GREEN WITH ENVY!

As indicated previously, we will bring to you the inside story regarding the fall of Robin Nair as Foreign Secretary during the run-up to COP23 meeting in Fiji, and over the preparatory Climate Change conference now being held in Bonn, Germany. Those criticizing Frank Bainimarama have been branded 'green with envy', and refusing to acknowledge the long-term environmental benefit of Fiji's COP23 presidency. After all, the Green Bond is an innovative and alternative source of funding projects that would reduce emissions and provide robust climate infrastructure needed in Fiji. Our only gripe is the alleged $3,000 daily travel allowance that Bainimarama is reportedly depositing into his bank account. We must, however, ensure that unsuitable projects are not financed through green bonds, not to mention financial mismanagement, but only a bond for which the issuer can demonstrate measurable environmental benefits, certified by an independent party, should qualify as a green bond. In conclusion, environment, climate change and social sustainability are of priority interest to all Pacific Island nations. Given the observed performance shown by the green bond market, it is important for Fiji and other Pacific island nations to embrace it as an innovative and alternative way of raising finance from both domestic and external sources for sustainability-driven investments

“Parliamentary approval has not been obtained for the $100m to be borrowed under this scheme. Paying the proceeds from the Bonds into the consolidated fund will put it at risk of being used for government's operating expenditure. Money's raised for specific purposes must be credited to a Trust Fund and not the consolidated fund.” - FLP

Govt’s $100m Green Bond contravenes Finance Act: Chaudhry

The Government yesterday launched its sovereign Green Bond issue aimed at raising $F100m for projects aimed at mitigating and adapting to problems created by climate change.

But Labour Leader Mahendra Chaudhry warned the Bond had been issued in contravention of the Finance Act.

“Parliamentary approval has not been obtained for the $100m to be borrowed under this scheme,” said Mr Chaudhry.

The Labour Leader was also critical of the fact that the proceeds from the Bond was to go into the Consolidated Fund, raising suspicions that it was just another borrowing mechanism for the debt-ridden FF government.

“Paying the proceeds from the Bonds into the consolidated fund will put it at risk of being used for government's operating expenditure. Money's raised for specific purposes must be credited to a Trust Fund and not the consolidated fund,” Mr Chaudhry said.

Meanwhile, Reserve Bank Governor Ariff Ali expressed high optimism, based on initial feedback, that the first issue of $40m would be over-subscribed.

The World Bank and the International Finance Corporation, among the pioneers of the Green Bond market, provided technical assistance to the RBF in issuing the bond.

The Government yesterday launched its sovereign Green Bond issue aimed at raising $F100m for projects aimed at mitigating and adapting to problems created by climate change.

But Labour Leader Mahendra Chaudhry warned the Bond had been issued in contravention of the Finance Act.

“Parliamentary approval has not been obtained for the $100m to be borrowed under this scheme,” said Mr Chaudhry.

The Labour Leader was also critical of the fact that the proceeds from the Bond was to go into the Consolidated Fund, raising suspicions that it was just another borrowing mechanism for the debt-ridden FF government.

“Paying the proceeds from the Bonds into the consolidated fund will put it at risk of being used for government's operating expenditure. Money's raised for specific purposes must be credited to a Trust Fund and not the consolidated fund,” Mr Chaudhry said.

Meanwhile, Reserve Bank Governor Ariff Ali expressed high optimism, based on initial feedback, that the first issue of $40m would be over-subscribed.

The World Bank and the International Finance Corporation, among the pioneers of the Green Bond market, provided technical assistance to the RBF in issuing the bond.

Fijileaks: The Paris Agreement has an often-overlooked yet critical provision: one of the aims of the agreement, outlined in Article 2, is “Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.”

Green bonds are like regular bonds, with a slight difference — they can only be used to fund projects that have been identified to have environmental benefits, with their contribution to emissions reduction clearly articulated

GREEN BONDS are fixed income, liquid financial instruments that are used to raise funds dedicated to climate-mitigation, adaptation, and other environment-friendly projects. This provides investors an attractive investment proposition as well as an opportunity to support environmentally sound projects.

At the request of Fiji’s Reserve Bank, the World Bank and the International Finance Corporation (IFC), a member of the World Bank Group focusing on private sector, provided technical assistance to assist the government in issuing a sovereign green bond.

This collaboration took place under a broader, three-year Capital Markets Development Project supported by the Australian Government. Through this partnership, Australia and IFC are helping stimulate private sector investment, promote sustainable economic growth and reduce poverty in the Pacific.

