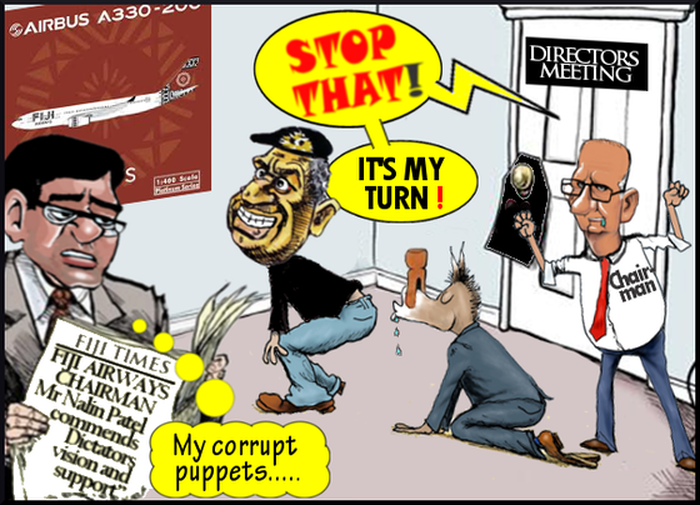

Fijileaks: Did Nalin Patel abuse his position as chairman of Fiji Airways and allegedly use taxpayers funds to buy former Prime Minister Laisenia Qarase's airline ticket to California for Qarase to help negotiate an out of court settlement with his former business partner Girdhar Lal of G.Lal & Co? The VDCL hearings was underway in July 2014 when Nalin, then former Vanua Development Corporation Ltd (VDCL) director, contacted Laisenia Qarase

"Nalin, Subsequent to your letter of 1 July, 2014, Girdhar was contacted on 3 July by Laisenia Qarase who informed that you had sought his assistance in faciliating a meeting between you and Girdhar in California to reach a settlement out of Fiji courts. Girdhar had agreed to meeting with Mr. Qarase only during his trip to California and, in the process, receive what your intentions were. These meetings have occurred up to 2 weeks ago and we trust you have received Girdhar's responses." 28 August 2014

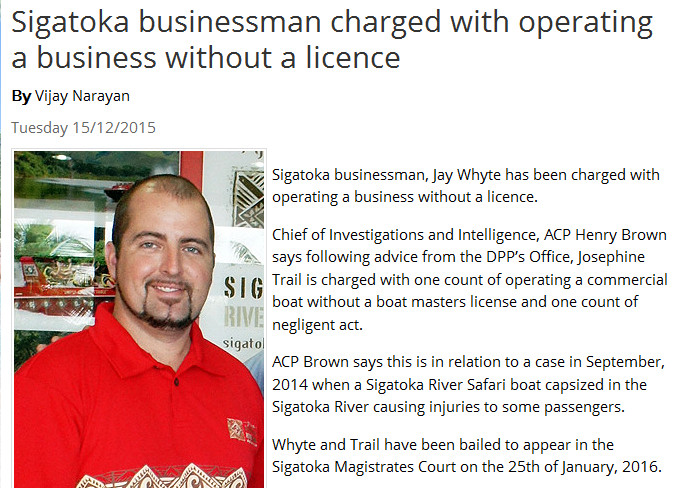

Whyte fronts Sigatoka Magistrates Court over injury to passengers when his Safari boat capsized in September 2014; in June 2013 the Australian had become Khaiyum's special administrator for Sigatoka town, resigning in January 2015 due to "personal and professional reasons"

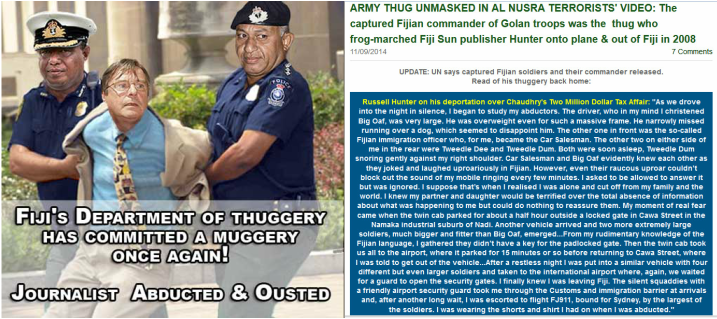

Fijileaks: When will Nalin Patel be charged for his role in helping Mahendra Chaudhry hide $2million from FIRCA and Indo-Fijians?

