The accusations are political dynamite because every cent of the kickbacks, in the form of overstated marketing costs, would otherwise have been booked as profits accruing to the beleaguered Fiji National Provident Fund, which – together with Amalgamated Telecom Holdings, also majority owned by the FNPF – are the sole owners of Vodafone Fiji Ltd.

But in a strange twist of fate – so typical of the self-dealing world of Frank Bainimarama’s corrupt regime – the man supposedly fighting for the interests of the FNPF and Fiji’s taxpayers is also the chairman of Vodafone, the company who stands to lose the most from any investigation, enforcement and action taken, and its parent company ATH.

Central to the allegations that FIRCA is uncovering is the Cuvu-born, squint-eyed sign-writer Sagadewan Goundar – better known as Nicholas Goundar - and his long-standing relationship with Vodafone CEO Pradeep Lal.

Fijileaks understands that FIRCA picked up the trail of Goundar as he was operating a business generating hundreds of thousands of dollars of revenue each year and importing significant amounts of goods, despite having no registered company or tax identification number (TIN). He was also still serving a ban from acting as a corporate director because of a previous bankruptcy.

A FIRCA audit of Goundar’s income and expenditure revealed an extensive paper trail that led directly to Lal, who has been Vodafone’s CEO since July 2014 but has worked for the company in senior positions for almost twenty years.

Since the 2008 launch of Digicel in Fiji broke up Vodafone’s long-standing monopoly, both cellular companies have fought an intense corporate- and product-awareness battle played out across any location in the country that could be branded. Vodafone’s marketing budget, that was once measured in the millions, is now in the tens of millions as the company tries to blunt Digicel’s penetration.

In marketing and commercial circles in Fiji, it is widely known that Goundar handles the majority of Vodafone’s lucrative signwriting and branding – including billboards, high-visibility signage and shop fitouts.

Goundar has also won Vodafone contracts to erect repeater towers which he then subcontracts, despite having no obvious qualifications or relevant background.

It is understood that many of Goundar’s contracts were won without a tender process or rival quotes to benchmark against price or quality.

Separately, Fijileaks has been able to confirm that more than a decade ago Goundar and four others were hired by Lal to fit out the home that he has in Sydney – although it is not clear if this was paid for directly or indirectly by the mobile phone giant.

‘What Nicholas lacks in physical presence and school qualifications, he more than makes up for in natural charm and guile,’ one marketing executive told Fijileaks about the 43-year-old signwriter. Despite suffering from a squint which can cause problems with depth perception, Goundar fell into signwriting because of a brilliant talent as a free-hand artist.

On the face of it, the FIRCA investigation into the Goundar-Vodafone Fiji relationship should be of intense interest to Aiyaz Sayed-Khaiyam, the country’s all-powerful Minister of All Things.

In his 2016 budget address, Sayed-Khaiyum blasted companies who were failing to file correct tax returns or filed no tax returns (such as Goundar). He described this as ‘ducking their civic responsibilities’.

He told Parliament, ‘For example, one well-known company that owns major grocery outlets with other businesses across Fiji has paid no taxes in the last 6 years. Yet it is inconceivable that this company has made no profits. By not paying taxes, company management is denying services and opportunities to ordinary Fijians—the very people they need to sustain their business.’

Goundar's non-TIN registered business was transacting with Vodafone Fiji Ltd but as the payee Vodafone Fiji Ltd stands guilty of abetting exactly what Sayed-Khaiyum accused the grocery company of doing.

Even more ironically, Sayed-Khaiyum went on to lambast those accountancy firms who conspired to manipulate or hide corporate transactions so that they avoided the scrutiny of FIRCA.

‘We have also learned that a major accounting firm—in breach of its civic responsibility and the ethics of the accounting profession—has helped its clients make exaggerated claims of allowable expenses. This has to stop.’

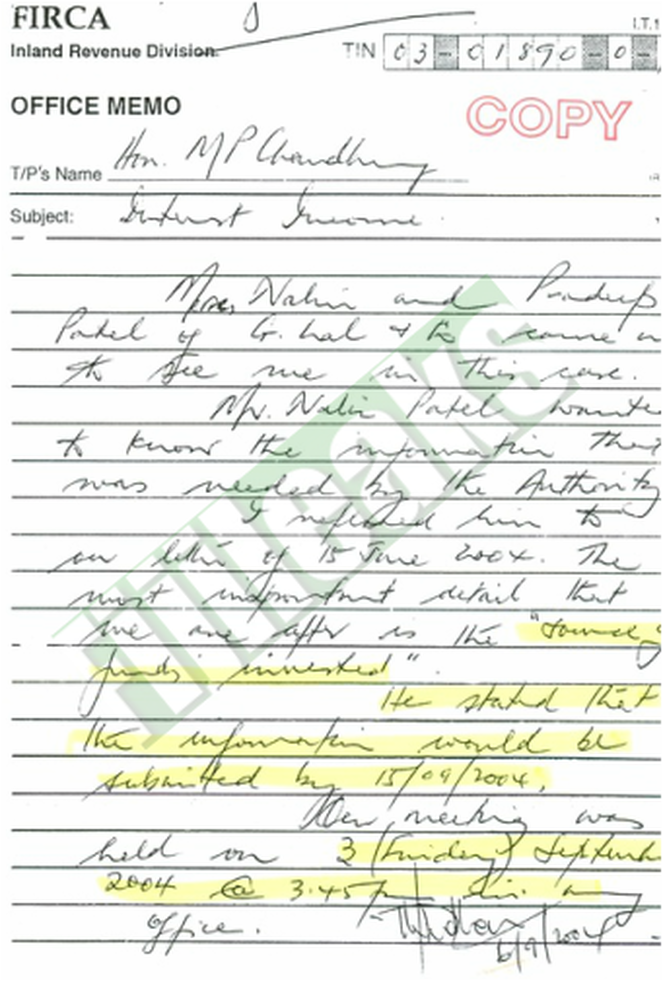

Vodafone Fiji Ltd and ATH’s auditors are BDO, who signed off on the sham, inflated marketing invoices paying out to a non-TIN registered entity. Sayed-Khaiyum’s aunt Nur Bano Ali previously held the franchise for BDO but later lost it. BDO is currently represented by G. Lal & Co. The 2016 financial report showed that BDO earned more than $250,000 from the ATH relationship. G. Lal & Co is run by the brothers Nalin and Pardeep Patel.