Projects financed from the Fiji green bond will follow the internationally developed Green Bond Principles, and will focus primarily on investments that build resilience against the impacts of climate change.

Sustainalytics US (Sustainalytics), a provider of environmental, social and governance research and analysis, evaluated Fiji Sovereign’s green bond transaction and its alignment with the Green Bond Principles.

Fiji will also use bond proceeds for projects supporting its commitment to achieve 100% renewable energy and reduce its CO2 emissions in the energy sector by 30% by 2030.

At the request of Fiji’s Reserve Bank, the World Bank and the International Finance Corporation (IFC), a member of the World Bank Group focusing on private sector, provided technical assistance to assist the government in issuing a sovereign green bond.

This collaboration took place under a broader, three-year Capital Markets Development Project supported by the Australian Government. Through this partnership, Australia and IFC are helping stimulate private sector investment, promote sustainable economic growth and reduce poverty in the Pacific.

Projects financed from the Fiji green bond will follow the internationally developed Green Bond Principles, and will focus primarily on investments that build resilience against the impacts of climate change.

Sustainalytics US (Sustainalytics), a provider of environmental, social and governance research and analysis, evaluated Fiji Sovereign’s green bond transaction and its alignment with the Green Bond Principles.

Fiji will also use bond proceeds for projects supporting its commitment to achieve 100% renewable energy and reduce its CO2 emissions in the energy sector by 30% by 2030.