VICTOR LAL and Russell Hunter (September 2012) to DPP and Fiji Police:

"Perjury in False Affidavit, Abuse of Office, and Aiding and Abetting Perjury"

"6. We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

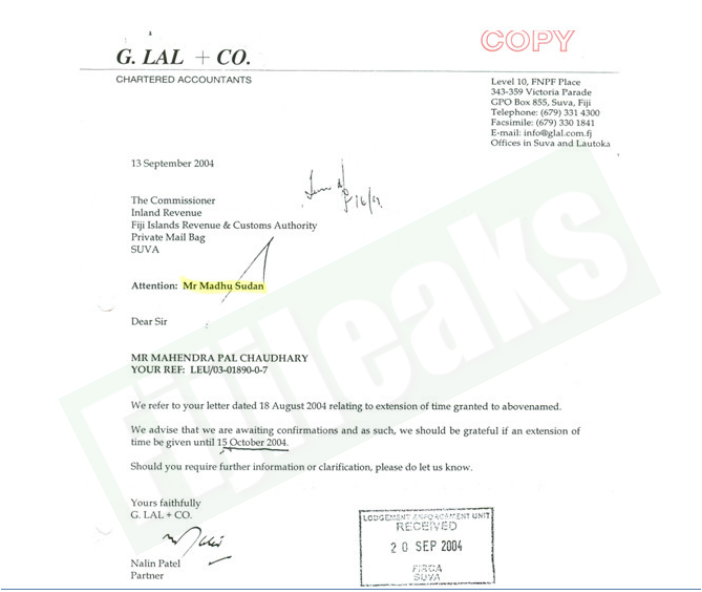

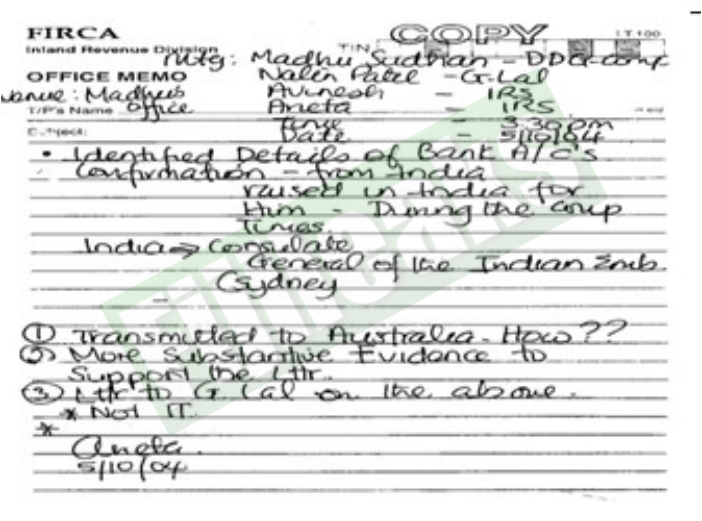

7: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent which dealt with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Study Group letter dated 12 October 2004.

8: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account." Victor Lal and Russell Hunter's 60 page legal submission to DPP's Office, 12 September 2012

Dear Nalin

Bula.

Did You/Pradeep read the contents of Harbhajan Lal's letter dated 9 September 2004, which is in direct contrast to the evidence you were presenting to FIRCA on his [Mr Chaudhry’s] behalf?

When was the first time you came into possession of Harbhajan Lal's letter?

From all the correspondence to FIRCA there are so many inconsistencies - the letter was written on 9 September and you chaps were still asking for extension on the 15 September.