Vodafone Fiji Ltd is the most important lucrative in ATH’s portfolio of investments, and the FNPF’s, and definitely the highest profile corporate member.

According to ATH’s 2016 financial report, the group’s revenue was $356m of which $260m was generated by the mobile phone operator - approximately three out of every four dollars. Profit after tax for ATH was nearly $82m of which Vodafone represented almost $52m, almost two-thirds.

With so much cash swimming around, one would expect Vodafone to be the entity under most scrutiny to uphold ATH’s corporate pledge to its shareholders (mostly FNPF and the Government, but also including various widely held trust funds and four provincial councils):

•on Integrity: ‘Practising good corporate governance and being faithful to our stakeholders.’

•And Accountability: ‘Helping our stakeholders understand how we make decisions, taking ownership and being answerable and responsible for our actions.

Bainimarama favourite Ajit Kodagoda – the Sri Lankan accountant – is chairman of both FNPF and FIRCA (the ‘losers’ in this case) as well as ATH and Vodafone Fiji (the culprits); he is at the same time hopelessly compromised and uniquely positioned to help Vodafone avoid trouble as FIRCA has sole prosecutorial and enforcement powers over tax code breaches.

Were he not implicated in this debacle, this whole issue should also be of critical interest to Kodagoda who told FBC in November 2015 how difficult FIRCA’s job was when so few followed the basic tax code.

‘There’s 10,000 companies registered in Fiji, out of this 10,000, only 4,000 submit any returns at all, that means 6,000 people are not even bothering to send a return and out of the 4,000, only 1,000 actually send any return, right and pay some tax, so out of the 10,000 companies registered, 1,000 people pay tax.’

Goundar’s sign-writing operation was not even registered let alone paying taxes, as Fijileaks understands. Yet Goundar was being sustained by payments signed off by the CEO of Vodafone Fiji Ltd whose chairman was Kodagoda who – wearing a different hat – was charged with cracking down on such tax-dodging malfeasance.

Wearing yet another series of hats, Kodagoda was responsible for acting on behalf of FNPF, the majority owners of both ATH and, with ATH of, Vodafone Fiji Ltd, to maximise the income derived from the superannuation fund’s investments for the benefit of the country’s pensioner community.

The act that governs FIRCA stipulates that the chairman should normally be the Permanent Secretary of Finance but Kodagoda was appointed in 2011 direct from the private sector where he remains employed. For, in addition to his various chairmanships, Kodagoda is still listed as the finance controller of the CJ Patel Group which has benefitted handsomely from a number of Bainimarama initiatives such as the free milk and Weet-bix initiatives for primary school students.

The media have reported that CJ Patel-owned Rewa Milk meant for Year 1 students was in fact being sold on the street and in markets, while the auditor-general complained that his office were not able to reconcile the school vouchers issued so it was not clear how much of the more than $2m in milk provided in 2015 actually went to students.

CJ Patel are also owners of the pro-regime newspaper Fiji Sun which has been propped up the government’s ban on advertising in the more popular Fiji Times.

So powerful is Kodagoda that Fijileaks was contacted by FIRCA employees anxious that Vodafone’s involvement in what started as a non-payment of taxes investigation into Goundar may be ‘fixed up’ to minimise embarrassment to the Bainimarama government to whom the mobile phone operator have been slavishly devoted supporters.

Bainimarama has consistently acted in favour of Vodafone’s interests in the intense battle with Digicel for dominance of the domestic cellular market. In 2015, Kodagoda – as chairman of Vodafone Fiji Ltd – announced that the company was gifting Bainimarama and his wife a return business class trip to the Rugby World Cup’s opening match plus accommodation, estimated to be worth $65,000.

This was just at the time that the Fiji Rugby Union had served a 30-day termination notice on Vodafone to end their controversial sponsorship deal which was announced as being worth $40m over five years. By the end of the first year, Vodafone had paid less than $3m of the pledged $8m, hence the termination letter.

But thanks to the involvement of Bainimarama – president of the FRU – and the money-no-object trip to see Fiji play England at the RWC, the differences were papered over and Vodafone remains the lead sponsor of the FRU – but still only paying less than $3m a year.

It is not clear how far back FIRCA’s investigations have gone but the relationship between Goundar and Lal is significantly more than a decade old. Lal has held multiple senior positions at Vodafone, such as chief financial officer, chief marketing officer and COO, between 1997 and when he became CEO.

Before becoming CEO, Lal was number two to Aslam Khan and if FIRCA has uncovered wrong-doing that stretches back to Khan’s time, serious questions have to be asked of Khan’s legacy.

In addition, the investigation may have international ramifications because it was only in mid-2014 that the final 49 percent of Vodafone Fiji Ltd was purchased by the FNPF from Vodafone International Holdings BV.

If significant kickbacks can be clearly demonstrated that may have impacted on dividends paid out by Vodafone Fiji Ltd to their minority owner over past years, and these tainted results affected the valuations that Vodafone International Holdings BV accepted as part of the negotiations, then many lawyers will busy for a long time to come.

The BVI-registered company was paid F$160 million for their 49 percent stake.