Fiji Green Bond Summary Terms and Conditions

Issuer: Government of Fiji

Amount: 100 million Fiji dollars

Pricing date: 1 November 2017 – May 2018

Settlement date: 1 November 2017 – May 2018

Maturity date: 1 November 2022 and 1 November 2030

Issue price: 100

Coupon: 5 years: 4.00%; 13 years: 6.30%

Denomination: Fiji Dollars

Issuer: Government of Fiji

Amount: 100 million Fiji dollars

Pricing date: 1 November 2017 – May 2018

Settlement date: 1 November 2017 – May 2018

Maturity date: 1 November 2022 and 1 November 2030

Issue price: 100

Coupon: 5 years: 4.00%; 13 years: 6.30%

Denomination: Fiji Dollars

Green Projects from Around the World

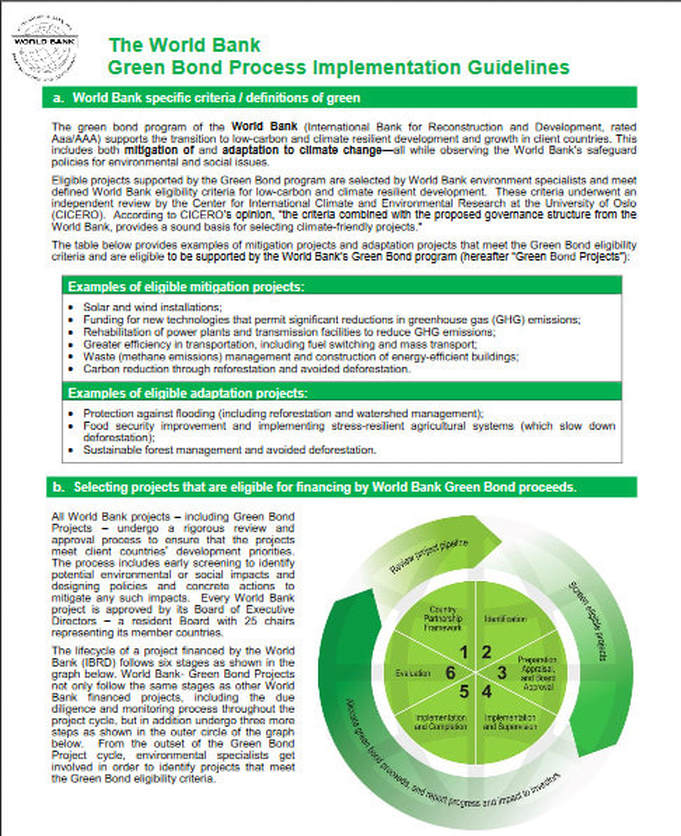

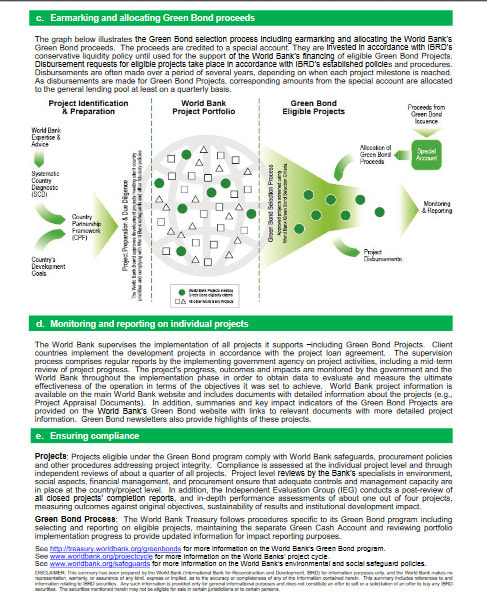

World Bank Green Bonds support projects selected by World Bank environment and other sector specialists that meet specific criteria for development activities that help lower global carbon emissions.

World Bank green projects, like all World Bank projects, are designed to reduce poverty and improve local economies. But they specifically focus on tackling climate change issues that directly impact developing countries.

Eligible Projects may include projects that target (a) mitigation of climate change including investments in low-carbon and clean technology programs, such as energy efficiency and renewable energy programs and projects ("Mitigation Projects"), or (b) adaptation to climate change, including investments in climate-resilient growth "Adaptation Projects").

The following list are “green” projects which are funded in whole or in part, by World Bank Green Bonds. These projects promote the transition to low-carbon and climate resilient growth in the recipient country, as determined by IBRD. (http://treasury.worldbank.org/cmd/htm/MoreGreenProjects.html)

World Bank Green Bonds support projects selected by World Bank environment and other sector specialists that meet specific criteria for development activities that help lower global carbon emissions.

World Bank green projects, like all World Bank projects, are designed to reduce poverty and improve local economies. But they specifically focus on tackling climate change issues that directly impact developing countries.

Eligible Projects may include projects that target (a) mitigation of climate change including investments in low-carbon and clean technology programs, such as energy efficiency and renewable energy programs and projects ("Mitigation Projects"), or (b) adaptation to climate change, including investments in climate-resilient growth "Adaptation Projects").

The following list are “green” projects which are funded in whole or in part, by World Bank Green Bonds. These projects promote the transition to low-carbon and climate resilient growth in the recipient country, as determined by IBRD. (http://treasury.worldbank.org/cmd/htm/MoreGreenProjects.html)

What are World Bank Green Bonds and the Implementation Guidelines:

http://treasury.worldbank.org/cmd/htm/WorldBankGreenBonds.html

The Independent (London): 10 photographs to show to anyone who doesn't believe in climate change

Click the following link to see the other eight photos:

www.independent.co.uk/news/science/climate-change-worse-water-temperature-reading-scientists-global-warming-ice-melt-weather-a8020696.html#gallery

PROFESSOR WADAN NARSEY:

"Bainimarama rewriting history, telling lies, pretending to be a greenie"

(17 October 2017 By PROFESSOR WADAN NARSEY Not too long ago, intrepid Fiji Sun journalist, Jyoti Pratibha, reported from New York (8 June 2017) that Prime Minister Bainimarama had announced to the world, “I repeat: no development on land or at sea in Fiji takes place if there is any risk to the environment”. Just yesterday, Bainimarama was again reported to have claimed in Sydney to adoring fans (Fiji Times 16 October 2017 “”No development in Fiji under my Government has taken place at the expense of the environment, and none ever will.” Oh dear me. Read read this 2013 Letter to the Editor by me, actually published in the Fiji Sun itself. http://fijisun.com.fj/2013/05/10/mangrove-destruction-3/ Read this Letter to the Editor https://narseyonfiji.wordpress.com/2014/06/16/green-sustainable-development-strategy-in-fiji-and-mangroves-letter-to-editor-16-june-2014/ Read this article (FT June 21 2014) http://www.fijitimes.com/story.aspx?id=272094 People in Fiji know that all over Fiji, mangroves have been destroyed by businessmen who were supported by government officials, no doubt on the orders of those higher up, usually Bainimarama or Khaiyum. When someone makes a statement that he knows is false, it is not just inaccurate but a fat lie. | It seems that Fiji’s Prime Minister believes that if he repeats a false statement often enough, people will believe him. Certainly it is possible for the Qorvis spin to be believed in New York and even in Sydney. But do people in Fiji believe these lies? Or even if they do not believe them, do they even care that their Prime Minister is lying through his teeth, as long as they get their freebies? Where are the leaders in Fiji, the environmentalists, who have the courage to call out these lies which I am sure they all talk about privately? |