Please note that I am not blaming you for anything but I need to ascertain certain facts

Warm regards

Victor Lal

Three days earlier, on 17 August 2012, Victor Lal had written to Nalin Patel:

Bula Nalin

You may recall I contacted you regarding Mahendra Chaudhry's tax details. You neither acknowledged nor replied to my set of questions that I had sent you in 2008.

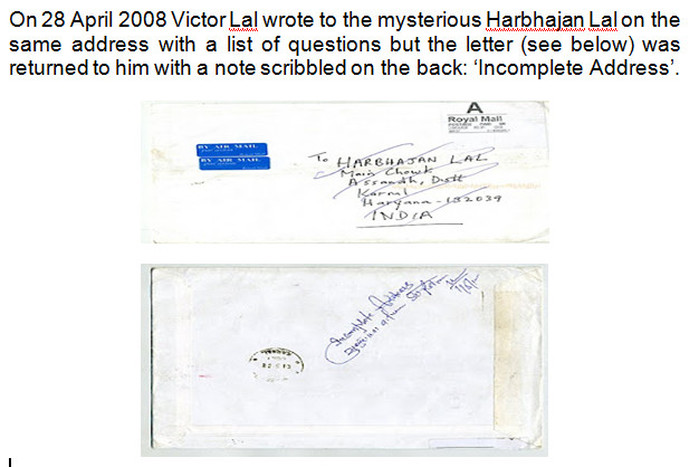

To date, I have not been able to locate Harbhajan Lal in Haryana, and now Justice Goundar's judgment quotes a letter from Delhi Study Group, which was never a part of your exchanges, on behalf Mr Chaudhry, with FIRCA in 2004.

I would be very grateful if you could comment on the attachment, especially with the Prime Minister calling upon accountants to take a more active role in the Constitution making in Fiji.

When did you submit that Harbhajan Lal letter dated 9 September 2004 to FIRCA that year?

Did you have a copy of the Delhi Study Group letter dated 12 October 2004 also but chose to submit the Harbhajan Lal one?

Look forward to hearing from you.

Warm regards

Victor Lal

VICTOR LAL and Russell Hunter (September 2012) to DPP and Fiji Police:

"Perjury in False Affidavit, Abuse of Office, and Aiding and Abetting Perjury"

To summarize, Justice Goundar observed in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012):

