VC Rajesh Chandra's response to Executive Director Finance Boila:

Dear Boila

Please see my comments below and respond to me:

Professor Rajesh Chandra

Vice-Chancellor and President

The University of the South Pacific

Headquarters and Laucala Campus

Suva, FIJI

Ph 679 3232313

Fax 679 3231550

Email [email protected]

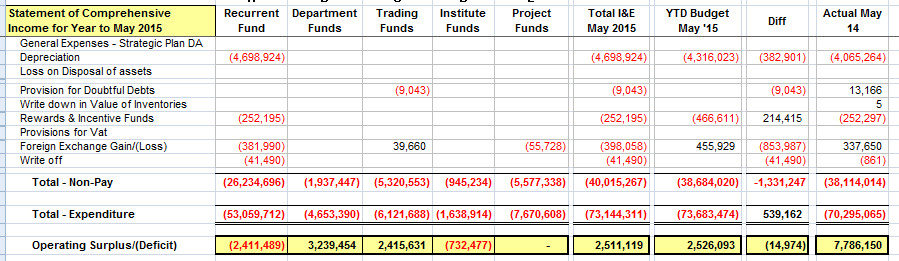

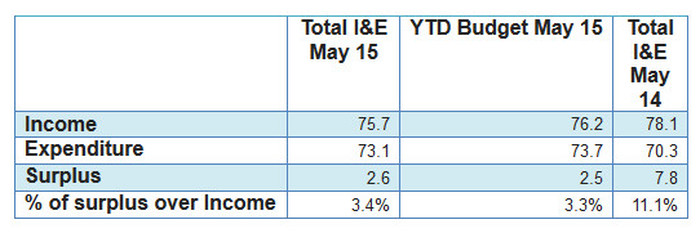

1. FIC Chair has been saying we need to be more analytical when reporting. The most glaring thing in the able is the drop in total income by May this year compared with the same time in 2014 of $2.4 million. This needs more explanation than the better than budget surplus of $0.1 million. In addition, given this thin margin of 0.1 million, we should be worried that had we spent staffing funds “not slower” and done the required deferred maintenance as we should have done, then our financial posit[i]on would have been below budget. No mention of this?

2. There is also a worrying drop in unencumbered cash down to 1.3 months as opposed to 2 months. Had we spent as needed for capex and strategic plan, the situation would have been worse.

3. As EDF you are expected to pick up these and take corrective action; it should not be left to the VC to pick them up and worry about how our financial performance will turn out this year.

Date: June 9, 2015 at 7:06:10 PM GMT-7

Subject: YTD financial results for May 2015

Brief Report:

1. Financial Performance

The University recorded an operating surplus of $2.6m for the 5 months of 2015 against a budgeted surplus of $2.5m.

The table below provides a summary of the financial performance

The better than budget surplus performance of $0.1m was largely driven by slower spending of staff costs and deferred maintenance costs, offset by drop in development assistance income due to drop in exchange rate.

2. Cash Flows

The cash-flow of the University showed a net decrease in cash, cash equivalents and other financial assets by $2.4m, taking our balances from $45.6m at the beginning of the year to $43.3m as at 31st May 2015, compared to a projected balance of $51.8m. The decrease in the cash target was due to non-receipt of full Government grant contribution for the second quarter except from Cooks, Niue, Tokelau and Tuvalu, offset by receipt of 50% of the grant income from both Australia and New Zealand and slower spending of capex and strategic plan funding.

The available cash was $14.7m and is below the cash reserve benchmark of $22m and is adequate to operate the University for 1.3 months. This is funded $9.7m (66%) by unencumbered cash and $5m (34%) by the overdraft facility.

We will soon circulate the detailed provisional expenditure reports by Section for each Head of Section and Unit Manager to review and provide comments for adjustments if needed.

Kind Regards

Kolinio Boila

Executive Director Finance