shares will not be issued for some time, but I need to give the lawyers involved in the readmission of the shares to the AIM market details of the company number and copies of its incorporation documents".

There is no indication in the Mossack files whether the proposed investment proceeded. However, it raises the thorny question of how much banks should know about what their staff do in their private investments.

In a statement for Lighezzolo, Mr Puxon told the AFR that her 2007 decision to set up the structure "was not connected in any way with her work for the bank".

Ms Lighezzolo, whose email sign-off described her as Principal Counsel for nabCapital, "does not know what the bank's policy was as regards executives holding shares. Our client was not an executive of the bank," Mr Puxon said.

Ms Lighezzolo had joined NAB under a short-term contract in September 2007 after a year at Commonwealth Bank and five years at Westpac.

While some US banks for governance reasons restrict senior staff from holding accounts with other banks, Mr Puxon said the NAB's only requirement was that Ms Lighezzolo should have a NAB account to process her salary.

"As far as our client is aware there were no other restrictions to prevent her from having accounts with other banks."

He said the Seychelles/Panama Foundation structure "was not and has not been used by our client".

A NAB spokeswoman said the bank was legally barred from discussing personal finances of former employees but said NAB had "a strict code of conduct that all employees must adhere to as part of their employment, which specifies that commercial and personal interests must never interfere with the ability to make sound, objective business decisions – and that employees must help safeguard market integrity."

"NAB requires all employees to disclose where there is any potential conflict of interest."

Insisting that employees only held bank accounts at NAB would be an invasion of privacy, she said.

Read more: http://www.afr.com/business/banking-and-finance/financial-services/the-panama-papers-anz-was-the-leading-australian-bank-in-mossacks-universe-20160403-gnx40c#ixzz44sCzv6Sq