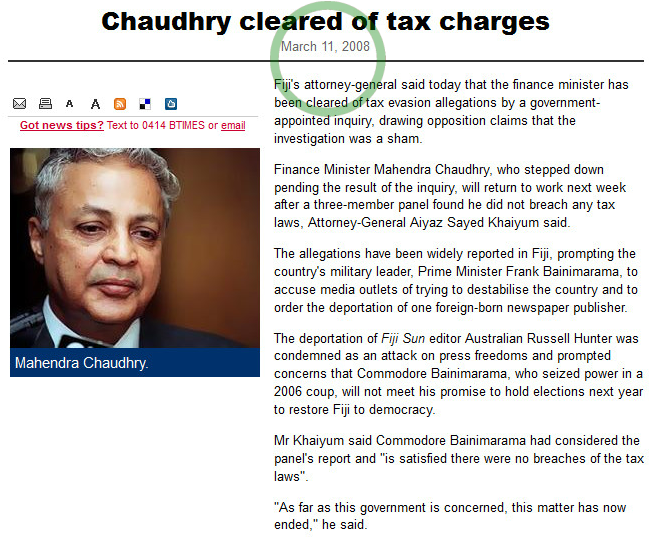

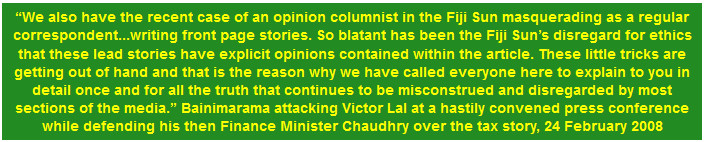

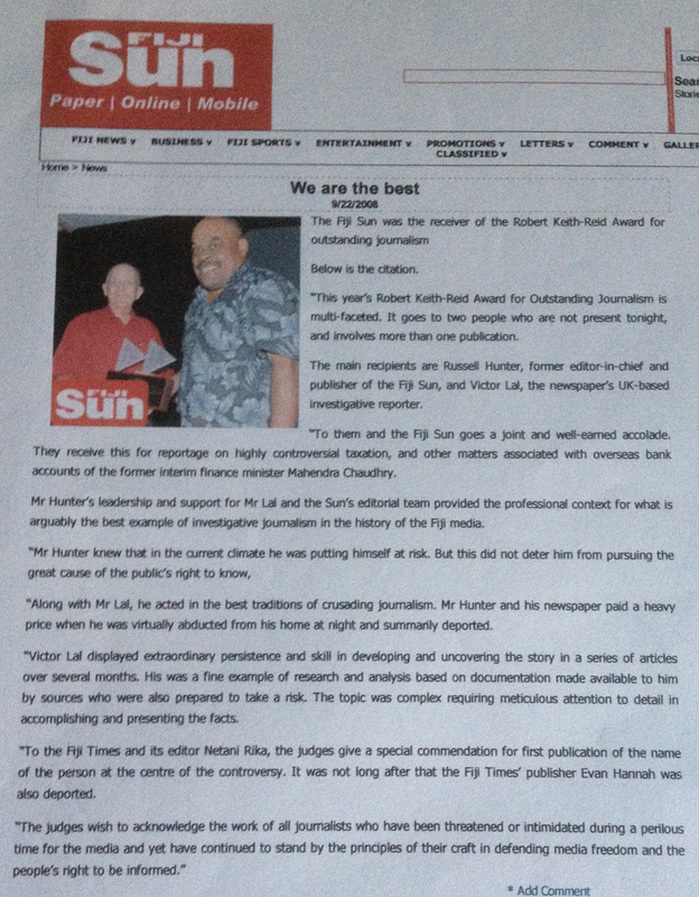

“The applicant says he later found out that a former editor of the Fiji Sun obtained his confidential tax details from FIRCA and released it to Victor Lal, a former Fiji journalist residing overseas. Victor Lal published those details in anti-government websites.” We have demonstrated that we never published Mr Chaudhry’s tax details in any anti-government websites but in the Sunday Sun dated 24 February 2008, including the first tax story in the Fiji Sun, on 15 August 2007.

1: We therefore call upon the Director of Public Prosecutions to investigative whether Mr Chaudhry committed the offence of “perjury in a false affidavit”.

2: We call upon the Director of Public Prosecutions to investigate whether Mr Chaudhry’s legal representatives in offering his affidavit to the Fiji High Court are also guilty of aiding and abetting the offence of perjury in a false affidavit, for it is abundantly clear that we did not publish Mr Chaudhry’s tax details in any anti-government websites.

3: We request the Director of Public Prosecutions to establish on what grounds the original letter tendered from one Harbhajan Lal dated 9 September 2004 to FIRCA from Haryana in India was withheld [if it was] and a new letter from Delhi Study Group dated 12 October 2004 substituted in Mr Chaudhry’s affidavit before Justice Daniel Goundar in the Fiji High Court.

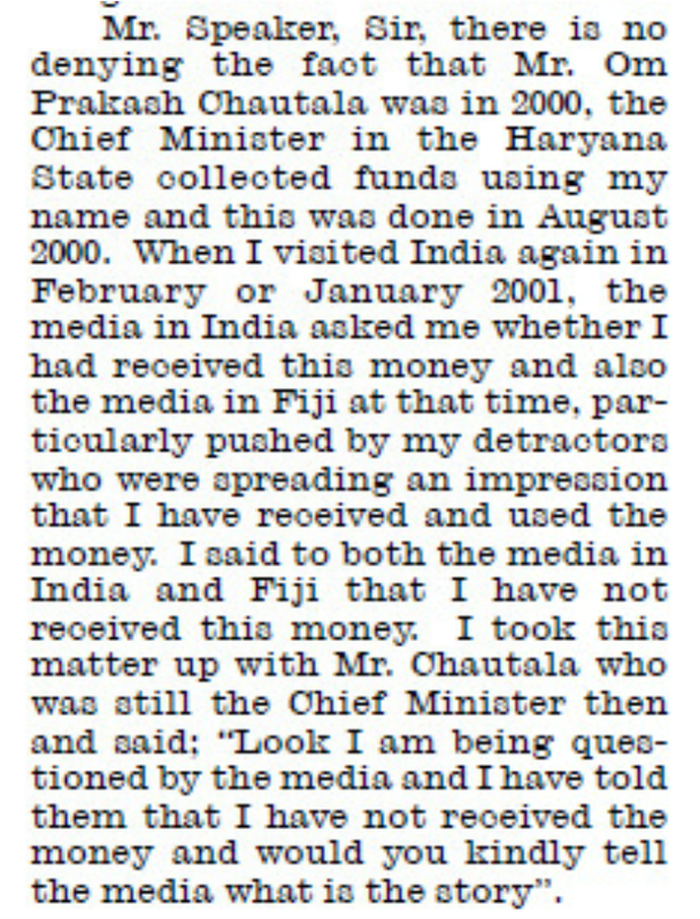

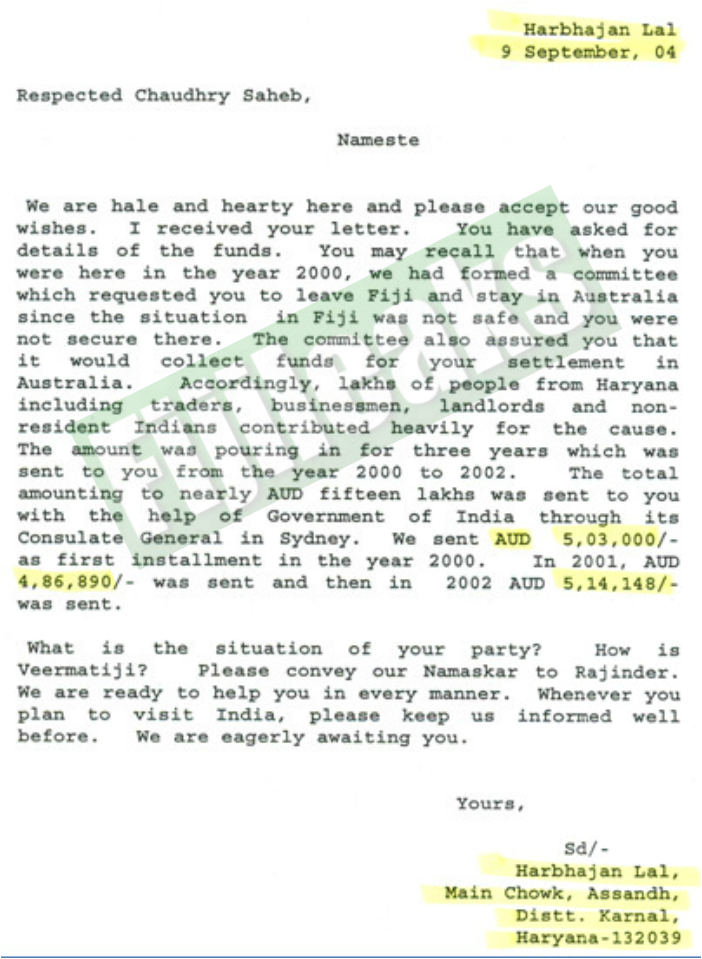

4. The “Harbhajan Lal Letter” of 9 September 2004 states the money was collected in Haryana and part of it was transacted through the Indian Consulate in Sydney, Australia. Harbhajan Lal wrote from Haryana:“Respected Chaudhry Saheb, Nameste. We are hale and hearty here and please accept our good wishes. I received your letter. You have asked for details of the funds. You may recall that when you were here in the year 2000, we had formed a committee, which requested you to leave Fiji and stay in Australia since the situation in Fiji was not safe and you were not secure there. The committee also assured you that it would collect funds for your settlement in Australia.Lakhs of people from Haryana including traders, businessmen, landlords and non-resident Indians contributed heavily for the cause. The amount was pouring in for three years, which was sent to you from the year 2000 to 2002. The total amounting to nearly AUD fifteen laks was sent to you with the help of Government of India through its Consulate General in Sydney. We sent AUD 503,000/- as first instalment in the year 2000. In 2001, AUD $486,890/- was sent and then in 2002 AUD $514, 149/- was sent.”

5. The “Delhi Study Group Letter” states, “This is to confirm that funds were collected in New Delhi and other parts of India, including NRI's (Non-Resident Indians) to assist Hon'ble Mahendra Pal Chaudhry, Former Prime Minister of Fiji in 2000-2002.”5: We call upon the Director of Public Prosecutions to ask Mr Chaudhry who transferred the money from India – Delhi Study Group based in New Delhi or Harbahajan Lal in Haryana, India?

6: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel, in presenting to FIRCA the letter from Harbhjan Lal, whose content was materially false [re his enquiring the details of the funds etc] –Chaudhry (and Nalin Patel) committed a criminal offence under Fiji’s tax laws by offering a false document to FIRCA, namely the Harbhajan Lal letter.

7: We request the Director of Public Prosecutions to investigate the Suva accountancy firm of G. Lal & Co, Mr Chaudhry’s delegated tax agent to deal with FIRCA in 2004, to establish whether it was aware of the inconsistencies in the Harbhajan Lal-Chaudhry correspondence regarding the $2million, and whether the accountancy firm also had in its possession the Delhi Support Group letter dated 12 October 2004.

8: We request the Director of Public Prosecutions to establish whether Mr Chaudhry and Nalin Patel submitted Harbhajan Lal’s letter knowing its content was false in material respects to prevent FIRCA from pursuing the original source of the funds in Mr Chaudhry’s Australian bank account.

9: We request the Director of Public Prosecutions to investigative whether Mr Chaudhry, in presenting the Tax Amnesty submission to the Cabinet in September 2007 for endorsement, might have abused office as Interim Finance Minister and direct line manager of Fiji Island Revenue and Customs Authority (FIRCA), to benefit himself, and to escape any future criminal prosecutions for submitting late tax returns between 2000 and 2003.We have documentary evidence that in August 2007 Mr Chaudhry still owed FIRCA $57,000 in tax debt, due to be paid on 9 August 2007. His own $57,000 could have fitted into insufficient advance payment or even late payment amnesty.

10. We therefore request the DPP to establish whether Mr Chaudhry had taxes or returns outstanding and paid during the amnesty period he had ordered and hence gained avoidance of penalties, and if so, then a case for Abuse of Office as Finance Minister and line manager of FIRCA could be made against him.

11: We call upon the Director of Public Prosecutions to plead with the Fiji High Court to expunge the patently false claims made against us in Chaudhry v State [2012] FJHC 1229; HAM034.2011 (25 July 2012) – re that we published Mr Chaudhry’s tax details in anti-government websites.

In conclusion, we leave you with the words of the great English judge, the late Lord Denning in King v Victor Parsons & Co [1973] 1 WLR 29, 33-34:

“The word 'fraud' here is not used in the common law sense. It is used in the equitable sense to denote conduct by the defendant or his agent such that it would be 'against conscience' for him to avail himself of the lapse of time. The cases show that, if a man knowingly commits a wrong (such as digging underground another man's coal); or a breach of contract (such as putting in bad foundations to a house), in such circumstances that it is unlikely to be found out for many a long day, he cannot rely on the Statute of Limitations as a bar to the claim: see Bulli Coal Mining Co v Osborne [1899] AC 351 and Applegate v Moss [1971] 1 QB 406. In order to show that he 'concealed' the right of action 'by fraud', it is not necessary to show that he took active steps to conceal his wrongdoing or breach of contract. It is sufficient that he knowingly committed it and did not tell the owner anything about it. He did the wrong or committed the breach secretly. By saying nothing he keeps it secret. He conceals the right of action. He conceals it by 'fraud' as those words have been interpreted in the cases. To this word 'knowingly' there must be added recklessly': see Beaman v ARTS Ltd [1949] 1 KB 550, 565-566. Like the man who turns a blind eye. He is aware that what he is doing may well be a wrong, or a breach of contract, but he takes the risk of it being so. He refrains from further inquiry least it should prove to be correct: and says nothing about it. The court will not allow him to get away with conduct of that kind. It may be that he has no dishonest motive: but that does not matter. He has kept the plaintiff out of the knowledge of his right of action: and that is enough: see Kitchen v Royal Air Force Association [1958] 1 WLR 563.”

The limitation statute’s aim is to prevent citizens from being oppressed by stale claims, to protect settled interests from being disturbed, to bring certainty and finality to disputes and so on. These are, as legal commentators have pointed out, laudable aims but they can conflict with the need to do justice in individual cases where an otherwise unmeritorious defendant can play the limitation trump card and escape liability.

We call upon the Director of Public Prosecutions to ask Mr Chaudhry which of the two letters – Harbhajan Lal or Delhi Study Group – is the lie – as they both can’t be genuine. Apart from the false accusations against us in his affidavit, the contents of the Harbhajan Lal letter dated 9 September 2004 does not accord with his bank statements from the Commonwealth Bank of Australia which he offered to FIRCA.

In our humble submission we beg the Director of Prosecutions to call upon the Fiji High Court to waiver the statute of limitation for prima facie there is evidence in the “Harbhajan Lal” letter that Mr Chaudhry obtained a favourable decision from FIRCA (an oversight on the part of FIRCA tax officers) through alleged fraud – the contents of the Harbhajan Lal letter does not square with his Australian bank statements.

Moreover, although we do not have a copy of Mr Chaudhry’s affidavit cited by Justice Goundar (despite requests for one from the Director of the Public Prosecutions) we call upon the Director of Public Prosecutions to examine the contents of both the Harbhajan Lal and the Delhi Support Group letters. If there are glaring disparities in the two letters than Mr Chaudhry must be deprived of the statute of limitation for the “fraud”, if any on his part, would be a continuing “fraud” since 2004 when he first offered Harbhajan Lal’s letter and now the Delhi Study Group letter in 2012 to explain away the $2million is his Australian bank account.

VICTOR LAL and RUSSELL HUNTER, 4 September 2012

__________

Cc:

Justice Anthony Gates, Chief Justice of Fiji

[email protected]

Mr Aiyaz Sayed-Khaiyum, Attorney-General and Minister for Justice

[email protected]

Mr Christopher Pryde, Director of Public Prosecutions

[email protected]

Prime Minister Commodore Voreqe Bainimarama

c/o [email protected]

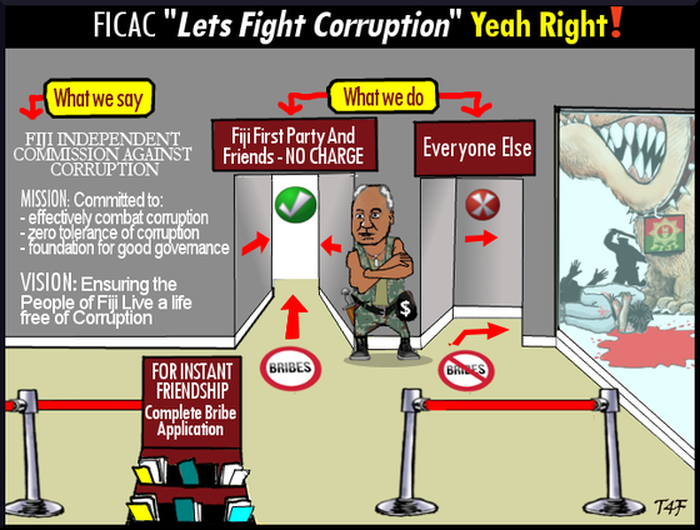

Mr George Langman, Deputy Commissioner, FICAC

c/o [email protected]

Madam Nazhat Shameem, Consultant, FICAC

c/o [email protected]

Ms Elizabeth Yang, FICAC Prosecutor

[email protected]